FYI I'm pretty sure @Surfer of Life was just kidding; DON'T even THINK of messing with options unless you totally understand what you're getting into .Quick fix: buy LEAPS instead. Those shares will suddenly seem just lovely!

Not advice.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Of course. Larger is better only if the way it's used is similar. Given that an individual's driving style isn't likely to change much over time, larger is better. Two different people can have different results but larger will still be better for each individual.Well, the curve really depends on what the pack is subject to.

A smaller pack (say 80 rather than 100Kwh), in a car that uses 20% less Wh/mi (in the ball park for an S vs. a 3)would see the same impact for car driven the same miles.

---

Mod: last post on battery degradation. Take it to the dedicated threads.

Because I saw quite a bit of personal spending coming up until next year, I decided to sell some TSLA.

Based on the sentiment here of Q1 results I sold before publication of Q1, at USD 187.xx

In hindsight thatwas looks like a good decision.

Why looks like? Because that is hindsight now.

Could be that next month that in hindsight it was a bad decision, should TSLA rise again.

So, looks like I was lucky.

Let's be honest, timing the market is a gamble.

For now, thx everyone for the useful info.

Based on the sentiment here of Q1 results I sold before publication of Q1, at USD 187.xx

In hindsight that

Why looks like? Because that is hindsight now.

Could be that next month that in hindsight it was a bad decision, should TSLA rise again.

So, looks like I was lucky.

Let's be honest, timing the market is a gamble.

For now, thx everyone for the useful info.

Krugerrand

Meow

Absolutely, but mountain. Like a solid rock one. Not one of those sissy pants wanna be one. As in it took the guy weeks to prepare the house site, breaking the ginormous jackhammer multiple times. According to the excavator dude, never in all his decades of breaking rock has he encountered such bizarrely unyielding rock. Yes, we considered explosives and truthfully the spouse was really wanting to see that, but the number of skilled, licensed explosive experts within a 100 mile radius of The Mountain was pretty light and all booked for literally months.Totally off topic but did you look at the earth battery approach. Basically a very low power geothermal system which works great for greenhouses.

He is back at the main office in East Setauket, NYHow’s Karen Rei?

Skryll

Active Member

So you will lose shares either way.My point was that buying at higher-than-later pricing is effectively the same as losing shares.

As is not buying at lower than future prices...

JusRelax

Active Member

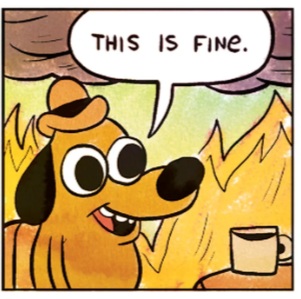

MSFT: AI! -> Stock up 10%

META: AI! -> Stock up 15%

TSLA: Real world AI! -> Stock down 20%

META: AI! -> Stock up 15%

TSLA: Real world AI! -> Stock down 20%

Krugerrand

Meow

?Vehicle prices are the ultimate truth of that - If they start going up he was telling the truth, if they go down he was not (or stating the spot position over that week or something)

Couldn’t the demand level simply rise at the same rate of production meaning no price or adjustments?

Or couldn’t the economic situation continue to worsen and to keep demand in parallel to production prices could go lower - but that wouldn’t constitute a lie since he can’t predict what’s going to happen next month or the one after, and that last was clearly stated.

Indeed, prices down right this second doesn’t mean he was lying on the call, it would mean things have changed since the call. No?

How long do people need to have no additional lowering of prices to not view him as a liar? A year? 2? 6 months?

Captkerosene

Member

Having listened to hundreds of conference calls over the years, that statement jumped out to me as being somewhat "insincere." The statement seemed like data mining or a statistic presented in a way to hide the truth. Tesla had a price cut days before the call, of course there was a jump in sales for a few days. Given the large price cuts over the thirty or ninety days before the call it seems to me that demand relative to production was softening.Elon just said on the quarterly call that demand >production.

Do you think he's lying?

2daMoon

Mostly Harmless

I'm in no way saying I can time anything.

What I am saying is that while number of shares does not change with the stock price, I think it is oversimplification to say that when those shares were bought doesn't matter.

If one cares about number of shares:

Then there must be some downside (loss) buying half as many shares at $300 vs $150.

Again, not debating DCA in general.

Further down the road having more shares will be better than not having them. To have them one must buy them.

When is the best time to buy anything? When it is on sale. Today, it is on sale. If it goes down tomorrow, yay, another sale. If it goes up next week and there is more cash to buy with, then get some more even if the sale is over.

The cost itself is a dynamic variable being affected by a lot of factors which cannot be predicted or controlled by the buyer.

The number of shares one holds is a known factor that is completely within the control of the shareholder, regardless of these myriad factors that affect the price of the shares.

Buying shares on the way down and on the way up will average out the cost basis for the shares, and, the share count will steadily increase.

Waiting for the perfect moment to buy will always have a potentially higher risk/reward ratio. That is great for anyone who is lucky enough to buy all their shares at exactly the right moment. If luck has a running record of being on your side, by all means, make use of that advantage.

For the rest of us, accumulating little by little whenever we can may be the most resourceful bet to make over time for people who prefer to avoid counting upon luck to favor them. Particularly when the company has stellar fundamentals and a long-term upside potential.

I have always found it better to have and not need than to need and not have.

Last edited:

Krugerrand

Meow

Headline of the day:

Tesla Cars Are Most Likely to be Recalled, Study Claims

Tesla Cars Are Most Likely to be Recalled, Study Claims

Skryll

Active Member

Especially in the light of having done a second drop in prices right before the event, as in trying to make it so on the projection of real time data. Remember Elon tweeting FED has too high latency in their data they make decisions on?Having listened to hundreds of conference calls over the years, that statement jumped out to me as being somewhat "insincere." The statement seemed like data mining or a statistic presented in a way to hide the truth. Tesla had a price cut days before the call, of course there was a jump in sales for a few days. Given the large price cuts over the thirty or ninety days before the call it seems to me that demand relative to production was softening.

Waiting for the bottom to hit? Can you share what SP that is so that we can all plan to short $TSLA and then buy back in after the bottom? TIAWaiting for the bottom to hit. I'm not selling, mind you, but I've lost enough money on this slide over the last month to hit pause.

Hundreds of Elon's calls?Having listened to hundreds of conference calls over the years,

Elon isn't like most other CEO's (he's actually TechnoKing, remember...)that statement jumped out to me as being somewhat "insincere." The statement seemed like data mining or a statistic presented in a way to hide the truth. Tesla had a price cut days before the call, of course there was a jump in sales for a few days. Given the large price cuts over the thirty or ninety days before the call it seems to me that demand relative to production was softening.

He's a guy on the spectrum that tends to value logic and objective data, and is motivated by things like getting to Mars and preventing existential threat on earth more do than money ... see:

I tend to take any carefully couched statements as having more to do with not feeding the trolls than being disingenuous...

Headline of the day:

Tesla Cars Are Most Likely to be Recalled, Study Claims

Read an article with the same headline a few days ago. It’s the ultimate FUD. The result of that study is not based on physical recalls but on Tesla’s track record of mostly OTA updates and most of those were for new versions of FSD!

Read an article with the same headline a few days ago. The result of that study is not based on physical recalls but on Tesla’s track record of mostly OTA updates and most of those were for new versions of FSD!

Reading is fundamental, unfortunately, MSM just spreads the negative rhetoric with these headlines, hoping the uninformed just spread the "Did you see the article where Tesla is the most recalled vehicle of all automakers?"

2daMoon

Mostly Harmless

Waiting for the bottom to hit? Can you share what SP that is so that we can all plan to short $TSLA and then buy back in after the bottom? TIA

Dang it!

Looks like we missed the bottom, ...

again.

/s (for the sarcastically impaired)

Last edited:

nativewolf

Active Member

Well your solar

Solar yield should be amazing, project sounds fun. Explosives definitely the way to do it if you do an expansion fortificationAbsolutely, but mountain. Like a solid rock one. Not one of those sissy pants wanna be one. As in it took the guy weeks to prepare the house site, breaking the ginormous jackhammer multiple times. According to the excavator dude, never in all his decades of breaking rock has he encountered such bizarrely unyielding rock. Yes, we considered explosives and truthfully the spouse was really wanting to see that, but the number of skilled, licensed explosive experts within a 100 mile radius of The Mountain was pretty light and all booked for literally months.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M