Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Chickenlittle

Banned

Years do not cause recessionWhether or not we avoid it in 2019, 2020 will still cause a recession.

.

Buy low, sell high.

Advice.

Depending on your long range price target, that just means buy buy buy buy buy buy buy hold hold hold...

Except for once a year when you have to sell due to RMD on your IRA... (looking like I should have done that last week).

Hock1

Member

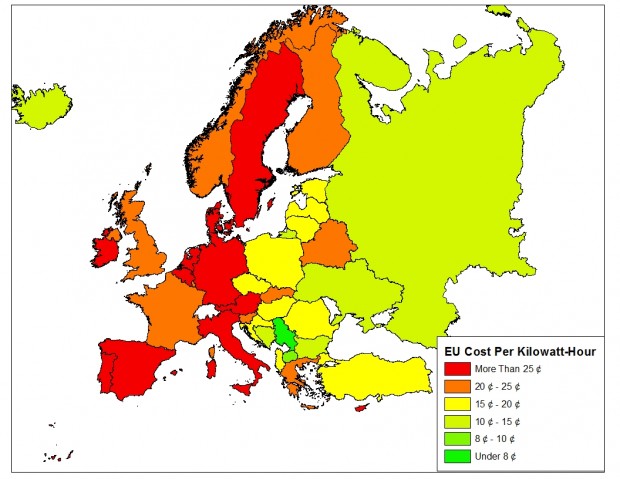

Here's an older but intuitive price map:

It's 5 years old so a bit dated, prices have come down a bit in some of these areas, but this map shows the general distribution of cost of electricity. 20-25 cents per kWh is a good rule of thumb for residential electricity, in western Europe.

Note that in many markets you can get cheaper overnight electricity plans in the $10c range (sometimes less), which will skew these costs. Nothing will beat the almost-free Texas overnight wind electricity prices though.

This also suggests that the Model 3 will be non-linearly more popular in Eastern Europe, which has similar gasoline prices with high tax content, but much lower (often subsidized) electricity prices. The main barrier to EV adoption there is the high cost of the cars - the Standard Range Model 3 will be a big hit there.

Thanks FC. Very helpful. In terms of energy-dollars, I get about 100 mpg-e (with gas at say, $3.10/gal). It looks like, in some cases in Europe, with gas in the $6-7 range, that around 200 mpg-e could be achieved. No??

Krugerrand

Meow

Not possible. That whole week is typically a holiday week. A very slow week. You are not going to find many employees nor buyers willing to spend time rather than visiting family and other holiday pursuits.

Except someone just posted a page or so ago that they were informed Tesla would be delivering cars 12/23-12/31 from 6am-12am (midnight). Another forum member also just said they’ve volunteered to help at their local store/SC on the 30th & 31st

As another point of reference, employees apparently worked right on thru Thanksgiving at Gigafactory.

And another point of reference - employees generally get some time off in the New Year and it’s been that way since I’ve been following Tesla.

None of that sounds anything like you’re implying, but rather the opposite. It’s full bore at Tesla the last two weeks at Tesla right thru AND during holidays. And there are plenty of shoppers and gift receivers during that time. Getting cars for Christmas has been the ultimate holiday gift for decades according to all those OEM commercials.

Last edited:

The 240v standard in Europe will help EV demand too. One of my concerns buying a Tesla was not having 240v in the garage, having to deal with house modifications & contractors, etc.

Someone had mentioned Europeans favor smaller engines, but I think that is mostly due to taxes based on engine displacement, not because they undervalue acceleration. I think the Model 3 will do very well in Europe, and not just the slower versions.

Someone had mentioned Europeans favor smaller engines, but I think that is mostly due to taxes based on engine displacement, not because they undervalue acceleration. I think the Model 3 will do very well in Europe, and not just the slower versions.

Zhelko Dimic

Careful bull

I take exception to this statement. Last couple of years have been unbearable, but current coverage is relatively benign. No, it's not balanced, but it doesn't feel driven by that malicious force that was present in the past.We all experience a lot of FUD these days from the shorts and the already known manipulation from media and analysts trying to create a negative sentiment. The Fed decision is a catalyst for it.

...

As such, I suspect we're seeing relatively natural SP reactions.

I am saying this from the perspective of 'bad guys could come back out', don't be caught flat footed. I feel it's an error to assess situation incorrectly. Some of the demand worries are natural market behaviours, as in market for any stock will always worry about something. Most often next quarter results, whether there is a reason or not.

Krugerrand

Meow

A Tesla employee (who organize test drives in Paris) told me recently that Tesla will probably open some chargers to other manufacturers in each SC station, and that the wait time for these ones would end up much longer than those reserved for Tesla vehicles. This way, they would be open but keep a clear advantage.

*pushing ‘that’s interesting’ button*

tivoboy

Active Member

I’m betting than over the next 30 days there will be a chance for a same or lower price and the tax loss now becomes a gain then. Depends on how big the loss is. If it’s not 10% or more then I’d just ride it out. We’re going to see lower prices IMHO of probably 5%+ before any ATH or higher.Are you betting we're going another 10% down? Otherwise, why buy later?

With everybody saying resession is scheduled for 2020, what reasons do you have to believe that the slide will continue prior to 2020?

Also, with those analysts claiming that you might miss 5-10% growth in 2019 if you quit the market early, seems to be a a ridiculous argument if we're poised to keep losing 10% per week.

If you're giving an advice to sell, it'd be appropriate to rationalize it somehow, otherwise it is reading as a BS.

Like all things in life it’s about timing. At this point one would have to wait till end of Jan to rebuy the STOCK. Wash sale rules don’t allow buyers to buy a call option without triggering the wash sale rule. The opposite isn’t true though which is odd. Anyhow. Within 30 days we’ll have a lower entry point. 45+ days we’ll have a higher price- than today’s. That’s my thesis that im wrapping my options contracts around.

Notarecommmedationtobuyorsell

Currently down in premarket (9:18 eastern) on 51k volume.

Max pain at 345 (~$15 higher) per Opricot Open Interest|Volume|Max Pain

Interesting times.

Max pain at 345 (~$15 higher) per Opricot Open Interest|Volume|Max Pain

Interesting times.

Electroman

Banned

I read lately the i-pace outselling Tesla in Norway

Yes as Anton adequately explained in his Seeking Lies article, I-Pace sales crushed Tesla in Norway on Nov-01, between 10 am and 3:45 pm

Last edited:

Electroman

Banned

I can see that the Shorts are taking this advice seriously - entering low and exiting high - when it comes to TeslaBuy low, sell high.

Advice.

cheshire cat

Member

Was there a strong smell of solvent about ?A Tesla employee (who organize test drives in Paris) told me recently that Tesla will probably open some chargers to other manufacturers in each SC station, and that the wait time for these ones would end up much longer than those reserved for Tesla vehicles. This way, they would be open but keep a clear advantage.

cheshire cat

Member

pnungesser

BarNun

Analyst007

Member

As I told, TSLA is going down to sub 300$ before Christmas. I guess a bounce will happen at 275.

Artful Dodger

"Neko no me"

anthonyj

Stonks

Can’t believe I dug myself out of the $420 funding secured hole, and now I have to dig myself out of this...

That has to be the first 20% drop in one week of any stock on no news at all.

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 254

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K