cheshire cat

Member

Not sure you haven't just invented a new phrase there.Pedo dip! Nice option opportunity before we move into profitability. When are 3Q earning out?

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Not sure you haven't just invented a new phrase there.Pedo dip! Nice option opportunity before we move into profitability. When are 3Q earning out?

Glad I could provide you some humor on this otherwise gloomy TSLA day.The term "Market Manipulation" from you of all people? Really? Now THAT'S funny.

Dan

August 2018 YTD U.S. Passenger Car Sales Rankings - Best-Selling Cars In America -

Model 3 is #5 best selling passenger car in US last month, up 2 spots from July.

Well he's confirmed his true nature when insisting on calling Elon's predictions/goals/aspirations as "promises".I now regret giving you a sincere reply earlier. Please consider it revoked... to you only.

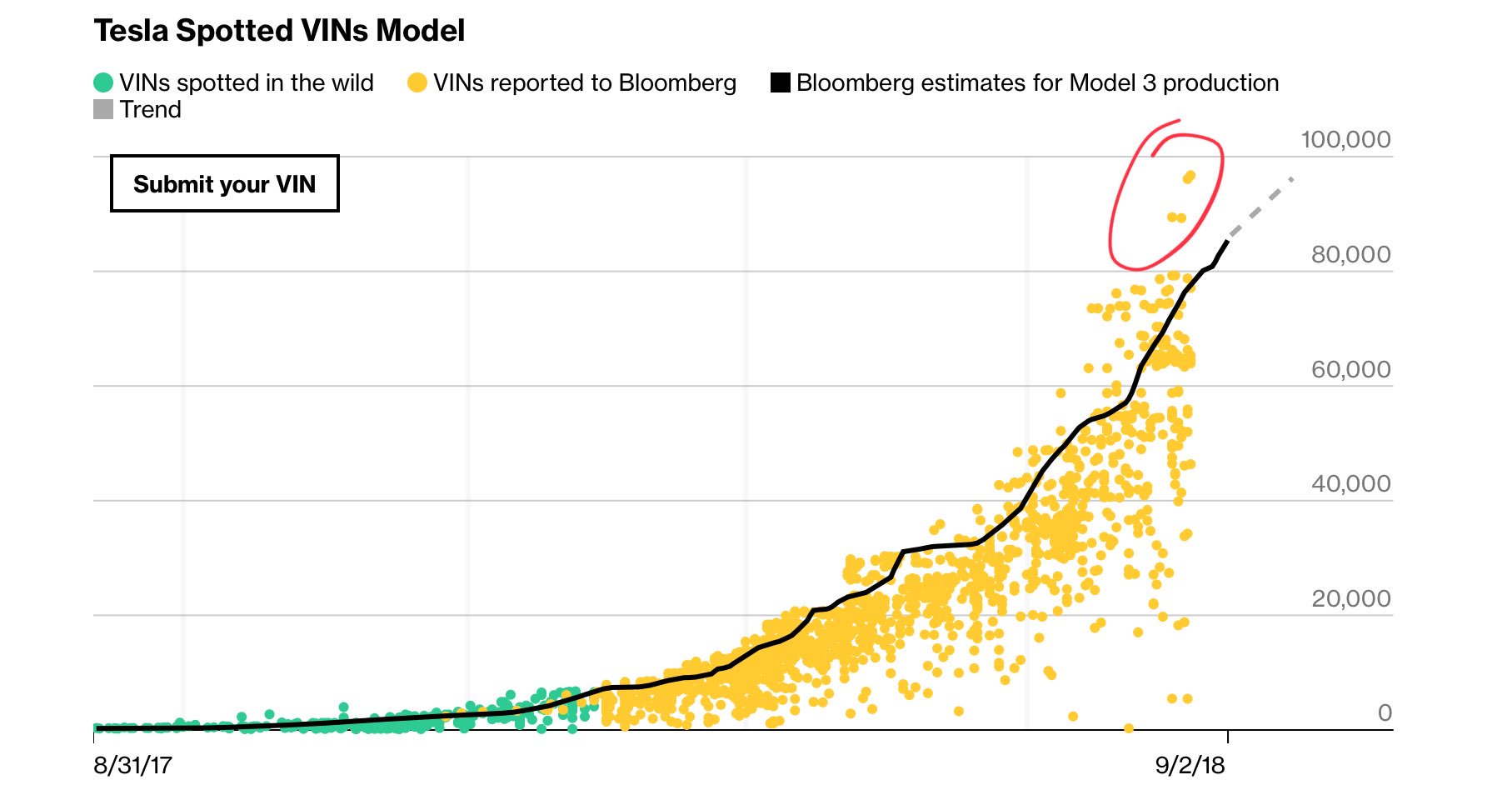

If you add up their total for Model 3, it comes out to under 57k. Bloomberg is reporting 84k today. That's quite a spread.

August 2018 – 20,450 Tesla Model 3 sold, according to estimates from "Good and Bad car". For the first month, Tesla is in the top 10 for cars sold in US, including ICE.

Miguel PeraIv0 on Twitter

Also, 450% yoy growth.Check this out, August sales by brand:

U.S. Auto Sales Brand Rankings - August 2018 YTD -

TESLA is now brand-wide outselling Audi, BMW and Mercedes!!

I don't believe Bloomberg's estimation model, because the calculations that go into that model are public and can be manipulated.

See this thread: TeslaCharts on Twitter

Specifically, this:

I assume your point is that their are some very high outliers. Even if true (which I doubt since I saw a photo of a VIN in the upper 90k's) just a visual examination supports a total production in the 80k range that Bloomberg is reporting. What bothers me, and seemingly no one else, is that the latest reported VIN in the chart is more than ten days old. Look at the line at the bottom for 9/2. Today's chart is exactly the same except it shows 9/4. The most recently added point was about 8/20. What good is this chart if you're not going to keep it current?

If you add up their total for Model 3, it comes out to under 57k. Bloomberg is reporting 84k today. That's quite a spread.

You definitely are not alone in having options deeply red from this latest drop. This was about like a black swan event for me due to adding options when the stock was up high when I would typically never add them. Depending upon your strikes, I wouldn't say any are a lost cause yet. September monthlies (SEP21) still have 12 trading days. That's quite a bit yet. October and beyond are still totally in play. If strikes are way out of the money in SEP and OCT, you will probably lose some money there. Consider shifting a small amount to shorter term lower strike once this dip bottoms. That's what I'm looking at. I'm also shifting some to June 2019 OTM for more time safety.as far as total port-

i’m kinda loaded on stk right now. not looking to add a significant amount more unless it drops further.

trying to salvage some options contracts

sept - lost cause

oct - most likely lost cause

dec - trying to avg down

jan:

- exercised one position based upon private prospects and loading up on shrs (hence the reason i’m not adding a significant amount more)

- other contracts not touching

this last month hasn’t been good to me, i know i’m not alone. such is tsla

still waiting for 3 delivery. maybe that will cheer me up. but not likely, i was up 2Ps now down a base (chump change for some of you, i know).

positioned for comeback though. if it doesn’t comeback well then this will be the most expensive purchase i’ve ever made. life goes on. still have health, fam, and friends. and the dog is relatively happy hahha

I can't understand this price action.

I follow Elon on Twitter. I have seen nothing controversial from him for a while. What did I miss?Try "Twitter".

Robin

I follow Elon on Twitter. I have seen nothing controversial from him for a while. What did I miss?

Dan

That’s a minimum(assuming 100% of those were RWD black Model 3s with no options) of $1,000,000,000 in revenue on the 3s alone, just for August.