SageBrush

REJECT Fascism

Thanks.This explains the current rates BIK rates 2017 - BIK Tax Bands UK - Find BIK 2016/17

But in the past diesel was given the advantage. The common as muck BMW 320d was also charged 0 annual road tax (putting it on a par with an EV). Ridiculous.

If I am understanding the BIK correctly, diesel is not given an advantage since the CO2 emissions are per distance. Moreover, a 3% surcharge is added (since 2015 I think.) I accept the externalized cost of the exhaust pollutants has not been adequately captured, but the company motivation to purchase diesel is not explained yet.

I'm more inclined to think that the wide-spread adoption of turbo in diesel is to blame here. It allowed the manufacturers to downsize the engines and gain spectacular results on the government CO2 testing that is not seen on-road. The BIK is fine as a CO2 based scheme; the Euro version of the EPA was gamed. Again.

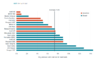

As an aside, the BIK table stands out by making a big taxation deal over relatively small differences in CO2 emissions in the already efficient cars, and then treating everything else the same. In US terms the taxation is the same for any car with worse than 37 MPG -- and that is using the Euro testing. In EPA terms taxation levels off at MPG below ~ 26 MPG. What rationale supports that scheme ?

Last edited: