Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Keep wasting that time. My call expires Jan 2026 currently sitting on 80% profit with 20 being time. Probably wise to close this as it's not worth 20% for 1.5 years of time but I really don't want to pay taxes today when the money is in tax free bonds.

You could turn it into a spread - vertical or calendar.

Some of my worst decisions start with that thought....but I really don't want to pay taxes today when the money is in tax free bonds.

EW update: TSLA is starting to accelerate a little under the 61.8% for (2), starting to look even more like the yellow (iii) of circle c of 3 in the (C) wave for a wider flat P.4 retesting the $100 region, but in a choppy way.

TSLA - Big Macro Clean - Apr-18 0952 AM (4 hour)

TSLA - Primary Analysis - Apr-18 0951 AM (4 hour)

TSLA - Big Macro Clean - Apr-18 0952 AM (4 hour)

TSLA - Primary Analysis - Apr-18 0951 AM (4 hour)

Same here, strike price 400I’m in a similar boat. I have a bunch of sold calls from last summer and winter that I’m up 80-90% on. But I want to at least wait until Jan 2025 to close them out so that the corresponding taxes won’t be due until the following April.

But for mine, the strikes price are all at 400 and above. The lower we keep going, the more comfortable I feel letting those actually ride out until they die for nothing

If you still have CC's in the 400s for Jan 26 you could easily make more $$ by rolling down to the 300's for Jan 26. Want to break even , roll to 250's in Jan 25.I’m in a similar boat. I have a bunch of sold calls from last summer and winter that I’m up 80-90% on. But I want to at least wait until Jan 2025 to close them out so that the corresponding taxes won’t be due until the following April.

But for mine, the strikes price are all at 400 and above. The lower we keep going, the more comfortable I feel letting those actually ride out until they die for nothing

if SP goes up, you could always roll out ...

CC - safety valve, if the pressure ain't going to be 400, then why is the valve setting at 400

Personally, I'd lean towards taking the calculated risk till after the Earning Report in 2 trading days, because I feel the odds of a +400% are so much greater than a -100%...I'm still sitting on 20 spreads +p150/-p140 for 4/26, which are now plus 100%. That could go to 400% if we close under 140 next week. But it could also become -100% if we close above 150. I'll probably close them earlier, at least part of them, as I don't want to be dependent on what happens on earnings day. But when? Maybe if we close the gap around 144. Decisions, decisions.

I can't explain why I feel comfortable breaking @Yoona 's rule of not losing capital if this goes the wrong way... And I plead guilty to talking about my feelings, not T/A, so, grain-of-salt...

FYI I have loaded my TSLA cart with tons of various +Puts and selling all the -Calls that all my relatively modest inventory of TSLA shares allows me to buy these last few days, and even a little this morning, all May through August 2024 expirations, so there's lots of extra time for things to go my way...

Also I'm surprised no one mentioned daily trading by buying first thing on the Opening Momentary Morning Haywire high, selling on the MMD, then buying back an hour or two later. I've done that for a few days...

-All mostly because this forum's recent discussions have been mostly bullish lately, with @tivoboy 's persistant bearishness clinching the deal, I'm mostly holding my +Puts & -Calls. Long term, I'm totally Bullish in Tesla, even as my many, many old LEAPS are disintegrating before my eyes.

YMMV with my personal, feelings, leanings, not advice, and comfort levels.

-Edited and expanded upon

Last edited:

EVNow

Well-Known Member

I've 155 and 150 puts sold for tomorrow. I'll probably take the shares at 155 - those were assigned calls at 210  Will roll 150 puts. Those were part of "tax harvesting" assigned call sale from last year at 182.5.

Will roll 150 puts. Those were part of "tax harvesting" assigned call sale from last year at 182.5.

StarFoxisDown!

Well-Known Member

Main reason is taxes. I have to decide what year is most efficient use of taxes. I'm also in a situation where the company I work for will likely IPO either this year or next and when they do, I'll have massive taxes to be paid. So I'm waiting on them to some extent to make their move. If they IPO this year, I will definitely wait to close out those calls until 2025. If they IPO next year, I might close some of them out at the end of Dec this year.If you still have CC's in the 400s for Jan 26 you could easily make more $$ by rolling down to the 300's for Jan 26. Want to break even , roll to 250's in Jan 25.

if SP goes up, you could always roll out ...

CC - safety valve, if the pressure ain't going to be 400, then why is the valve setting at 400cheers!!

There's also the element that while things seem downright terrible right now, if Tesla and their autonomy were to have a true ChatGP moment, I don't want to get caught trying to get out of a position where I rolled my calls lower just to collect some additional cash right now.

Let's remember, Nvidia the stock was taken to the woodshed and left for dead by Wall St until the ChatGP moment happened and then the stock went up unrelentingly for a year and a half. At the current strike prices I have 400-450, I feel rather safe in that even if TSLA has that ChatGP moment at some point over the next year, those strike prices will still be safe.

Main reason is taxes. I have to decide what year is most efficient use of taxes. I'm also in a situation where the company I work for will likely IPO either this year or next and when they do, I'll have massive taxes to be paid. So I'm waiting on them to some extent to make their move. If they IPO this year, I will definitely wait to close out those calls until 2025. If they IPO next year, I might close some of them out at the end of Dec this year.

There's also the element that while things seem downright terrible right now, if Tesla and their autonomy were to have a true ChatGP moment, I don't want to get caught trying to get out of a position where I rolled my calls lower just to collect some additional cash right now.

Let's remember, Nvidia the stock was taken to the woodshed and left for dead by Wall St until the ChatGP moment happened and then the stock went up unrelentingly for a year and a half. At the current strike prices I have 400-450, I feel rather safe in that even if TSLA has that ChatGP moment at some point over the next year, those strike prices will still be safe.

I started the year with jan 26 CC's in 500 -600s. On the way down I rolled them down to the 400s, then I further rolled to Jan 25 -250, 270 range.(was 6-7 $, now in 3-4$, so like 50% gains in jan 25 CC)

Now my time commitment is just till Jan 25. Based on current trends 250 seems safe

If SP starts going up, I can still roll to Jan 26 - 400s, and jan 27(once it opens) to 600 -

(I want to wait till Aug to roll to Jan 26 - right now if I roll - I can get around 750 more shares with proceeds, just checked ... )

@ 600 - taxes be dammed (kidding, most in IRA) - I am in Mt. Retirement

EVNow

Well-Known Member

Even a "false ChatGPT" moment. All it will take, for eg., is for an announcement about one of the OEMs adopting Tesla FSD - with absolutely no change in the status of FSD capabilities. Could happen this year or in 2030.There's also the element that while things seem downright terrible right now, if Tesla and their autonomy were to have a true ChatGP moment, I don't want to get caught trying to get out of a position where I rolled my calls lower just to collect some additional cash right now.

Like @Cherry Wine mentions, you may be able to lock in CC profits and still delay taxes by purchasing an almost-similar long position (depends on holdings and brokerage). One strike below for slightly less gain now but 100% future coverage, or one above for a bear spread.

Seeking non-advice:

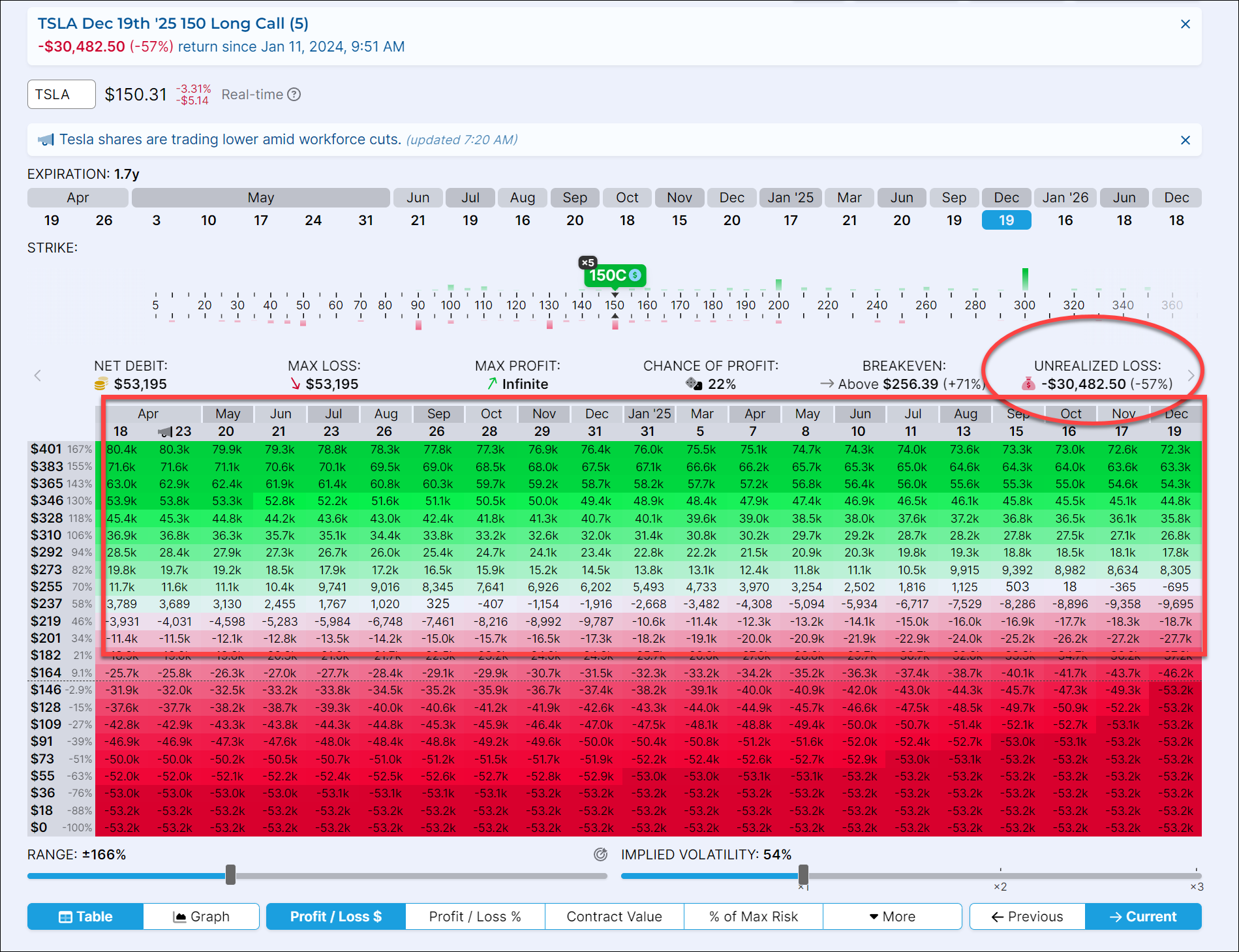

I have 5x +C150 12/19/25 (610 days left) that's negative -$30,000 (-57%) and losing more each day. See chart below for escape areas (green) and corresponding dates. What do you guys do in such cases, hold them and sell calls against them; book the loss and exchange for shares here (can salvage $23k = 153 shares) which don't expire (but do they move the same?); or do something else.

TIA

I have 5x +C150 12/19/25 (610 days left) that's negative -$30,000 (-57%) and losing more each day. See chart below for escape areas (green) and corresponding dates. What do you guys do in such cases, hold them and sell calls against them; book the loss and exchange for shares here (can salvage $23k = 153 shares) which don't expire (but do they move the same?); or do something else.

TIA

StarFoxisDown!

Well-Known Member

Yup, pretty much at this point you have to treat TSLA like a startup AI company. They could have a breakthrough an announcement in a form of a adoption of said tech by another company or by giving data of S curve in user adoption rates that could completely reverse the narrative...and you/we have absolutely no way of knowing if that moment is 3 months out, 6 months, 1 year or 5 years.Even a "false ChatGPT" moment. All it will take, for eg., is for an announcement about one of the OEMs adopting Tesla FSD - with absolutely no change in the status of FSD capabilities. Could happen this year or in 2030.

KQID time engine theoretical foundation leader is speaking:

TexasGator

Member

Seeking non-advice:

I have 5x +C150 12/19/25 (610 days left) that's negative -$30,000 (-57%) and losing more each day. See chart below for escape areas (green) and corresponding dates. What do you guys do in such cases, hold them and sell calls against them; book the loss and exchange for shares here (can salvage $23k = 153 shares) which don't expire (but do they move the same?); or do something else.

TIA

typically with underwater LEAPs (and i have plenty losers rn), i average down some, and then sell -CC against them to recover some of the cost.

mostly come out ahead, but have had some fairly big losses as well. overall have come out well ahead. But now i am much more disciplined about averaging down just a few at a time to preserve capital in case thiings keep going south (like currently)

a notable example, back in 2020 i had leaps for August, that went way underwater, so I averaged down. they finally recovered to where i had a small profit. Cashed out, and of course not long after the first split was announced... had i held, those would have been worth close to $500k. was still great, since had plenty of others to take advantage

typically with underwater LEAPs (and i have plenty losers rn), i average down some, and then sell -CC against them to recover some of the cost.

mostly come out ahead, but have had some fairly big losses as well. overall have come out well ahead. But now i am much more disciplined about averaging down just a few at a time to preserve capital in case thiings keep going south (like currently)

a notable example, back in 2020 i had leaps for August, that went way underwater, so I averaged down. they finally recovered to where i had a small profit. Cashed out, and of course not long after the first split was announced... had i held, those would have been worth close to $500k. was still great, since had plenty of others to take advantage

Thanks. By average down you mean buy more?

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K