Tesla says that software features don't count against the MSRP for the tax credit. So they can still finance it.So with this price cut, model Y owners cannot finance FSD and must buy after the fact. I probably see a down tick in fsd purchase and uptick in subscription

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

thesmokingman

Active Member

Yeap, it's gonna heavily reduce sales potential for legacies further pushing them to the brink.In another forum one of the guys on the EV room has been lusting after the Cadillac for months talking about how awesome it is and apologizing for it’s terrible efficiency. Talking trash about Tesla non-stop…

Suddenly he’s all ears about the Model Y. Almost instant, like that dog from Up.

If he’s changed his attitude this much. This is going to shake up the EV market in a big way.

theschnell

Member

But if you’re a used car dealer that paid near MSRP in mid to late 2022, you’ve just lost more like $20,000 per car. So 20 cars would be more like $400,000 loss.Holy crap. Looking at my early 2021 Model Y outside it just lost $7,000 - $10,000 in value.

Imagine you own a used Car lot and you have 20 Model Ys in stock. Boom…. $150,000 - 200,000 loss overnight.

theschnell

Member

This is a FAR better use of the funds then a buy back. FAR, FAR better for long term shareholder valueI Believe that 8% Bounce was actually shorts covering and bears taking profits. We may not have this luxury this time around.

Maybe... but at this point you are going to see free cash flow plummet. $3billion, now down to $1 billion. Asking for a buyback when the company does $1 billion a quarter on net profit is not going to happen.

Remember when we were saying we are trading at 20 times forward earnings? Now we could be trading at 60 times forward earnings.

Price cuts also in Finland, an example

Recall Elon has been predicting deflation this year. If the Tesla bean counters agree, they may foresee much, much lower commodity prices.The carnage has officially commenced.

I suspect they will still guide for 18-20% margins given the new IRA battery credits to Tesla, much lower commodity prices, and higher production volume. Should be a fun earnings call.

I Believe that 8% Bounce was actually shorts covering and bears taking profits. We may not have this luxury this time around.

Maybe... but at this point you are going to see free cash flow plummet. $3billion, now down to $1 billion. Asking for a buyback when the company does $1 billion a quarter on net profit is not going to happen.

Remember when we were saying we are trading at 20 times forward earnings? Now we could be trading at 60 times forward earnings.

I feel like there should be a “funny but painful” icon for certain Tesla discussions

Webeevdrivers

Active Member

SquirrelIn another forum one of the guys on the EV room has been lusting after the Cadillac for months talking about how awesome it is and apologizing for it’s terrible efficiency. Talking trash about Tesla non-stop…

Suddenly he’s all ears about the Model Y. Almost instant, like that dog from Up.

If he’s changed his attitude this much. This is going to shake up the EV market in a big way.

thesmokingman

Active Member

We need to stop feeding it.I feel like there should be a “funny but painful” icon for certain Tesla discussions

Dikkie Dik

If gets hard, use hammer

Didn’t TSLA go up after the China price cuts? I thought it was Chinese auto stocks that dropped that day. I may be misremembering as there’s been so many BIG down days lately, so they all seem to run together.

It seems to me Wall Street could buy this move. Clearly signals increased volumes and COGS deflation.

Exactly, this board and Twitter were bracing hard for a crash the evening of the China price cuts. The following day we hit the low of 101 and then bounced back.

StarFoxisDown!

Well-Known Member

What on earth are you talking about? Zach said himself that on the Q3 earnings call that Austin/Berlin were a 4-5% gross margin hit in Q3. Berlin and Austin were only averaging 1.000-1,500 weekly production in Q3. We know this for a fact now. Berlin and Austin will be averaging 5,000/week in Q1.Well we were at 28% in Q3 I think. You just need to do some quick math to know it'll be much lower than that.

I think i mentioned in some previous posts. Berlin and Austin opened up last year, over the last 3 quarters with their ramping, commodity prices, a few price rises, an increase of 40% volume production, we only saw auto gross margin fluctuate by single % points. I'm talking like 3-5%. Do we seriously believe we will see it go up 15% due to economies of scale? I mean lets be real here guys.

Berlin and Austin didn’t switch over from capex costs to operating costs until Q2 of 2022. So before Q2, they had zero impact to gross margin. Combined that with the fact that Covid lockdowns prevented Shanghai from running at full utilization in Q2 and Q3 and it’s very clear to see why gross margins didn’t budge much in Q2 and Q3. In fact it’s amazing gross margins didn’t drop more simply due to utilization rate.

I’m not trying to be rude but you really don’t understand the mechanics of what all effects gross margin/operating margin and free cash flow as a factory increase production levels and I would really suggest you go back to the Model 3 ramp and even the Model Y ramp. Both times, margins and net income came down materially only to rebound heavily as the factories progressed their ramp and achieved 5k/week

Xd85

Member

so hindsight being 20/20 and all but here's an argument for 4D chess. Increase prices at moderate ("40%") growth to compensate for factory money furnaces in 2021-22. THEN, flood gates open by reverting to old prices with factories ramped. Increased volumes for free! With the psychology of massive sale. I for one will be telling everyone i know to get a Y.

This is a great buying opportunity - for both TSLA and the Model Y I could not get in December (unfortunately, I convinced my brother to buy a Model Y in December).Produce 3 times as many cars, so by like 2025?

Might surprise some in this thread who don’t have me on ignore, but my sole interest here has been trying to identify the long-term buying opportunity and share insights that I think could be beneficial to others.

StealthP3D

Well-Known Member

I'm totally pumped about this! Every Model 3 and Model Y is eligible for the $7500 rebate which makes Tesla's super affordable, finally! Except if you want the Model Y Performance you have to add the 7-seat option for $4,000 to get the $7,500. The bad news is we have to listen to all the complaining from people who bought recently and don't think Tesla has the right to change their pricing, LOL!

The thing I'm not clear on is whether Tesla is eligible for the battery payments on the 2170 cells and how they phase out depending upon the sourcing of the battery metals and whether the sourcing for the 4680 cells is an issue with the battery payments.

In any case, this is exactly what I was hoping Tesla might do with the incentives. Hello big volumes! Not worried about margins, they will still be strong.

dhanson865

Well-Known Member

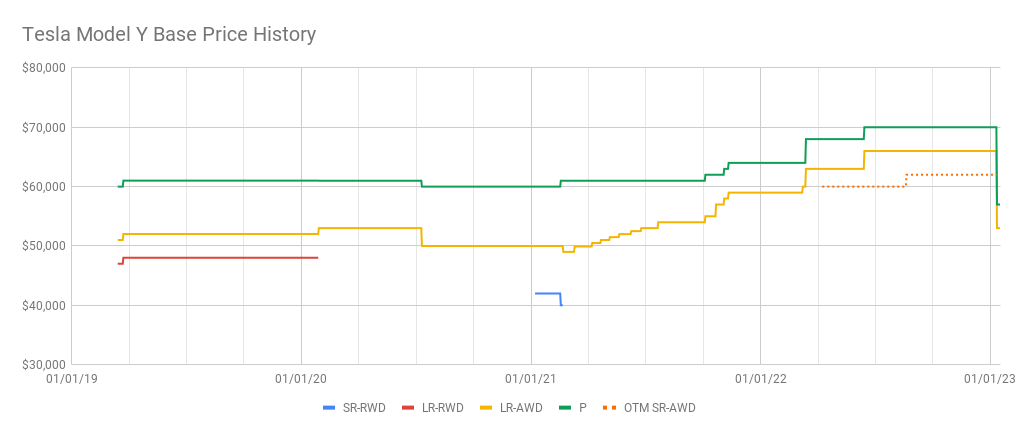

I wonder what the new price will be on the Off The Menu (OTM) SR-AWD Model Y

Looks like it could be right under $50k if Tesla wants to call it $49,990.

Looks like it could be right under $50k if Tesla wants to call it $49,990.

I would recommend people go back and listen to Zach’s comments on the last earnings call before jumping to optimistic conclusions about this.Recall Elon has been predicting deflation this year. If the Tesla bean counters agree, they may foresee much, much lower commodity prices.

Who here works in some type of manufacturing using a commodity as feedstock? Please don’t let me be the only voice commenting on the potential complexity of procurement contracts and why current commodity futures may not be an indicator of cost savings at the same point in time.

Please don’t stay silent unwilling to eat the potential downvotes and then come out of the woodwork with “oh well that was so obvious” after reality becomes apparent.

No they aren't. The Model Y Performance isn't and depending on options others can be excluded as well. (You want a red Model 3 Performance? No tax credit for you.)I'm totally pumped about this! Every Model 3 and Model Y is eligible for the $7500 rebate

There is no 7-seat option for the Model Y Performance.Except if you want the Model Y Performance you have to add the 7-seat option for $4,000 to get the $7,500.

Webeevdrivers

Active Member

Hmmm. No. The rotors are different on the performance.Brakes are the same now on P vs AWD, they just pop some Red covers over the calipers now.

thesmokingman

Active Member

It doesn't matter the changes have no difference except reducing cost... and I'll take it for the 23% price reduction.Hmmm. No. The rotors are different on the performance.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M