Plenty of L4 competitors but I can't find any credible L5 competitor. The ones who claims they are working on L5 still have yet to activate them so it's impossible to judge how well they work ...everywhere. Tesla is the only one with almost half a million cars running all over the US providing real feedback on their L5's shortcomings while mobile eye is showing video of pretty much Omar's equivalent location specific drive in their promo video and claims they have similar L5 system.Now you're getting into fantasy territory. The more good AVs there are, the _less_ reason there is to mandate it. Much more likely would be governments getting tougher on driver testing and OUI.

In addition, people forget that there's ADAS competition as well.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

cliff harris

Member

It could allow all sorts of great things, but it doesn't magically make $10,000 more in disposable income appear in the pockets of potential buyers. $10k is a crazy amount of money for most people.Well, they say they wouldn't pay that, but in part that's because it's not autonomous. Autonomous would be a huge difference as it can expand acceptable commutes, which can lower the cost of housing. Autonomous would allow stretch commuters to shut down immediately after the workday ends.

Whew...thought it was because Elon borrowed $1B from SpaceX?Market weakness most likely due to China banning government officials from using iPhones.

Todd Burch

14-Year Member

They'll have to update the line in Fremont first. Haven't seen any evidence of that. I expect Fremont will take 2-3 times longer than Shanghai to spin up.For those wanting Model 3 refresh in the U.S. (and Canada) don't hold your breath until Q4 and Cybertruck release event.

This will be the 1 more thing they add - sales and delivery will start immediately in Q4 with CT release.

Makes sense for financials and end of year push.

But hey Q4 is less than 25 days away.....

Artful Dodger

"Neko no me"

Even if FSD isn't active, if the human does sonething different that the NN would have, then that can get flagged and submitted, just like a disengagement does (without voice note, of course).

Further, there is no operational definition of a "real" FSD disengagement. Users often turn off FSD accidentally by tugging the steering wheel too hard, or on purpose when they decide to change navigation mid-trip.

These non-driving / control disengagements make for much noisier data than what shadow mode provides just by comparing its intent to the driver's actions. Tesla will run FSD in shadow mode on all HDW 4 cars until they have enough training data collected to catch up with the performance of FSD on HDW3 cars.

Tesla's Director of Autopilot software Ashok Elluswamy said during his FSD ride-along with Elon on Aug 25 that FSD v12 will go out to Users in shadow mode in a few weeks.

Last edited:

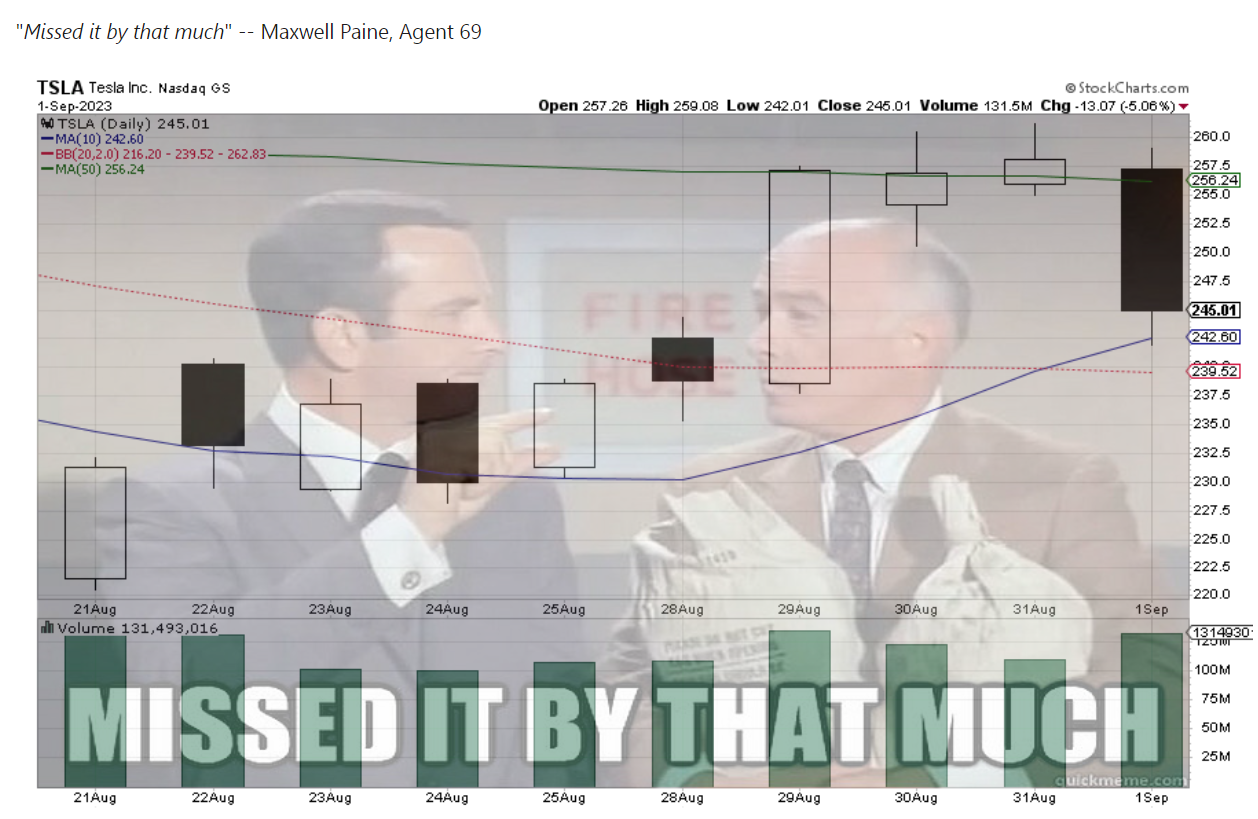

All right: Who peed in the punch bowl this morning?

I'm itching to buy some back on today's sale... $245 seems reasonable for such an amazing company, right?

I looked back in time to see if the dodger had any useful charts and found this old one. Is there any update?

50 done.

50 more? Or wait?

I looked back in time to see if the dodger had any useful charts and found this old one. Is there any update?

50 done.

50 more? Or wait?

Last edited:

Artful Dodger

"Neko no me"

All right: Who peed in the punch bowl this morning?

It's all just Snakes'n'Ladders to Wall-E... Funny thing is they think they're 'contributing' to the economy.

Cheers to the longs!

Artful Dodger

"Neko no me"

Whew...thought it was because Elon borrowed $1B from SpaceX?

... and PAID IT BACK with INTEREST already! Don't forget that in yer headline.

Do you actually think the government would allow that? The politics would be horrible .If the government mandated self driving then the numbers get even crazier for Tesla. Tesla would be the only vendor and every OEM would have to license Tesla's FSD. So just in the US, that's about 14 million cars. And say Tesla "only" charges $10,000. That's $140 billion per year.

Morgan Stanley? They completed their takeover of ETrade over the weekend, and I got a margin call this morning. I had plenty of available margin yesterday. Did this happen to anyone else?All right: Who peed in the punch bowl this morning?

I have messaged "ETrade from Morgan Stanley" for an explanation.

FSD mandate? Maybe someday. Public shaming of human drivers is one approach. Media showing a head-on accident, "No FSD" shock. Times will change along with the perception of safety.Do you actually think the government would allow that? The politics would be horrible .

Not sure they'd mandate a specific company. Maybe a minimum safety level - like seat belts. Can you believe every car has them now... back seats too!

For the first time in 8 years, Tesla will be at the Detroit auto show...

Knightshade

Well-Known Member

A long, long time ago, when I was still a teenager, my father took me aside and explained about Car Loans. (Note: This was all very much pre-computer and PC).

Case #1: One does not have money in the bank to buy a car outright, so one takes out a loan. He very carefully calculated out how much one would have to pay for that loan, complete with the car loan interest rate. At the end of that time, plus maybe a few years, one still doesn't have that much money in the bank, so one has to take out another car loan. For those not truly well-off, one gets stuck in this rat race.

Case #2: Hold off buying the car, but deposit a certain amount of money every month into an interest-bearing account. (This was back when, well, banks actually paid reasonable interest on deposits. Today, one would use a bond fund or something for the purpose.) Since one is aiming at buying a car down the road, the amount being saved becomes larger over time due to compounding interest, so the amount put away every month is substantially less than what one would have to pay for with a loan.

When enough money is accumulated, go out and buy the car. With cash. Drives the dealerships beserk; they like those loan origination fees. And the chance to diddle the loan interest rates. And, if played right, gives one a leg up on the dealer's usual machinations of trying to extract the most from a buyer.

Once one has the car: Keep on putting money aside for the next car. At the end of each cycle of this method, one has a heck of a lot more money.

I have never taken out an auto loan in, what, five decades of owning cars.

The above is, I'm sure, no surprise to anybody who hangs out on an investment forum. But it's amazing how few consumers realize how bad the rat race of buying stuff on time is.

Whereas I happily took a car loan for my Tesla at 2.29% and used the cash to buy more TSLA back in 2018.

Be happy to run the math on how your strategy worked versus mine sometime

Your dad (and the general Dave Ramsey view of NEVER BORROW MONEY) is useful for folks with low financial literacy, but ignores the opportunity costs of putting your cash where it does the most good versus avoiding all debt at all costs-- and there IS a cost...

Electroman

Well-Known Member

Unnecessary... unproductive and I would say a move that will hurt more than benefit.For the first time in 8 years, Tesla will be at the Detroit auto show...

Most importantly one has to make sure to stay in the game. Just because you (and many of us here) lucked out doesn’t make you a genius.Whereas I happily took a car loan for my Tesla at 2.29% and used the cash to buy more TSLA back in 2018.

Be happy to run the math on how your strategy worked versus mine sometime

Your dad (and the general Dave Ramsey view of NEVER BORROW MONEY) is useful for folks with low financial literacy, but ignores the opportunity costs of putting your cash where it does the most good versus avoiding all debt at all costs-- and there IS a cost...

Knightshade

Well-Known Member

Morgan Stanley? They completed their takeover of ETrade over the weekend, and I got a margin call this morning. I had plenty of available margin yesterday. Did this happen to anyone else?

I have messaged "ETrade from Morgan Stanley" for an explanation.

FWIW I have a friend who has a small FAFO day trading account at Etrade--- Mostly uses it to experiment with 0DTE and other lottery type plays... normally when you have PDT flag you have to have 25k in there of value or they'll restrict you to settled cash only transactions.... that's long understood as a rule- and he's usually right around that amount as it's a play account.

Recently he told me etrade changed policy and if you have a PDT flag and slip under 25k balance at the end of any day they ENTIRELY LOCK the account other than liquidation sales of holdings unless you bring it back over 25k. Weird stuff.

Knightshade

Well-Known Member

Most importantly one has to make sure to stay in the game. Just because you (and many of us here) lucked out doesn’t make you a genius.

Not really though. You can certainly say the ~1300% TSLA is up in that period is my "getting lucky" if you want.

But if I had instead just put it in an S&P 500 index fund I'd still be way ahead of the "savings" of having paid cash for the car.

S&P500 is up over 55% in the period I describe. Versus my ~2% car loan.

Same with the ~2% mortgage I got in 2016 instead of foolisly paying cash for the home.

You're cherrypicking counterfactuals.Not really though. You can certainly say the ~1300% TSLA is up in that period is my "getting lucky" if you want.

But if I had instead just put it in an S&P 500 index fund I'd still be way ahead of the "savings" of having paid cash for the car.

S&P500 is up over 55% in the period I describe. Versus my ~2% car loan.

Same with the ~2% mortgage I got in 2016 instead of foolisly paying cash for the home.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M