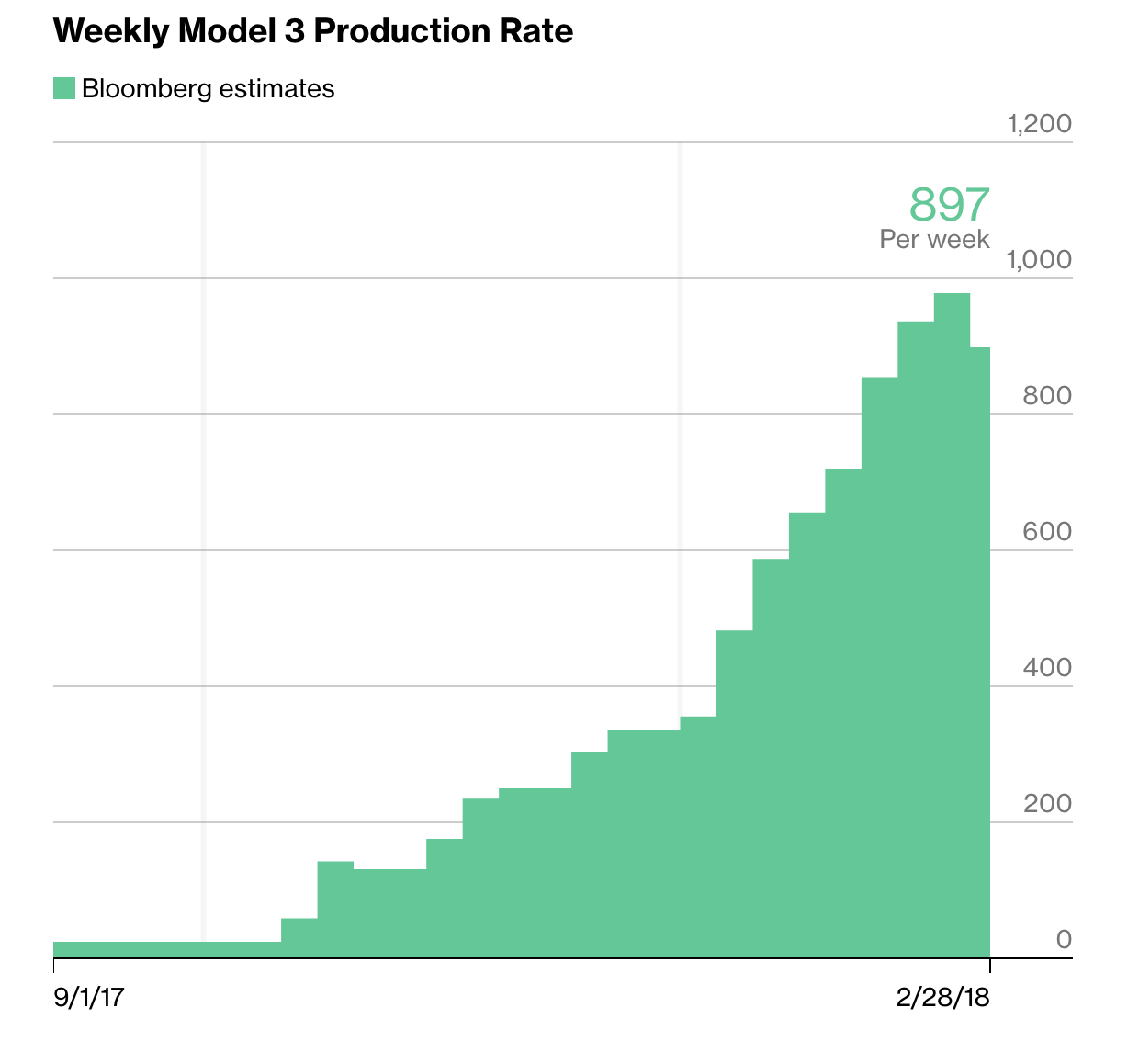

I'm not sure how much we can trust the Bloomberg Model 3 Tracker, but it does look like Model 3 production has dropped this week. Could this mean they are retooling for AWD? In any case, how are they going to hit 2,500 by 3/31 at this rate?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Model 3 Production Levels Down?

- Thread starter EV-lutioin

- Start date

LV Acrobat

Member

I think the line stopped for a little over a week, maybe to install new automation, really who knows but vins definitely stopped being issued for some reason. BUT we are back to normal VINs coming out of Fremont now, and the fact that a huge number of invites went out last week and again this week makes me think that they are very confident in the line now. Should start seeing an uptick in weekly number very soon.

Mark Z

Active Member

DanL3

Member

No, Bloomberg is estimating. They probably over estimated the last 3 weeks and when they realized the error they have adjusted downward, but only adjusted the last week.

In actuality it is probable that the rate has never been over 850/week.

In actuality it is probable that the rate has never been over 850/week.

Kant.Ing

Member

By my count, including September output, estimated as ~22K, the totals for the year in sales for the Model 3 are 78,817 to date. Assuming that October, Nov and December roughly equal but don't exceed the record Sept output, that means total sales of M3 will be ~145,000. that compares with total sedan sales of Mercedes estimated at ~130K total for 2018, while total BMW 3 series sales are estimated at ~100K and total sedan sales are also less than just Model 3 numbers for the year. It's worth emphasizing that this is literally out of nowhere - from niche boutique manufacturer to beating the iconic Germans at their A game level. The tide has indeed turned, and a revolution is underway. It will only gain momentum, as the technical excellence of the Model 3 PV wins people over while the cost of operation means there is no going back.

Kichwas

Member

Actually I think it is wise for Tesla to think about Tax credits... that $7800 credit being cut in half on January 2019 is going to be a smack in the face to sales.

It will make it a lot harder to get middle income buyers to get in.

Myself... ordered a RWD on 9/30, but my order page says 10/3... so I am guessing I got bumped down a few days... and I kinda hope they don’t retool away from RWD too soon...

It will make it a lot harder to get middle income buyers to get in.

Myself... ordered a RWD on 9/30, but my order page says 10/3... so I am guessing I got bumped down a few days... and I kinda hope they don’t retool away from RWD too soon...

PremiumPackage

Member

Actually I think it is wise for Tesla to think about Tax credits... that $7800 credit being cut in half on January 2019 is going to be a smack in the face to sales.

It will make it a lot harder to get middle income buyers to get in.

Eh - with the doubling of the standard deduction this year, there will be a lot fewer buyers who can take advantage of the tax credit in the first place. Rough estimates I've seen are that only about 5% of filers (as opposed to ~26% of filers previously) will itemize deductions. Now if you're on the edge, a smaller tax credit could in theory move you from itemizing, to not, but I think that'll be a distinct minority of buyers.

It does bring up an interesting question, though. They will at some point have to tell buyers "You're getting a car in 2018, or not". For example right now per the website, delivery estimates for LR AWD are "2-4 months", which straddles 2018/2019. I gotta think buyers for whom the tax credit matters are going to take a dim view of that range - at some point Tesla is just going to have to say "hey listen you're getting your car in 2019". Probably not great for end of quarter delivery stats.

Actually I think it is wise for Tesla to think about Tax credits... that $7800 credit being cut in half on January 2019 is going to be a smack in the face to sales.

It will make it a lot harder to get middle income buyers to get in.

Myself... ordered a RWD on 9/30, but my order page says 10/3... so I am guessing I got bumped down a few days... and I kinda hope they don’t retool away from RWD too soon...

True Dat. Not sure what Tesla can do about it though, other than get the ridiculous limit on full tax credits for only the first 200K cars or whatever it is changed. That's looking like an uphill climb with the idiots in charge in Washington, but people can vote these fossil fuel stooges out.

If domestic demand starts slowing down, Tesla will just start shipping internationally. They did this with Model S and X and didn’t miss a beat. And then, of course, they can start shipping SR version, that’s still a huge (and probably growing) backlog.

If domestic demand starts slowing down, Tesla will just start shipping internationally. They did this with Model S and X and didn’t miss a beat. And then, of course, they can start shipping SR version, that’s still a huge (and probably growing) backlog.

Yup. But you left out the Model Y - which given the popularity of smaller SUVs is poised to rock the market and take over that segment, in the same way that the Model 3 has done with premium sedans. Word is spreading, and sales appear to follow the first emergence of a Model 3 in a neighborhood. Soon there are two, then three Model 3s, all within a circle of friends and neighbors.

The car is spreading like a contagion. Model Y will do the same.

voip-ninja

Give me some sugar baby

Actually I think it is wise for Tesla to think about Tax credits... that $7800 credit being cut in half on January 2019 is going to be a smack in the face to sales.

It will make it a lot harder to get middle income buyers to get in.

Myself... ordered a RWD on 9/30, but my order page says 10/3... so I am guessing I got bumped down a few days... and I kinda hope they don’t retool away from RWD too soon...

You need to realize that Tesla is in competition with companies selling similar products, at similar prices, who benefit from no tax credits. So either Tesla can compete without tax credits or Tesla will have to lower prices.

But wait! Current high "entry" price to Model 3 puts the vehicle out of reach of those who, for example, might have a car budget of $45,000 vs $50,000-$75,000.

If only Tesla could find a way to lower the entry barrier to owning one of their cars, then they wouldn't have to do anything with their pricing as demand begins to soften in the face of phased out tax cuts.

If only Tesla could offer a lower priced version of their ubiquitous (in CA anyway) Model 3 so that they could continue to capture more of the market away from their principle competition, the Germans...

Hmmmmm.... I wonder how they might do such a thing?

jelloslug

Active Member

A middle income purchaser would not be able to take the entire $7500 tax credit anyway.Actually I think it is wise for Tesla to think about Tax credits... that $7800 credit being cut in half on January 2019 is going to be a smack in the face to sales.

It will make it a lot harder to get middle income buyers to get in.

Myself... ordered a RWD on 9/30, but my order page says 10/3... so I am guessing I got bumped down a few days... and I kinda hope they don’t retool away from RWD too soon...

Wow you guys sure know how to necro old threads lol.

Model 3 ramp up came and went, production levels are no longer an issue even the shortsellers don't even try to bring this up anymore.

For people worrying about Model 3 demand or the phasing out of 7500 tax credit, at this price point, $3400 isn't going to make someone all of a sudden say no to this car. Model 3 has now captured the car enthusiast market, you know, people who love power, speed, and tech. It's going to do well for a very long time.

But for those still doubting, Model 3 is launching in Europe soon. This car is arguably a better car for EU, it's got the longest range of EV's, it's small enough which EU drivers prefer, and it has all the tech that the EU market craves. There won't be any demand issues.

Model 3 ramp up came and went, production levels are no longer an issue even the shortsellers don't even try to bring this up anymore.

For people worrying about Model 3 demand or the phasing out of 7500 tax credit, at this price point, $3400 isn't going to make someone all of a sudden say no to this car. Model 3 has now captured the car enthusiast market, you know, people who love power, speed, and tech. It's going to do well for a very long time.

But for those still doubting, Model 3 is launching in Europe soon. This car is arguably a better car for EU, it's got the longest range of EV's, it's small enough which EU drivers prefer, and it has all the tech that the EU market craves. There won't be any demand issues.

You need to realize that Tesla is in competition with companies selling similar products, at similar prices, who benefit from no tax credits. So either Tesla can compete without tax credits or Tesla will have to lower prices.

But wait! Current high "entry" price to Model 3 puts the vehicle out of reach of those who, for example, might have a car budget of $45,000 vs $50,000-$75,000.

If only Tesla could find a way to lower the entry barrier to owning one of their cars, then they wouldn't have to do anything with their pricing as demand begins to soften in the face of phased out tax cuts.

If only Tesla could offer a lower priced version of their ubiquitous (in CA anyway) Model 3 so that they could continue to capture more of the market away from their principle competition, the Germans...

Hmmmmm.... I wonder how they might do such a thing?

Well, it's not as easy as you make it sound. First of all, I don't know if you have seen the tech teardowns on the M3 - done recently, in conjunction with a parallel teardown of the Chevy Bolt and the BMW i3. The tech guys who disassembled were stunned by what they call the "military grade" components throughout the M3, not seen remotely in the other two. Their conclusion: NO WAY Tesla can make money with this kind of construction without some premium value added features, such that they are not selling primarily Model 3s without upgrades.

So . . . . they first have to get some cash in the front door. After all, Tesla for all the attention it gets has actually not made ANY money. Musk is if anything generous to a fault and doing this for all the right reasons - he would rather have the best car in the most homes than an extra ten billion added to his personal wealth. Anyone who thinks he's just in this for the money doesn't know Elon. This has created an unusual dynamic, never seen before at this scale anyway in a spectacularly successful disruptive tech business: the CEO/Chairman giving stuff away at cost virtually, while the bean counters are trying to get him to raise prices.

Bottom line - Tesla is allowing us to reap the benefits of Musk's most unusual approach. They will produce that $35k everyman car. But not until its break even price is buffered by the S, X, and max optioned 3.

Last edited:

Wow you guys sure know how to necro old threads lol.

Model 3 ramp up came and went, production levels are no longer an issue even the shortsellers don't even try to bring this up anymore.

For people worrying about Model 3 demand or the phasing out of 7500 tax credit, at this price point, $3400 isn't going to make someone all of a sudden say no to this car. Model 3 has now captured the car enthusiast market, you know, people who love power, speed, and tech. It's going to do well for a very long time.

But for those still doubting, Model 3 is launching in Europe soon. This car is arguably a better car for EU, it's got the longest range of EV's, it's small enough which EU drivers prefer, and it has all the tech that the EU market craves. There won't be any demand issues.

It was too good a thread to die - not a necro thread but a zombie thread? Hah!

The Model 3 will capture Europe even more than the States, in a matter of 2-3 years, it will be the biggest selling car in the EU (assuming there still is an EU with all the tribalism in resurgence everywhere). Tesla will have to open a ginormous factory over there . . . .and soon.

CapnLoki

Member

Eh - with the doubling of the standard deduction this year, there will be a lot fewer buyers who can take advantage of the tax credit in the first place. Rough estimates I've seen are that only about 5% of filers (as opposed to ~26% of filers previously) will itemize deductions. Now if you're on the edge, a smaller tax credit could in theory move you from itemizing, to not, but I think that'll be a distinct minority of buyers.

As I understand it (and I'm certainly not a tax pro) the Tax Credit has nothing to do with deductions, which reduce the taxable income. The Tax Credit is applies to the actual tax paid, so any tax paid up to $7500 gets erased. Its money in the pocket for anyone who pays federal tax, regardless of their deductions. If withholding was paid there could be a large refund.

The only people who can't take advantage of this are those that pay little or no tax - which usually means low income, or retired and living off pension and savings, but little actual income, or a very clever accountant.

CapnLoki

Member

Probably true, but it depends on what you consider "middle income" - at $100,000 the average rate paid is about 8% so they might be able to use the full credit. Clearly at $50,000 income you're only paying about 3-4% so there's little benefit, but you're probably not buying a $60,000 car, either.A middle income purchaser would not be able to take the entire $7500 tax credit anyway.

The other point is that I'm pretty sure this credit applies to capital gains, so this may be an opportunity take the gains from the recent stock market surge, or maybe do a Roth IRA conversion.

Similar threads

- Replies

- 2

- Views

- 460

- Replies

- 1

- Views

- 133

- Article

- Replies

- 3

- Views

- 227

- Article

- Replies

- 15

- Views

- 1K