I will always go back to the fundamentals, when I have not forgotten what it was that I was originally thinking about

. You may have read this, but it is striking to the point of; is this really from an author on SA.

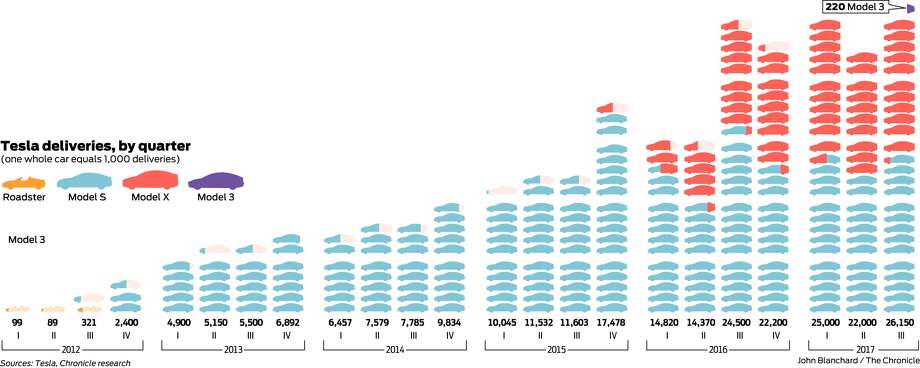

Tesla Analysts See Soaring Sales Amid Investor Skepticism

Up until I retired from active duty in February 1994, my wife and I routinely donated blood. However, once back in the states we were no longer allowed to do so. Why? Guilt by association:-( England had had a large outbreak of Mad Cow disease and we had traveled in and around England during that period and therefore unable to donate our blood. If any of you are considering a military career, I say become a British officer! During one of my last joint war games, the Brits hosted it, and while I had the graveyard shift, we ate in a British mess hall. OMG I was escorted to a table with a white table cloth, silverware and china plates, and called Sir so many times I had to check my name tag to ensure my last name was spelled correctly. They even had a menu! Granted my last name begins with an “S” and my namesake in England hosts one of the tallest cathedrals in Europe, but I doubt that was . . . Oh, in the US field mess I typically would wait until my folks were fed, then have some spaghetti scooped onto a slice of bread, I’d slap another slice on top and call it good ~ swallowed down with my second pot of coffee for the day. I think it was wonder bread

Okay, to the point. My road trip last September to visit where Xena came from was almost as exciting as my first visit to the “wall” in Nuremberg, Germany, back in 1971; in both cases it was just to look

If you do not recall, that afternoon following our tour, Xena was violated when her back windshield became the scene of a “smash and grab.” And as a result there was a long delay in posting my experience/tour.

Bringing you back around; since that time we all discovered that those thousands of parts and robots waving to us on the tram, was not because the humans had stopped for lunch. I do have a picture, taken by my wife, of me using the owners key card attempting to unlock a M3. I am now thirty pounds thinner, and the belly is missing

but, with few exceptions, some folks have been exhibiting symptoms of Mad Cow disease. I love a good steak, but come on folks, the Tesla fundamentals are still very strong and if I stuck my head outside the computer, I would probably know that much better.

Please do not tell me, the owner/employee with a baby car seat of his M3 was a plant for gullible Tesla owners supercharging their Ss and Xs after hours at the Fremont plant. PLEASE

Montana Skeptic

Montana Skeptic