Agree. Actually, I was okay to lose these shares at $195 as I plan to convert to Jan25 LEAPs (hopefully after an SP drop next week) and raise a little cash in a closed IRA, then leverage the coming share price recovery. Now hope to get $195+ on Monday, but wouldn’t have minded the guaranteed $195 today via assignment.If you really don't want to lose the shares, I've always followed the advice that it's better to BTC for pennies right before expiration rather than take the risk of after hours assignment...

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Your broker is flat wrong. Any option you sell can be assigned to you any day, regardless of stock price. (At least with American options.) Of course it is highly unlikely that someone would execute an OTM option, but they could. And they can after hours as well.What @mongo said + I had the impression you could get assigned if your strike price got hit after-hours, but my broker is telling me only if hit during regular hours, therefore our 12/2 $195 CC are safe. We shall see, eh?

Last edited:

After hours assignment happens and it isn't fun when you are not expecting it the first time it happens. But at least the first time it happens can only happen once!Your broker is flat wrong. Any option you sell can be assigned to you any day, regardless of stock price. (At least with American options.) Of course it is highly unlikely that someone would execute an OTM option, but they could. And then can after hours as well.

After hours assignment happens and it isn't fun when you are not expecting it the first time it happens. But at least the first time it happens can only happen once!

Based on reading here over the years, that’s what I thought, thus the “we shall see”. Perhaps the broker phrased it loosely, thinking likelihood vs. strict possibility.

Agree. Actually, I was okay to lose these shares at $195 as I plan to convert to Jan25 LEAPs (hopefully after an SP drop next week) and raise a little cash in a closed IRA, then leverage the coming share price recovery. Now hope to get $195+ on Monday, but wouldn’t have minded the guaranteed $195 today via assignment.

If you plan to convert to LEAPS anyway, wouldn't you want to be increasing leverage at as low an SP as possible?

So if SP is at 190, I think it would be better to close out the 195c and sell 100 shares to convert - I think you come out ahead compared to letting them exercise at 195 and then converting.

True, but I’m trying to sell at $195 and buy LEAPs at lowerIf you plan to convert to LEAPS anyway, wouldn't you want to be increasing leverage at as low an SP as possible?

So if SP is at 190, I think it would be better to close out the 195c and sell 100 shares to convert - I think you come out ahead compared to letting them exercise at 195 and then converting.

EVNow

Well-Known Member

Oh .... the have cake and eat it too strategyTrue, but I’m trying to sell at $195 and buy LEAPs at lower

I've had puts close Friday OTM be assigned in the recent past...What @mongo said + I had the impression you could get assigned if your strike price got hit after-hours, but my broker is telling me only if hit during regular hours, therefore our 12/2 $195 CC are safe. We shall see, eh?

Don't forget it's the CBoE that distributes the assignments randomly to brokers

I BTC my $195 CCs too early at 75% profit.

Open positions are CCs at $200 and $205 for Friday.

I feel like these are safe-ish (still in a bear market, on a big call wall and maxpain at $190), but expect at some point to spike up to $200 and plan to sell more for the following Friday.

Seems like a =<0.50 hike is priced in at this point, worry comes from PMI on Friday 8:30am coming to cause a more dovish Fed hike on Dec 14th.

Open positions are CCs at $200 and $205 for Friday.

I feel like these are safe-ish (still in a bear market, on a big call wall and maxpain at $190), but expect at some point to spike up to $200 and plan to sell more for the following Friday.

Seems like a =<0.50 hike is priced in at this point, worry comes from PMI on Friday 8:30am coming to cause a more dovish Fed hike on Dec 14th.

R

ReddyLeaf

Guest

I’m guessing that Monday/Tuesday will be pivotal, and the next two weeks will be very, very interesting. Furthermore, I would NOT be leveraged at this point because the break could be significant in either direction. Did the recent upgrade and semi sales event awaken the beast? Or will selling tax loss harvesting and continued shorting rule until Jan1st?

While doing a search for the S&P rebalancing date (thanks @Artful Dodger for alerting us to the significance of these events in past years), I found the following Calendar . Important upcoming dates are 12/09 (short interest, addition/deletion announcement) and 12/16 (triple witching, rebalancing), so expect the unexpected.

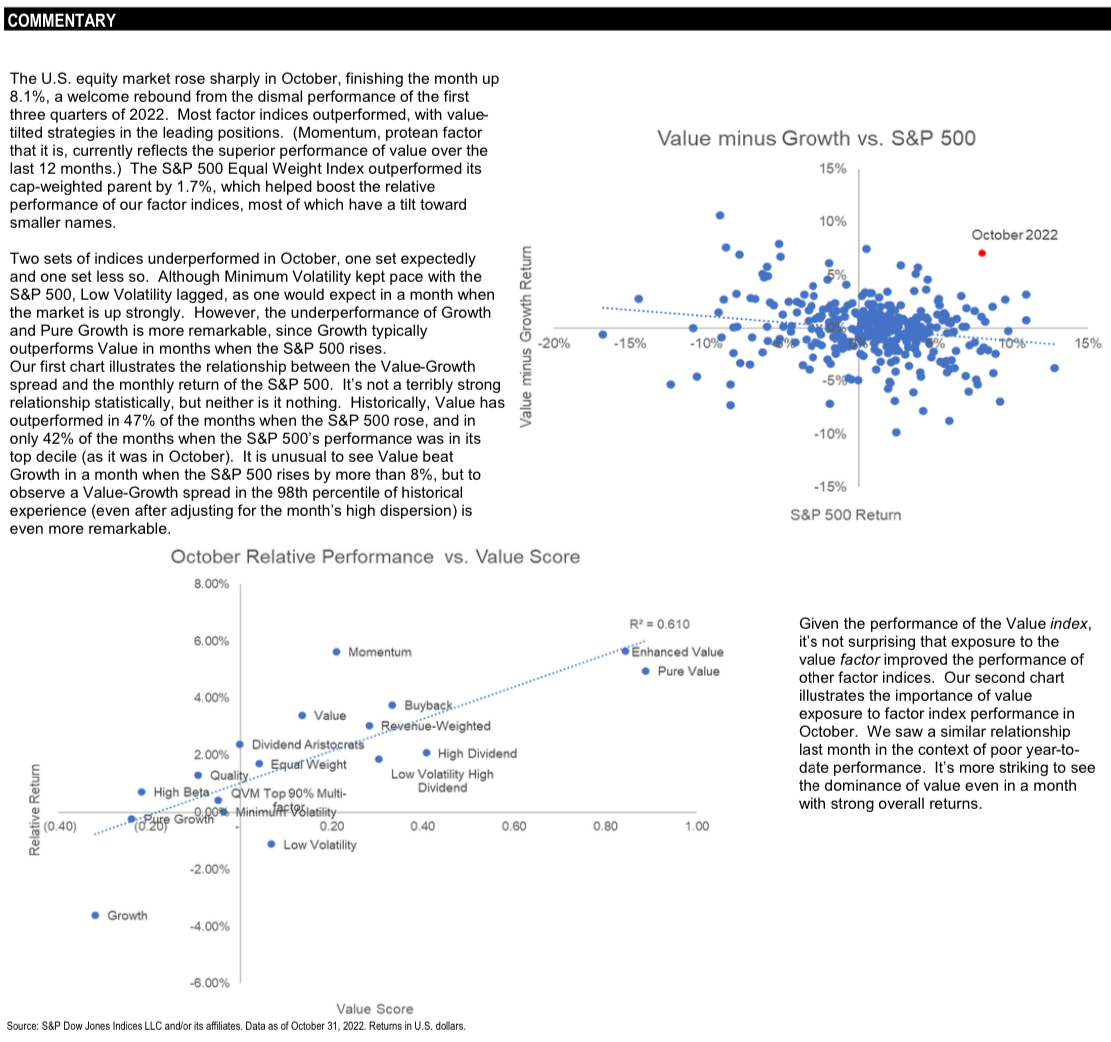

Also found this little analysis paper, though not exactly sure what it means. Seems to indicate that in 2022, and even more so in October, value stocks have outperformed beyond their typical statistical significance. TSLA, as non-value High Beta, probably helped.

So, what to expect? Looking at 12/16 MaxPain, the options market seems to be positioned for $190+/-$5, though there’s a big p150 interest that could drive us down further. I do expect that $200 will be tested on Monday, and this is a crucial pivot point for me. I’m guessing that it won’t hold for the week and it’s only to entice/trick the call buyers into parting with their hard-earned cash. GLTA. Personally, I’m still short 12/30 190 strangles, plus a few other minor positions (-c195s, -c160, -p170s, +c220s), slightly more weighted to benefit from a dropping SP. If wrong, then I will need to roll up and out some more.

While doing a search for the S&P rebalancing date (thanks @Artful Dodger for alerting us to the significance of these events in past years), I found the following Calendar . Important upcoming dates are 12/09 (short interest, addition/deletion announcement) and 12/16 (triple witching, rebalancing), so expect the unexpected.

Also found this little analysis paper, though not exactly sure what it means. Seems to indicate that in 2022, and even more so in October, value stocks have outperformed beyond their typical statistical significance. TSLA, as non-value High Beta, probably helped.

So, what to expect? Looking at 12/16 MaxPain, the options market seems to be positioned for $190+/-$5, though there’s a big p150 interest that could drive us down further. I do expect that $200 will be tested on Monday, and this is a crucial pivot point for me. I’m guessing that it won’t hold for the week and it’s only to entice/trick the call buyers into parting with their hard-earned cash. GLTA. Personally, I’m still short 12/30 190 strangles, plus a few other minor positions (-c195s, -c160, -p170s, +c220s), slightly more weighted to benefit from a dropping SP. If wrong, then I will need to roll up and out some more.

EVNow

Well-Known Member

So, is it just safe to BTC all open options - if we don't want to get assigned/shares sold ?I've had puts close Friday OTM be assigned in the recent past...

Don't forget it's the CBoE that distributes the assignments randomly to brokers

The worst experience I had was the week of S&P 500 inclusion. The SP was below 660 minutes before the close. I tried to roll my 660 calls. The rolls that would normally go through - didn't get executed ! SP jumped to ~ 690 (?) at the close. My shares that I had from 2011 got sold ...

Since then, I've mostly BTC options, irrespective of OTM/ITM status.

first, the theoryalso, there is an opening gap down to 194.76 that was likely to be filled, and it did

now, the facts... in 2022, there is a 68% chance that sometime during the day, sp will touch the Prev Day Close if there is an opening gap

TSLA - If Today's Open Has a Gap from Prev Day's Close, Will It Be Filled Today?

gap is filled if High >= PrevDayClose >= Low

TBH I think it's the only guarantee, indeed. Annoying for those of us with broker fees, but that's the cost of doing business, as they saySo, is it just safe to BTC all open options - if we don't want to get assigned/shares sold ?

The worst experience I had was the week of S&P 500 inclusion. The SP was below 660 minutes before the close. I tried to roll my 660 calls. The rolls that would normally go through - didn't get executed ! SP jumped to ~ 690 (?) at the close. My shares that I had from 2011 got sold ...

Since then, I've mostly BTC options, irrespective of OTM/ITM status.

EVNow

Well-Known Member

Fidility doesn't charge broker fees if the option value is below 65 cents.TBH I think it's the only guarantee, indeed. Annoying for those of us with broker fees, but that's the cost of doing business, as they say

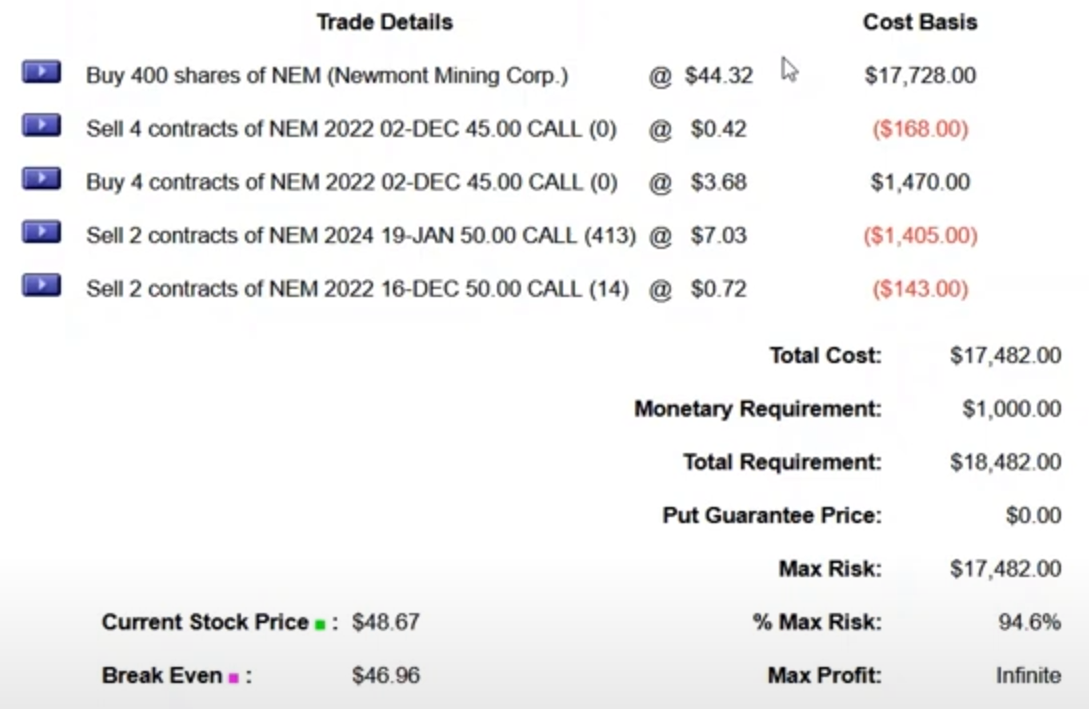

interesting way of fixing an ITM CC (ie, sp jumps to 230 next week on a -c200 cc)

instead of rolling all the problem contracts, just partial roll with good credit enough to cover the buyback costs and still be able to maximize the return selling short-term over time

in other words, there's still weekly income since not everything is stuck in the future

has anyone tried this strategy on TSLA?

"

We had a YouTube comment come in from Michael S: "I had 400 shares. I bought back and sold one 2 year leap for the same as the cost to buy the 4 options. That left 300 shares free to continue selling monthly."

We take a look at how this might play out. As the sold calls went In the Money - but we wanted to hold on to the trade - we took a look at rolling one or two contracts further out in time to receive a credit against the buy back, then keeping some of the shares open to continue shorter term covered calls to maximize the annual return (~16 mins)

"

instead of rolling all the problem contracts, just partial roll with good credit enough to cover the buyback costs and still be able to maximize the return selling short-term over time

in other words, there's still weekly income since not everything is stuck in the future

has anyone tried this strategy on TSLA?

"

We had a YouTube comment come in from Michael S: "I had 400 shares. I bought back and sold one 2 year leap for the same as the cost to buy the 4 options. That left 300 shares free to continue selling monthly."

We take a look at how this might play out. As the sold calls went In the Money - but we wanted to hold on to the trade - we took a look at rolling one or two contracts further out in time to receive a credit against the buy back, then keeping some of the shares open to continue shorter term covered calls to maximize the annual return (~16 mins)

"

Last edited:

I don't like it for TSLA for a couple reasons. First, I expect TSLA to be >400 in Jan 2025. Rolling out 1-2 years would require using a really high strike. I also don't like tying up those shares for 1-2 years with no further profit on the CCs. I would rather take the loss, and then play again with all my shares instead of just half of them.interesting way of fixing an ITM CC (ie, sp jumps to 230 next week on a -c200 cc)

instead of rolling all the problem contracts, just partial roll with good credit enough to cover the buyback costs and still be able to maximize the return selling short-term over time

in other words, there's still weekly income since not everything is stuck in the future

has anyone tried this strategy on TSLA?

"

We had a YouTube comment come in from Michael S: "I had 400 shares. I bought back and sold one 2 year leap for the same as the cost to buy the 4 options. That left 300 shares free to continue selling monthly."

We take a look at how this might play out. As the sold calls went In the Money - but we wanted to hold on to the trade - we took a look at rolling one or two contracts further out in time to receive a credit against the buy back, then keeping some of the shares open to continue shorter term covered calls to maximize the annual return (~16 mins)

"

View attachment 881135

I prefer the strategy of selling additional short term CCs on additional shares for income to raise the strikes higher on the ITM CC in the hope of getting all of them OTM soon.

interesting way of fixing an ITM CC (ie, sp jumps to 230 next week on a -c200 cc)

instead of rolling all the problem contracts, just partial roll with good credit enough to cover the buyback costs and still be able to maximize the return selling short-term over time

in other words, there's still weekly income since not everything is stuck in the future

has anyone tried this strategy on TSLA?

"

We had a YouTube comment come in from Michael S: "I had 400 shares. I bought back and sold one 2 year leap for the same as the cost to buy the 4 options. That left 300 shares free to continue selling monthly."

We take a look at how this might play out. As the sold calls went In the Money - but we wanted to hold on to the trade - we took a look at rolling one or two contracts further out in time to receive a credit against the buy back, then keeping some of the shares open to continue shorter term covered calls to maximize the annual return (~16 mins)

"

View attachment 881135

My strategy that has worked so far was to roll my CCs out and away to the next resistance level for a small ~1$ credit as soon as it reaches my strike price. I might lose income however this prevents having poisoned my shares with DITM CCs. It might be 2 weeks out or more however since there is always a reversal it has worked well so far in a bear market.

This won’t work during bull market bull runs.

SebastienBonny

Member

Same, as long as you don't rely on the weekly income, it's no problem to sit it out for a couple of weeks and most of the time the SP will go down again so you'll be able to close it at least b/e. Should we head to a bull market, we would be rolling months in stead of weeks and that would be painful. I would consider rolling one contract way further out to cover the loss of the other contract(s) to stay in the game. Right now I got 50% long shares and 50% "garbage" shares (which, obviously, I wouldn't mind keeping as well).My strategy that has worked so far was to roll my CCs out and away to the next resistance level for a small ~1$ credit as soon as it reaches my strike price. I might lose income however this prevents having poisoned my shares with DITM CCs. It might be 2 weeks out or more however since there is always a reversal it has worked well so far in a bear market.

This won’t work during bull market bull runs.

SebastienBonny

Member

Looks like CC's might be safe...

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ST3WOZEF2BJQNEEC3WE2DVBDJM.jpg)

www.reuters.com

www.reuters.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ST3WOZEF2BJQNEEC3WE2DVBDJM.jpg)

Tesla cuts output plan for Shanghai plant for Dec -sources

Tesla plans to cut December output of the Model Y at its Shanghai plant by more than 20% from the previous month, two people with knowledge of electric vehicle maker's production plan said on Monday.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 11K

- Replies

- 5

- Views

- 6K