I'm regretting not opening more BPSs yesterday when premiums were much higher. Shows you just can't time this stuff. Had I opened the maximum and the SP had gone down, I would have been kicking myself for not waiting. Maybe tomorrow or Monday will offer an opportunity. Overall, the SP going up is good for my account. Needs to get to 380 by December....

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

TheTalkingMule

Distributed Energy Enthusiast

Well there's certainly gonna be a shot taken at a 285 close tomorrow. History says you should see an opportunity at 281 during the MMD. We shall see.I'm regretting not opening more BPSs yesterday when premiums were much higher. Shows you just can't time this stuff. Had I opened the maximum and the SP had gone down, I would have been kicking myself for not waiting. Maybe tomorrow or Monday will offer an opportunity. Overall, the SP going up is good for my account. Needs to get to 380 by December....

Looked real strong today tho.

Sold my assigned shares from -p285 last week today at 288, bit under my 1%/week but it will do...

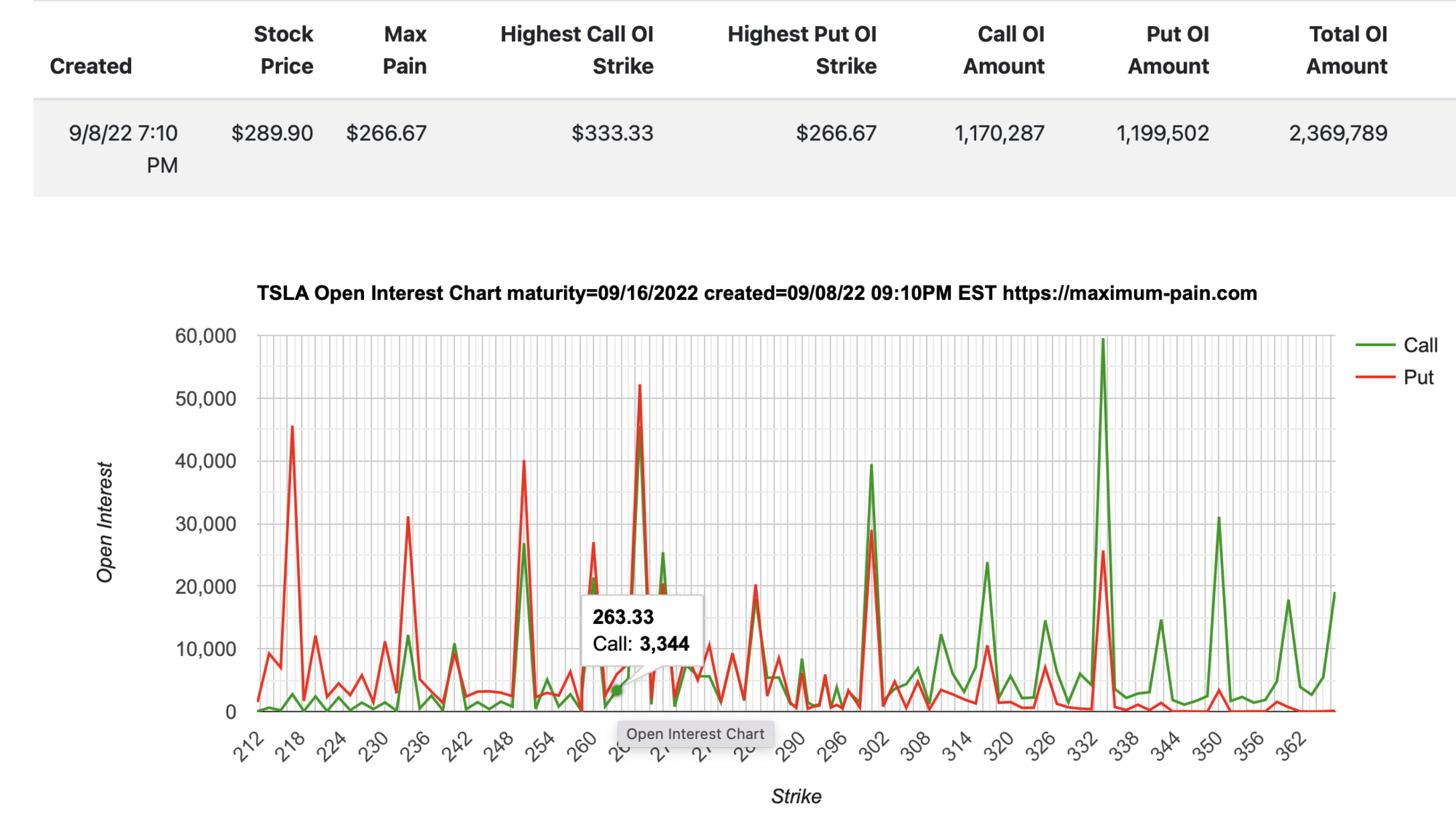

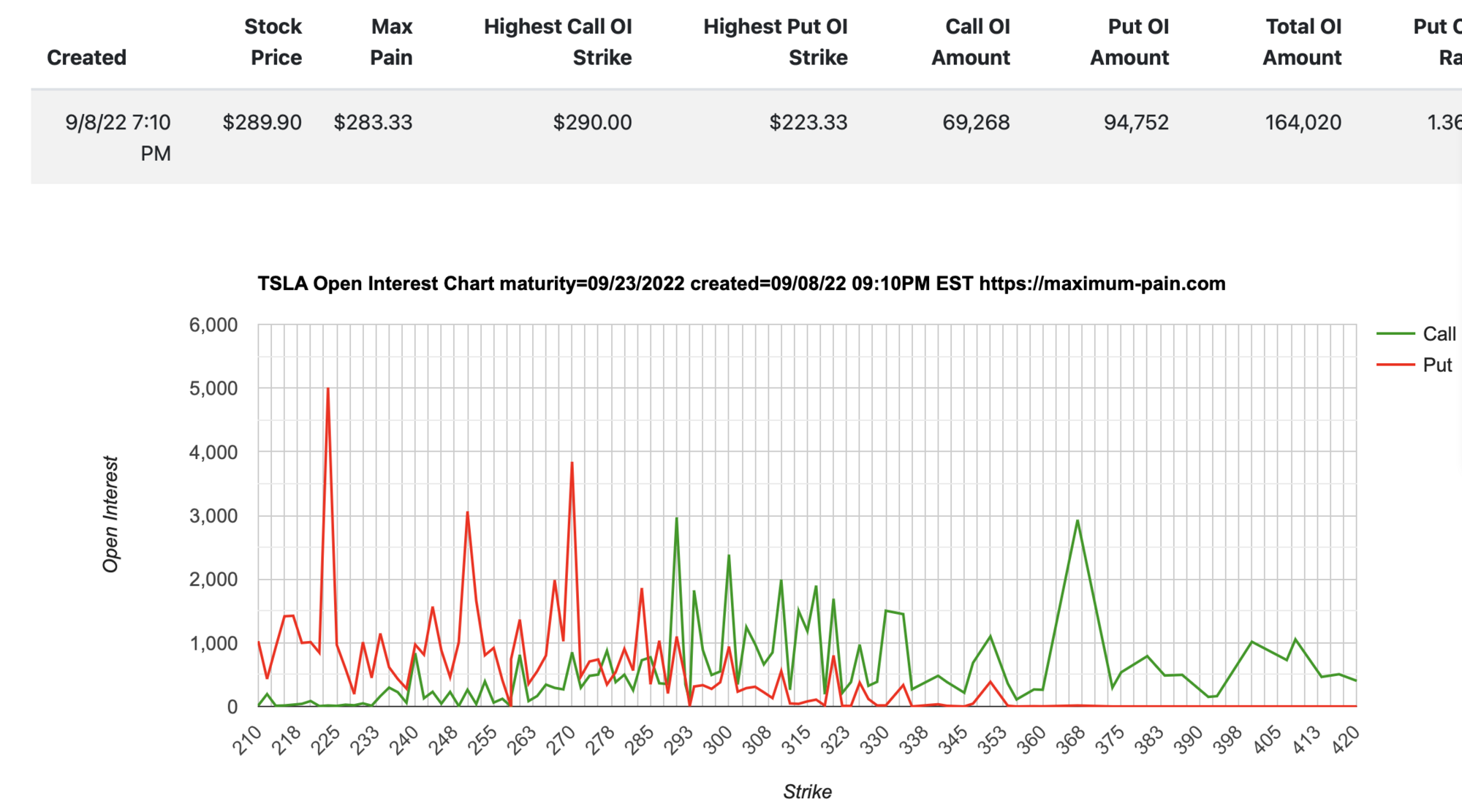

Next week max pain looks very low!

As monthly expiration I wonder if will change on Monday! Is the following week more predictive?

Next week max pain looks very low!

As monthly expiration I wonder if will change on Monday! Is the following week more predictive?

TheTalkingMule

Distributed Energy Enthusiast

Next week max pain looks very low!

Next week is all about the CPI report on Wednesday. If we have the kind of lowered inflation indicators we think are coming, that takes some of the pressure off the Fed. Maybe Sep 21st we get .5pt rate hike instead of .75.

These next two weeks are very big for the markets in general, and absolutely humongous for TSLA. If we're on a very strong macro rise heading into 3Q P&D then earnings......we should see fireworks.

LOT of if's, but it's looking more likely every day. Careful with those CC's for next week.

Tonight I sleep thinking whether my 300s will be safe for tomorrow  Rock&Roll

Rock&Roll

300 CC for tomorrow & 308 CC's for next Fri ... (was thinking it will be staggered and could bet against the same leaps) ... 1 set will have to be rolled.

(+leaks seems to suggest strong innings for Q3)

300 CC for tomorrow & 308 CC's for next Fri ... (was thinking it will be staggered and could bet against the same leaps) ... 1 set will have to be rolled.

(+leaks seems to suggest strong innings for Q3)

Last edited:

jeewee3000

Active Member

What leaks specifically? China numbers you mean?Tonight I sleep thinking whether my 300s will be safe for tomorrowRock&Roll

300 CC for tomorrow & 308 CC's for next Fri ... (was thinking it will be staggered and could bet against the same leaps) ... 1 set will have to be rolled.

(+leaks seems to suggest strong innings for Q3)

I guess referring to the CNBC Kolodny article about a change of lead for GF Nevada: Tesla changes leadership and sets new goals at Nevada GigafactoryWhat leaks specifically? China numbers you mean?

Despite a few snarky digs it's an overwhelmingly positive piece and talks about record production in August:

During the meeting, Sagar celebrated the fact that Tesla made around 134,000 cars in its Fremont, Calif., factory in the second quarter of 2022, and said that August was one of the record months for Fremont in terms of production. The Fremont factory is now able to make around 12,000 cars per week and is aiming for 14,000 per week as its next goal, he said.

intelligator

Active Member

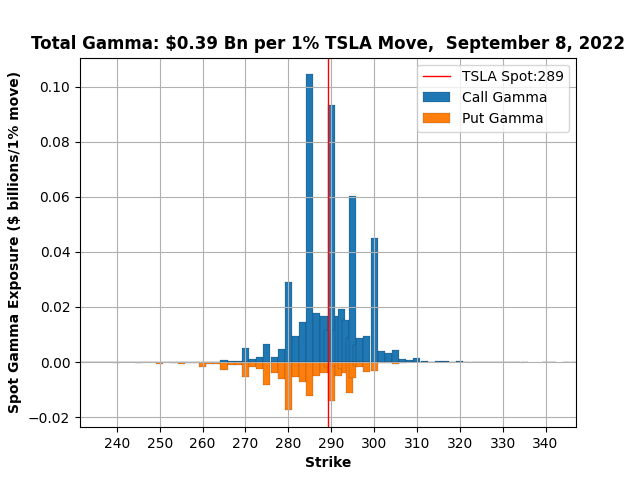

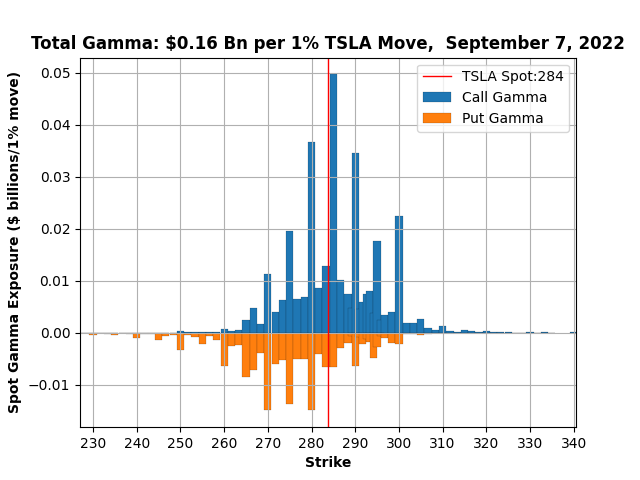

Nice pre-market action! The gamma charts are now fixed ... the bar width overlapped adjacent strikes to the one with the most call or put gamma exposure, creating what appeared to be an aggregation. Looks like the rising tide lifted all boats! As some of you have already done, I decided to wait til today to roll -290c to next Friday -300c. It's likely the roll will need management next week as well. I'll have to move swift this AM, roll and add -280csp or maybe ATM for next week. GLTA !

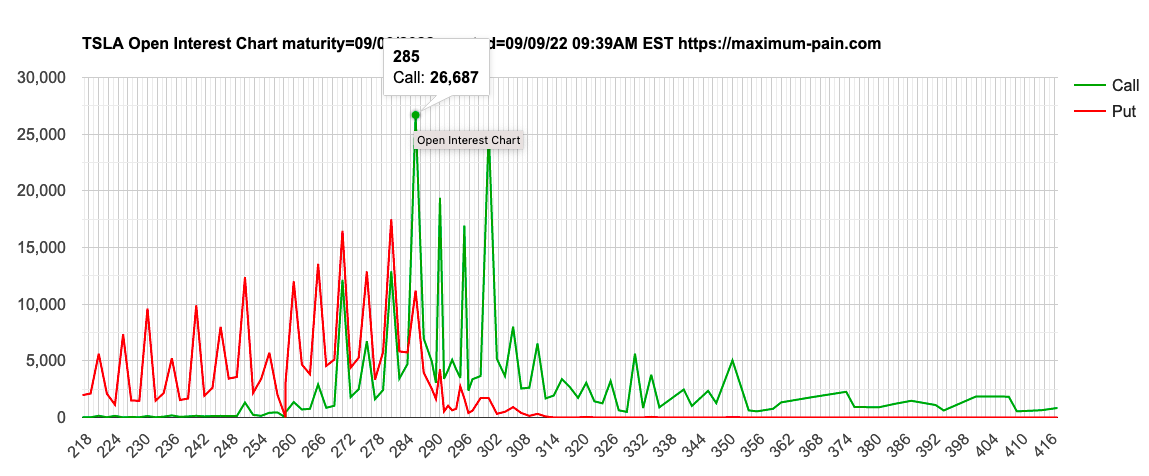

Open interest shifted more bullish again compared to yesterday. Now 280 has more puts than calls, and 285 also gathered some puts, but the calls still outnumber the puts and that is the tallest wall:

Clearly, MMs would still like to close under 285, the question is will macro and buying interest allow them ?

They would have to throw in a lot of shorts (probably naked).

Clearly, MMs would still like to close under 285, the question is will macro and buying interest allow them ?

They would have to throw in a lot of shorts (probably naked).

Decided to close todays CC's, still net gain of around 3K (good enough)Tonight I sleep thinking whether my 300s will be safe for tomorrowRock&Roll

300 CC for tomorrow & 308 CC's for next Fri ... (was thinking it will be staggered and could bet against the same leaps) ... 1 set will have to be rolled.

(+leaks seems to suggest strong innings for Q3)

Who knows where FOMO etc will take this and I don't have time to monitor this all day (& getting nervous) ...

Next week might be good for exercise or roll (good thing is CC's only against Leaps I had recently converted fro shares on the dip)

+ reminded me of this ..

You've got to know when to hold 'em

Know when to fold 'em

Know when to walk away

And know when to run

You never count your money

When you're sittin' at the table

There'll be time enough for countin'

When the dealin's done

Gambler - Kenny Rogers

cheers!!

Last edited:

Next week will be interesting with MP 266 on a quarterly expiration when $300 seems to be very much in reach...Nice pre-market action! The gamma charts are now fixed ... the bar width overlapped adjacent strikes to the one with the most call or put gamma exposure, creating what appeared to be an aggregation. Looks like the rising tide lifted all boats! As some of you have already done, I decided to wait til today to roll -290c to next Friday -300c. It's likely the roll will need management next week as well. I'll have to move swift this AM, roll and add -280csp or maybe ATM for next week. GLTA !

View attachment 850638 View attachment 850639

Well there's certainly gonna be a shot taken at a 285 close tomorrow. History says you should see an opportunity at 281 during the MMD. We shall see.

Looked real strong today tho.

I thought it would close on max pain but it seem we are taking off

I can't write CCs fast enough. IMHO now that everyone is back at the office this is a squeeze up before the dump.I thought it would close on max pain but it seem we are taking off

need advice!

sp is at 297... for those with ITM buy-writes (ie -c280) using garbage shares with lower cost basis, do you

sp is at 297... for those with ITM buy-writes (ie -c280) using garbage shares with lower cost basis, do you

- normally roll for another round at this point (pro = milk it to death, con = lower new prems), or

- wait for assignment and start new BW all over again (pro = gains are realized, con = higher cost basis)

for my rolls i currently do a:need advice!

sp is at 297... for those with ITM buy-writes (ie -c280) using garbage shares with lower cost basis, do you

TIA!

- normally roll for another round at this point (pro = milk it to death, con = lower new prems), or

- wait for assignment and start new BW all over again (pro = gains are realized, con = higher cost basis)

CC at strike X, SP X+5$ -> Roll 1 week out, 5$ up. Usually this is ±0 when the SP touches X+5$.

Preparing the next roll.. when we touch 300..

currently that position is "covered" by dec 300c

need advice!

sp is at 297... for those with ITM buy-writes (ie -c280) using garbage shares with lower cost basis, do you

TIA!

- normally roll for another round at this point (pro = milk it to death, con = lower new prems), or

- wait for assignment and start new BW all over again (pro = gains are realized, con = higher cost basis)

I had a buy-write expiring today with a 260 strike. I could roll for another week and .50, or 2 weeks and 1.70. I decided to wrap it up and look for / hope for a drop on Monday to reenter. Since it was a 260 strike and actual shares I got 259.95 (paid .05 to be out early, rather than going through expiration over the weekend). In this circumstance I suspect that I could have received 259.98 (pay .02 for the early exit).

Also in a retirement account so no tax considerations.

I've decided that I'll sit on the cash over the weekend. I also considering buying some calls to make even better use of a further move up, but decided that would make me really, really overweight a move up. I've got plenty of remaining exposure to the shares continuing upwards.

Any idea on how to gain risk-free theta in the current situation (meaning: worst-case is losing out on profit, but not loss)?

for Fr->Fr the "safe" amount should be 18% iirc... so i looked at CCs ... at 350.. 0.1$ .. what a joke.

I don't want to open new BPS, because i got burned hard by reversals.

I do have some calendar-calls lessening the impact (aka leap-CC here), but i don't want to risk ALL upside on the "leaps"..

for Fr->Fr the "safe" amount should be 18% iirc... so i looked at CCs ... at 350.. 0.1$ .. what a joke.

I don't want to open new BPS, because i got burned hard by reversals.

I do have some calendar-calls lessening the impact (aka leap-CC here), but i don't want to risk ALL upside on the "leaps"..

strago13

Member

BTC 9/9 285p @ $1.9 for 88% gain. I will then sit on my hands for tomorrow as I have met my monthly income goal. I thought about letting it ride for tomorrow, but it didn't really make sense to do that given the uncertainty with the macro for $1.9 per contract. My gut tells me tomorrow is going to be a down day after 2 up days

Woops, was wrong with this guess.

How long you think squeeze will last?I can't write CCs fast enough. IMHO now that everyone is back at the office this is a squeeze up before the dump.

CPI, AI Day, Q3 numbers are 3 catalysts in next 3-4 weeks.

If SP goes high would be tempting for me to sell CC for jan 24 against all my shares (buy shares with proceeds) and wait for pull back.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K