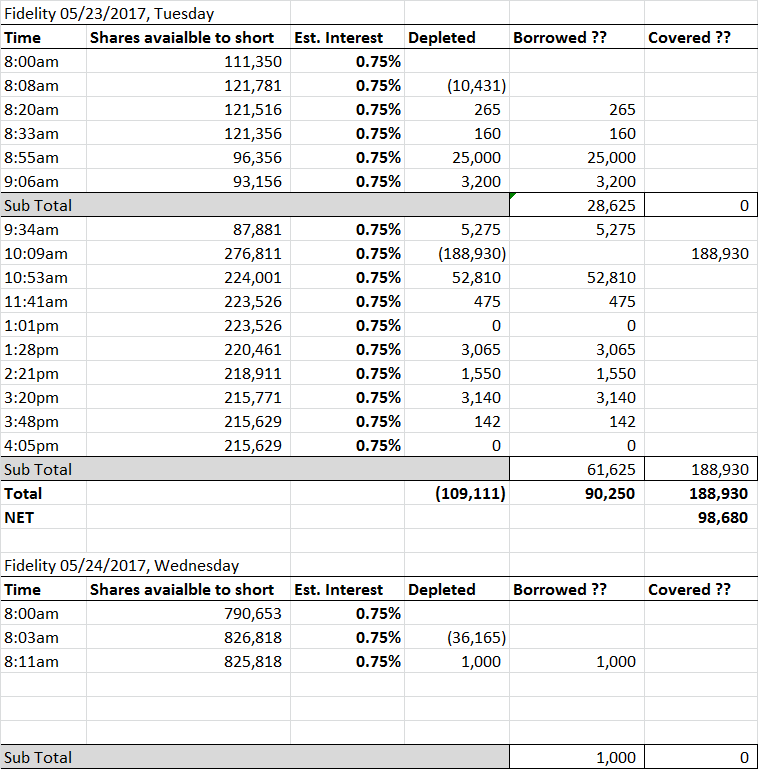

Availability of shares for shorting at Fidelity data suggest that yesterday some short sellers saw as an opportune time to close some of their positions, as data combined with review of the SP chart suggest that yesterday could have been a net covering day (insert your favorite disclaimer here)

It seems that Fidelity anticipates high demand for borrowing, as the availability of shares today is highest since April 21st.

It seems that Fidelity anticipates high demand for borrowing, as the availability of shares today is highest since April 21st.

Last edited: