Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Discussion : All discussion regarding Model 3 and Tax credit in model 3 subforum

- Thread starter mapman

- Start date

It is still a tax credit, and you still have to qualify. If you take it at time of purchase and don't qualify, for all/part, of it will be added to your tax liability and you will have to pay it back.As many of you already know starting in January 24 EV's can be purchased using a $7,500 instat rebate off the price of the car vs a Tax Credit that you take off your Federal taxes at the end of year(providing you have a Tax liability).

Mike I think you are mistaken. I will go grab the new Law. We worked very hard to get an actual Rebate so those of us with little Fed tax liabilities (Minnesota still hits hard) so working familes ..those that actually need the boost to get an EV woul;d have acess. that was the entire Point of Rebate over Credit , to qualify millions more AmericansIt is still a tax credit, and you still have to qualify. If you take it at time of purchase and don't qualify, for all/part, of it will be added to your tax liability and you will have to pay it back.

That would mean that the income limit was removed as well, and everyone would qualify, which is not the case.We worked very hard to get an actual Rebate so those of us with little Fed tax liabilities (Minnesota still hits hard) so working familes ..those that actually need the boost to get an EV woul;d have acess.

No, the point was so people wouldn't have to finance the amount of the tax credit and wait until they file taxes to get it.that was the entire Point of Rebate over Credit , to qualify millions more Americans

B

BTW ..aas a Rebate instead of a Credit the Rebate goes to the Dealer(They take off thier dealership Taxes) ..Not to the Buyer. The $7500 (or $3,500 or what ever becomes more of a pass through). This allows the Dealer to sell the EV for up-t0 47,500 less to Incentivy the Buyer . The Dealer is getting the same money if you pay full price or take the rebateIt is still a tax credit, and you still have to qualify. If you take it at time of purchase and don't qualify, for all/part, of it will be added to your tax liability and you will have to pay it back.

Disagree Mike the reason was to open up the EV Market to working familes. The Tax credit is USELESS to 47% of the population that have little Federal tax liabilities.That would mean that the income limit was removed as well, and everyone would qualify, which is not the case.

No, the point was so people wouldn't have to finance the amount of the tax credit and wait until they file taxes to get it.

Adoption of all EV's can only happen if everyone has access to them . affordability

Check out the Last paragraph...

(11) MANUFACTURER’S SUGGESTED RETAIL PRICE LIMITA-

TION.— ‘‘(A) IN GENERAL.—No credit shall be allowed under

subsection (a) for a vehicle with a manufacturer’s suggested

retail price in excess of the applicable limitation.

‘‘(B) APPLICABLE LIMITATION.—For purposes of subpara-

graph (A), the applicable limitation for each vehicle classi-

fication is as follows:

‘‘(i) VANS.—In the case of a van, $80,000.

‘‘(ii) SPORT UTILITY VEHICLES.—In the case of a

sport utility vehicle, $80,000.

‘‘(iii) PICKUP TRUCKS.—In the case of a pickup

truck, $80,000.

‘‘(iv) OTHER.—In the case of any other vehicle,

$55,000.

‘‘(C) REGULATIONS AND GUIDANCE.—For purposes of

this paragraph, the Secretary shall prescribe such regula-

tions or other guidance as the Secretary determines nec-

essary for determining vehicle classifications using criteria

similar to that employed by the Environmental Protection

Agency and the Department of the Energy to determine

size and class of vehicles.’’.

(g) TRANSFER OF CREDIT.—

(1) IN GENERAL.—Section 30D is amended by striking sub-

section (g) and inserting the following:

‘‘(g) TRANSFER OF CREDIT.—

‘‘(1) IN GENERAL.—Subject to such regulations or other guid-

ance as the Secretary determines necessary, if the taxpayer

who acquires a new clean vehicle elects the application of

this subsection with respect to such vehicle, the credit which

would (but for this subsection) be allowed to such taxpayer

with respect to such vehicle shall be allowed to the eligible

entity specified in such election (and not to such taxpayer).

‘‘(2) ELIGIBLE ENTITY.—For purposes of this subsection, the

term ‘eligible entity’ means, with respect to the vehicle for

which the credit is allowed under subsection (a), the dealer

which sold such vehicle to the taxpayer and has—

(11) MANUFACTURER’S SUGGESTED RETAIL PRICE LIMITA-

TION.— ‘‘(A) IN GENERAL.—No credit shall be allowed under

subsection (a) for a vehicle with a manufacturer’s suggested

retail price in excess of the applicable limitation.

‘‘(B) APPLICABLE LIMITATION.—For purposes of subpara-

graph (A), the applicable limitation for each vehicle classi-

fication is as follows:

‘‘(i) VANS.—In the case of a van, $80,000.

‘‘(ii) SPORT UTILITY VEHICLES.—In the case of a

sport utility vehicle, $80,000.

‘‘(iii) PICKUP TRUCKS.—In the case of a pickup

truck, $80,000.

‘‘(iv) OTHER.—In the case of any other vehicle,

$55,000.

‘‘(C) REGULATIONS AND GUIDANCE.—For purposes of

this paragraph, the Secretary shall prescribe such regula-

tions or other guidance as the Secretary determines nec-

essary for determining vehicle classifications using criteria

similar to that employed by the Environmental Protection

Agency and the Department of the Energy to determine

size and class of vehicles.’’.

(g) TRANSFER OF CREDIT.—

(1) IN GENERAL.—Section 30D is amended by striking sub-

section (g) and inserting the following:

‘‘(g) TRANSFER OF CREDIT.—

‘‘(1) IN GENERAL.—Subject to such regulations or other guid-

ance as the Secretary determines necessary, if the taxpayer

who acquires a new clean vehicle elects the application of

this subsection with respect to such vehicle, the credit which

would (but for this subsection) be allowed to such taxpayer

with respect to such vehicle shall be allowed to the eligible

entity specified in such election (and not to such taxpayer).

‘‘(2) ELIGIBLE ENTITY.—For purposes of this subsection, the

term ‘eligible entity’ means, with respect to the vehicle for

which the credit is allowed under subsection (a), the dealer

which sold such vehicle to the taxpayer and has—

Sooooo back to my original post... do I buy now at 38K with no tax credit /rebate or do I wait until Jan 2024 .

Like I asked , will Tesla up their prices and use the Tax Rebate simply as a way to increase revenues/profit.. instead of 40K will the up the base price to 45? They can then get $7,500 Tax credit for themselves PLUS an Price increase of 5-10k for the Car ..

Is that going to happen when once again ..we get screwed (btw..talking about all EV manufactrures not just Tesla)

Would you buy new Base Tesla for 38K if you could now or take chances that the Tax Rebate would work in your favor (as someone will usually very low Fed Tax liability)

Like I asked , will Tesla up their prices and use the Tax Rebate simply as a way to increase revenues/profit.. instead of 40K will the up the base price to 45? They can then get $7,500 Tax credit for themselves PLUS an Price increase of 5-10k for the Car ..

Is that going to happen when once again ..we get screwed (btw..talking about all EV manufactrures not just Tesla)

Would you buy new Base Tesla for 38K if you could now or take chances that the Tax Rebate would work in your favor (as someone will usually very low Fed Tax liability)

Tough question here, what if you qualify for the the CVRP for the $7500 because of low income then you married someone couple of months after. Now do you need to file joint? And due to higher income from both of you, you probably be qualified for the $7500 fed rebate. With this scenario, can you get the full $15k refund?

SilentWarp

Member

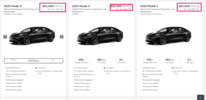

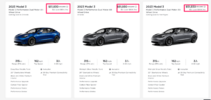

I want a new M3P to take advantage of federal tax credit of $7500 + reduced pricing for in-stock. There a plenty of in-stock here in Florida, making every possible M3 combo available same day, any config.

However... if I want any non-white plus white interior, the MSRP = $55,240

If I want Red with black its also over $55,240.

I am forced to get a black interior, or a white exterior to get msrp under $55,000. With all the price jiggering Elon has been doing, why not a little adjustment to get ALL his M3's eligible for $7500. Its so frustrating. Also, why is tax credit on msrp, not sales (discounted) price?? That is also eff'd.

However... if I want any non-white plus white interior, the MSRP = $55,240

If I want Red with black its also over $55,240.

I am forced to get a black interior, or a white exterior to get msrp under $55,000. With all the price jiggering Elon has been doing, why not a little adjustment to get ALL his M3's eligible for $7500. Its so frustrating. Also, why is tax credit on msrp, not sales (discounted) price?? That is also eff'd.

whisperingshad

Active Member

SilentWarp

Member

True, I could spend the entire tax credit on a wrap. haha. I know a lot of folks plan to wrap before even buying the vehicle, but I'm a little too old school for that. Not all techies are under 40Just get in white then Wrap it

whisperingshad

Active Member

you can get a wrap for like 3k or less, a PPF wrap run ya like 7k though( in cali). I bought with no tax credit and just got blue, done.True, I could spend the entire tax credit on a wrap. haha. I know a lot of folks plan to wrap before even buying the vehicle, but I'm a little too old school for that. Not all techies are under 40

buckets0fun

Active Member

White Interior is 2-2.5k$, swap it in after purchase and sell your black interior?

SilentWarp

Member

I'm in Florida too and I can see a bunch of M3P's with white interiors and non-white exterior for under $55K. Am I missing something? Here are a few.

MSRP's on all those are $55,240. When you actually choose them (add to cart), the $7500 credit indicator goes away

The only add on outside of the msrp cap is the FSD, but paint choice? No way!

I can't beleive the bean counters missed this.

Last edited:

I would contact Tesla directly or go to one of the dealerships, when you add it to the cart it still charges you the $250 and the $1390 for destination charge. Those should be waived if it's sitting on the lot. It's more than likely just an oversight, give them a shout and see what they say.MSRP's on all those are $55,240. When you actually choose them (add to cart), the $7500 credit indicator goes away

The only add on outside of the msrp cap is the FSD, but paint choice? No way!

I can't beleive the bean counters missed this.

fholbert

Active Member

I don’t think so.I would contact Tesla directly or go to one of the dealerships, when you add it to the cart it still charges you the $250 and the $1390 for destination charge. Those should be waived if it's sitting on the lot. It's more than likely just an oversight, give them a shout and see what they say.

It still cost money to get the car to it’s destination, the $250 deposit is part of the purchase price.

SilentWarp

Member

I would contact Tesla directly or go to one of the dealerships, when you add it to the cart it still charges you the $250 and the $1390 for destination charge. Those should be waived if it's sitting on the lot. It's more than likely just an oversight, give them a shout and see what they say.

Nah, IRS is pretty clear on this. MSRP is MSRP:

---------------------------------------------------------------------------------------

In addition, the vehicle's manufacturer suggested retail price (MSRP) can't exceed:

- $80,000 for vans, sport utility vehicles and pickup trucks

- $55,000 for other vehicles

---------------------------------------------------------------------------------------

The Tesla website is also clear on this, where the 'Tax Credit' notice suddenly vanished when you choose a white interior with a non-white exterior.

I think when they came up with the last price drop, it was just $240 too small to cover all of the MY3 configs. It was an oversight by the marketing MBAs. and they should be a little embarrassed they didn't do all their research. I'm pretty sure a bunch of buyers were fooled, and are now expecting a cool $7500 off their 2023 taxes when they file next year. Boy will many be pissed when the auditors come a knockin'.

Similar threads

- Replies

- 17

- Views

- 660

- Replies

- 925

- Views

- 106K

- Replies

- 80

- Views

- 12K

- Replies

- 10

- Views

- 3K