Cory of Munro & Associates focusing on the important stuff!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

MC3OZ

Active Member

Assuming Tesla needs to purchase parts in China for export to the US or EU.Isn't this just accounting? It's not like Tesla converted foreign currency into USD.

Would they just purchase those parts using the supply of the local Chinese currency?

For any market, purchasing local parts in the local currency seems to make sense.

For the rest of the local currency, why not pick and choose the times when it is converted to USD?

Seems to me the only to me there would only be an urgent need to covert foreign currency into USD would be when the cash was urgently needed in the US.

In a market like Australia, a supply of the ,local currency could be used to pay miners for raw materials? But that in part depends on whether the contract price is in USD.

Thekiwi

Active Member

Foreign exchange should have been a tailwind this quarter. Apparently Zach has never heard of hedging.

quarterly results are always comparing year on year results. The US dollar was significantly stronger in Q1 2023 vs Q1 2022, so international sales were weaker in equivalent US dollar value, thereby it was a headwind, not a tailwind in Q1.

Thankfully Q2 looks like it will be roughly flat y-o-y so far, possibly even a slight benefit hopefully.

Hedging is a separate issue which I think they should start to do at least to some degree.

oh you guys. Such fear and drama. I finally listened to the call and it was not nearly as bad as I figured it would be after reading the comments here. This was all more of the same. Let the short term fools give us an even better buying opportunity.

I'll be buying more tomorrow while watching Starship and NCC1701D fly with a giant smile on my face.

I'll be buying more tomorrow while watching Starship and NCC1701D fly with a giant smile on my face.

A few graphs that were not getting enough attention:

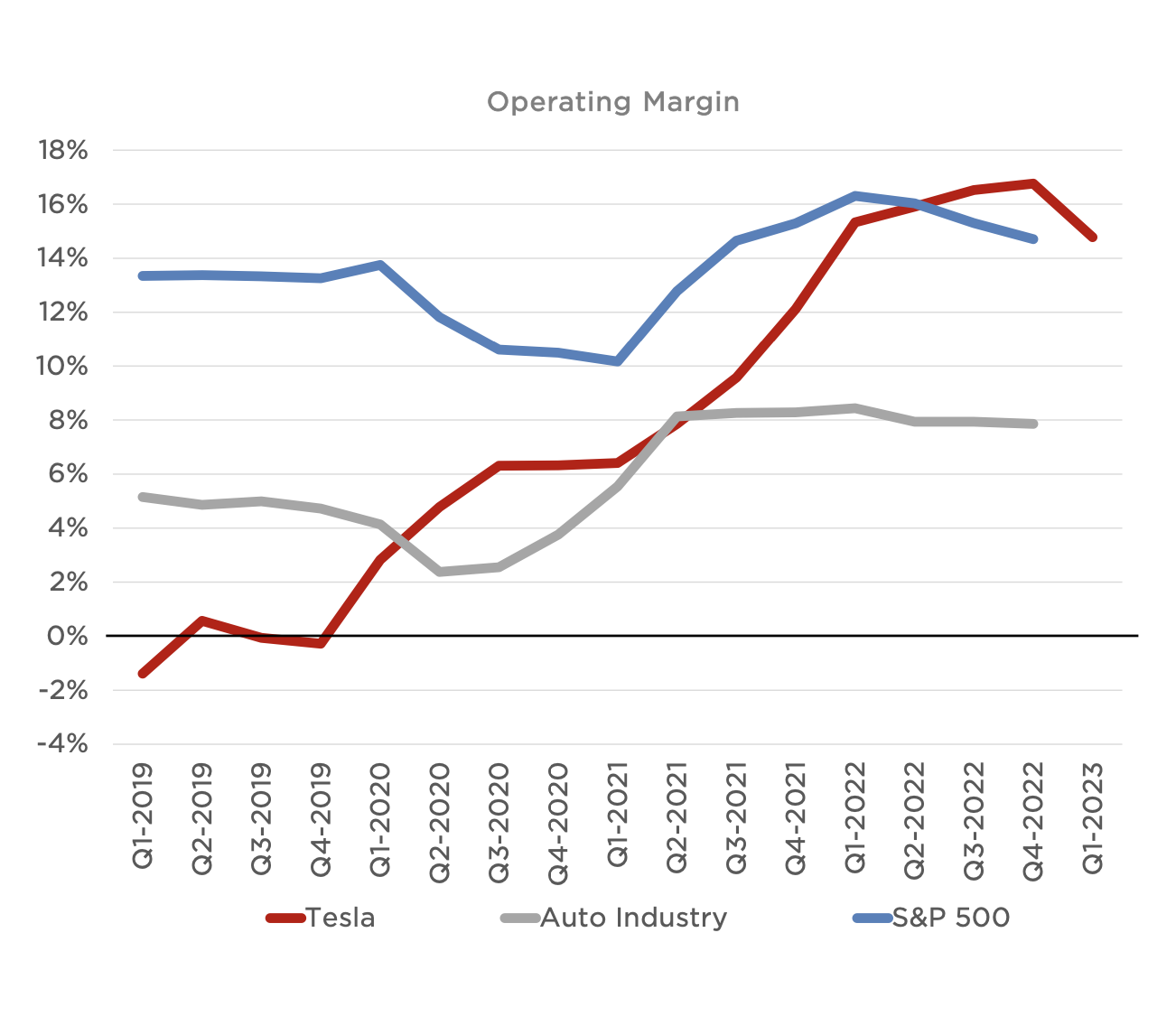

Operating margin is relatively stable with the macroeconomic sistuation. If they stay around 16%±2% and keep growing 50%/year this is incredible. It's just that we have been too spoilt with the crazy backlog and insane prices during the pandemic and people expecting even more.

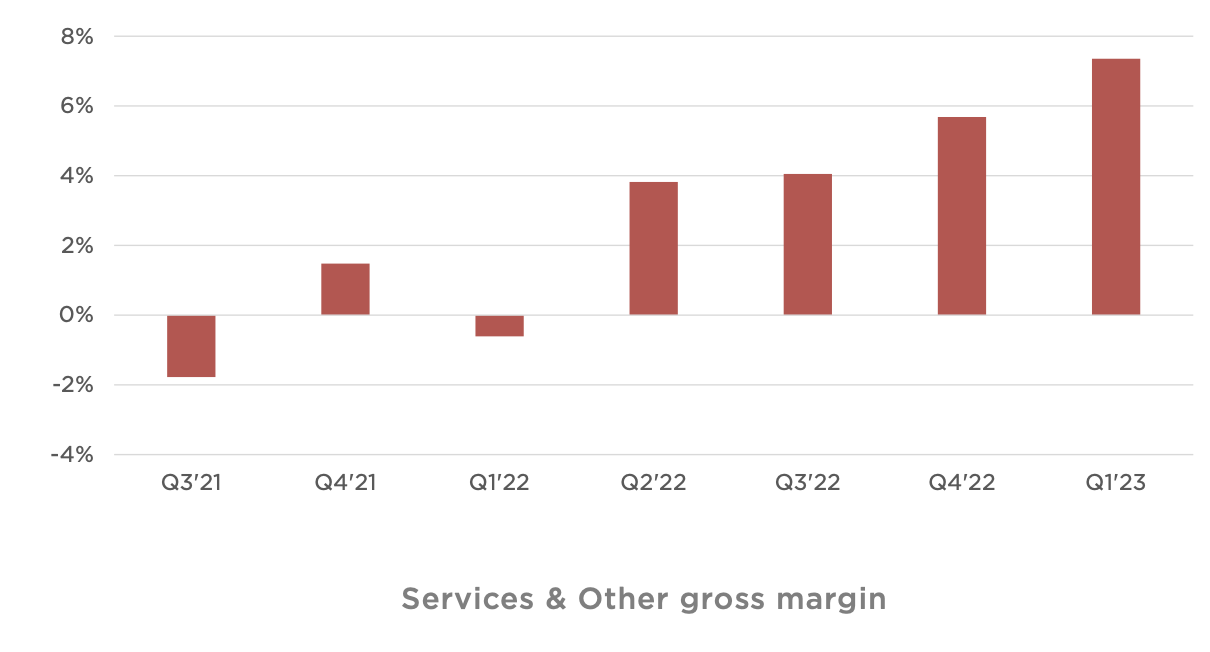

This is great progress. From negative to 7% over a year.

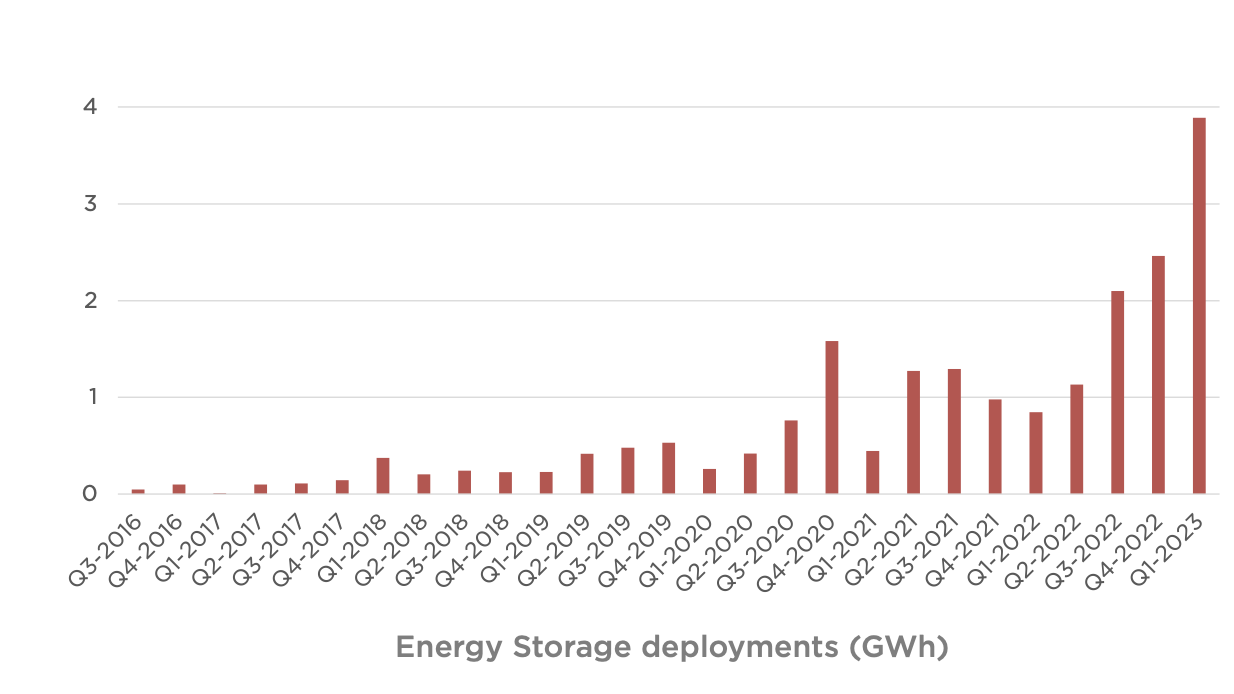

Another crazy growth chart. This is supposed to be a weak quarter like the previous three Q1 numbers, instead we see a takeoff.

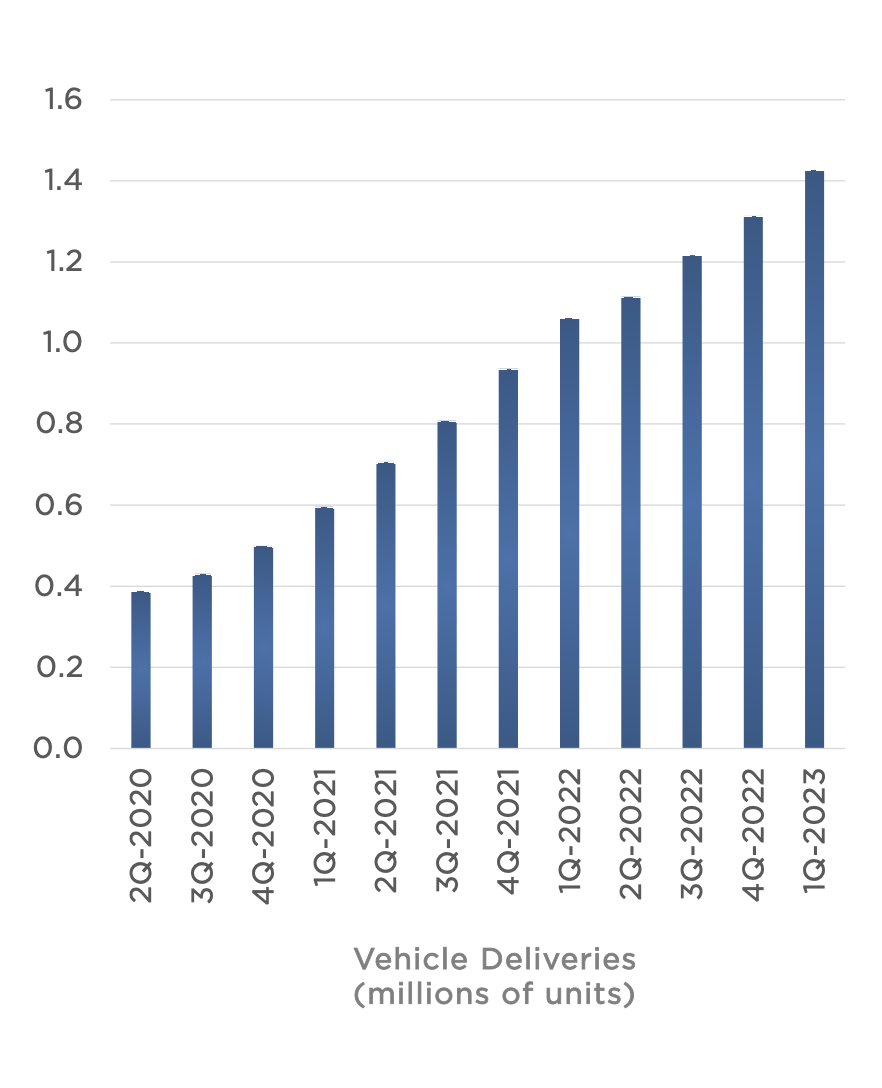

TTM for vehicles deliveres, removing the noise that some people focus on too much. Tesla has been growing steadily for the last 10 years meanwhile analysts have been thinking that the next quarter is crucial. Why would this be different? Imo remove the noise to understand the story better...

Operating margin is relatively stable with the macroeconomic sistuation. If they stay around 16%±2% and keep growing 50%/year this is incredible. It's just that we have been too spoilt with the crazy backlog and insane prices during the pandemic and people expecting even more.

This is great progress. From negative to 7% over a year.

Another crazy growth chart. This is supposed to be a weak quarter like the previous three Q1 numbers, instead we see a takeoff.

TTM for vehicles deliveres, removing the noise that some people focus on too much. Tesla has been growing steadily for the last 10 years meanwhile analysts have been thinking that the next quarter is crucial. Why would this be different? Imo remove the noise to understand the story better...

Krugerrand

Meow

Agree with what you are saying but at the risk of causing a mini-storm and raising the hair on your back. I'm still convinced that Elon's purchase of Twitter and foray into politics has turned off quite a few potential buyers. No way to prove it obviously but it was always my instinctual read and I wouldn't be surprised if its definitely part of the short term problem .

oh you guys. Such fear and drama. I finally listened to the call and it was not nearly as bad as I figured it would be after reading the comments here. This was all more of the same. Let the short term fools give us an even better buying opportunity.

I'll be buying more tomorrow while watching Starship and NCC1701D fly with a giant smile on my face.

No the call wasn't bad at all. Quite positive for the future of the company honestly, just worrisome about the margins and the rest of this year, 2023.

Oh and I'll be watching the Picard finale in less than nine hours now too!

Krugerrand

Meow

I hear you. I’ve just resigned myself to the fact that Tesla will never cater to WS. And honestly I like that we don’t negotiate with crooks.I agree 100%, it just would have been nice if the mgmt team showed care towards us beleaguered investors. Instead of Elon pretty much emphasizing that Tesla could very well reduce margins to zero, it would have been nice for them to remind Wall Street of the positive benefits IRA is going to do to margins. I can guarantee you GM and Ford will talk about this in their CC.

You and I know all is well, but geez, it would have been nice to convince Wall Street of the same.

1.5 new models in 11 years. No real SUV. A freaky truck incoming that should have been the basis for selling a million pickups and SUVs.

This will be the drag on TSLA. Cybertruck will sell out production and have great reviews. It was also a stupid choice of vanity.

This will be the drag on TSLA. Cybertruck will sell out production and have great reviews. It was also a stupid choice of vanity.

nativewolf

Active Member

The company launching in Colorado has the same density.Holy guacamole, that's CATL, not some University lab.

That density would match aviation requirements indeed.

They mentioned automotive applications as well, implying cost isn't through the roof.

Intriguing to say the least!

Krugerrand

Meow

We’ve been told now on a number of occasions that the path forward for Tesla hinges on FSD. That’s a fact. What you want to happen is of no consequence. They’re straight up telling us that FSD is the goal. There is no contingency plan. The sooner that’s accepted, the sooner you can make choices that best suit you.That was harsh even for you Krugerrand, are you out of cat food tonight?

I feel it is reasonable to wish for a better strategy than "wait for FSD to save the financials". I'd like the company to have a plan just in case FSD never gets solved. I think that is both a tenable and practical expectation to have. Aggressively price cutting to kill margins while planning for FSD to someday possibly save said margins is not a very reassuring strategy. What if FSD never pans out?

For the record I do think FSD will get solved someday, but I also think we are still many years away from that, let alone deploying the RoboTaxi fleet, and I'd prefer the stock to trade better than sideways for the next few years if at all possible.

In my honest opinion of course. Obviously you disagree, thus the insults. If I am a slow learner than you certainly are not helping the matter with posts like that.

Thekiwi

Active Member

A few graphs that were not getting enough attention:

View attachment 930080

Operating margin is relatively stable with the macroeconomic sistuation. If they stay around 16%±2% and keep growing 50%/year this is incredible. It's just that we have been too spoilt with the crazy backlog and insane prices during the pandemic and people expecting even more.

[…]

Unfortunately your Operating Margin chart is trailing 12 months. They are not going to stay around ~16% this year when the just reported quarter was only 11%, and Q2 looks likely to be the same or worse. Should recover in medium term future of course.

Form over function? I think they went for both and were willing to risk the edge case to maximize both. It’s going to be interesting to watch. Unfortunately it’s too big for my garage..1.5 new models in 11 years. No real SUV. A freaky truck incoming that should have been the basis for selling a million pickups and SUVs.

This will be the drag on TSLA. Cybertruck will sell out production and have great reviews. It was also a stupid choice of vanity.

Thekiwi

Active Member

One thing that went under the radar today:

Berlin is listed in the shareholder deck as now having capacity of >350,000 annually (or ~7k per week run rate). I think this explains why the weekly China sales numbers came in so high last night - 12.5k! - which is highly usual for the 2nd/3rd week of a quarter when most China production is normally being exported.

Germany obviously handling the bulk of EU model Y demand now, with Shanghai now just needing to send the Model 3 & Model Y SR over now (until Germany ramps the SR RWD Y)

Berlin is listed in the shareholder deck as now having capacity of >350,000 annually (or ~7k per week run rate). I think this explains why the weekly China sales numbers came in so high last night - 12.5k! - which is highly usual for the 2nd/3rd week of a quarter when most China production is normally being exported.

Germany obviously handling the bulk of EU model Y demand now, with Shanghai now just needing to send the Model 3 & Model Y SR over now (until Germany ramps the SR RWD Y)

CT didn't need to be maximized. It needed to be the basis for a range of pickups and SUVs of several whellbases. Tesla has a substaintial lead in manufacturing. They have the price advantage. Eliminating 2/3 of potential customers before the first one goes on sale while planning for high growth is stupid.Form over function? I think they went for both and were willing to risk the edge case to maximize both. It’s going to be interesting to watch. Unfortunately it’s too big for my garage..

As far as cars, boring 2/3 of potential buyers is also not a plan for growth.

As soon as read this in shareholder deck, it did not seem good.

“Our near-term pricing strategy considers a long-term view on per vehicle profitability given the potential lifetime value of a Tesla vehicle through autonomy, supercharging, connectivity and service. “

Autonomy= Giant questions of if and when. Take rates?

Supercharging= Is it a huge moneymaker? Am I missing where it on the balance sheet or is it just included under other?

Connectivity= 120 per year. If you drop price of vehicle a few k, going to be a while before you make that up.

Service- remember when Elon stated the plan was never to make money of of service and have it be income neutral?

Need model 2 asap. Need cybertruck asap. Need semi ramp asap. Need major model s and x major refresh asap. Not many people care about plaid, but they do care ( for better or worse) of not having a similar looking vehicle than their neighbour who bought it 7 years ago.

“Our near-term pricing strategy considers a long-term view on per vehicle profitability given the potential lifetime value of a Tesla vehicle through autonomy, supercharging, connectivity and service. “

Autonomy= Giant questions of if and when. Take rates?

Supercharging= Is it a huge moneymaker? Am I missing where it on the balance sheet or is it just included under other?

Connectivity= 120 per year. If you drop price of vehicle a few k, going to be a while before you make that up.

Service- remember when Elon stated the plan was never to make money of of service and have it be income neutral?

Need model 2 asap. Need cybertruck asap. Need semi ramp asap. Need major model s and x major refresh asap. Not many people care about plaid, but they do care ( for better or worse) of not having a similar looking vehicle than their neighbour who bought it 7 years ago.

Going over the pix now and ummmm...."I can tell from some of the pixels and from seeing quite a few shops in my time" Come on Tesla. :/

Well their service has a 8% margin so they are making money. However I believe the service they are referring to is mostly Tesla Insurance.As soon as read this in shareholder deck, it did not seem good.

“Our near-term pricing strategy considers a long-term view on per vehicle profitability given the potential lifetime value of a Tesla vehicle through autonomy, supercharging, connectivity and service. “

Autonomy= Giant questions of if and when. Take rates?

Supercharging= Is it a huge moneymaker? Am I missing where it on the balance sheet or is it just included under other?

Connectivity= 120 per year. If you drop price of vehicle a few k, going to be a while before you make that up.

Service- remember when Elon stated the plan was never to make money of of service and have it be income neutral?

Need model 2 asap. Need cybertruck asap. Need semi ramp asap. Need major model s and x major refresh asap. Not many people care about plaid, but they do care ( for better or worse) of not having a similar looking vehicle than their neighbour who bought it 7 years ago.

Thekiwi

Active Member

Service includes Supercharging & Used vehicle sales as well. Used vehicle sales is a good profit center for them.Well their service has a 8% margin so they are making money. However I believe the service they are referring to is mostly Tesla Insurance.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M