What is the current assessment of the likelihood of Tesla vehicles again qualifying for the the $7,500 US federal government tax credit or possibly $10,000 if including made in America provision? What purchase/pickup date would one have to have to qualify for the credit? I've seen various thoughts on whether that would be retroactive to late May, the date the legislation passes, or not until January 1, 2022. Assuming it could go into effect in July/August (passing this summer) why would anyone be purchasing a car now unless literally have nothing else to drive, his or her tax liability won't require the credit, certain it will take months to get the car with the increased demand the credit will drive, and/or Tesla will generally raise the price to offset much/all of the credit? I am currently in the 8 - 12 week window (placed M3 order at end of May) and want the car now but can't imagine my frustration if I had waited a couple of weeks/month and would have had a massive tax benefit.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2021 EV Tax Credit

- Thread starter DLK1974VA

- Start date

Glendale MY

Member

After the election results last night, it definitely faces a steeper uphill climb now.It's irrelevant, because the bill isn't going to pass.

Upvote

0

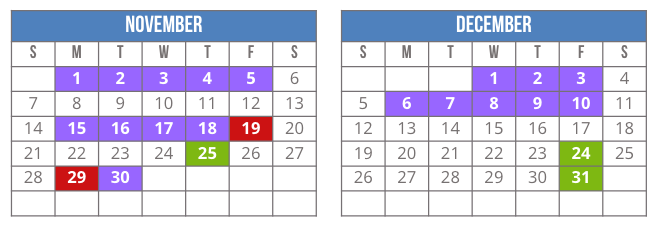

If it doesn't pass before the early part of your EDD window, I think it likely won't. Congress goes into recess mid-Dec and will soon need to start working on the debt limit.It would be great to have a good idea if/when this may pass. My EDD is 11/15-11/29.

Upvote

0

They go on recess this Friday and then are back for 5 days before Thanksgiving. Debt ceiling expires December 3rd, all the focus will be on that after this week.

I think both bills will die honestly. This has turned into a progressives vs moderates at this point, forget the other party entirely.

Purple = House + Senate in session

I think both bills will die honestly. This has turned into a progressives vs moderates at this point, forget the other party entirely.

Purple = House + Senate in session

Upvote

0

Not from my perspective. I'd rather not get the $8k and the government spend and grow less.Wouldn’t best case be it passes and you get it?

Upvote

0

House Modifications to EV Tax Credit

The revised legislation is [here]

The revised legislation is [here]

- Income Caps

- $800,000 *-->* $500,000 (joint filers)

- $400,000 --> $250,000 (single filers)

- Vehicle MSRP Caps

- Vans: $64,000 --> $80,000

- SUVs: $69,000 --> $80,000

- Pickup Trucks: $74,000 --> $80,000

- Other: $55,000 --> $55,000 (*unchanged*)

- New Provision

- Each taxpayer cannot claim more than 1 vehicle per year

Upvote

0

MrFusion

Member

I really don’t get why there is a cap when the credit is the same, especially when the cap varies depending on vehicle type.House Modifications to EV Tax Credit

The revised legislation is [here]

- Income Caps

- $800,000 *-->* $500,000 (joint filers)

- $400,000 --> $250,000 (single filers)

- Vehicle MSRP Caps

- Vans: $64,000 --> $80,000

- SUVs: $69,000 --> $80,000

- Pickup Trucks: $74,000 --> $80,000

- Other: $55,000 --> $55,000 (*unchanged*)

- New Provision

- Each taxpayer cannot claim more than 1 vehicle per year

Upvote

0

jsdugan

Member

So, if married, would each spouse be able to claim one each of they make under $250,000 each?House Modifications to EV Tax Credit

The revised legislation is [here]

- Income Caps

- $800,000 *-->* $500,000 (joint filers)

- $400,000 --> $250,000 (single filers)

- Vehicle MSRP Caps

- Vans: $64,000 --> $80,000

- SUVs: $69,000 --> $80,000

- Pickup Trucks: $74,000 --> $80,000

- Other: $55,000 --> $55,000 (*unchanged*)

- New Provision

- Each taxpayer cannot claim more than 1 vehicle per year

Upvote

0

Was wondering the same thing, not sureSo, if married, would each spouse be able to claim one each of they make under $250,000 each?

Upvote

0

Bradford_G

Member

I'm not a tax expert, but as it reads in PNWLeccy's post, it's "per taxpayer", meaning you'd need to file separately. That impacts a whole slue of other things that you'd want to talk to your tax guy/gal about.So, if married, would each spouse be able to claim one each of they make under $250,000 each?

Upvote

0

Here is a good plain english summary:

Build Back Better Act — Rules Committee Print 117-18

Section-By-Section

PART 4 – GREENING THE FLEET AND ALTERNATIVE VEHICLES

Section 136401. Refundable new qualified plug-in electric drive motor vehicle credit for individuals.

This provision provides for a refundable income tax credit for new qualified plug-in electric drive motor vehicles placed into service by the taxpayer during the taxable year. The credit is limited to one vehicle per-taxpayer per-taxable year.

The amount of credit allowed by this provision with respect to a qualified vehicle is equal to the base amount of $4,000 plus an additional $3,500 for vehicles placed into service before January 1, 2027 with battery capacity no less than 40 kilowatt hours and a gasoline tank capacity not greater than 2.5 gallons, and for vehicles with battery capacity of no less than 50 kilowatt hours thereafter.

The amount credit allowed for a qualified vehicle is increased by $4,500 if the final assembly of the vehicle is at a facility in the United States which operates under a union-negotiated collective bargaining agreement.

The amount of credit allowed for a qualified vehicle is increased by $500 if the vehicle model are powered by battery cells which are manufactured within the United States.

The amount of credit allowed for a qualified vehicle is limited to 50 percent of its purchase price.

Beginning in 2027, this credit shall only apply with respect to vehicles for which final assembly is within the United States.

For purposes of this credit, a new qualified plug-in electric drive motor vehicle means a vehicle

• the original use of which commences with the taxpayer,

• is acquired for use by the taxpayer and not for resale, which is made by a qualified manufacturer,

• which is treated as a motor vehicle for purposes of title II of the Clean Air Act,

• which has a gross vehicle rating of less than 14,000 pounds,

• which is propelled to a significant extent by an electric motor which draws electricity from a battery which has a capacity of not less than ten kilowatt hours and is capable of being recharged from an external source of electricity,

• does not have a gasoline tax capacity of greater than 2.5 gallons, and

• is not depreciable property.

A qualified manufacturer means any manufacturer which enters into written agreement with the Secretary to ensure each vehicle manufactured meets the requirements of this provision and is labeled with a unique vehicle identification number, and that such manufacture will periodically provide such vehicle identification numbers to the secretary in such a manner as the Secretary may prescribe.

No credit shall be allowed for vehicle by which the manufacturer’s suggested retail price exceeds the applicable limitation, which is as follows:

• Vans: $80,000

• SUVs: $80,000

• Pick Up Trucks: $80,000

• For any other vehicle: $55,000

The credit is phased out by $200 for each $1,000 of the taxpayer’s modified adjusted gross income as exceeds $500,000 for married filing jointly, $375,000 for head of household, and $250,000 in any other case. For a given taxable year, the taxpayer may use modified adjusted gross income for that year or the immediately preceding year, whichever is lower.

The taxpayer may elect to transfer the credit to the vehicle dealer, provided the dealer is registered as an eligible entity with the Secretary, discloses the MSRP, credit amount, associated fees, and the amount to be paid to the taxpayer in the form of a down payment or otherwise with respect to the transfer of credit. The Secretary shall establish a program to make advance payments to any eligible dealer equal to the cumulative amount of transferred credits.

This provision provides for a 30% credit, not to exceed $7,500, for two and three wheeled plug in electric vehicles which have a battery capacity of no less than two and a half kilowatt hours, are manufactured primarily for use on roads and highways, and are capable of achieving a speed of 45 miles per hour or greater, and otherwise meet the requirements of this section.

The Secretary shall make payments to mirror code territories for the amount of revenue lost with respect to this provision. The Secretary shall make payments to non-mirror code territories for the amount of revenue lost with respect to operating a similar credit for electric vehicles.

This provision is made effective beginning after December 31, 2021, replacing section 30D, the plug-in electric drive motor vehicles credit.

No credit shall be allowed under this provision for vehicles acquired after December 31, 2031.

Section 136402. Credit for previously-owned qualified plug-in electric drive motor vehicles.

The provision creates a new refundable credit for the purchase of used battery and fuel-cell electric cars after date of enactment through 2031. Buyers can claim a base credit of $2,000 for the purchase of qualifying used EVs, with an additional $2,000 based on battery capacity. The credit is capped at the lesser of $4,000 or 50% of the sale price.

To qualify for this credit, used EVs must generally meet the eligibility requirements in the existing Section 30D credit for new EVs, not exceed a sale price of $25,000, and be a model year that is at least two years earlier than the date of sale.

Buyers with up to $75,000 ($150,000 for married couples filing jointly and $112,500 for head of household filers) in adjusted gross income can claim the full amount of the credit. The credit phases out by $200 for every $1,000 in AGI in excess of the limitation. Buyers must purchase the vehicle from a dealership for personal use and cannot claim the credit more than once every three years. The credit only applies to the first resale of a used EV and includes restrictions on sales between related parties. A “look-back rule” for the phaseout threshold allows taxpayers to use prior-year income for purposes of determining the phaseout of the credit. This rule keeps taxpayers eligible for the credit even when their income rises above the phaseout range in a single year.

The credit may be transferred to the seller of the previously-owned electric vehicle to allow the purchaser to access the value of the credit at the time of sale.

The Secretary shall make payments to mirror code territories for the amount of revenue lost with respect to this provision. The Secretary shall make payments to non-mirror code territories for the amount of revenue lost with respect to operating a similar credit for previously-owned electric vehicles.

Section 136403. Credit for qualified commercial electric vehicles.

This provision creates a new credit for qualified commercial electric vehicles placed into service by the taxpayer.

The amount of credit allowed by this provision with respect to a qualified commercial electric vehicle is equal to 30% of the cost of such vehicle, or 15% in the case of hybrid vehicles. A leasing company may elect to determine the credit using the structure of the individual credit under section 36C if the vehicle is leased to an individual. Tax-exempt entities have the option of electing to receive direct payments.

For purposes of the credit a qualified commercial electric vehicle means any vehicle

• the original use of which commences with the taxpayer,

• which is acquired for use or lease by the taxpayer and not for resale,

• which is made by a qualified manufacturer,

• which is treated as a motor vehicle for purposes of title II of the Clean Air Act or mobile machinery for purposes of section 4053(8),

• which is propelled to a significant extent by an electric motor which draws electricity from a battery which has a capacity of not less than ten kilowatt hours and is capable of being recharged from an external source of electricity, or is a fuel cell vehicle based upon the requirements of section 30B,

• is not powered by an internal combustion engine and is of a character subject to the allowance for depreciation.

A qualified manufacturer means any manufacturer which enters into written agreement with the Secretary to ensure each vehicle manufactured meets the requirements of this provision and is labeled with a unique vehicle identification number, and that such manufacture will periodically provide such vehicle identification numbers to the secretary in such a manner as the Secretary may prescribe. No credit shall be allowed with respect to any qualified vehicle unless the taxpayer includes the vehicle identification number of such vehicle on their return for that taxable year.

This provision shall take effect after December 31, 2021. No credit shall be allowed under this provision for a vehicle acquired after December 31, 2031.

Section 136404. Qualified fuel cell motor vehicles.

This provision extends the credit for the purchase of a qualified fuel cell motor vehicle through 2031, but only with respect to vehicles not of a character subject to depreciation. Beginning on January 1, 2022, commercial fuel cell vehicles otherwise eligible for this credit will be eligible for the new section 45Y credit for qualified commercial electric vehicles.

Section 136405. Alternative fuel refueling property credit.

The provision extends the alternative fuel vehicle refueling property credit through 2031. Beginning in 2022, the provision expands the credit for zero-emissions charging and refueling infrastructure of a nature subject to depreciation by providing a base credit of 6% for expenses up to $100,000 and 4% for allowable expenses in excess of such limitation (i.e., it allows a credit for expenses beyond the limit if certain requirements are met). The provision provides an alternative bonus credit level of 30% for expenses up to $100,000 and 20% thereafter.

To qualify for the credit for expenses in excess of the $100,000 limitation, the property must: 1) be intended for general public use and either accept credit cards as a form of payment or not charge a fee, or 2) be intended for exclusive use by government or commercial vehicle fleets.

In order to claim the bonus credit amount with respect to eligible property, taxpayers must satisfy prevailing wage requirements for the duration of the construction of such property.

This provision also clarifies that bidirectional charging equipment is eligible property and expands the list of eligible property to include electric charging stations for electric 2- and 3-wheeled motor vehicles manufactured for use on public street, roads, and highways, but only if such stations are 1) intended for general public use and either accept credit cards as a form of payment or not charge a fee, or 2) intended for exclusive use by government or commercial vehicles.

Section 136406. Reinstatement and expansion of employer provided fringe benefits for bicycle commuting.

This provision eliminates the temporary suspension of the exclusion for qualified bicycle commuting benefits and increases the maximum benefit from $20 per month to $81 per month.

This provision expands the definition of qualified benefit to include the direct or indirect provision of qualified commuting property by an employer and employer reimbursement of expenses incurred for the purchase, financing, lease, rental (including bikeshare), improvement, or storage of qualified commuting property if the employee regularly uses such property for travel between the employee’s residence and place of employment or mass transit facility connecting an employee to place of employment.

Qualified community property includes bicycles, electric bicycles (within the meaning of Section 30E as established by this legislation), 2- or 3-wheeled scooters (other than scooters equipped with motors), and any 2- or 3-wheeled scooter propelled by an electric motor if such motor does not provide assistance in excess of 20 miles per hour.

Section 136407. Credit for certain new electric bicycles.

This provision provides for a 30% refundable tax credit for qualified electric bicycles placed into service before January 1, 2026.

Beginning in 2022, taxpayers may claim a credit of up to $900 for electric bicycles placed into service by the taxpayer for use within the United States. A taxpayer may claim the credit for one electric bicycle per taxable year (two for joint filers). The credit phases out starting at $75,000 of modified adjusted gross income ($112,500 for heads of household and $150,000 for married filing jointly) at a rate of $200 per $1,000 of additional income. For a given taxable year, the taxpayer may use modified adjusted gross income for that year or the immediately preceding year, whichever is lower.

A qualified electric bicycle is defined as a bicycle which is equipped with fully operable pedals, a saddle or seat for the rider, an electric motor of less than 750 watts which is designed to provide assistance in propelling the bicycle, and does not provide assistance if the bicycle is moving in excess of 20 miles per hour or only provides assistance when the rider is pedaling and does not provide assistance if the bicycle is moving in excess of 28 miles per hour.

In order to be eligible for the credit, the aggregate amount paid for the acquisition of such bicycle must not exceed $4,000.

In order for an electric bicycle to be eligible for the credit, the manufacturer must assign each bicycle a unique vehicle identification number and report such information to the Treasury in a manner prescribed by the Secretary. Taxpayers must then provide the proper vehicle identification number assigned to the electric bicycle by the manufacturer in order to claim the credit.

The credit may be transferred to the seller of the electric bicycle to allow the purchaser to access the value of the credit at the time of sale.

The Secretary shall make payments to mirror code territories for the amount of revenue lost with respect to this provision. The Secretary shall make payments to non-mirror code territories for the amount of revenue lost with respect to operating a similar credit for electric bicycles.

Build Back Better Act — Rules Committee Print 117-18

Section-By-Section

PART 4 – GREENING THE FLEET AND ALTERNATIVE VEHICLES

Section 136401. Refundable new qualified plug-in electric drive motor vehicle credit for individuals.

This provision provides for a refundable income tax credit for new qualified plug-in electric drive motor vehicles placed into service by the taxpayer during the taxable year. The credit is limited to one vehicle per-taxpayer per-taxable year.

The amount of credit allowed by this provision with respect to a qualified vehicle is equal to the base amount of $4,000 plus an additional $3,500 for vehicles placed into service before January 1, 2027 with battery capacity no less than 40 kilowatt hours and a gasoline tank capacity not greater than 2.5 gallons, and for vehicles with battery capacity of no less than 50 kilowatt hours thereafter.

The amount credit allowed for a qualified vehicle is increased by $4,500 if the final assembly of the vehicle is at a facility in the United States which operates under a union-negotiated collective bargaining agreement.

The amount of credit allowed for a qualified vehicle is increased by $500 if the vehicle model are powered by battery cells which are manufactured within the United States.

The amount of credit allowed for a qualified vehicle is limited to 50 percent of its purchase price.

Beginning in 2027, this credit shall only apply with respect to vehicles for which final assembly is within the United States.

For purposes of this credit, a new qualified plug-in electric drive motor vehicle means a vehicle

• the original use of which commences with the taxpayer,

• is acquired for use by the taxpayer and not for resale, which is made by a qualified manufacturer,

• which is treated as a motor vehicle for purposes of title II of the Clean Air Act,

• which has a gross vehicle rating of less than 14,000 pounds,

• which is propelled to a significant extent by an electric motor which draws electricity from a battery which has a capacity of not less than ten kilowatt hours and is capable of being recharged from an external source of electricity,

• does not have a gasoline tax capacity of greater than 2.5 gallons, and

• is not depreciable property.

A qualified manufacturer means any manufacturer which enters into written agreement with the Secretary to ensure each vehicle manufactured meets the requirements of this provision and is labeled with a unique vehicle identification number, and that such manufacture will periodically provide such vehicle identification numbers to the secretary in such a manner as the Secretary may prescribe.

No credit shall be allowed for vehicle by which the manufacturer’s suggested retail price exceeds the applicable limitation, which is as follows:

• Vans: $80,000

• SUVs: $80,000

• Pick Up Trucks: $80,000

• For any other vehicle: $55,000

The credit is phased out by $200 for each $1,000 of the taxpayer’s modified adjusted gross income as exceeds $500,000 for married filing jointly, $375,000 for head of household, and $250,000 in any other case. For a given taxable year, the taxpayer may use modified adjusted gross income for that year or the immediately preceding year, whichever is lower.

The taxpayer may elect to transfer the credit to the vehicle dealer, provided the dealer is registered as an eligible entity with the Secretary, discloses the MSRP, credit amount, associated fees, and the amount to be paid to the taxpayer in the form of a down payment or otherwise with respect to the transfer of credit. The Secretary shall establish a program to make advance payments to any eligible dealer equal to the cumulative amount of transferred credits.

This provision provides for a 30% credit, not to exceed $7,500, for two and three wheeled plug in electric vehicles which have a battery capacity of no less than two and a half kilowatt hours, are manufactured primarily for use on roads and highways, and are capable of achieving a speed of 45 miles per hour or greater, and otherwise meet the requirements of this section.

The Secretary shall make payments to mirror code territories for the amount of revenue lost with respect to this provision. The Secretary shall make payments to non-mirror code territories for the amount of revenue lost with respect to operating a similar credit for electric vehicles.

This provision is made effective beginning after December 31, 2021, replacing section 30D, the plug-in electric drive motor vehicles credit.

No credit shall be allowed under this provision for vehicles acquired after December 31, 2031.

Section 136402. Credit for previously-owned qualified plug-in electric drive motor vehicles.

The provision creates a new refundable credit for the purchase of used battery and fuel-cell electric cars after date of enactment through 2031. Buyers can claim a base credit of $2,000 for the purchase of qualifying used EVs, with an additional $2,000 based on battery capacity. The credit is capped at the lesser of $4,000 or 50% of the sale price.

To qualify for this credit, used EVs must generally meet the eligibility requirements in the existing Section 30D credit for new EVs, not exceed a sale price of $25,000, and be a model year that is at least two years earlier than the date of sale.

Buyers with up to $75,000 ($150,000 for married couples filing jointly and $112,500 for head of household filers) in adjusted gross income can claim the full amount of the credit. The credit phases out by $200 for every $1,000 in AGI in excess of the limitation. Buyers must purchase the vehicle from a dealership for personal use and cannot claim the credit more than once every three years. The credit only applies to the first resale of a used EV and includes restrictions on sales between related parties. A “look-back rule” for the phaseout threshold allows taxpayers to use prior-year income for purposes of determining the phaseout of the credit. This rule keeps taxpayers eligible for the credit even when their income rises above the phaseout range in a single year.

The credit may be transferred to the seller of the previously-owned electric vehicle to allow the purchaser to access the value of the credit at the time of sale.

The Secretary shall make payments to mirror code territories for the amount of revenue lost with respect to this provision. The Secretary shall make payments to non-mirror code territories for the amount of revenue lost with respect to operating a similar credit for previously-owned electric vehicles.

Section 136403. Credit for qualified commercial electric vehicles.

This provision creates a new credit for qualified commercial electric vehicles placed into service by the taxpayer.

The amount of credit allowed by this provision with respect to a qualified commercial electric vehicle is equal to 30% of the cost of such vehicle, or 15% in the case of hybrid vehicles. A leasing company may elect to determine the credit using the structure of the individual credit under section 36C if the vehicle is leased to an individual. Tax-exempt entities have the option of electing to receive direct payments.

For purposes of the credit a qualified commercial electric vehicle means any vehicle

• the original use of which commences with the taxpayer,

• which is acquired for use or lease by the taxpayer and not for resale,

• which is made by a qualified manufacturer,

• which is treated as a motor vehicle for purposes of title II of the Clean Air Act or mobile machinery for purposes of section 4053(8),

• which is propelled to a significant extent by an electric motor which draws electricity from a battery which has a capacity of not less than ten kilowatt hours and is capable of being recharged from an external source of electricity, or is a fuel cell vehicle based upon the requirements of section 30B,

• is not powered by an internal combustion engine and is of a character subject to the allowance for depreciation.

A qualified manufacturer means any manufacturer which enters into written agreement with the Secretary to ensure each vehicle manufactured meets the requirements of this provision and is labeled with a unique vehicle identification number, and that such manufacture will periodically provide such vehicle identification numbers to the secretary in such a manner as the Secretary may prescribe. No credit shall be allowed with respect to any qualified vehicle unless the taxpayer includes the vehicle identification number of such vehicle on their return for that taxable year.

This provision shall take effect after December 31, 2021. No credit shall be allowed under this provision for a vehicle acquired after December 31, 2031.

Section 136404. Qualified fuel cell motor vehicles.

This provision extends the credit for the purchase of a qualified fuel cell motor vehicle through 2031, but only with respect to vehicles not of a character subject to depreciation. Beginning on January 1, 2022, commercial fuel cell vehicles otherwise eligible for this credit will be eligible for the new section 45Y credit for qualified commercial electric vehicles.

Section 136405. Alternative fuel refueling property credit.

The provision extends the alternative fuel vehicle refueling property credit through 2031. Beginning in 2022, the provision expands the credit for zero-emissions charging and refueling infrastructure of a nature subject to depreciation by providing a base credit of 6% for expenses up to $100,000 and 4% for allowable expenses in excess of such limitation (i.e., it allows a credit for expenses beyond the limit if certain requirements are met). The provision provides an alternative bonus credit level of 30% for expenses up to $100,000 and 20% thereafter.

To qualify for the credit for expenses in excess of the $100,000 limitation, the property must: 1) be intended for general public use and either accept credit cards as a form of payment or not charge a fee, or 2) be intended for exclusive use by government or commercial vehicle fleets.

In order to claim the bonus credit amount with respect to eligible property, taxpayers must satisfy prevailing wage requirements for the duration of the construction of such property.

This provision also clarifies that bidirectional charging equipment is eligible property and expands the list of eligible property to include electric charging stations for electric 2- and 3-wheeled motor vehicles manufactured for use on public street, roads, and highways, but only if such stations are 1) intended for general public use and either accept credit cards as a form of payment or not charge a fee, or 2) intended for exclusive use by government or commercial vehicles.

Section 136406. Reinstatement and expansion of employer provided fringe benefits for bicycle commuting.

This provision eliminates the temporary suspension of the exclusion for qualified bicycle commuting benefits and increases the maximum benefit from $20 per month to $81 per month.

This provision expands the definition of qualified benefit to include the direct or indirect provision of qualified commuting property by an employer and employer reimbursement of expenses incurred for the purchase, financing, lease, rental (including bikeshare), improvement, or storage of qualified commuting property if the employee regularly uses such property for travel between the employee’s residence and place of employment or mass transit facility connecting an employee to place of employment.

Qualified community property includes bicycles, electric bicycles (within the meaning of Section 30E as established by this legislation), 2- or 3-wheeled scooters (other than scooters equipped with motors), and any 2- or 3-wheeled scooter propelled by an electric motor if such motor does not provide assistance in excess of 20 miles per hour.

Section 136407. Credit for certain new electric bicycles.

This provision provides for a 30% refundable tax credit for qualified electric bicycles placed into service before January 1, 2026.

Beginning in 2022, taxpayers may claim a credit of up to $900 for electric bicycles placed into service by the taxpayer for use within the United States. A taxpayer may claim the credit for one electric bicycle per taxable year (two for joint filers). The credit phases out starting at $75,000 of modified adjusted gross income ($112,500 for heads of household and $150,000 for married filing jointly) at a rate of $200 per $1,000 of additional income. For a given taxable year, the taxpayer may use modified adjusted gross income for that year or the immediately preceding year, whichever is lower.

A qualified electric bicycle is defined as a bicycle which is equipped with fully operable pedals, a saddle or seat for the rider, an electric motor of less than 750 watts which is designed to provide assistance in propelling the bicycle, and does not provide assistance if the bicycle is moving in excess of 20 miles per hour or only provides assistance when the rider is pedaling and does not provide assistance if the bicycle is moving in excess of 28 miles per hour.

In order to be eligible for the credit, the aggregate amount paid for the acquisition of such bicycle must not exceed $4,000.

In order for an electric bicycle to be eligible for the credit, the manufacturer must assign each bicycle a unique vehicle identification number and report such information to the Treasury in a manner prescribed by the Secretary. Taxpayers must then provide the proper vehicle identification number assigned to the electric bicycle by the manufacturer in order to claim the credit.

The credit may be transferred to the seller of the electric bicycle to allow the purchaser to access the value of the credit at the time of sale.

The Secretary shall make payments to mirror code territories for the amount of revenue lost with respect to this provision. The Secretary shall make payments to non-mirror code territories for the amount of revenue lost with respect to operating a similar credit for electric bicycles.

Upvote

0

I understand that this new draft simplifies the vehicle MSRP caps ($80k Trucks/SUVs, $55k Sedans/etc.) but this really should just be a universal $80k MSRP cap. Vehicle class should not even matter as the goal should be to incentivize people to replace whatever type of vehicle people are already using and have decided they need. If anything, we should be incentivizing smaller, more efficient sedans vs trucks/SUVs which is counter to the current MSRP cap structure.I really don’t get why there is a cap when the credit is the same, especially when the cap varies depending on vehicle type.

Also, I think that Tesla has adjusted it's 2022 VINs to help address these vehicle class caps. The Model 3 and S are keeping the 5YJXXX VINs (NHTSA: Passenger Car, Sedan/Saloon) and the Model X and Y are getting the 7SAYXXX VINs (NHTSA: Multipurpose Passenger Vehicle, Sports Utility Vehicle).

Upvote

0

These price caps by vehicle category are really f***** up. I'm all for incentivizing EV adoption but at this point, I want this bill to die. This is the opposite of progressive. Same with the extra tax credit for union-made.House Modifications to EV Tax Credit

The revised legislation is [here]

- Income Caps

- $800,000 *-->* $500,000 (joint filers)

- $400,000 --> $250,000 (single filers)

- Vehicle MSRP Caps

- Vans: $64,000 --> $80,000

- SUVs: $69,000 --> $80,000

- Pickup Trucks: $74,000 --> $80,000

- Other: $55,000 --> $55,000 (*unchanged*)

- New Provision

- Each taxpayer cannot claim more than 1 vehicle per year

This bill has become mostly pork for traditional American car makers to push more extra large, extra profitable vehicles - that just happen to be EVs.

Upvote

0

I also don't agree with price caps for vehicle types and if anything (see my comment above) think that it should favor smaller, efficient vehicles. However, I think a universal price cap is best since some people need pickup trucks for work, some people need vans to shuttle their kids, some people only need a small city commuter car - I don't think we should punish people with different needs/lifestyles.These price caps by vehicle category are really f***** up. I'm all for incentivizing EV adoption but at this point, I want this bill to die. This is the opposite of progressive. Same with the extra tax credit for union-made.

This bill has become mostly pork for traditional American car makers to push more extra large, extra profitable vehicles - that just happen to be EVs.

Is your primary issue with the $80k price cap itself? I know some people argue for no price cap since any EV that replaces an ICE vehicle is good but I tend to think wealthy people aren't making their decision to buy a Model S or Taycan based on a ~$8k tax credit. The truth is that the avg. new car costs $45k(!) today and batteries add about $10k-$15k to the cost so I think a universal cap of $60k-$70k would be fine.

Upvote

0

I'm most angry at the price caps by body style, for promoting bigger vehicles over smaller ones. Yes sometimes people need or want bigger cars, that's fine, but we shouldn't push car buyers into bigger, less efficient vehicles by subsidizing them more! I'm guessing it's a handout to the "big 3" who have focused most of their production and profits on SUVs and trucks, and will probably continue doing so with EVs.I also don't agree with price caps for vehicle types and if anything (see my comment above) think that it should favor smaller, efficient vehicles. However, I think a universal price cap is best since some people need pickup trucks for work, some people need vans to shuttle their kids, some people only need a small city commuter car - I don't think we should punish people with different needs/lifestyles.

Is your primary issue with the $80k price cap itself? I know some people argue for no price cap since any EV that replaces an ICE vehicle is good but I tend to think wealthy people aren't making their decision to buy a Model S or Taycan based on a ~$8k tax credit. The truth is that the avg. new car costs $45k(!) today and batteries add about $10k-$15k to the cost so I think a universal cap of $60k-$70k would be fine.

I also take issue with having a hard price cutoff at all. Take the $55k sedan cutoff, it will slice the Model 3 into subsidized (SR+/RWD, LR) vs non-subsidized (P) and will make its pricing really screwy. Sure bumping that up to $80k would solve it for the Model 3, but presumably will do the same thing to some other car in the higher price range. Since the tax credit is a fixed amount, I have no issue with letting any EV purchaser use it. If there has to be a cutoff, at least make it progressive. Otherwise automakers will need to (re)design around the price cutoff, and I think that will ultimately hurt our choices as consumers.

The union subsidy is another part I really dislike. Why are we favoring some American workers over others? Again, it's a handout to the "big 3." I don't hate the big 3, in fact I want them to succeed and build great EVs, but I see no reason to give them extra handouts and favoritism over other American car makers and other American assembly plants.

Upvote

0

cusetownusa

2022 LR5 MSM/Bl | 19"

I agree, and it smells of blatant corruption. Can’t believe more isn’t being said of it in the mainstream media.I'm most angry at the price caps by body style, for promoting bigger vehicles over smaller ones. Yes sometimes people need or want bigger cars, that's fine, but we shouldn't push car buyers into bigger, less efficient vehicles by subsidizing them more! I'm guessing it's a handout to the "big 3" who have focused most of their production and profits on SUVs and trucks, and will probably continue doing so with EVs.

I also take issue with having a hard price cutoff at all. Take the $55k sedan cutoff, it will slice the Model 3 into subsidized (SR+/RWD, LR) vs non-subsidized (P) and will make its pricing really screwy. Sure bumping that up to $80k would solve it for the Model 3, but presumably will do the same thing to some other car in the higher price range. Since the tax credit is a fixed amount, I have no issue with letting any EV purchaser use it. If there has to be a cutoff, at least make it progressive. Otherwise automakers will need to (re)design around the price cutoff, and I think that will ultimately hurt our choices as consumers.

The union subsidy is another part I really dislike. Why are we favoring some American workers over others? Again, it's a handout to the "big 3." I don't hate the big 3, in fact I want them to succeed and build great EVs, but I see no reason to give them extra handouts and favoritism over other American car makers and other American assembly plants.

Upvote

0

Yea, I agree that this should not be structured to favor the unionized Big 3. The additional credit for union-built EVs complicates the main goal of this tax credit, which is to incentive EV adoption. Neither the car manufacturer nor consumer can force employees to unionize so the tax credit for unionized EVs is not accomplishing anything. A tax credit is supposed to incentivize a certain behavior (for example, pushing consumers towards EVs instead of ICE) but all this does is unfairly make vehicles from certain car manufacturers cheaper.I'm most angry at the price caps by body style, for promoting bigger vehicles over smaller ones. Yes sometimes people need or want bigger cars, that's fine, but we shouldn't push car buyers into bigger, less efficient vehicles by subsidizing them more! I'm guessing it's a handout to the "big 3" who have focused most of their production and profits on SUVs and trucks, and will probably continue doing so with EVs.

I also take issue with having a hard price cutoff at all. Take the $55k sedan cutoff, it will slice the Model 3 into subsidized (SR+/RWD, LR) vs non-subsidized (P) and will make its pricing really screwy. Sure bumping that up to $80k would solve it for the Model 3, but presumably will do the same thing to some other car in the higher price range. Since the tax credit is a fixed amount, I have no issue with letting any EV purchaser use it. If there has to be a cutoff, at least make it progressive. Otherwise automakers will need to (re)design around the price cutoff, and I think that will ultimately hurt our choices as consumers.

The union subsidy is another part I really dislike. Why are we favoring some American workers over others? Again, it's a handout to the "big 3." I don't hate the big 3, in fact I want them to succeed and build great EVs, but I see no reason to give them extra handouts and favoritism over other American car makers and other American assembly plants.

Upvote

0

Adding detail to this point...if the $55k sedan cutoff remains, and you were in charge of the Model 3 lineup at Tesla, what would you do? For sure M3P sales will plummet with the current pricing, I think only a small portion of current M3P buyers could justify to themselves an ~ $18k premium over the already quick LR.Otherwise automakers will need to (re)design around the price cutoff, and I think that will ultimately hurt our choices as consumers.

You could drop the price of the M3P but then it would be too cheap, and too close to the LR. And I can't imagine Tesla dropping the whole Model 3 lineup pricing to match in today's market. You could discontinue the M3P entirely, or since you already developed the car, you could just drastically cut its production to match the extremely reduced demand. That would be fiscally responsible but would be a shame.

What I would do, if possible, is give the M3P a big performance upgrade - presumably along with a further price increase - to justify a big premium over the LR. M3P sales might still drop overall but at least it would be a more differentiated and justifiable product in the market, and you'd have a chance to retain or increase its profit margin.

I've seen others here suggest crippling the M3P to sell it under the $55k cap and unlock/upgrade it with post-sale addons. If the cap becomes law that actually makes sense to me, especially with Tesla's experience offering post-sale addons, but the whole situation here is just silly.

I'll also note that going forward, it seems likely no automaker will develop sedans/hatches/wagons in the $55k-$70k price range. They're be shooting themselves in the foot in terms of value vs any car that just sneaks under the cap. They'll either focus a car entirely under the cap, even to its detriment, or they'll focus well above the cap, to the detriment of affordability. Sure this would hardly be the end of the world, but it's not good for consumers who might otherwise buy in this price range.

Upvote

0

Similar threads

- Replies

- 0

- Views

- 92

- Replies

- 1

- Views

- 504

- Replies

- 4

- Views

- 1K

- Replies

- 1

- Views

- 2K

- Replies

- 136

- Views

- 20K