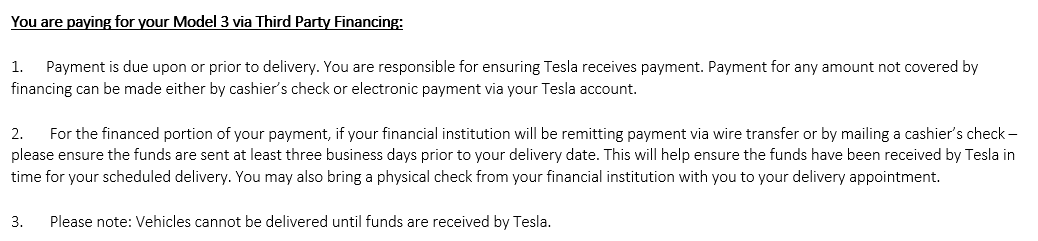

Did you guys see this in the delivery appointment letter, or has it changed recently, or did my ISA make this up?

This is not how my CU rep explained it will work, not what others have described happened, and not what I would consider reasonable, or, in fact, doable.

The CU will not cut me a check for a car I have not picked up, or am not in the process of picking up. They will not wire the funds to Tesla three days prior. They will write up a loan agreement, have me sign it, and, I presume, will send me a DFR - Dealer Funding Request. This I will take to Tesla, and Tesla finance people will get on the phone (fax maybe) with the CU and get the payment finalized. The funds will be overnighted to them, or perhaps my CU rep said it will take two days, I will check.

Is that how it worked our for your guys, and if so why would Tesla put that crap in the email? Just to try?

Or are they serious?

If the actual mechanics/timings of the third-party financing are different, please educate me and let me know what I need to do to actually leave with a car on the delivery date.

This is not how my CU rep explained it will work, not what others have described happened, and not what I would consider reasonable, or, in fact, doable.

The CU will not cut me a check for a car I have not picked up, or am not in the process of picking up. They will not wire the funds to Tesla three days prior. They will write up a loan agreement, have me sign it, and, I presume, will send me a DFR - Dealer Funding Request. This I will take to Tesla, and Tesla finance people will get on the phone (fax maybe) with the CU and get the payment finalized. The funds will be overnighted to them, or perhaps my CU rep said it will take two days, I will check.

Is that how it worked our for your guys, and if so why would Tesla put that crap in the email? Just to try?

Or are they serious?

If the actual mechanics/timings of the third-party financing are different, please educate me and let me know what I need to do to actually leave with a car on the delivery date.