Interesting 7/21 $200/$230 bull call spread spotted based on unusual TSLA options activity (Tesla’s Q2-23 earnings is around 7/19-7/26; P&D first week of July.)

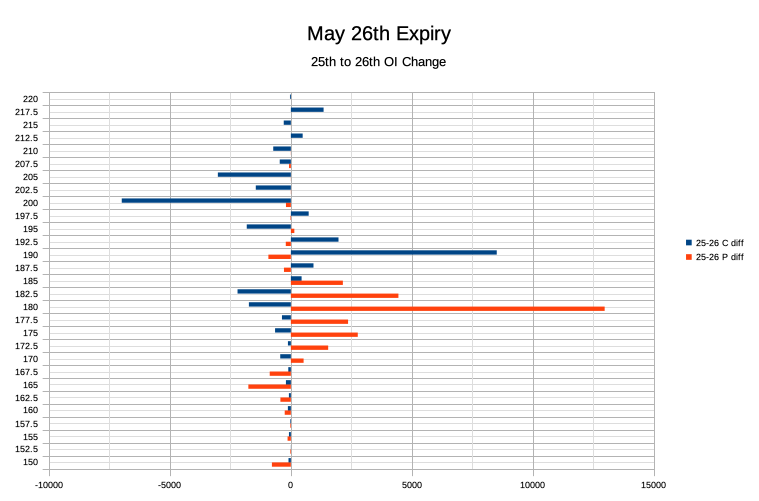

View attachment 941013

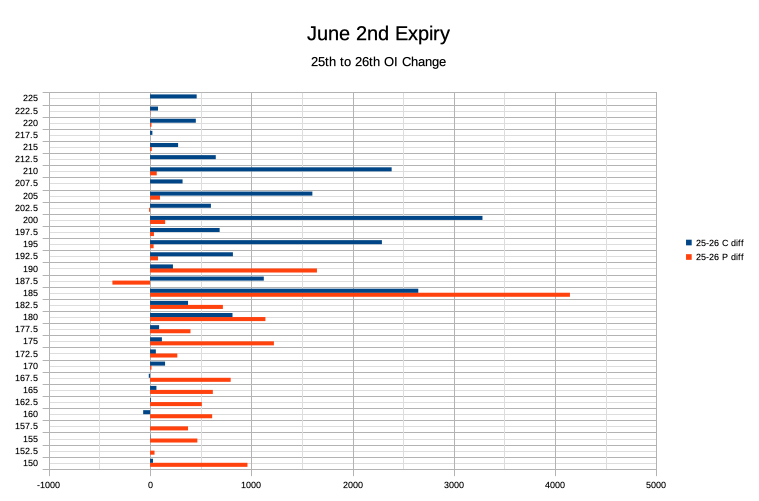

View attachment 941014

Whether it’s “someone always knows” positioning for a beat or just a closing order remains to be seen based on the option chain over the next several days.

Anyone have thoughts on this play?

PS Here's a link to the trade I copied into Optionstrat:

optionstrat.com

View attachment 941015

View attachment 941016

I'm not sure that this is a Bull Call Spread - his video and chart has them as red / green to indicate buy / sell but that's not what the red - green mean.

Red is at the Bid and Green is at the ask - yellow is mid

There is no way to know who sold or bought an option because by definition there are always 2 players in a transaction.

I don't know why any savvy trader would buy a Bull Call Spread that close in time that is that far OTM.

Seriously - unless the underlying moves up in the next 2 weeks to above the bought strike - then the theta decay starts working overdrive.

If you are positioning for a $200+ bull call spread for news with earnings or the P&D report then the minimum you would be looking to purchase your spread at is September.

That way there would significant Theta left when the "news" happens.

In my opinion this looks to me like a 60 day Bear Call spread for Theta farming and allowing for it to stay OTM until the P&D and close before June 30th.

This would make the most sense as over the next 45 days (where you would want to be in the time value) for theta decay before a binary event.

That way you close it out and keep the majority of your premium without too much risk.

This is text book option selling by bigger players where they sell OTM spreads at least 45 days out and close them before they expire.

I consider myself a gambler and go with my gut more than a chart but even I would not spend the money on this as a Bull Call Spread and would actually consider this a potential Bear Call Spread.... However I don't do spreads for the way up.. only occasionally on the put side, but even those have been abandoned.

Curious if anyone else agrees?

Either way it's a fun thought experiment.