Featsbeyond50

Active Member

I've been advocating this type of MY price cut for the purpose of breaking the IRA. My question now is, does this break the IRA?

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

How did you get an estimate of $1B profit per quarter?

So…you used a random number generator.I don't really want to say because it's just the dumbest way ever. But if you must know, I literally just took their 3 billion from the previous quarter and cut it by 2/3 because that's how much their auto profit just dropped by.

I welcome anyone who actually is willing to put in the time to do the math. There are far smarter people than I with actual spreadsheets that I would like to take a look at.

From the price drop? 30% on the price before the drop.Where are you getting the $19.5k and $6.5k profit numbers from? When I bought my Model Y LR (May 2022) for $54k it was said that profit margins were close to 30% on that.

| Model Y | $65,990 | $52,990 | -$13K (-20%) |

You had any left??If TSLA goes down tomorrow due to this news I will lose the remaining shards of respect I had.

The YLR was £54k when first released in the UK in Oct-21 and is what I paid for it at delivery in Mar-22. There could only have been a few orders at the £58k mark that were delivered and they would have been in Q3/4-22.According to my records the following price changes have occurred in the UK, standard options:

Model 3 | £48,490 -- > £42,990 (-11.34%)

Model 3 LR | £57,490 -- > £50,990 (-11.31%)

Model 3 Performance | £61,490 --> £57,990 (-5.69%)

Model Y | £51,990 --> £44,990 (-14.43%)

Model Y LR | £57,990 --> £52,990 (-8.62%)

Model Y Performance | £67,990 --> £59,990 (-11.77%)

1) In a lot of countries the bulk of the relevant housing stock (i.e. pitched roof low-rise) is already built out and has a considerable outstanding economic lifetime. Therefore the newbuild market is quite a small fraction of the total residential on-roof market. We will (we must) go through the majority of the solar adoption curve during the next twenty years. We must do that for climate change reasons, but we will do that for economic reasons, and history also shows us that most of these S-curves are 20-year affairs (and so does the theoretical modelling). So Tesla cannot afford to hang around and take a seventy-year view on that. Besides which the worst customer to have is a property developer's buying team.

OK... the above contradiction aside, in your full reply to me you say:

A few points and/or questions...

Why would solar tile be relevant to a "minority of a minority" (people in countries)? There was some discussion of partnering with builders, and it would seem that in the lifetime of an average roof, there are also a LOT of houses built. I don't think Tesla is playing the short game here... we are talking an adressible market growing over the next several decades...

It would seem odd for such an intense copying effort to be mounted if it were a largely irrelevant product, no?

You mention "the rest of the solar industry took the other 99.9% of the market"... given the relatively low adoption rate currently, the total addressable market is HUGE, no?

According to This Article, the US is only 3%.. parts of the rest of the world are in the lower double digits. Places like Africa may not much at all.

There are apparently many people posting here who simply do not understand what marketing is, thinking it is a synonym for hype All the names you mention, plus nearly all products of LVMH (the new richest person in the world), and many more achieve stellar margins year after year through superior product position, placement, production and pricing. They also all provide unusually good customer service. All of them share those, all components of marketing. In short, quoting from a thesis I wrote decades ago, “marketing is what you do if you’re too large to personally know all your customers”.

@petit_bateau , for example, provides excellent information, but forgets or does not know that price simply never if the prime driver in decision making, despite quite consistently being described as such by purchasers. That is to say people do change purchase timing based on price and they will often nit make purchases they cannot afford. Neither of those precludes very high margins.

Many of us and most analysts assume that low market share reflects poor performance. That may be true, but in the Tesla case for cars and TE, the entire market is nascent, but growing very quickly. Thus market share is titillating, but not terribly relevant.

About three or four years from now we will know whether Tesla can deliver high market share with consistent high profit and high quality. Before that we have only clues. Right now we cannot know whether Tesla will be similar to LVMH, Apple or Amazon. It even could turn out more like Kodak or Xerox.

in the meantime we need intelligent critical analysis, including understand Impediments to success. Examining carefully helps us to be more nearly rational in our decidions.

One good result probably is that most sane investors now know how ridiculous it is to use much margin, less so any derivative. Strangely some seeming wise investors are viewing Tesla as a generic car company so is overpriced. Such a decision is only possible if one does ignore product, design, placement and positioning.

1126 in inventory as of this post, from your link.The waiting list for LRs is going to get very long, very fast. Tesla will surely want to prioritize Performance Ys. 7 Seat performance Y will dominate for a while.

1813 in inventory currently. I wonder how fast that drops tomorrow. Will be fun to watch. I know 2 people personally who are now considering jumping on it.

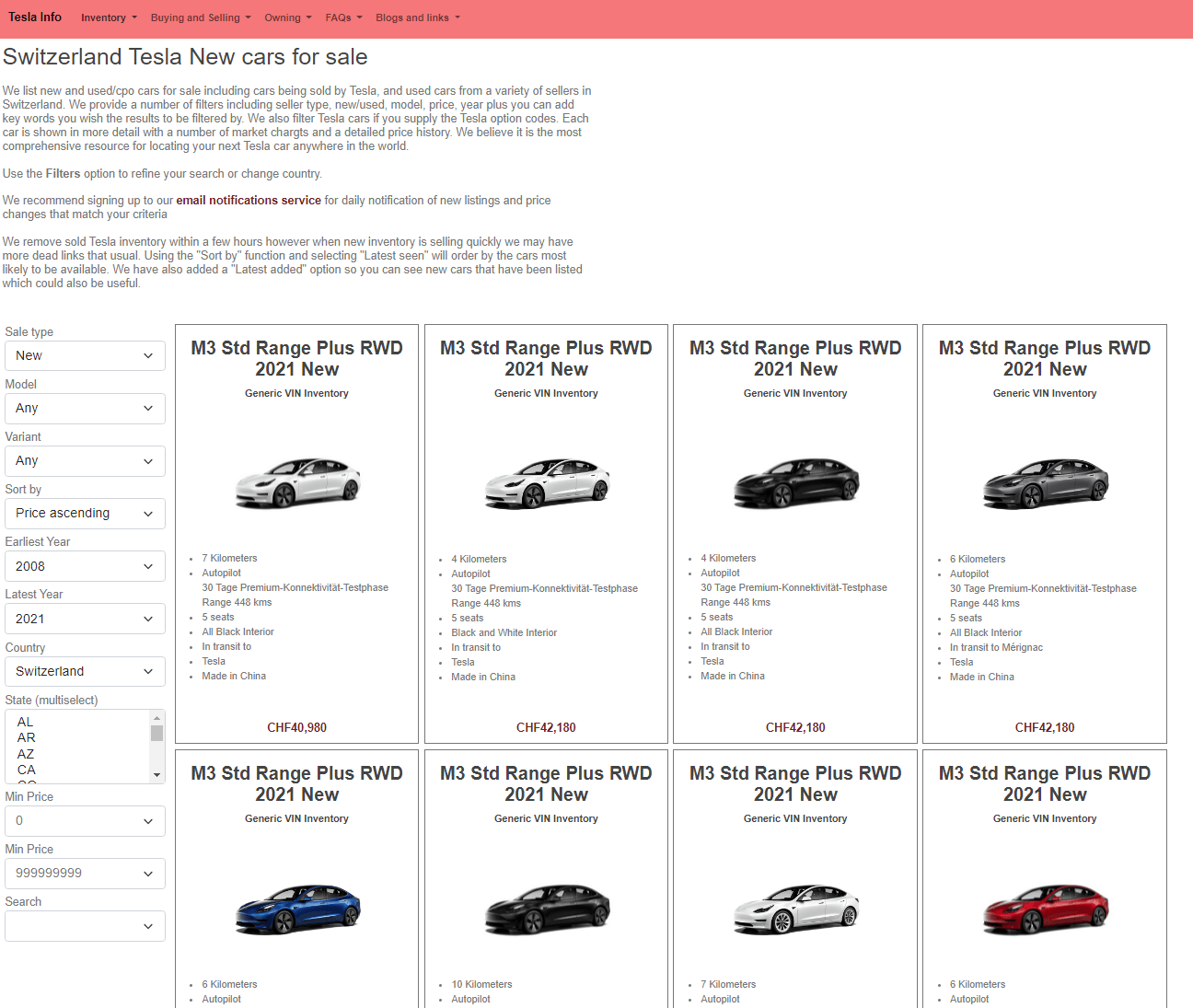

United States Tesla All inventory

This is the All inventory for cars in United States. The inventory is taken from Tesla directly and refreshed every few minutes, we also explicitly differentiate between New and Demo cars both of which Tesla list as New. In many countries we also gather used cars from various sources. We allow...tesla-info.com

If you have 100 models (isn't that what was said) and sell two of each, that's technically more than Tesla.Remember, GM is going to sell more EVs than Tesla in 2025.

I've been advocating this type of MY price cut for the purpose of breaking the IRA. My question now is, does this break the IRA?

Tesla announces World-wide price cuts on a Thursday evening after Thursday’s closing share price has already run above Friday’s Max Pain of 120, and after the Market already accepted China price cuts as a Good Thing earlier in the week. So WS calls out the B Team to run damage control for the incoming short burn. If Elon and Tesla would have only waited until the weekend for this news then MM’s wouldn’t have to drop the price at their expense. I can’t imagine any reason Elon would want to release this news a day early <s>OK the CNBC hit piece is out, loaded with inaccurate claims and a headline that is straight from fantasy-land. Apparently Q4 deliveries were "lackluster"