Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

When to retire?

- Thread starter BornToFly

- Start date

One thing I just noticed on page 96 of that document is the idea of combining a Roth with an IRA for the purposes of increasing the total balance in order to calculate a higher distribution - but then to only take the distributions from the IRA, leaving the Roth untouched and avoiding the unqualified tax issue. Anyone have thoughts on that?

Following up on my own post, it looks like it is allowable that the Roth balance can be combined with an IRA to calculate the withdrawal amount but not have any withdrawals come from the Roth. This is a revelation for me and makes a huge difference for people with large TSLA earnings in a Roth trying to get a higher withdrawal amount from a 72T without losing the tax advantage.

Below is just a forum response but is consistent with other sources and I've found nothing to contradict it. Also, it just makes sense to be able to include a Roth in the calculation because the whole idea is to make sure that you have enough money to last.

Yes, you can have a SEPP plan using both a Roth and TIRA account in the same plan. You do NOT have to pro rate between the two, you can take your annual total in any combination you wish between the two and that includes taking nothing from the Roth if you wish. If you want to take some from the Roth and the Roth ordering rules result in your taking a distribution of conversions under 5 years, do not worry about a penalty because the SEPP exception will eliminate the conversion 5 year holding penalty as well. Earnings come out last and will be taxable until you reach 59.5 and also have 5 years from your first Roth contribution year. You can manage your tax bill by taking selective distributions from one or the other IRA types, but there are more moving parts, so be very careful. You will also need an 8606 to report the Roth distributions.

adiggs

Well-Known Member

Good grief - the thread that just keeps on giving!Following up on my own post, it looks like it is allowable that the Roth balance can be combined with an IRA to calculate the withdrawal amount but not have any withdrawals come from the Roth. This is a revelation for me and makes a huge difference for people with large TSLA earnings in a Roth trying to get a higher withdrawal amount from a 72T without losing the tax advantage.

Below is just a forum response but is consistent with other sources and I've found nothing to contradict it. Also, it just makes sense to be able to include a Roth in the calculation because the whole idea is to make sure that you have enough money to last.

Yes, you can have a SEPP plan using both a Roth and TIRA account in the same plan. You do NOT have to pro rate between the two, you can take your annual total in any combination you wish between the two and that includes taking nothing from the Roth if you wish. If you want to take some from the Roth and the Roth ordering rules result in your taking a distribution of conversions under 5 years, do not worry about a penalty because the SEPP exception will eliminate the conversion 5 year holding penalty as well. Earnings come out last and will be taxable until you reach 59.5 and also have 5 years from your first Roth contribution year. You can manage your tax bill by taking selective distributions from one or the other IRA types, but there are more moving parts, so be very careful. You will also need an 8606 to report the Roth distributions.

The idea of taking multiple IRA type account balances and using that to calculate the withdrawal amount, but then take it all from the IRA (and none from the Roth) -- that never occurred to me. I've been assuming that each different IRA would need it's own SEPP, which sort of leaves any smallish IRAs out of the picture.

But if I can add the Roth and Rollover IRAs together and then take the withdrawals only from the Rollover - oh this has possibilities.

If anybody else has links or insights into this approach I'd be grateful for that info. If I learn anything down this path I'll relay it as well.

Good grief - the thread that just keeps on giving!

The idea of taking multiple IRA type account balances and using that to calculate the withdrawal amount, but then take it all from the IRA (and none from the Roth) -- that never occurred to me. I've been assuming that each different IRA would need it's own SEPP, which sort of leaves any smallish IRAs out of the picture.

But if I can add the Roth and Rollover IRAs together and then take the withdrawals only from the Rollover - oh this has possibilities.

If anybody else has links or insights into this approach I'd be grateful for that info. If I learn anything down this path I'll relay it as well.

You can definitely aggregate IRAs any way you want into a single "SEPP universe" that you can then only use for distributions (forum post from an accountant below). But I didn't realize until today that Roths could be used but not withdrawn from - this has doubled the amount I'm able to withdraw.

You do not have to do anything other than keep your own record of which account numbers are the basis for your “SEPP 72-T UNIVERSE”, and their respective balances used in your calculation of the annual SEPP distribution amount. There is no such thing as a “SEPP 72-T IRA ACCOUNT” per se anywhere except in your privately kept documents, unless you choose to identify the accounts and balances you used in a footnote to your tax return to “memorialize” with the IRS your basis for the SEPP. As with all IRA distributions, you can take SEPP distributions from any one or more account, or from all accounts designated as your SEPP account(s).

Featsbeyond50

Active Member

Is it better to draw money from an IRA, before required withdrawals, even if you have plenty in a regular brokerage account?The idea is to take money out of the taxable IRA a little at a time to keep the tax bracket low

Good question. My approach (at 64 with 80% of marketable securities in Trad. and Roth IRAs) is to spend down the non-IRA monies before touching any of the tax-deferred or untaxed assets in the IRAs. Very interested to see alternative approaches, so thanks.Is it better to draw money from an IRA, before required withdrawals, even if you have plenty in a regular brokerage account?

Probably not.Is it better to draw money from an IRA, before required withdrawals, even if you have plenty in a regular brokerage account?

IRA grows tax free, brokerage doesn't so it's better to let that grow.

However, you can use margin in a brokerage, thus amplifying cash value. Also look at your long term plan and tax brackets, especially at the step changes.

It may be better if you expect to have significant a RMD starting at age 72 and you can pay a lower rate on some of that by withdrawing now.Is it better to draw money from an IRA, before required withdrawals, even if you have plenty in a regular brokerage account?

adiggs

Well-Known Member

NOT-ADVICE. And since my own thinking / plans are completely at odds with financial planners / advisors advice, really really do your own diligence here. Consider my own thoughts to be another way to think about things for yourself; we all make our own decisions and experience our own consequences.Is it better to draw money from an IRA, before required withdrawals, even if you have plenty in a regular brokerage account?

My own thinking here, but that I haven't yet implemented, is that I've got ~7 years to go until I have full access to IRA accounts. The advice I've gotten from financial advisors is to use the brokerage for that time period, spending it down to nothing if necessary, and allow the retirement accounts to grow unhindered during that time period.

That makes a lot of sense to me, as long as what one is optimizing for is "most money" for life, and/or "most money" to pass along to the next generation.

For my wife and I there is no next generation. And the pile is big enough that the primary question is exactly how much we'll give away while we're alive, and then when we pass on. There is also a question of cash flow, tax impact from selling low cost basis assets, stuff like that which would occur spending down the brokerage to 0 during that 7 years.

Which means, oddly enough to me, that the next few years to retirement account access will be our 'toughest' financially as we only otherwise have about 1/3rd of the portfolio available to spend on stuff we want. These are also the years that we would like to be spending the most money on ourselves / lifestyle (I assume this to be a steadily decreasing amount as we grow older).

So we do have plenty in the brokerage AND I'm strongly considering starting a SEPP against the IRA accounts anyway. We are easily generating the income needed to cover the SEPP distributions inside of the IRAs and despite the high tax bracket we're in, we would have that much incremental income today.

We would be giving up a lot of value in that 7 year time frame when we'd have unpenalized access to the money in exchange for the income today. But if we only have an extra 3 piles over what we need for ourselves instead of an extra 5 piles - does that really matter? We'd have 2 fewer piles to give away, so that is something (I made up those numbers to be directionally accurate - future results will be different

My own way of thinking about this - better income and cash flow dynamics this decade in exchange for a smaller pile to give away later seems like a good trade.

The tax man will also be happier. While I don't want to spend more on taxes than necessary, I also don't put lowering my tax bill very high in my decision making criteria.

EDIT to add: The SEPP now won't help us from a tax point of view, by getting us access to money now at a lower tax bracket than it'll be later (assuming tax law / brackets are unchanged over time), so this particular driver doesn't influence my own thinking for my own situation.

dgpcolorado

high altitude member

This is generally my view but it fascinating to read the other approaches above.It may be better if you expect to have significant a RMD starting at age 72 and you can pay a lower rate on some of that by withdrawing now.

One wrinkle I would suggest is a hybrid approach if RMDs figure to be a burden after age 72: spend down the taxable brokerage/savings accounts but ALSO gradually convert the taxable IRAs to Roth IRAs up to the top of one's current tax bracket. Then that money can grow completely tax free in the Roth IRA. This mostly makes sense if the tax bracket at age 72 is likely to be the same or higher than the current tax bracket. At some point one must just take a guess and live with it.

In my case, with modest assets by TMC standards, to put it mildly, depleting my taxable IRAs before RMD age is more of a convenience than anything else. Since my last taxable IRA will be gone next year I won't even have to think about RMD when I reach age 72. For some with huge 401(k)/IRA accounts, it may be difficult to do that. However, it is easier to deplete taxable IRA accounts if one starts early, rather than waiting until the last minute, which is why I mentioned it in the first place.

Another thing to consider when trying to decide whether to deplete a taxable account or an IRA first: what is your emergency financial reserve? Early retirees need money they can live on for several years to wait out a bear market or deal with other financial emergencies! If you have a SEPP plan in place you can't tap those retirement accounts without risking a whole lot of penalties. I kept some money in my taxable brokerage account for simple liquidity reasons.

My main emergency reserve was/is Series I Savings Bonds, purchased back in the days when interest rates were much higher. (How much higher? I have 1.6% plus inflation and 3.0% plus inflation Savings Bonds, not due to mature until 2031-2033. They have more than doubled in value and, given how low interest rates are nowadays, I really want to keep those as long as I can and tap them only as a last resort!)

Not advice: In your specific case, it seems like the 10% penalty may worth absorbing to boost your standard of living in the near term. (After spending post tax brokerage).NOT-ADVICE. And since my own thinking / plans are completely at odds with financial planners / advisors advice, really really do your own diligence here. Consider my own thoughts to be another way to think about things for yourself; we all make our own decisions and experience our own consequences.

My own thinking here, but that I haven't yet implemented, is that I've got ~7 years to go until I have full access to IRA accounts. The advice I've gotten from financial advisors is to use the brokerage for that time period, spending it down to nothing if necessary, and allow the retirement accounts to grow unhindered during that time period.

That makes a lot of sense to me, as long as what one is optimizing for is "most money" for life, and/or "most money" to pass along to the next generation.

For my wife and I there is no next generation. And the pile is big enough that the primary question is exactly how much we'll give away while we're alive, and then when we pass on. There is also a question of cash flow, tax impact from selling low cost basis assets, stuff like that which would occur spending down the brokerage to 0 during that 7 years.

Which means, oddly enough to me, that the next few years to retirement account access will be our 'toughest' financially as we only otherwise have about 1/3rd of the portfolio available to spend on stuff we want. These are also the years that we would like to be spending the most money on ourselves / lifestyle (I assume this to be a steadily decreasing amount as we grow older).

So we do have plenty in the brokerage AND I'm strongly considering starting a SEPP against the IRA accounts anyway. We are easily generating the income needed to cover the SEPP distributions inside of the IRAs and despite the high tax bracket we're in, we would have that much incremental income today.

We would be giving up a lot of value in that 7 year time frame when we'd have unpenalized access to the money in exchange for the income today. But if we only have an extra 3 piles over what we need for ourselves instead of an extra 5 piles - does that really matter? We'd have 2 fewer piles to give away, so that is something (I made up those numbers to be directionally accurate - future results will be different).

My own way of thinking about this - better income and cash flow dynamics this decade in exchange for a smaller pile to give away later seems like a good trade.

The tax man will also be happier. While I don't want to spend more on taxes than necessary, I also don't put lowering my tax bill very high in my decision making criteria.

EDIT to add: The SEPP now won't help us from a tax point of view, by getting us access to money now at a lower tax bracket than it'll be later (assuming tax law / brackets are unchanged over time), so this particular driver doesn't influence my own thinking for my own situation.

adiggs

Well-Known Member

That's an interesting point, and something I should also think about. Paying penalties is still tough for my wife and I. Call it a penalty and we don't want it, whatever it isNot advice: In your specific case, it seems like the 10% penalty may worth absorbing to boost your standard of living in the near term. (After spending post tax brokerage).

Being ready to just pay the penalty has the highly desirable virtue of being really, really flexible. H'mm.... It's also a lot easier to setup (no setup needed) and do the paperwork for (no paperwork needed - broker reports the distribution, and TurboTax calculates the 10% penalty).

Yeah, 10% is 10% less which grates on ones's optomization function, but if you are already at a 24% tax bracket + state , it's less of a relative change.That's an interesting point, and something I should also think about. Paying penalties is still tough for my wife and I. Call it a penalty and we don't want it, whatever it isThere are habits of thought and behavior that we've learned over our adult lives that aren't necessarily the best for us at this point in our lives. I have learned that those habits don't change overnight, whether I want them to or not.

Being ready to just pay the penalty has the highly desirable virtue of being really, really flexible. H'mm.... It's also a lot easier to setup (no setup needed) and do the paperwork for (no paperwork needed - broker reports the distribution, and TurboTax calculates the 10% penalty).

24% tax to 37.4% (25%+10%+10%*24%) is less than the next bracket of 38%, for instance.

I can save 6% of the price of a Tesla by not buying it (sales tax), but then I lose the benefit.

It's a thing, but doesn't need to be the driving factor.

adiggs

Well-Known Member

Hopefully you've visited the insurance marketplace.What do you think for health insurance (US)? COBRA will only take me so far...

My kids can stay on mine until they're 26, which is great. Now I wish the law would update and I could get on theirs!

In my case I've got more than 10 years to Medicare. I've got an insurance company (finally) that doesn't have me or my wife screaming in frustration, so I went to their website to find a plan as close to what my employer (and now COBRA) provided. I found such a plan and it weighs in at around $1k/month (for the 2 of us).

That's a lot better than the retiree medical plan available through my former employer ($2500/month - ugh).

At the very least that got me something I could budget around.

dgpcolorado

high altitude member

Depends a lot on your income. If you can arrange to keep your income low, you can get a basic plan through the ACA marketplace for free. If you are over the income limit it can get expensive. That's something you might want to consider before setting up a SEPP plan or other income stream! (This stuff may have changed in the three or four years since I was last on ACA.)What do you think for health insurance (US)? COBRA will only take me so far...

My kids can stay on mine until they're 26, which is great. Now I wish the law would update and I could get on theirs!

Prior to ACA, I bought the least expensive high deductible plan I could find and opened a Health Savings Account with the maximum allowable contribution each year (Fidelity offers HSAs). It is really hard to parse health plans because there are so many moving parts. My general view on insurance is that it is to protect from catastrophic losses that I couldn't otherwise afford — I can just self insure for the little stuff. Hence, the high deductible plans. I can come up with $6000 or $7000 to cover the deductible if I have to. For those with expensive chronic health conditions the calculation might be different.

In twenty years of buying my own health insurance plans I only exceeded the deductible once. That's the way I like it — stay healthy and let someone else use the insurance pool! (Same with car and house insurance.)

adiggs

Well-Known Member

I want to emphasize this, as I see plenty of people not understanding it. Catastrophic varies for people and thus the level that can be self insured.My general view on insurance is that it is to protect from catastrophic losses that I couldn't otherwise afford — I can just self insure for the little stuff.

But buying insurance looking to make money is taking the wrong side of a stacked deck. Using a housing example - I can fix broken windows and stuff like that. If the house blows away in a tornado though, leaving me with a mortgage on a slab of concrete - that's bad. Insure the tornado and fix the window yourself.

The primary place I see this problem in the US is around health insurance. Many or most of our employee sponsored health plans are designed to minimize our out-of-pocket expenses. Since the premiums are also hidden, the end result is that health care can look free (or close to it) to us, the end consumer. It's not nearly free by a long short, and what we see conditions us to think in terms of medical insurance paying for all of our medical expenses.

I'm in the high deductible health plan camp as well. I like to see the medical expenses myself, and I really like the possibility of not spending that deductible amount (that's not going as well

Acroyear

Member

I'm on COBRA this year as well, but I plan to use ACA starting next January. I'm in California, so I can qualify for different state and federal subsidies based on my income level. The trick is to keep your income at whatever subsidy level you desire. I'm not sure if your state has subsidies but it's worth checking out. In my case, the ACA plans with subsidies are much lower than the COBRA premiums. The only reason I'm using COBRA this year is due to the pandemic subsidy, which effectively cut the premiums in half for the year.Depends a lot on your income. If you can arrange to keep your income low, you can get a basic plan through the ACA marketplace for free. If you are over the income limit it can get expensive. That's something you might want to consider before setting up a SEPP plan or other income stream! (This stuff may have changed in the three or four years since I was last on ACA.)

Prior to ACA, I bought the least expensive high deductible plan I could find and opened a Health Savings Account with the maximum allowable contribution each year (Fidelity offers HSAs). It is really hard to parse health plans because there are so many moving parts. My general view on insurance is that it is to protect from catastrophic losses that I couldn't otherwise afford — I can just self insure for the little stuff. Hence, the high deductible plans. I can come up with $6000 or $7000 to cover the deductible if I have to. For those with expensive chronic health conditions the calculation might be different.

In twenty years of buying my own health insurance plans I only exceeded the deductible once. That's the way I like it — stay healthy and let someone else use the insurance pool! (Same with car and house insurance.)

BTW, thanks to everyone for this thread. It's been super informative.

I'm on COBRA this year as well, but I plan to use ACA starting next January. I'm in California, so I can qualify for different state and federal subsidies based on my income level. The trick is to keep your income at whatever subsidy level you desire. I'm not sure if your state has subsidies but it's worth checking out. In my case, the ACA plans with subsidies are much lower than the COBRA premiums. The only reason I'm using COBRA this year is due to the pandemic subsidy, which effectively cut the premiums in half for the year.

BTW, thanks to everyone for this thread. It's been super informative.

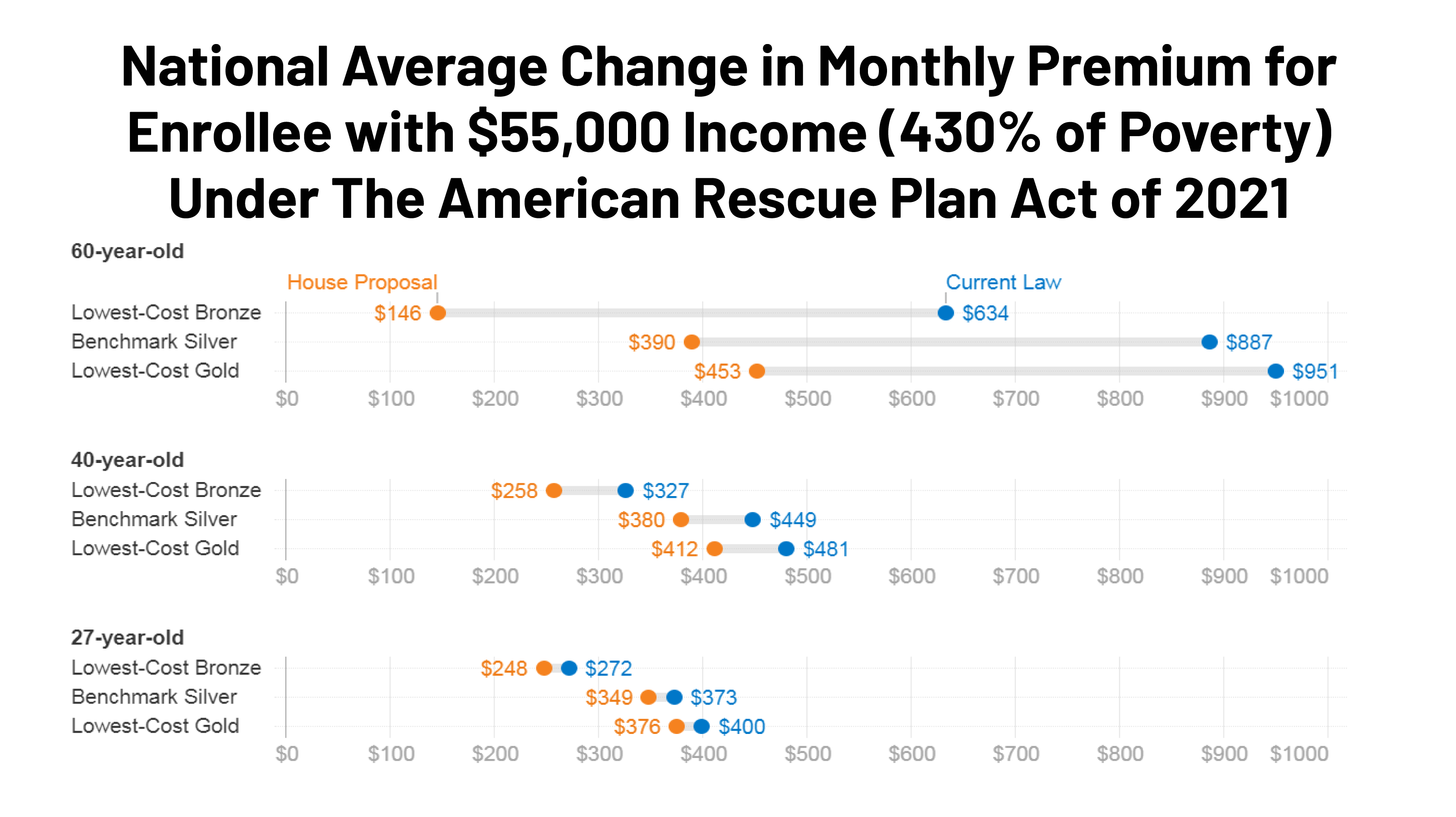

Also, be aware that recent stimulus packages have increased ACA subsidies for higher-income level individuals and is set to expire unless Congress extends it with the upcoming (human) infrastructure package.

Impact of Key Provisions of the American Rescue Plan Act of 2021 COVID-19 Relief on Marketplace Premiums | KFF

This data note estimates how tax credits premiums will change for people at various ages and incomes under the temporary boost in subsidies included in the American Rescue Plan Act of 2021, the COVID-19 relief plan signed into law in March 2021.

Federal infrastructure bill and budget resolution to have major health care impacts

In a major win for medicine, Senators eliminated the proposal to use unspent COVID-19 Provider Relief Funds to pay for the infrastructure package. CMA told leaders that many physician practices were...

www.cmadocs.org

Similar threads

- Replies

- 35

- Views

- 2K

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 11

- Views

- 481

- Replies

- 109

- Views

- 7K