Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Forgive my ignorance, but if we just consolidate the next week or so, will RSI go down? Does it necessarily have to be a sharp reversal?November 2, 2021 10:15 AM ET (BZ Newswire) -- Long Ideas

Shares of Tesla, Inc. (NASDAQ:TSLA) made history Monday, but it might not be the good kind.

The stock is very overbought. This means it has reached extremes above what would be its typical or average trading range. This is important because overbought stocks tend to sell off.

The lower half of the below chart shows the RSI Momentum Indicator. It measures how far Tesla's stock has moved in a short period of time. When the indicator reaches high levels it shows overbought conditions.

As you can see on the chart, the RSI reached its highest level ever. Stocks don't usually make history, but when they do, it's time to pay attention. Tesla may be about to reverse.

View attachment 728465

Had half of my CCs early assigned this morning. Emotional roller coaster of cursing the pull back on the same day as assignment just to see the pull back fizzle out. Crazy. Went from thinking this is the other side of the blow-off, to it looks more like a bull flag.

After managing positions ended up with the following for this week

And for next week

- 100x IC 750/800 1400/1450;

- 20x IC 850/900 1200/1250;

Some short term paper losses that make my eyes bleed, but we'll see how things shake out over next few trading sessions. I'll likely leave that pile in cash for now and slowly DCA back in to a mix of shares and leaps.

- Rolled 50x BCS 1000/1060 to 1100/1200 for $4 cr;

- I'll enter the BPS leg of that likely next week subject to price action;

Finally, orders in to roll my remaining CCs (790 and 795) which expire this week. Not much to do there as I'm not ready to turn those in to anything other than CCs for now. 3-week roll for $5 strike improvement aiming for 1cr, may change the order later in day.

Also sold out of some uncovered leaps this morning, feeling a little more comfortable with that portion of the portfolio in cash right now. Those leaps were up 100%. I'll be needing to pull some cash for next year's living expenses (and home renos) and it leaves me with a little more margin room to manage the spreads if needed.

If you don't mind sharing, what expirations (I'm assuming 11/5) and strikes for the CCs that got exercised? I rolled my CCs expiring this week yesterday after open.

BrownOuttaSpec

Active Member

Premiums going up for next week it looks like..... Just got some 795/895 for 11/12 for 3.20

Edit: still going up.. up to $4.2 now... Darn, missed out on "the peak"

Edit: still going up.. up to $4.2 now... Darn, missed out on "the peak"

Last edited:

samppa

Active Member

Had half of my CCs early assigned this morning. Emotional roller coaster of cursing the pull back on the same day as assignment just to see the pull back fizzle out. Crazy. Went from thinking this is the other side of the blow-off, to it looks more like a bull flag

I'm curious about this early assignment. What were the strikes and how long to expiry? How much was delta if you have an idea?

I'm trying to figure what circumstances can cause early assignment.. never happened to me so far.

My play for this week (from last Thursday) was straight Puts - $825 for $5.50 each

Next week Puts are paying the same for the $825's again right now - more than $350 away from the strike... easy to roll as well!

Not advice but I am opening now on the down turn and leaving room to open more if we get another dip after FED minutes released.

Next week Puts are paying the same for the $825's again right now - more than $350 away from the strike... easy to roll as well!

Not advice but I am opening now on the down turn and leaving room to open more if we get another dip after FED minutes released.

Forgive my ignorance, but if we just consolidate the next week or so, will RSI go down? Does it necessarily have to be a sharp reversal?

strago13

Member

BTC 11/5 795 puts for 1.07

STO 11/12 850 Puts for 7.3

Couldn't resist, the premiums are so juicy and I am $325 out of the money

STO 11/12 850 Puts for 7.3

Couldn't resist, the premiums are so juicy and I am $325 out of the money

jeewee3000

Active Member

Sold 11/5 1400cc's @2 per contract

Sold 11/5 BPS -950p/+700p @2.5 per contract

Sold 11/5 BPS -950p/+700p @2.5 per contract

jeewee3000

Active Member

It's completely random which option seller is picked when an option buyer exercises early. It could be any one of us.I'm trying to figure what circumstances can cause early assignment.. never happened to me so far.

corduroy

Active Member

STO BPS 11/12 -790/690.

33% and $390 OTM, and if I have to mange these I'm resigning from options trading.

33% and $390 OTM, and if I have to mange these I'm resigning from options trading.

They were 11/5 800s and I've now had sold puts and sold calls assign/exercise early over the last year; almost always happened in the week of expiration when they were DITM. One always hopes that the little extrinsic value prevents assignment, but doesn't always. The 800s had $2-3 of extrinsic on them but someone out there was happy to eat that cost.If you don't mind sharing, what expirations (I'm assuming 11/5) and strikes for the CCs that got exercised? I rolled my CCs expiring this week yesterday after open.

R

ReddyLeaf

Guest

Well, I freaked out about my DITM $855 and $860 11/12 CC and put together a reallocation plan for my total TSLA investment to move forwards. The 3AM thinkinghelped in the light of day over the past 5 days or so.

Another data point: I also had my 11/05 -c800s exercised at 7:30EDT. I’m guessing that a bunch of somebody’s are expected that 1200 was the top and wanted to sell those shares. That’s fine with me, I was planning to let them go on Friday. I still have some 11/12 -c805s from a previous roll and will wait on the SP action to see if another $5/wk roll is warranted. I’ve been selling puts for $20-$30/wk premium and that seems preferable to rolling calls $5/wk (at least for the past two weeks). If we crash back to the 900s, then rolling my -p1050 to -p1100s will be difficult, but not impossible. Will just have to see what the future brings. Since this is all IRA money and not needed for years, I’m not stressed.It's completely random which option seller is picked when an option buyer exercises early. It could be any one of us.

Edit: a quick look and MaxPain “looks” about right today, maybe the hedgies are back in control.

Last edited by a moderator:

Knightshade

Well-Known Member

Any thoughts on this trade?

+795p/-895p/-1400c/+1500c

11/12 exp, ~$8 credit

+795p/-895p/-1400c/+1500c

11/12 exp, ~$8 credit

Premiums going up for next week it looks like..... Just got some 795/895 for 11/12 for 3.20

Edit: still going up.. up to $4.2 now... Darn, missed out on "the peak"

Same for me. That is: missed out on the peak. I rolled p860's 11/5 to 11/12 for a net gain of $5. Five minutes later it reached $6. Well, I guess you can't have it all. But I've learned my lesson and for my p850's put in a roll order for $7. Also looking to roll my p810's by a week, likely to a higher strike like 850 or 860.

As its time to acquire new leaps for me (for selling calls), this is what I've been thinking about but haven't decided. High delta (far OTM) 1-2 month calls or 24 month calls. Can you tell us more about the thinking / strategy?Those were what I use in place of LEAPs. I hold long calls at around .9 delta about a month out. These don't cost much to roll and are like half the cost of a LEAP. I use the excess to sell puts. So I was taking profits.

TheTalkingMule

Distributed Energy Enthusiast

Sorry to circle back, but Fidelity was no help.

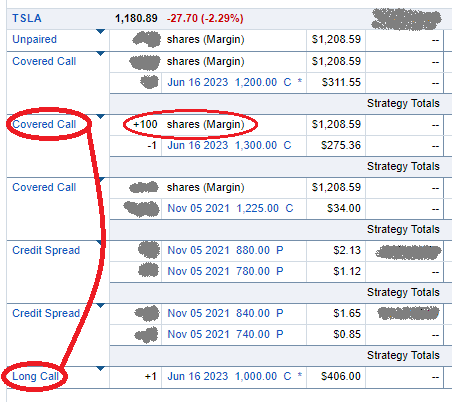

I bought a debit call spread months back, Jun2023 -1300/+1000. Bull(debit) call spreads require no cash or shares as margin, but due to some actions from Fidelity, my two contracts became unpaired. Now the sold portion is holding 100 shares of margin I'd rather use for other purposes.

Can I just create a 4 leg ticket to "sell" and "rebuy" this position and the new(same) position will likely pair properly without any share margin held?

I bought a debit call spread months back, Jun2023 -1300/+1000. Bull(debit) call spreads require no cash or shares as margin, but due to some actions from Fidelity, my two contracts became unpaired. Now the sold portion is holding 100 shares of margin I'd rather use for other purposes.

Can I just create a 4 leg ticket to "sell" and "rebuy" this position and the new(same) position will likely pair properly without any share margin held?

TheTalkingMule

Distributed Energy Enthusiast

Your SPR(sleep-to-premiums ratio) must be nearing optimal.Sold 11/5 1400cc's @2 per contract

Sold 11/5 BPS -950p/+700p @2.5 per contract

I'm excited for this all to click in my head so I can pull these relatively safe, utterly roll-able, and straightforward positions out of my butt each week with ease.

When this has happened to me (also with Fidelity) it looked like (but I didn't validate) that it was Fidelity pairing up my positions in a way that minimized my margin usage. A consequence here is that you won't have the easy 1 click Close Strategy button to clear those out, but check the actual margin consumpion. I could easily be wrong about what's going on there.Sorry to circle back, but Fidelity was no help.

I bought a debit call spread months back, Jun2023 -1300/+1000. Bull(debit) call spreads require no cash or shares as margin, but due to some actions from Fidelity, my two contracts became unpaired. Now the sold portion is holding 100 shares of margin I'd rather use for other purposes.

View attachment 728503

Can I just create a 4 leg ticket to "sell" and "rebuy" this position and the new(same) position will likely pair properly without any share margin held?

Please remember to give your “two weeks” in the unlikely eventSTO BPS 11/12 -790/690.

33% and $390 OTM, and if I have to mange these I'm resigning from options trading.

I’m looking to open some BPS <900 before end of today at about 25% of my usual. Making sure I have room to open more if we see bigger drop.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 11K

- Replies

- 5

- Views

- 6K