DragonWatch

Small FootPrint

Just saw a story about another nation banning Fossile Fuel vehicles on BBC World News.

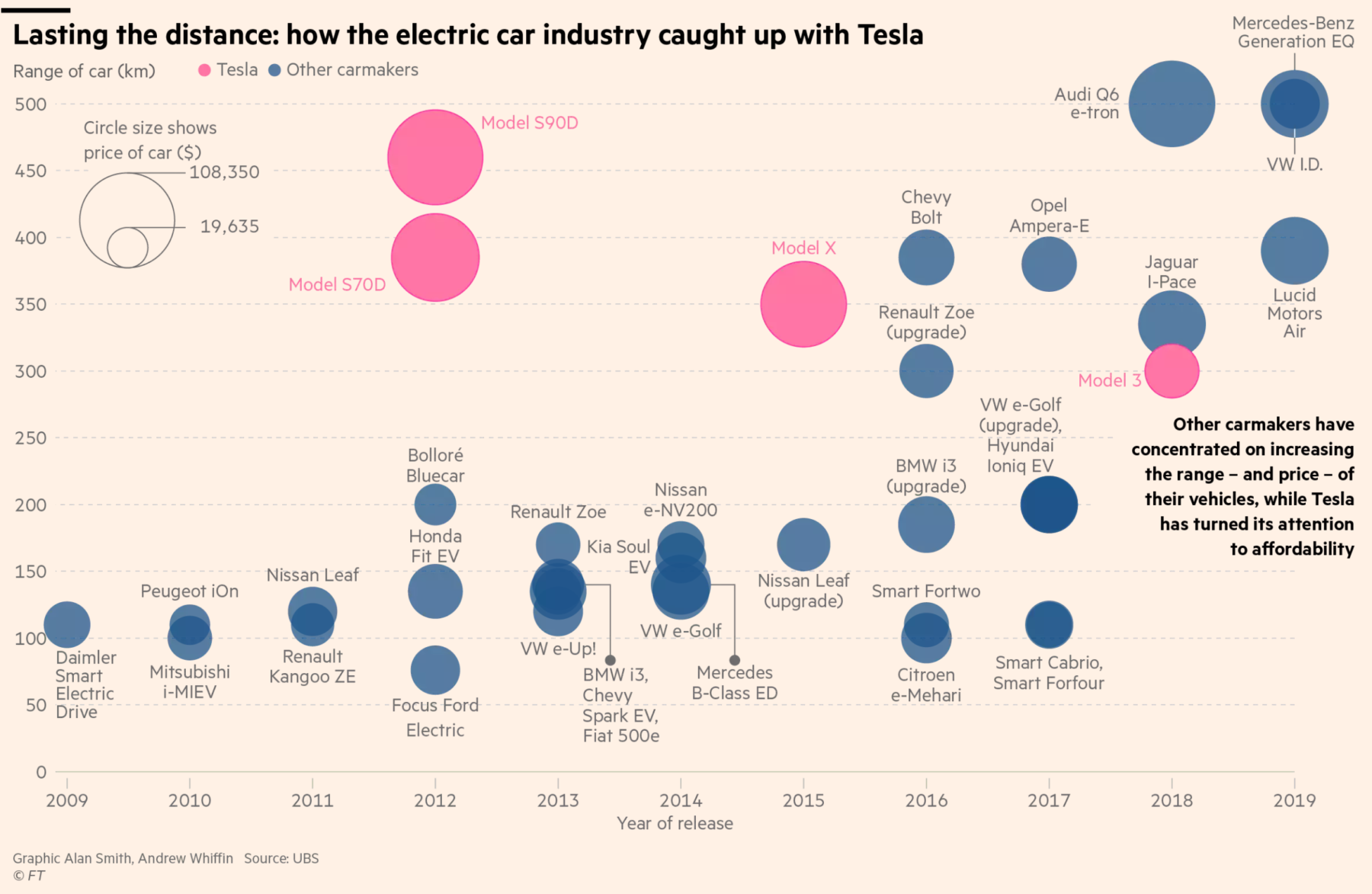

Instead of the US leading the charge, Ford and GM will have the world market dictating to them the transformation to EVs, placing a mega lift on the shoulders of Tesla. Me, I believe not only Tesla will continue to out shine, I believe they are the future.

Tesla will probably be the only shining light for this country for the next ten to fifteen years at a minimum.

Yeah, okay, I am a long horn bull

Instead of the US leading the charge, Ford and GM will have the world market dictating to them the transformation to EVs, placing a mega lift on the shoulders of Tesla. Me, I believe not only Tesla will continue to out shine, I believe they are the future.

Tesla will probably be the only shining light for this country for the next ten to fifteen years at a minimum.

Yeah, okay, I am a long horn bull