Yup!Do they have that interwebs thing over there?

/s

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

If I may, I'd like to put some focus back on the long-term view and I'm overdue for an annual update. Here's my previous updates for reference:

1. From 2020 comparing the market & TSLA to the Dot-com bust

2. One year later (2021)

95 - 2000 (Dot-com): +456%

Dec 2015 - Dec 2020: +157%

Dec 2016 - Dec 2021: +190%

Dec 2017 - Dec 2022: +60%

95-2000 (avg 11x - 40x)

Dec 2015 - Dec 2020 (avg 2.5x - 6x)

Dec 2016 - 2021 (1.5x - 3x)

Dec 2017 - Dec 2022 (big spread! -34% all the way to +725%)

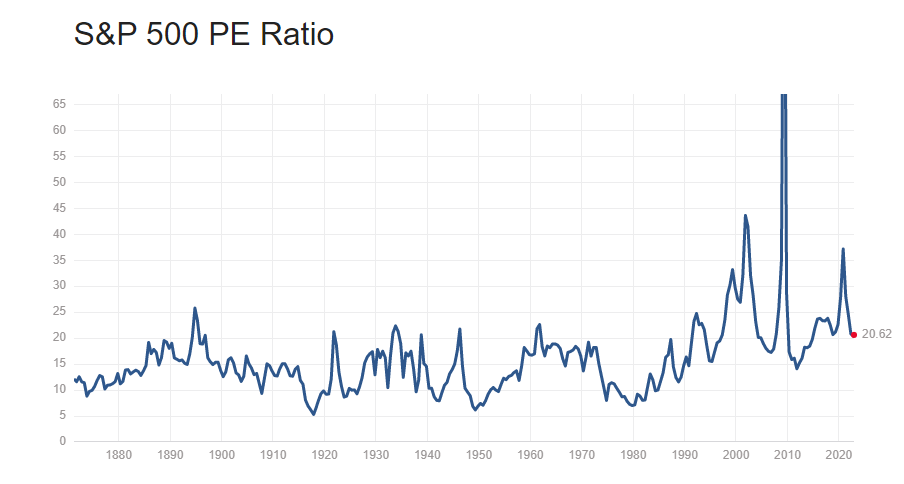

Dot-com: 44

Covid Peak: ~37

Current: 20.62

Current average earnings yields (E/P) are:

10-year US bonds:

The one-two Fed punch of liquidity drying (fewer dollars needing to find a home) against an increasingly enticing risk-free return rate (I-bonds hit over 9% for individuals!) makes for a very different landscape for investors. Companies with weak to no earnings have gotten particularly punished.

As a whole, commodities prices have declined substantially from covid peaks. Supply chain shortages have eased significantly and surpluses have popped up in retail here and there. This and other factors have clearly sowed concern and pricing-in of some amount of recession on top of normal interest rate correction.

Much has been written about Elon and the leadership team at Tesla lately. Tesla continues to be an incredible outlier. We've seen a meteoric rise in valuation at just the right time as substantial earnings began to be produced.

It's clear that what was written in 2020 still applies:

And we can now add the following:

1. From 2020 comparing the market & TSLA to the Dot-com bust

I get the sentiment. I even agree with it in regards to certain companies and perhaps the EV and related space. Seeing companies with no product in market and 0 to virtually 0 revenue (NKLA, QS) commanding multi-billion dollar valuations is astronomically absurd.

However, those are the exception rather than the rule. The numbers just don't point to another dot-com bust. Here's a nice thorough write-up penned in Sept on why. No, This Isn't a Repeat of the Dot-Com Bubble – Of Dollars And Data

Here are some key takeaways from the article:

Note: I've also adjusted some of the numbers to show where we are now vs when this was written in Sept as well as added a few tidbits not in the article

1. Nasdaq 5-year performance:

95 - 2000: +456%2015-Current: +156%2. Sampling of biggest individual performers:

95-2000 (avg 11x - 40x)Intel: +998%Cisco: +3,910%Oracle: +1,220%Microsoft: +1,600%2015-2020 (avg 2.5x - 6x)Apple: +401%Amazon: +375%Netflix: +361%Facebook: +155%Zoom: +559%TSLA: +1,234% <---- Noteable exception I address at the end of the post

3. P/E Ratios are still below the dot-com average: 44 vs 29-30ish

4. Yields (TINA - there is no other alternative)

Current average earnings yields (E/P) are:

Now: ~3-3.3% (1/29.5)Dot-com: ~2.2% (1/44)

Meaning, investors expect about a 3-3.5% return for every dollar they put in a stock now vs 2% during the dot-com bust.

That doesn't seem like a big difference, but when compared against a MUCH safer investment, the 10 year treasury, there's a huge difference.

10-year US bonds:

Now: <1%Dot-com: ~6%

In the dot-com bust, you were taking a risk on companies barely earning anything for a meager 2.2% yield versus a 6% virtually guaranteed return in bonds! Now, you're lucky to get 1% on bonds versus 3% or better in stocks. Needless to say, it's not crazy to hear folks saying Amazon and Apple are better than bonds for storing your dollars.

To sum it up

Yes, TSLA is absolutely a performance outlier. However, unlike in the dot-com bust, investors are being forced to stick their dollars somewhere and mega-cap tech in the world's largest TAMs (total addressable market) is one of the best places to do that.

TSLA is:

- credibly competing in the two largest TAMs and arguably leading technology driven disruption in both

- TSLA's technology and business model has already proven economical -- an important distinction when comparing against dot-com businesses that were not economical

- led by a truly once in a generation level leader in his prime with decades of experience

- incredibly resilient having survived two MASSIVE economic disasters, one of which was the largest seen since the great depression and early in TSLA's existence

I don't have a crystal ball, but I can tell you that this valuation isn't irrationally exuberant by any means.

2. One year later (2021)

Since it's been almost a year since this post, here's how things have changed:

Current Trailing 5-year perfOct 2016 - 2021: 177%

Current Trailing 5-year perf - Oct 2016 - 2021 (vs 2015-Dec 2020)Apple: +385% (-16%)Amazon: +295% (-80%)Netflix: +517% (+156%)Facebook: +154% (-1%)Zoom: +309% (-250%)TSLA: +1,915% (+681%)

Current is now ~34

View attachment 720333

https://www.multpl.com/s-p-500-pe-ratio

Meaning, investors expect about a3-3.5%2.9-3% return for every dollar they put in a stock now vs 2% during the dot-com bust.

Current (Oct 2021) 10yr yield is roughly 1.6%

Has my conclusion changed in the last 10 months? No.

- Bond vs Avg equity yields are still attractive for investors

- Despite a large expansion of the money supply and huge supply shocks, valuations aren't going crazy across the board. Winners are being rewarded and losers are being punished generally.

- SPAC craze occured and is passing with many SPACS now being hammered (rightly)

- TSLA itself took a big breather this year after touching $900 down into the 500s

- Yes, there are still some valuations that are way too generous: NKLA, QS, LCID, Rivian's rumored IPO -- to name a few, but at least NKLA has been punished to somewhere at least kind of close to book value if you squint hard enough and see the big actors behind it

But what about TSLA's meteoric 5 year trailing +681% vs 2015-2020 performance?

Suffice it to say, TSLA is extremely unique. Led by a once in a generation (multiple generation?) leader, Elon, TSLA has accomplished feats not seen in decades and others never seen (SpaceX booster landings anyone?). However, the share price has not and still doesn't reflect the underlying growth of the company.

View attachment 720354

What mega cap stock is guiding for continuous 50%+ growth while posting operating margin beating AMZN (11% vs 7%) and gross margin likely surpassing 30% this quarter or next and a path to AAPL-like gross margin of 35%-45% within two years?

What would the historical chart look like in 2013 to now if the above was known then?

Here is where we are now:

1. Nasdaq 5-year performance (trailing 5 year windows):

95 - 2000 (Dot-com): +456%

Dec 2015 - Dec 2020: +157%

Dec 2016 - Dec 2021: +190%

Dec 2017 - Dec 2022: +60%

2. Sampling of biggest individual performers from Dot-Com and initial Covid disruption:

95-2000 (avg 11x - 40x)

- Intel: +998%

- Cisco: +3,910%

- Oracle: +1,220%

- Microsoft: +1,600%

Dec 2015 - Dec 2020 (avg 2.5x - 6x)

- Apple: +401%

- Amazon: +375%

- Netflix: +361%

- Facebook: +155%

- Zoom: +559% (measures from IPO in 2019)

- TSLA: +1,234% (wow!)

Dec 2016 - 2021 (1.5x - 3x)

- Apple: +148%

- Amazon: +338%

- Netflix: +339%

- Facebook: +184%

- Zoom: +222% (measures from IPO in 2019)

- TSLA: +2,085% (holy cow!)

Dec 2017 - Dec 2022 (big spread! -34% all the way to +725%)

- Apple: +226%

- Amazon: +53%

- Netflix: +63%

- Facebook: -34% (ooof!)

- Zoom: +16% (measures from IPO in 2019)

- TSLA: +725% (wow!)

3. S&P 500 P/E

Dot-com: 44

Covid Peak: ~37

Current: 20.62

Source: S&P 500 PE Ratio

4. Yields

Current average earnings yields (E/P) are:

- Dot-com: ~2.2% (1/44)

- Dec 2020: ~3-3.3% (1/29.5)

- Covid Peak: ~2.7-2.9% (1/37)

- Now: ~4.7-5.2% (1/20)

Meaning, investors expect about a 4.7-5.2% return for every dollar they put in to S&P500 type equity now vs the 2% they expected during the dot-com bust and the 2.7-2.9% at the covid rally peak.

10-year US bonds:

- Dot-com: ~6% (crazy! investors went nuts investing in 2% yield equity versus 6% risk free!!)

- Covid Peak: ~1.5-1.7%ish (sensible, basically no return in bonds versus ~3% in equity -- TINA -- there is no alternative)

- Now: 3.5-4% (likely going higher than 4%)

Summary:

The one-two Fed punch of liquidity drying (fewer dollars needing to find a home) against an increasingly enticing risk-free return rate (I-bonds hit over 9% for individuals!) makes for a very different landscape for investors. Companies with weak to no earnings have gotten particularly punished.

As a whole, commodities prices have declined substantially from covid peaks. Supply chain shortages have eased significantly and surpluses have popped up in retail here and there. This and other factors have clearly sowed concern and pricing-in of some amount of recession on top of normal interest rate correction.

Much has been written about Elon and the leadership team at Tesla lately. Tesla continues to be an incredible outlier. We've seen a meteoric rise in valuation at just the right time as substantial earnings began to be produced.

It's clear that what was written in 2020 still applies:

TSLA is:

- credibly competing in the two largest TAMs and arguably leading technology driven disruption in both

- TSLA's technology and business model has already proven economical -- an important distinction when comparing against dot-com businesses that were not economical

- led by a truly once in a generation level leader in his prime with decades of experience

- incredibly resilient having survived two MASSIVE economic disasters, one of which was the largest seen since the great depression and early in TSLA's existence

And we can now add the following:

- weathered and continued >50% growth during a historic pandemic supply chain disruption masterfully (remember the chip shortage? battery shortage? parts shortages?)

- Took advantage of a monetary and fiscal stimulus environment to raise capital at premium valuations and ramped a gigafactory in China to a current run-rate over 1m vehicles while also building two new gigafactories

- industry leading margins, earnings, growth

- virtually no debt

- ~$20b war chest of cash

Dillon has a different number.My calculation is that at the end of November in China there were 4275 cars in China in inventory. That is take the 16K left over from October production. Add in the November production and subtract out the November local sales and exports.

Holy crap. @Gigapress has become a parody account!Except that demand fell off a cliff last Friday and Tesla is getting a trickle of orders now. Giga Shanghai will be cutting back to a three-day weekly schedule with all Wednesday-made cars being donated to the dolphins in the East China Sea. I've reduced my Q4 global delivery estimates to 420k with a 69k QoQ increase in inventory.

That will be $8; please pay on my Patreon page.

Raisin45567

Member

FSD, solar roof, Energy margins—these are all issues that need hands on Elon. This is far from a company that you can put on auto…pilot.I get what you're trying to say, but I think it's misplaced. At this point in almost every important way the entire company is a reflection of him and his ideas, philosophies, motivations etc. If he were to depart today, yes I suspect the outcome many many years into the future might trend differently, but as far as we can reasonably forecast, the company is fine. His influence will live on long after his tenure.

bkp_duke

Well-Known Member

If I may, I'd like to put some focus back on the long-term view and I'm overdue for an annual update. Here's my previous updates for reference:

1. From 2020 comparing the market & TSLA to the Dot-com bust

2. One year later (2021)

Here is where we are now:

1. Nasdaq 5-year performance (trailing 5 year windows):

95 - 2000 (Dot-com): +456%

Dec 2015 - Dec 2020: +157%

Dec 2016 - Dec 2021: +190%

Dec 2017 - Dec 2022: +60%

2. Sampling of biggest individual performers from Dot-Com and initial Covid disruption:

95-2000 (avg 11x - 40x)

- Intel: +998%

- Cisco: +3,910%

- Oracle: +1,220%

- Microsoft: +1,600%

Dec 2015 - Dec 2020 (avg 2.5x - 6x)

- Apple: +401%

- Amazon: +375%

- Netflix: +361%

- Facebook: +155%

- Zoom: +559% (measures from IPO in 2019)

- TSLA: +1,234% (wow!)

Dec 2016 - 2021 (1.5x - 3x)

- Apple: +148%

- Amazon: +338%

- Netflix: +339%

- Facebook: +184%

- Zoom: +222% (measures from IPO in 2019)

- TSLA: +2,085% (holy cow!)

Dec 2017 - Dec 2022 (big spread! -34% all the way to +725%)

- Apple: +226%

- Amazon: +53%

- Netflix: +63%

- Facebook: -34% (ooof!)

- Zoom: +16% (measures from IPO in 2019)

- TSLA: +725% (wow!)

3. S&P 500 P/E

Dot-com: 44

Covid Peak: ~37

Current: 20.62

Source: S&P 500 PE Ratio

4. Yields

Current average earnings yields (E/P) are:

- Dot-com: ~2.2% (1/44)

- Dec 2020: ~3-3.3% (1/29.5)

- Covid Peak: ~2.7-2.9% (1/37)

- Now: ~4.7-5.2% (1/20)

Meaning, investors expect about a 4.7-5.2% return for every dollar they put in to S&P500 type equity now vs the 2% they expected during the dot-com bust and the 2.7-2.9% at the covid rally peak.

10-year US bonds:

- Dot-com: ~6% (crazy! investors went nuts investing in 2% yield equity versus 6% risk free!!)

- Covid Peak: ~1.5-1.7%ish (sensible, basically no return in bonds versus ~3% in equity -- TINA -- there is no alternative)

- Now: 3.5-4% (likely going higher than 4%)

View attachment 882870

Summary:

The one-two Fed punch of liquidity drying (fewer dollars needing to find a home) against an increasingly enticing risk-free return rate (I-bonds hit over 9% for individuals!) makes for a very different landscape for investors. Companies with weak to no earnings have gotten particularly punished.

As a whole, commodities prices have declined substantially from covid peaks. Supply chain shortages have eased significantly and surpluses have popped up in retail here and there. This and other factors have clearly sowed concern and pricing-in of some amount of recession on top of normal interest rate correction.

Much has been written about Elon and the leadership team at Tesla lately. Tesla continues to be an incredible outlier. We've seen a meteoric rise in valuation at just the right time as substantial earnings began to be produced.

It's clear that what was written in 2020 still applies:

And we can now add the following:

And now enjoys:

- weathered and continued >50% growth during a historic pandemic supply chain disruption masterfully (remember the chip shortage? battery shortage? parts shortages?)

- Took advantage of a monetary and fiscal stimulus environment to raise capital at premium valuations and ramped a gigafactory in China to a current run-rate over 1m vehicles while also building two new gigafactories

There's so much more that could be added to those lists, but I'll leave it here. The future is bright.

- industry leading margins, earnings, growth

- virtually no debt

- ~$20b war chest of cash

@AudubonB - nominated for Post of Particular Merit.

Many here need to read, and re-read this, and re-ground themselves and focus on the long-game.

Mod: 100% agreed, done

Last edited by a moderator:

Tesla BoD speaks.

The next time Mr Musk's incentive package is up for reconsideration, I am going to remind those in this thread, and every institutional investor still in my Rolodex, and every member of Tesla's BoD of his above statement.

StealthP3D

Well-Known Member

If I may, I'd like to put some focus back on the long-term view and I'm overdue for an annual update. Here's my previous updates for reference:

1. From 2020 comparing the market & TSLA to the Dot-com bust

2. One year later (2021)

Here is where we are now:

1. Nasdaq 5-year performance (trailing 5 year windows):

95 - 2000 (Dot-com): +456%

Dec 2015 - Dec 2020: +157%

Dec 2016 - Dec 2021: +190%

Dec 2017 - Dec 2022: +60%

2. Sampling of biggest individual performers from Dot-Com and initial Covid disruption:

95-2000 (avg 11x - 40x)

- Intel: +998%

- Cisco: +3,910%

- Oracle: +1,220%

- Microsoft: +1,600%

Dec 2015 - Dec 2020 (avg 2.5x - 6x)

- Apple: +401%

- Amazon: +375%

- Netflix: +361%

- Facebook: +155%

- Zoom: +559% (measures from IPO in 2019)

- TSLA: +1,234% (wow!)

Dec 2016 - 2021 (1.5x - 3x)

- Apple: +148%

- Amazon: +338%

- Netflix: +339%

- Facebook: +184%

- Zoom: +222% (measures from IPO in 2019)

- TSLA: +2,085% (holy cow!)

Dec 2017 - Dec 2022 (big spread! -34% all the way to +725%)

- Apple: +226%

- Amazon: +53%

- Netflix: +63%

- Facebook: -34% (ooof!)

- Zoom: +16% (measures from IPO in 2019)

- TSLA: +725% (wow!)

Very good view! I like the way you zoomed out to see the big picture! This is something I did a lot when I was starting out (and still do a lot today).

I do wish you had explained how you selected your "sampling" of the biggest dot-com performers. I noticed it didn't include QCOM which confused me. Being lazy I wanted to see if the OpenAI chat bot was any good for doing stock research so I asked it how much QCOM appreciated between Jan 1, 1995 and December 31, 1999.

But I was getting a different answer each time I asked the same question. So I did a quick and dirty Yahoo stock chart which is only approximate because it doesn't necessarily capture the exact beginning and end of year (I should have done a 5 year chart for the exact dates). But the bottom line is that between the beginning of 1995 and the end of 1999 QCOM went from about a split-adjusted $1.50/share to $88.00/share for an appreciation of 5,766%. (58-bagger). That's far better performance than in your examples. Interestingly, half of those gains happened in 1999.

Which made me wonder why QCOM wasn't included. As I recall, they entered the S&P 500 in the middle of 1999.

@kemallette's post is a very good one. The portion I would have everyone here pay especial attention to - I'm talking most directly to you - those who were so adamant it was "unfair" TSLA's P/E was not well into triple digits - is Chart 3, the long-term look at the S&P's P/E. Of course, for me the scariest part of that chart is the size of the fraction to which I directly have been exposed. Weird, as I'm only 29.@AudubonB - nominated for Post of Particular Merit.

Many here need to read, and re-read this, and re-ground themselves and focus on the long-game.

You need a little "Get Up, Stand Up"... Peter Tosh does a killer version too.I spun up some Bob Marley on the old turntable, so feeling pretty irie, honestly.

⚡️ELECTROMAN⚡️

Village Idiot

I'm surprised @TSLA Pilot didn't give this response aIf you're going to accuse someone of lying, then provide evidence for the allegation. If you have no evidence, then why not give your fellow humans the benefit of the doubt with respect to malice vs. mistakes?

"FIVE-YEAR delay"? The Semi reveal was in Nov 2017 and the original estimated time for initial deliveries was 2019. So that's a three year delay. In between then and now, there have been major unexpected problems including Model 3 Production Hell, COVID, Supply Chain Hell, and surprisingly strong demand for 3 & Y that have sucked up all available resources. I would imagine Tesla has probably been in communication with Semi reservation holders in the meantime explaining the delays.

People challenge Elon's decisions all the time and he openly welcomes it. He is an actual scientist who fully embraces the philosophy of empiricism and striving to become less wrong over time via humility, open-mindedness, and careful observation and data collection. That is one of the main reasons why I'm invested, because that's both extremely important and extremely uncommon amongst senior managers in general in the corporate world. I can't find the video clip anymore, but I remember that Sandy Munro recounted an experience last year with sitting in on a SpaceX design review meeting in which Elon said they should do something and immediately another engineer directly contradicted him like "C'mon Elon, that won't work for XYZ reasons" and Elon was like "Oh, ok, what else have we got?" Sandy said he was shocked to witness that, because no other C-suite executive he'd ever had the displeasure of sitting with in a meeting would've responded positively to being called out like that. In my experience at Boeing and a previous company it was the same. We wasted so much time tiptoeing around executive egos and doing stuff we knew was a dead end because no one could just bluntly tell them why something wouldn't work and actually get anywhere with it. Normally executives are more interested in having subordinates stroking their egos and in maintaining an image of infallibility.

Also, what is your rationale for how a PR department would accelerate the world's transition to sustainable energy? That's the only criterion that matters. It seems like Martin Viecha is doing a decent-enough job, so he literally is serving as the ONE PERSON PR department you think we don't have.

Nice guess. Do you have data you can show us to demonstrate how you reached this conclusion?

I just checked and I see that the stock prices of all of the following have hit 1.5 to 2-year lows at some point in Q2 and in Q4, with most hitting extreme lows in the middle of October:

- Tesla

- S&P 500

- NASDAQ

- Microsoft

- Alphabet

- Amazon

- TSMC

- Meta

- NVIDIA

- Tencent

- Samsung

- Alibaba

- ASML

- Broadcom

- Oracle

- Cisco

- Texas Instruments

- Adobe

- Tata

- Netflix

- Qualcomm

- Salesforce

- SAP

- AMD

- Intel

- Meituan

- PinDuoDuo

*Renault, Suzuki and Changan hit 2-year lows in Q2 but not Q4. Suzuki and Changan did drop in October however, still following the overall group trend.

- Toyota

- Volkswagen

- Mercedes-Benz

- Ford

- Honda

- BMW

- GM

- Stellantis

- Hyundai

- Nissan

- BYD

- Kia

- Renault*

- Nio

- Li Auto

- Great Wall Motors

- Suzuki*

- Geely

- SAIC

- Changan*

- Ferrari

- Rivian

- Lucid

- Fisker

I see that this list includes (with the exception of Apple and IBM) all of the world's most valued software/electronics companies and all of the world's automotive companies.

It's really quite unfortunate that one man has the power to unleash this much destruction, not only on his own company's stock but also the stocks in his business sectors as well as the entire stock market. Why can't he just be normal? This is all his fault and I'm very angry at him for doing this. /s

It's been a month since I last updated these charts, but they clearly show the tight coupling between TSLA and the S&P 500. The relationship with the NASDAQ looks similar but slightly weaker.

View attachment 882120

View attachment 882121

As shown below, there clearly has been some decoupling in Q4 so far, starting on Oct 3rd, which was the first trading day of Q4 and also the Monday after the "disappointing" P&D numbers came out. To reiterate, the auto and tech sectors in general had really rough Octobers in the stock market, so TSLA was not especially unique.

The real nonsense mainly occurred in the beginning of November, and nothing seems to have pulled TSLA back up since then.

View attachment 882130

There is a convenient, emotionally salient explanation for this drop starting November 4th that maybe some people would like to discuss further in the Twitter thread. There are also other possible factors we could identify, like:

Without more information that we'll probably never be able to obtain, it's basically impossible to reach any strong conclusion without speculation. Let's give it more time and see how it plays out. Q4 P&D numbers are just four weeks away.

- The intensifying China-related fears regarding demand and potential COVID disruptions, in the aftermath of low October wholesale numbers being published, growing numbers of Omicron cases nationwide, new government lockdowns in some areas including Shanghai, and growing social unrest unprecedented in the entire post-Tiananmen Square era

- Elon selling 20M shares that week, plus market response to that news when the Form 4s later came out

- Elon saying in the Ron Baron interview that week, "...many times I've recommended people don't invest in Tesla and I've said our stock is too high, but then people just ignore me and keep buying the stock for some reason" and people misunderstanding what he was intending to communicate

- A major ramp-up of both the Tesla FUD onslaught and the prevalence of trolls appearing in investment discussion boards such as this one

- Increasing short interest including possible naked short-selling by market makers

- Lots of people getting margin calls

'Three Little Birds' got me in a good head space today. Love all the hits though!You need a little "Get Up, Stand Up"... Peter Tosh does a killer version too.

Indeed, maybe a little "Legalize It" as well?'Three Little Birds' got me in a good head space today. Love all the hits though!

Nothing, unless you're implying this necessarily means a rocketing TSLA price if it's all about the macros right now.I've been away from this thread for a few days. But I just had this thought to share.

Is the 4th quarter going to be "Epic" like Elon said?

Let's see. Production is way-way up. Price cuts have been rather puny and mostly limited to "in stock" vehicles. It's possible that ASP could be even higher than Q3. "Epic" might be an understatement.

What am I missing here?

(How will this age I wonder?)

thx1139

Active Member

I saw that and I am confused about how he and Rob can be so different. Lets see if Rob updates things tonight.Dillon has a different number.

I don't worry too much about China. My heuristic is basically "have I heard this before? did it matter before? if no then ignore it"

Examples from the past:

2020 Jan: Tesla faces challenging market in China as electric vehicle sales fall

2021 May: https://edition.cnn.com/2021/05/13/business/tesla-china-sales-decline/index.html

2021 June: Tesla's China orders fall by nearly half in May - report

2021 July: Tesla’s Fall From Grace in China Shows Perils of Betting on Beijing

Examples from the past:

2020 Jan: Tesla faces challenging market in China as electric vehicle sales fall

2021 May: https://edition.cnn.com/2021/05/13/business/tesla-china-sales-decline/index.html

2021 June: Tesla's China orders fall by nearly half in May - report

2021 July: Tesla’s Fall From Grace in China Shows Perils of Betting on Beijing

Does the Rolodex imply that those therein are mostly retired or deceased?The next time Mr Musk's incentive package is up for reconsideration, I am going to remind those in this thread, and every institutional investor still in my Rolodex, and every member of Tesla's BoD of his above statement.

The Smithsonian says they’re still produced, but I suspect only Warren Buffet, Charlie Munger,

Joe Biden, Mitch McConnell share your attraction for them.

We need to define ‘useless’

You realize that Elon is treading in the well worn footsteps of an entrepreneur founder in that he has kicked himself upstairs, so to speak, and now only needs to oversee strategy. I agree that he doesn’t need a huge pay package anymore. But what he’s doing is pretty typical for a long serving founder/CEO. At some point everyone, even Elon, gets burned out. He will no doubt get more involved in both companies when needed.The next time Mr Musk's incentive package is up for reconsideration, I am going to remind those in this thread, and every institutional investor still in my Rolodex, and every member of Tesla's BoD of his above statement.

I mean, it’s only been a month at Twitter. Like, the time some take for a vacation. And he hasn’t been doing nothing, he did lead the semi reveal in the middle of that.

29 and a Rolodex? In dog years?The next time Mr Musk's incentive package is up for reconsideration, I am going to remind those in this thread, and every institutional investor still in my Rolodex, and every member of Tesla's BoD of his above statement.

Edit:. Looks like @unk45 beat me to the punch!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M