Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Near-future quarterly financial projections

- Thread starter luvb2b

- Start date

-

- Tags

- elon is an ass

EVNow

Well-Known Member

This gives an interesting perspective on China EV market.

New Car Sales In China Fell 5.8% In 2018 | CleanTechnica

New Car Sales In China Fell 5.8% In 2018 | CleanTechnica

Many Chinese cities are densely populated and suffer from formidable congestion. In some cities, new car buyers must wait a year or more before they can register it if it is a car with a gasoline or diesel engine. Electric cars are granted registrations immediately, but the supply of electric cars — while growing rapidly — falls far short of total demand.

EVNow

Well-Known Member

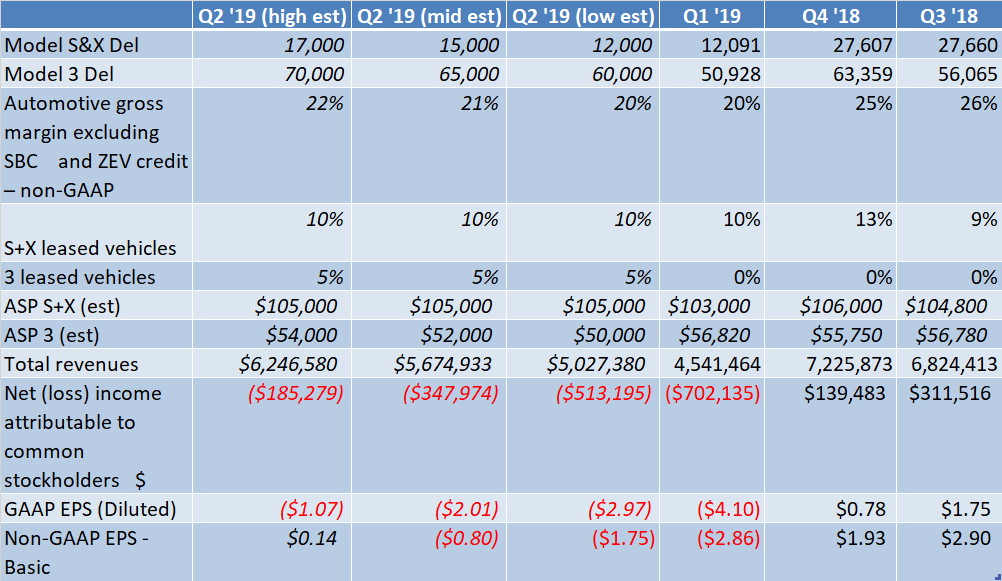

Here is my very rough estimate for Q2. Avg Yahoo (non-GAAP) EPS estimate is -0.44 and revenue est is $6.22B. This corresponds to my high estimate below.

Last edited:

neroden

Model S Owner and Frustrated Tesla Fan

Neorden - Are you short term bullish or bearish on the stock?

I don't do short term. Investment horizon always longer than 1 year.

EVNow

Well-Known Member

If I take the high case (17+70k delivery) - but 20% margin I end up with -0.46 non-GAAP EPS. Very close to the Yahoo avg.Here is my very rough estimate for Q2. Avg Yahoo (non-GAAP) EPS estimate is -0.44 and revenue est is $6.22B. This corresponds to my high estimate below.

View attachment 408684

As I understand it, to summarize it’s necessary they start delivering model s and x at prior rates

Of 25,000 per quarter to achieve profitability. Assuming

That demand is there, which I believe it is.

The moment they do, gross margins will start covering operating expenses.

Model 3 production may not increase beyond present rates until Panasonic

Increases cell production at giga 1, supposedly in June.

Hence, 2 necessary conditions 1. Increase s and x deliveries

2. Panasonic 2170 production increases substantially.

At that point profitability is within view.

Of 25,000 per quarter to achieve profitability. Assuming

That demand is there, which I believe it is.

The moment they do, gross margins will start covering operating expenses.

Model 3 production may not increase beyond present rates until Panasonic

Increases cell production at giga 1, supposedly in June.

Hence, 2 necessary conditions 1. Increase s and x deliveries

2. Panasonic 2170 production increases substantially.

At that point profitability is within view.

EVNow

Well-Known Member

25k S+X, 85k Model 3 gets close to GAAP breakeven on 20% margin. To get to non-GAAP breakeven they need S+X to be at 25k and Model 3 at 65k.Hence, 2 necessary conditions 1. Increase s and x deliveries

2. Panasonic 2170 production increases substantially.

If GF1 operates at 24 GWh - with the higher SR+ in the mix, they can make 90k Model 3s. They don't need GF1 cell production to increase substantially for that.

Getting GF1 to 35GWh is needed for energy products and ofcourse Y.

Last edited:

Doggydogworld

Active Member

How do you get to any number from Q3/Q4 ?

I looked at ongoing orders for LR after that wave crested and ongoing orders for AWD/P after that wave crested. I cross-checked some with Second Measure data and such which gave a feel for the size of the initial waves.Those $32k EVs are more like $16k after subsidies. China is phasing out subsidies and moving to a (ZEV-style) NEV credit system. Shanghai Teslas will qualify, but the initial NEV targets are low so the credits may be worthless for a couple years. Meanwhile, Model Y will ramp not long after Shanghai and I figure Fremont will shift to 7-8k/week for 3 + Y combined. Shanghai will then get Model Y and do an additional 4-5k/week for APAC.What you are now estimating is worldwide demand of 65k (5k/wk) - with lower trims and lower prices. Including in China, where now a $32k EV sells 30k a quarter ! Looks low to me.

I try to be conservative, but realistic. Your Q2 high/med/low estimates look reasonable to me, btw. Good work.

neroden

Model S Owner and Frustrated Tesla Fan

It's worth recalling that "profits are fictional, cash flow is real". Tesla seems to be in a position to be cash flow positive apart from inventory buildup, and they have enough cash to finance the necessary inventory-in-transit buildup.

As a result, Musk may simply ignore the stock market for the rest of the year and generate cash.

As a result, Musk may simply ignore the stock market for the rest of the year and generate cash.

Spacemanspliff

Member

IMHO the Model S effect was mostly about growing awareness of Tesla and high performance EVs in general. By 2016 Tesla was well known. Musk has 20m++ Twitter followers. He's on the evening news. The Model 3 reveal was a mass market sensation. Could we still see a "growing awareness" effect. Maybe, but it seems more hope than rational expectation.

Yet I have conversations all the time about people misinformed on how much a Tesla costs, where you can charge it, how far it can go, etc. in a state like California. When the reveal happened people saw it on the news sure, but I don't think people truly believe/understand/get it until they see one in person. Whether its from a neighbor down the street or a coworker, its someone they trust and it makes that product more real and they understand it better. That phenomenon is just starting, not just in the US but also world wide. The longer the company is around, the more service centers it builds, the more chargers (including V3) it builds, the more features it adds to autopilot/fsd the more appealing the product becomes. Thats why I've stated having good service center experiences and delivery experiences are crucial, because the customer is also Teslas main (and best) advertising source.

Will this incremental increase in demand happen? I have no idea and you are right it is hope, but I think there are some rational reasons on why we could see it happen and why I don't believe the first 3 quarters are indicative of true steady state demand.

Either way it will be fun to watch how it pans out.

Last edited:

EVNow

Well-Known Member

I think for a lot of EM twitter followers it is either an aspirational product and they do it just for entertainment. A good check would be to talk to folks who bought 3 recently and ask them about twitter. Anecdotally hardly anyone I talk to got much information from following EM on twitter.IMHO the Model S effect was mostly about growing awareness of Tesla and high performance EVs in general. By 2016 Tesla was well known. Musk has 20m++ Twitter followers. He's on the evening news. The Model 3 reveal was a mass market sensation. Could we still see a "growing awareness" effect. Maybe, but it seems more hope than rational expectation.

I think people in general do not trust celebrities on twitter to buy expensive products based on what they say. They need real life examples near home for that. So, in sales parlance - it is about converting leads to sales. I see all around me people who can easily afford a model 3, aware of Tesla but think they are expensive (or in some cases not sure about Tesla's financials).

qdeathstar

Completely Serious

It's worth recalling that "profits are fictional, cash flow is real". Tesla seems to be in a position to be cash flow positive apart from inventory buildup, and they have enough cash to finance the necessary inventory-in-transit buildup.

As a result, Musk may simply ignore the stock market for the rest of the year and generate cash.

Musk just say telsa is out of cash in 10 months... makes me a little nervous considering i just bought one.... probably shoulda leased it...

He said, at the Q1 loss rate, they would go through the 2.4 billion they just raised in 10 months (and be back to only $2.2 Billion in cash).Musk just say telsa is out of cash in 10 months... makes me a little nervous considering i just bought one.... probably shoulda leased it...

At the Q3 or Q4 rate, they will never use up the $2.4 Billion.

It was said to put things in perspective, costs are important, save where there is savings.

Barklikeadog

Active Member

Because big oil and established auto makers conspired extra hard to sabotage Tesla this year.why did Q1 have so many losses?

Pras

Member

Many points that can be and have been explained here. Tesla still has only three products in market, with only one with significant scale. So quarterly fluctuations look uglier than they are fundamentally. With model Y they can smooth out this further.why did Q1 have so many losses?

Do these numbers include fca payments?Here is my very rough estimate for Q2. Avg Yahoo (non-GAAP) EPS estimate is -0.44 and revenue est is $6.22B. This corresponds to my high estimate below.

View attachment 408684

electracity

Active Member

Musk just say telsa is out of cash in 10 months... makes me a little nervous considering i just bought one.... probably shoulda leased it...

First, any problems with getting good support for a leased vehicle would be the same for a purchased model 3. Second, Tesla's car business is solid and would continue even in the worst case scenario. So you car dropping unusually in value is very unlikely.

Most likely if you sell your car in three years there will be little difference compared to a lease.

Similar threads

- Replies

- 192

- Views

- 20K

- Replies

- 41

- Views

- 7K