Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

He can't afford one any more....He is probably trying to get a Model 3 right now...

The Blue Owl

Endangerous Herbivore

We really do need some clarity on building out GF capacity. Here they definitely need to hold cards close to chest, but I am concerned that facility planning is already a hard constraint on growth out to 2022. This also frustrates me around raising capital. To delay capacity build out until it can be funded by internal cash really makes the planning narrow and contingent. A shortfall in cash one year can delay capacity needed 3 or 4 years out. But a surplus of cash the next year can't speed things back up. Just barely being cash positive does not put you in a position to fund 50% annual growth.

I suspect they did recently get a more acute understanding of the constraints on growth other than capital, but they haven’t yet come up against those constraints.

If M3 sales ramp up as planned this year, they can raise more capital in Q1 2019 on good terms and use it for new capacity in China, for expanding Nevada and Buffalo, and maximizing Fremont. They don’t need new tech for the existing S/3/X lineup; they can copy and paste the best of what they’ve got. The main constraints will be access to inputs (raw materials for batteries, parts from suppliers) and hiring, of which the raw materials are probably the only potentially tricky one. I’m thinking they won’t hit the upper limits there before 700-800k per year, though, and more supply will come online after.

But yeah, hearing Musk scaling down their 2020 roadmap on the fly during the call was sobering for me too. As much as I dislike the guy, Higgins asked a good question.

If they are not so savvy, why is their brokerage allowing them to do options or short? a serious question. Schwab is quite cautious with me and I've been with then since 1980's.See, I don't know where my sympathy should start and end.

But, if there's a not-so savy investor who constantly hear things like 'losing money for every car they make', 'will run out of money in under a year', .

mutle

Member

Happy day ! AAPL is just over 1 T.B mark. When Tsla will be?

Yahoo is still using old share counts, but it will happen sooner than later: "$AAPL is NOT $1T until $207 based on the 10Q."

squawksquare on Twitter

I wonder if Tesla really has the capacity to make much more S/X at Fremont. Didn't they say that line is already runing full tilt? My guess is it will not happen before a major refresh to simplify production, and that will probably wait until 3 is where we all want it (including TE, etc). So, S/X not only battery constrained, IMO.I hear you. Thanks for spelling this out. My team hates me for my analogies so here goes: in this case really what we see is Tesla's transformation from a speedy roadster into being a massive Semi truck: Much harder to steer, not as nimble, but very powerful, and able to haul a metric ton of stuff. So while I think that growth in the Tesla universe in the past used to (mainly) come from new and innovative products and in spurts / chunks, I think that we will have two types of growth going forward: New stuff (Semi, Roadster, Model Y, next version of the Solar roof etc.) and growth from existing products (Model S, X, 3 etc.).

A lot of the short-thesis discussions used to be that none of the existing stuff is sustainable and that on the flimsy promise of future scale, Tesla is throwing one new product after the other onto the market (and raises capital for that).

This has changed: We haven't really seen much of that growth from Model S / X this year (battery constraints) but I'm convinced we will see lots of growth from incremental improvements going forward. The market is simply no where close to being saturated. And as scale comes into play, I'm wondering how much money these incremental sources of growth will cost. I'm convinced (also after EMs comments that it is cheaper to go from 5k to 10k than from 0 to 5k cars / week) that there is a ton of consolidation / growth potential in the existing product portfolio. Then again, of course there are limits to that...

If this was the case (delaying growth to manage it organically rather than raising funds), I would agree. From the call I gather that the problem right now is not to be solved by "more money" (i.e. one silver bullet) but rather by "many many bigger and smaller bottlenecks in a long and complex supply chain (i.e. many lead bullets)

But I'm just guessing, too.

The EC was simply not the venue to lay out a road map to 1 million vehicles. But my concern is that this is slipping from a once 2020 target to maybe 2022 reality. I hope I am wrong, and they are simply holding cards close to chest.

An important part of this reality is that Tesla has become the single largest EV maker in the world including PHEVs. By the end of Q3 their YTD numbers will prove this out. I believe that their July numbers already show this lead.

So this is going to mean a massive reframing of Tesla's leadership in the EV industry. Not only do they lead on tech, but they lead on scale too. Musk himself is starting to talk about how the bigness of Tesla is making it hard to move fast. I've set up a thread on EV Market Share just to deal with this emerging reality for Tesla.

We really do need some clarity on building out GF capacity. Here they definitely need to hold cards close to chest, but I am concerned that facility planning is already a hard constraint on growth out to 2022. This also frustrates me around raising capital. To delay capacity build out until it can be funded by internal cash really makes the planning narrow and contingent. A shortfall in cash one year can delay capacity needed 3 or 4 years out. But a surplus of cash the next year can't speed things back up. Just barely being cash positive does not put you in a position to fund 50% annual growth.

So we'll see how Musk lays out a plan for the next 2 to 4 years.

With regard to the 2020 production figure, note that Elon’s CC answer conflicts with the shareholder letter. Given Elon’s propensity to exaggerate, I’ll believe the letter. The WSJ reporter asked if 1M cars was still possible in 2020, and Elon said yes, and that Shanghai was the path to get there. Then Elon started backpedaling in his answer all the way back to 500K for 2020.

The shareholder letter said initial cars coming out of Shanghai will be in 3 years, that’s mid 2021. Initial cars, initial ramp.

So, I’d belive 500k cars, maybe, by 2020.

The bottom line is that to keep growing, Tesla needs to keep building factories. Both car assembly and battery cells.

A lot of things might be happening here, we just don’t know the answers. It may be that Elon made the decision to have a nice clean earnings report and not muddy the waters with talk of capital raises for future factories. A year from now when the share price is $500, he can credibly say the time is good to raise money for a European factory. Or Tesla’s credit might be good enough then to borrow the money for more factories. Thinking about it, secured loans for property and equipment shouldn’t be too expensive?

It is also possible that Tesla is running up against commodity pricing issues for dramatically increasing battery cell supply. Maybe they’ve identified supply, but it won’t come online for another couple of years. We just don’t know,

What I do know is that Tesla has a mission to continue to dominate the EV market, and have a lot of very interesting high sales volume future products (Semi, Model Y, pickup truck). I have little doubt they will grow as fast as they can, unconstrained by demand. How fast they can ramp is still unknown...

Bad WAPO.FYI Washington Post lead Biz Section article today:

View attachment 322408

The rocky results Wednesday will probably encourage Tesla skeptics who have criticized the company as underdelivering on its promise of reshaping the auto industry. In a letter Tuesday to clients, billionaire hedge-fund manager David Einhorn criticized Tesla’s manufacturing sprint and questioned “whether customers will be happy with the quality of a car rushed through production to prove a point to short sellers.”

Einhorn, a short seller who had bet against Tesla’s stock, also said he would not renew his own lease on a Model S, blaming touch-screen and window problems. Musk responded to the news on Twitter early Wednesday by saying he would send Einhorn “a box of short shorts to comfort him through this difficult time.”

Joe F

Disruption is hard.

"Drill baby, drill!"

"Drill baby, drill!!"

"Drill baby... What? WHAT?!"

What the hell do you mean "It's all gone"?!?

"Drill baby, drill!!"

"Drill baby... What? WHAT?!"

What the hell do you mean "It's all gone"?!?

+50% growth is a false goal.

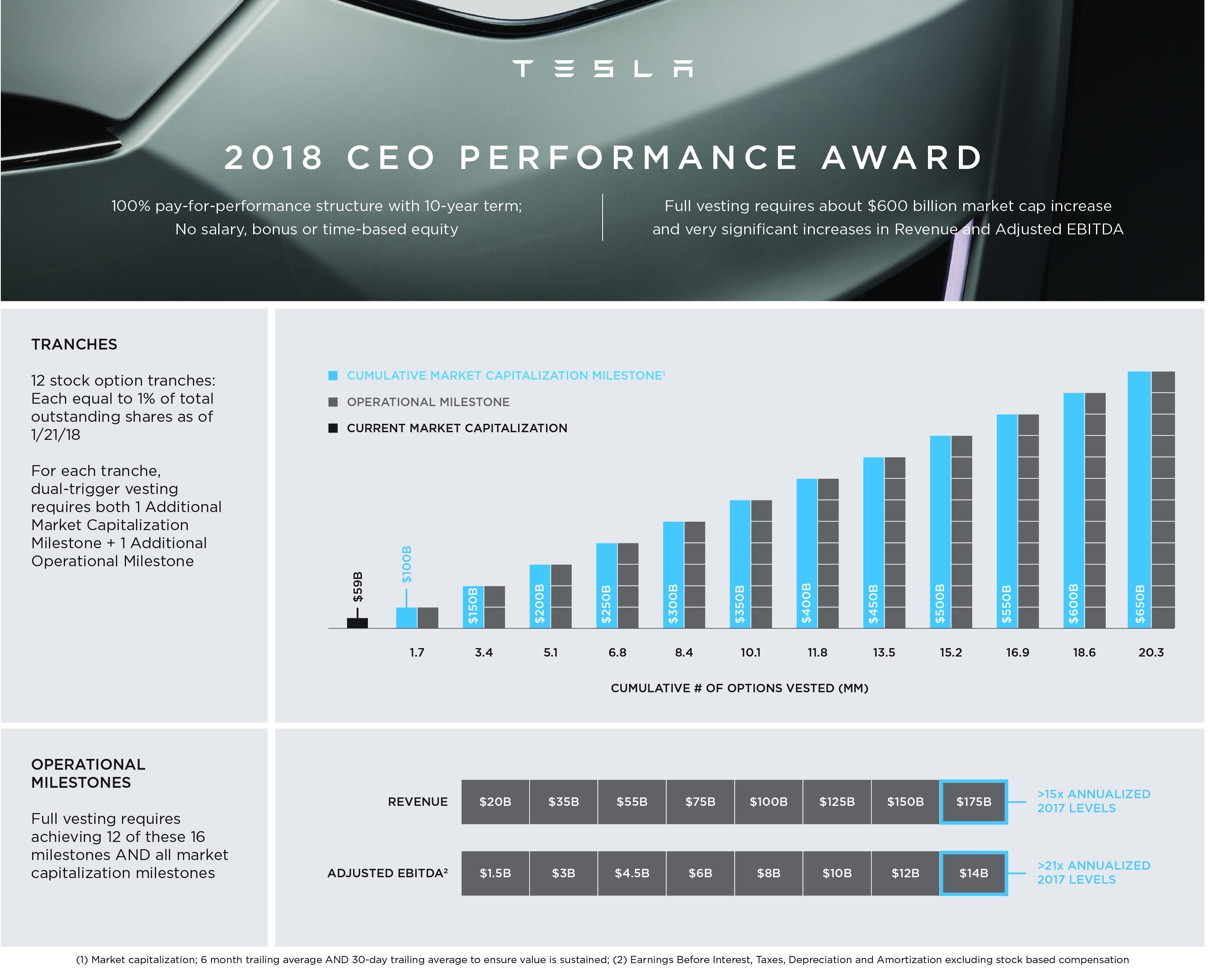

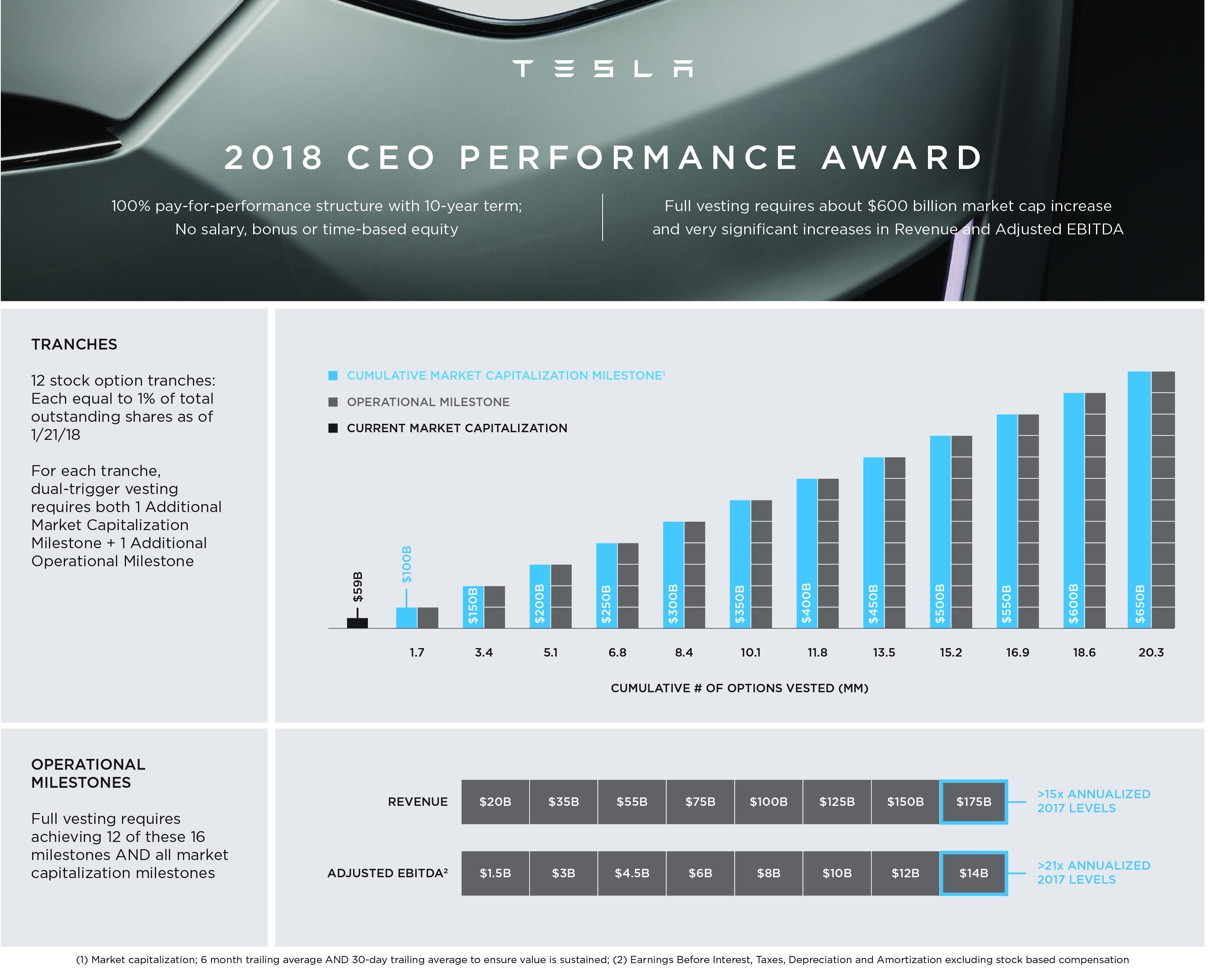

The official goal is defined in elon's compensation plan

It calls for +27% annualized growth rate for the next 10 years.

This same plan was judged as insane with those same short idiots, that now cry about "slow growth under 50%".

Do not play their game.

The official goal is defined in elon's compensation plan

It calls for +27% annualized growth rate for the next 10 years.

This same plan was judged as insane with those same short idiots, that now cry about "slow growth under 50%".

Do not play their game.

Unlikely that GF4 will have a higher production rate than GF3 (Shanghai) by that time. But GF3 will probably be closer to 500k by the end of 2021.

This is just one example of how growth might continue at 50% plus (your number could be right.)

On the other hand, I think 700K Model Y by EOY 2021 is not unreasonable. We don't have much insight yet into the plan for Model Y and Semi. But Elon thinks demand will be higher for Model Y than Model 3 and also believes they can manufacture more simply and efficiently and with less capital per vehicle. Also, Tesla undoubtedly has learned a ton from Model 3.

If they begin production in mid-2020 as previously forecast by EOY 2021 I think 700K is ambitious but not pie-in-the-sky (1.5 years to 700K/year v. 2 years to 500K/year current trajectory for Model 3, with no experience and lots of production glitches).

ABC NEWS:

Tesla stock up despite $717 billion loss last quarter

I think someone at ABC has trouble reading earnings reports.

Tesla stock up despite $717 billion loss last quarter

I think someone at ABC has trouble reading earnings reports.

I must admit, I am very disappointed !

Oh, not in the ER, but in the Shorts. I was expecting some real fireworks from them, a true all hands on deck effort to push the price down this morning. Come on, they can't just give up now and walk away with tail between legs! Where is the fighting spirit ?

Oh, not in the ER, but in the Shorts. I was expecting some real fireworks from them, a true all hands on deck effort to push the price down this morning. Come on, they can't just give up now and walk away with tail between legs! Where is the fighting spirit ?

ABC NEWS:

Tesla stock up despite $717 billion loss last quarter

I think someone at ABC has trouble reading earnings reports.

Personally, I tweet authors when they write something ignorant or just simple mistakes.

Politely. Don't be mean.

Last edited:

Sprung?

The Sprung could be put up tomorrow, set up the line,

while building the factory next door.

Elon mentioned they now unload the parts straight from the delivery trucks to the Fremont Sprung line.

BTW, I remember a 1990's Sprung type structure that was the original Pima Indian casino, right next to Scottsdale, AZ.

It's now a multi million $ resort; Talking Stick Resort and Casino | Resorts in Scottsdale, AZ

ABC NEWS:

Tesla stock up despite $717 billion loss last quarter

I think someone at ABC has trouble reading earnings reports.

What will happen first?????

Apple reaches 1 Trillion Capitalization

Tesla loses 1 Trillion

The bottom line is that to keep growing, Tesla needs to keep building factories. Both car assembly and battery cells.

I agree, especially on the battery cells which Elon said would become the limiting factor during the cc. What does not make sense is Elon's nuanced answer to growth vs reducing capital expediters to be profitable. He essentially said that Tesla has got to the point where throwing more money at growth would have little impact at this stage as compared to earlier stages. If battery cells are the limiting factor, then spending capitol on a new giga factory is exactly what would propel growth. The only thing I can think of is the degree of shorting has been so disruptive that shaking off the shorts initially is what is needed by proving profitability over cell production but that is not what Elon said or implied at any point in the cc.

Tslynk67

Well-Known Member

I must admit, I am very disappointed !

Oh, not in the ER, but in the Shorts. I was expecting some real fireworks from them, a true all hands on deck effort to push the price down this morning. Come on, they can't just give up now and walk away with tail between legs! Where is the fighting spirit ?

Spiegel's ranting away, but I'm not sure many are listening.

The 10% gain looks to be baked-in right now. Another 10% would be nice. Is that being greedy?

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 107

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K