No, not "Exactly". The $7,500 U.S. discounts came just 2 days after Treasury announced that they were delaying announcing the rules for some IRA incentives until sometime in March. That caused some potential buyers to hesitate, and Tesla responded.

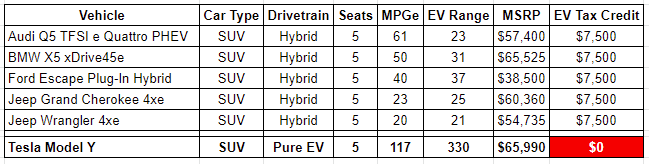

The "Huge" discounts didn't come until the final few days, with 10K Supercharger miles, and discounts on S/X. That's the point where Treasury lower the boom on Tesla's Q1 sales by "excluding" their best selling model from IRA incentives, yet giving them generously to gas-guzzling hybrids.

That's your red flag. And its planted in Washington.