Always a bright side to everything. Like you just got a reminder that you never know what can happen.Woops, was wrong with this guess.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

juanmedina

Active Member

I have 295cc's . I want to wait until the end of the day to roll but the stock looks really strong right now.

. I want to wait until the end of the day to roll but the stock looks really strong right now.

Wheeling, just STO 295C for 3.41 from last week's 285P shares.I have 295cc's. I want to wait until the end of the day to roll but the stock looks really strong right now.

intelligator

Active Member

I had the same thought with 290's, got $4 to roll to the same strike on the 16th when we were at 298 before noon. If we have a pull-back next week, I'll have room to work.I have 295cc's. I want to wait until the end of the day to roll but the stock looks really strong right now.

Capitulated on 0916-c$300 and rolled to 0930-c$315 for $0.26 debit (rolls kept getting worse above $290). May go to $303+ today, and who knows about Mon/Tue? If I was brave, I would have held off on the STO, but bird-in-the-hand seems to work more often.

Last edited:

Why can't the MM hit the <295-target the one time i try to profit off them as well?! ..

lets hope they get it under control with heavy naked shorting in the last hour and the have to unwind it by monday

For these $280's - this morning (looking like a strong up day) I BTC at open for $11 - and then set a sell order for the shares that were covering them for $297.Yeah,

I was a bit early on the $280's I sold yesterday. Going to see where we are on Friday and let them expire or exercise

So STO - $4 each

BTC - $11 each

Sold shares $297 -

Effective shares sold at $290 this morning

Went ahead and used half proceeds for a bunch (for me) September and June 23' $300 leaps to sell LCC's and ride up Q3 and Q4 with.

Now also have plenty more cash to write BW and CSP's going into P&D.

And for the final update.... wow did I get my flat the rest of this week prediction wrong on Wednesday... glad I said *not advice*

Sold 5 more -c300's for next week, now holding 105x -> 90x against B/W shares, 15x against Jan 24 c233.33's

Given next week is quarterly I'm guessing the Hedgies will fight to the death to keep it below 300, if they don't, no sweat, take the shares, I'll roll the 15x and sell 90x -p300's

The Wheel on Steroids...

Given next week is quarterly I'm guessing the Hedgies will fight to the death to keep it below 300, if they don't, no sweat, take the shares, I'll roll the 15x and sell 90x -p300's

The Wheel on Steroids...

juanmedina

Active Member

I have 295cc's. I want to wait until the end of the day to roll but the stock looks really strong right now.

I end up rolling some sideways and some to $300 for a $5 and $2.15 credit for next week.

Sold 5 more -c300's for next week, now holding 105x -> 90x against B/W shares, 15x against Jan 24 c233.33's

Given next week is quarterly I'm guessing the Hedgies will fight to the death to keep it below 300, if they don't, no sweat, take the shares, I'll roll the 15x and sell 90x -p300's

The Wheel on Steroids...

I wish I didn't have to pay taxes like you

Basically 25% on all profits, losses on options are deductible, but not losses on share sells... the more taxes I pay, the more I make, it's fine...I end up rolling some sideways and some to $300 for a $5 and $2.15 credit for next week.

I wish I didn't have to pay taxes like you

llirk

Member

This aged well /sI've decided to use the split to sell 1/3 weeklies, 1/3 monthlies and keep 1/3 HODL. Taking a 50% or 60% profit on monthlies with one or two weeks left to expiration is yet another way to achieve weekly income targets.

Current positions:

9/9 -c280, -c290

9/30 -c300 (not technically the Sept "monthly" but nicely timed to expire just before P/D)

Oh, and still wheeling with 9/9 -p265 for good measure.

The p265 expired worthless.

Allowed the c280s to be assigned and took profits on underlying. Will sell p280 on any early dip next week.

Rolled c290s to next week for $3.5 credit to protect against a bad CPI or sell the news of a good CPI.

Still holding 9/30 c300s for now. 900 pre-split still feels like a magnet.

HODL shares making me fell a lot better about only covering a portion of my underlying.

Lesson re-learned... stop chasing premium in low IV environment.

I'm in for 10x -c320s 0916 at the close for $0.97

Well well well being too greedy and not expecting a rise this week I sold 285C, 290C, 295C and 300C on Monday  . Definitely feeling the burn middle of the week and rolled prior to the close today. I 3x the unrealized loss by not closing out yesterday vs today. I left some 295c in the IRA to get called so I can 'wheel' it. Now we have 3x the shares I feel its more manageable and less of the FOMO fear. In the past this emotional FOMO fear has prevented me from actually doing the wheel pre split and therefore would roll (BTC and STO) for following week.

. Definitely feeling the burn middle of the week and rolled prior to the close today. I 3x the unrealized loss by not closing out yesterday vs today. I left some 295c in the IRA to get called so I can 'wheel' it. Now we have 3x the shares I feel its more manageable and less of the FOMO fear. In the past this emotional FOMO fear has prevented me from actually doing the wheel pre split and therefore would roll (BTC and STO) for following week.

Good new is the total rolled ITM calls represent less than 1/2 my total shares and my ~1 year BPS streak continues. Overall excellent week as the accounts continues to grow!

Good new is the total rolled ITM calls represent less than 1/2 my total shares and my ~1 year BPS streak continues. Overall excellent week as the accounts continues to grow!

There's more than one way to kill the cat*Well well well being too greedy and not expecting a rise this week I sold 285C, 290C, 295C and 300C on Monday. Definitely feeling the burn middle of the week and rolled prior to the close today. I 3x the unrealized loss by not closing out yesterday vs today. I left some 295c in the IRA to get called so I can 'wheel' it. Now we have 3x the shares I feel its more manageable and less of the FOMO fear. In the past this emotional FOMO fear has prevented me from actually doing the wheel pre split and therefore would roll (BTC and STO) for following week.

Good new is the total rolled ITM calls represent less than 1/2 my total shares and my ~1 year BPS streak continues. Overall excellent week as the accounts continues to grow!

*don't mention this in the "other" thread...

Speaking of the other thread, posts there about the latest filing for TWTR, with the agreement violation to pay off the whistleblower sounds like the first thing that might allow Musk to really dump this deal.

CC sellers, ask yourselves how the market might go next week if it is decided over the weekend that TWTR will be dumped and Musk will be free to do with his cash billions as he likes. I have CCs in the 330s and above and I am a little concerned…

Let us see what macros do.

CC sellers, ask yourselves how the market might go next week if it is decided over the weekend that TWTR will be dumped and Musk will be free to do with his cash billions as he likes. I have CCs in the 330s and above and I am a little concerned…

Let us see what macros do.

For those that aren't following the Russia / Ukraine thread I encourage you to at least skim it.

not-advice

I bring this up to provide my own interpretation as it applies to our short term trading, as I see it. When this all started the invasion was an important and negative component of the macro environment. It helped push the share price down.

Today I am increasingly of the opinion that Russia's invasion is collapsing. That probably doesn't mean days or weeks until the army is back into Russian borders, but I do think that it is going to start becoming obvious that is the outcome. My guess is also Crimea but the point is how this contributes to the macro environment.

The obvious reaction, at least initially, I expect to be one of relief that contributes to a rally in the shares. Removal of ambiguity / doubt.

Also obvious I think - should Russia decide on a nuclear response then that'll be bad.

I really don't have an idea of how I'll trade this - the point of my post is that you might want to be thinking about this if you haven't been already.

not-advice

I bring this up to provide my own interpretation as it applies to our short term trading, as I see it. When this all started the invasion was an important and negative component of the macro environment. It helped push the share price down.

Today I am increasingly of the opinion that Russia's invasion is collapsing. That probably doesn't mean days or weeks until the army is back into Russian borders, but I do think that it is going to start becoming obvious that is the outcome. My guess is also Crimea but the point is how this contributes to the macro environment.

The obvious reaction, at least initially, I expect to be one of relief that contributes to a rally in the shares. Removal of ambiguity / doubt.

Also obvious I think - should Russia decide on a nuclear response then that'll be bad.

I really don't have an idea of how I'll trade this - the point of my post is that you might want to be thinking about this if you haven't been already.

Capitulated on 0916-c$300 and rolled to 0930-c$315 for $0.26 debit (rolls kept getting worse above $290). May go to $303+ today, and who knows about Mon/Tue? If I was brave, I would have held off on the STO, but bird-in-the-hand seems to work more often.

Next resistance levels are 309 then 336 if you follow TA.

On other hand I love the feeling of rolling Covered Calls since my account and margin are finally inflating back.

However, I would not like to be in the situation of rolling uncovered calls.

juanmedina

Active Member

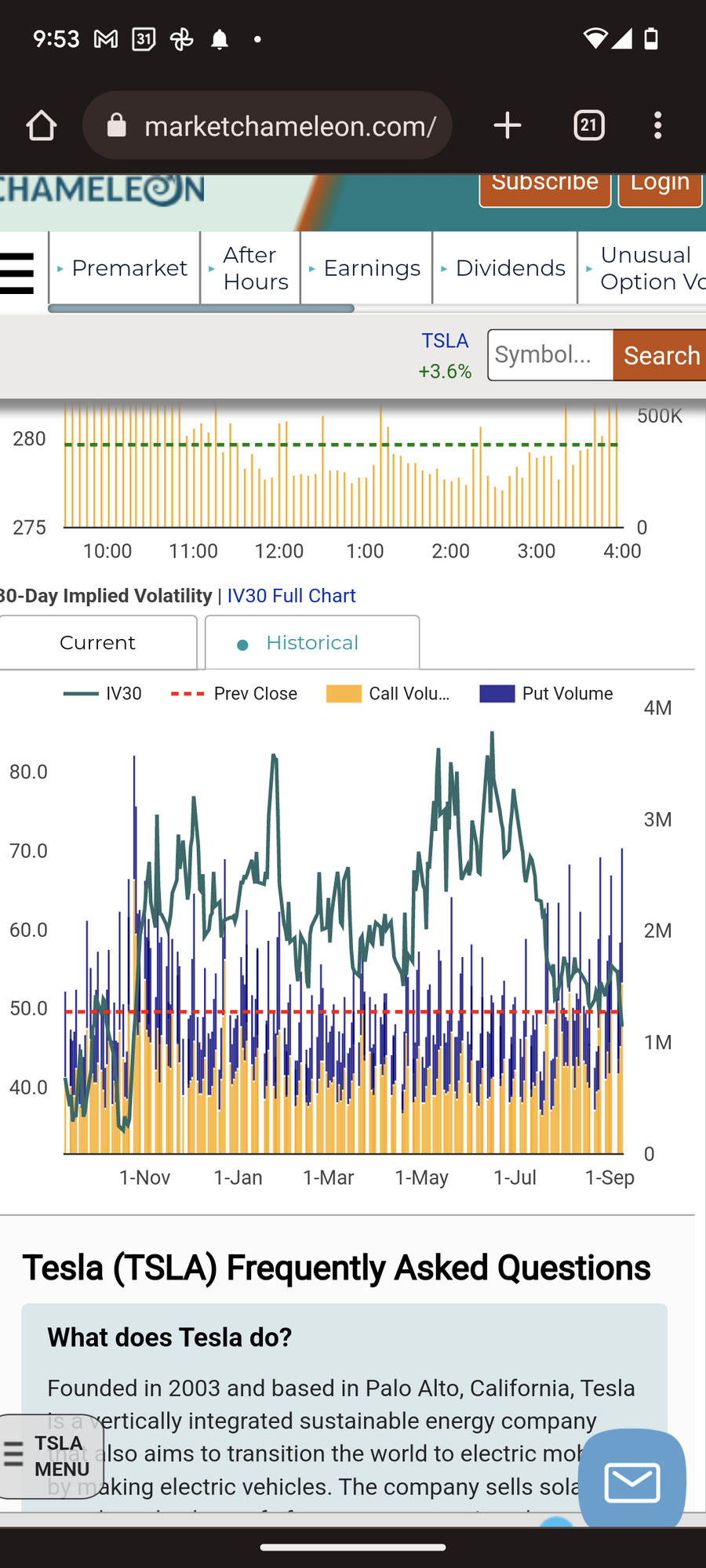

IV is also at the lowest for the year. It's time to be careful IMO.

+1. With P&D and then earnings coming up, IV should rebound soon. We all need to be patient/careful chasing premiums for the next week.

transpondster

Member

I see Jan 2025 strikes listed in IBKR app, guess soon they'll be tradable?

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K