The above post, written in bed at 5 a.m. with eyes half shut and zero caffeine,

seemingly confused people, so here's a better-articulated version:

----------

Tesla (TSLA) is often said to be valued as highly as certain traditional automakers, and the metric used for this argument is market capitalization. Let me explain why market capitalization is an imperfect measure.

What Is Market Capitalization?

The market capitalization of a company, or the total market value of its equity, is simply the number of shares outstanding multiplied by the stock price:

Market Capitalization = Shares Outstanding x Stock Price

Tesla currently has

168.9 million shares outstanding, so at the last stock price of $352, Tesla's market capitalization is

$59.5 billion. This figure represents the market value of Tesla's equity, or how

Mr. Market prices Tesla's equity.

Tesla's market capitalization compares similarly to that of General Motors (

GM):

Market capitalization, however, does not tell the whole story.

What Is Enterprise Value?

Enterprise Value (not to be confused with Intrinsic Value) is a more comprehensive measure than market capitalization, and represents the total market value of the

business, or market participants' estimate of the discounted value of future cash flows, some of which go to debt, minority interest, preferred stock holders. Enterprise value is calculated as follows:

Enterprise Value

= Market Cap

+ Debt

+ Minority Interest

+ Preferred Stock

- Cash

The following is how Tesla's enterprise value compares to that of General Motors:

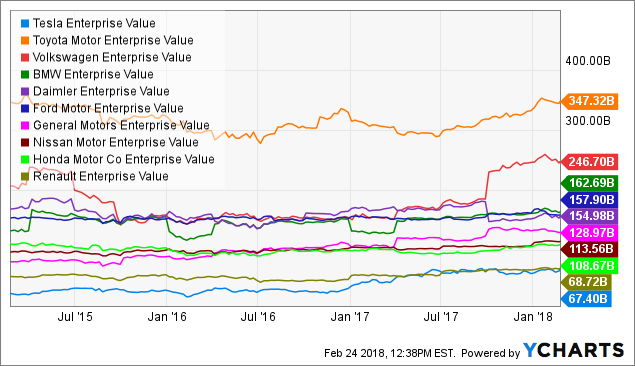

The above graph illustrates that, even though the market value of Tesla's equity is similar to that of GM, Mr. Market currently prices the total value of GM's business nearly twice as highly as that of Tesla. In fact, Mr. Market currently prices Tesla's enterprise value less than all other global automakers:

Why Is This Important?

Bears argue that Tesla and GM are price similarly (per market capitalization), and they conclude that this is unwarranted as General Motors produces 10 million cars annually, whereas Tesla has produced only 100,000 in 2017.

The above argument ignores several key valuation issues such as differences in enterprise values, which is a more comprehensive measure of valuation than market capitalization, as well as differences in average selling prices, gross profit margins, operating expense trends, but most importantly, the diverging future of the two companies' bread-and-butter business lines: internal combustion engine vehicles versus all-electric vehicles.

The Future Is All-Electric

Tesla's Elon Musk

says it, Apple's (

AAPL) Tim Cook

proclaims it, and General Motors' Mary Barra

agrees: the future of transportation is increasingly electric. Where players disagree is how quickly this future will materialize, and depending on that, what role internal combustion engines and hybrids will play during the transition.

Tesla is betting that the future will arrive quicker than others expect, which is why the company produces only all-electric vehicles. In fact, Tesla is now

producing more all-electric vehicles than any other player across the industry, and it has the most aggressive plans to expand all-electric vehicle production among all global automakers.

Bottom Line

Enterprise value is a more comprehensive measure of corporate valuation than market capitalization, and Mr. Market still prices Tesla less than all of its traditional competitors, even though it has the highest run-rate production and the most aggressive expansion plans of all-electric vehicle production, which many agree is the future of transportation. This is why I invest in Tesla.