Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

intelligator

Active Member

Looks like gamma flip this session , may mean more downward pressure. I am in 4/8 -1045/+985 BPS , yikes! Going to roll to 4/14 and try to close before Friday or push out to June.

EDIT: Didn't make it in time to roll - we'll see what Thursday brings.

EDIT: Didn't make it in time to roll - we'll see what Thursday brings.

Last edited:

corduroy

Active Member

I can't believe that stock split announcement was only 9 days ago. How fast things change around here. Congrats to everyone who opened aggressive CCs that day.

I day traded some -950 puts today on the wild volatility, but don't have any conviction to hold anything (except my -1000p's I sold too early yesterday).

I day traded some -950 puts today on the wild volatility, but don't have any conviction to hold anything (except my -1000p's I sold too early yesterday).

Last edited:

Knightshade

Well-Known Member

I can't believe that stock split announcement was only 2 days ago.

The announcement they were going to split pending a vote for more shares was March 28th, 9 days ago.

corduroy

Active Member

I don't expect much impact, if any, on the short term movements of the stock regarding the stock split. Step 1 will be the shareholder vote - that won't happen until the info goes out with all of the shareholder proposals. I think they were talking about annual meeting more June / July(ish) than Sept/Octoberish, so sooner than last year. But still not soon.I can't believe that stock split announcement was only 9 days ago. How fast things change around here. Congrats to everyone who opened aggressive CCs that day.

I day traded some -950 puts today on the wild volatility, but don't have any conviction to hold anything (except my -1000p's I sold too early yesterday).

Then there will be an unknown amount of time between the vote to authorize more shares, and the announcement of an actual split and its mechanics. I imagine that the board could also include in the share authorization vote the details of the initial split and timing, but I expect these to be two different events.

So 1 month after the annual meeting if it goes fast?

My not-advice point is that it won't have much immediacy right now. I know that I'm not incorporating the stock authorization announcement into my trades yet - not until we have more details, especially around timing.

Please someone talk me out of STO -p1300 19/8 Puts for $318 credit to edge against my 19/8 1500 CC. I could close my -p1050 for a profit if the stock goes down in the 900s for margin management. I have 75% of margin available now. I just don’t see how the stock could not continue to increase once split announcement is officially announced in the next couple of months.

I don’t know if I should bet on a SP increase against like I did for the January earnings and get screwed again.

I don’t know if I should bet on a SP increase against like I did for the January earnings and get screwed again.

You gonna trade we all know that.Please someone talk me out of STO -p1300 19/8 Puts for $318 credit to edge against my 19/8 1500 CC. I could close my -p1050 for a profit if the stock goes down in the 900s for margin management. I have 75% of margin available now. I just don’t see how the stock could not continue to increase once split announcement is officially announced in the next couple of months.

I don’t know if I should bet on a SP increase against like I did for the January earnings and get screwed again.

Please stay on top of your margin and stress test to make sure nothing short of a true black swan can take out your portfolio.

We don't know the date of the annual meeting yet. If it's September you could get screwed.Please someone talk me out of STO -p1300 19/8 Puts for $318 credit to edge against my 19/8 1500 CC. I could close my -p1050 for a profit if the stock goes down in the 900s for margin management. I have 75% of margin available now. I just don’t see how the stock could not continue to increase once split announcement is officially announced in the next couple of months.

I don’t know if I should bet on a SP increase against like I did for the January earnings and get screwed again.

I can't tell you how many times, since 2013, I've said the SP can't possibly go below XXX ever again, only to have my portfolio nearly destroyed. You are betting on an SP above the ATH. Premium is ok now, but if you have to roll in August and the SP is around 900, you won't get much on the roll.Please someone talk me out of STO -p1300 19/8 Puts for $318 credit to edge against my 19/8 1500 CC. I could close my -p1050 for a profit if the stock goes down in the 900s for margin management. I have 75% of margin available now. I just don’t see how the stock could not continue to increase once split announcement is officially announced in the next couple of months.

I don’t know if I should bet on a SP increase against like I did for the January earnings and get screwed again.

Please someone talk me out of STO -p1300 19/8 Puts for $318 credit to edge against my 19/8 1500 CC. I could close my -p1050 for a profit if the stock goes down in the 900s for margin management. I have 75% of margin available now. I just don’t see how the stock could not continue to increase once split announcement is officially announced in the next couple of months.

I don’t know if I should bet on a SP increase against like I did for the January earnings and get screwed again.

With short puts you're looking for the share price to be above the strike (OTM). The catalyst I see in that timeframe that is scheduled, that might push the share price up significantly, is the Q2 production report that happens July 1(ish). As with the last 2, I expect a day after report jump in the share price, when Tesla surprises (again) at just how much volume they've produced. Followed by a regression - I expect the wider macro environment to be more similar than different to what we have today (still high inflation, still good employment, rising interest rates; hopefully the Ukraine invasion is over, and we're into rebuilding).

As a result, if I were going out that far, I would be looking at July or October, so that my expiration is as soon after the production report as possible.

The thing about the split announcement is that there are, I expect, two meaningful dates for that. And neither of them are announced, so we're guessing at when the dates will be announced, much less what those dates will be.

The first date is the vote on the increased share authorization. Do you know when the annual shareholders meeting is? Maybe that's been announced and I just missed it - the authorized shares won't go up until the shareholder meeting.

The second date is when the split actually occurs. Do you know / have you seen an announcement on what the lag on that will be, once the authorized shares are increased? Or the scale of the split? What if its a 2:1 - I don't see a share price double on such a small split.

So there's my not-advice attempt at talking you out of the August expiration. You and I both know that the split is coming - we just don't know if its August, November, or even this year (this year does seem highly likely to me though). Not knowing when makes it really hard to be right on the timing.

Therefore - don't pin a particular short term(ish) option trade to the split. Go out much further (Jan '23?) to allow for whatever those dates might be, or pin the trade to a date based on recurring stuff.

Knightshade

Well-Known Member

The thing about the split announcement is that there are, I expect, two meaningful dates for that.

So there's really 5 or 6 relevant dates.

1) The proxy statement sent to shareholders ahead of the meeting- Unknown date (though I've seen it claimed it must go out by May 2, haven't confirmed this) that is going to have more details about the vote and split (but unknown how many details)-- so this may or may not tell us the split ratio or the 3 or 4 dates at the end of this list. If this moves the stock will depend on the details. If it's just "We will ask you to authorize X more shares" then not so much... if it's FULL details of the entire split then it well might.

2) The vote to authorize more shares- Unknown date but likely Juneish from pre-covid years (sept/oct in the covid years). This by itself isn't likely to move the stock though- it's a foregone conclusion it passes.

3) A final board vote on approving the split (the 8K said "Tesla’s Board of Directors has approved the management proposal, but the stock dividend will be contingent on final Board approval.")- unknown date but could be same as the shareholder meeting in theory (thus 5 or 6). This again COULD move the stock if this is when they hold off on giving the details of the split until....

4-6) And then there's 3 dates relevant to the actual split- the record date (all shareholders as of this date will be entitled to the extra shares), the split date (all shareholders should GET the extra shares after market close on this date), and the ex date (stock begins trading on split adjusted basis on this date.

Those last 3 usually are FAIRLY close together, the record date was August 21 (a Friday), the split date was August 28 (a Friday), and the ex date was August 31 (a Monday).... and we ought to find all 3 out at the same time (possibly concurrent with either date 1 or 3)

That's certainly likely to move the stock as folks want to position themselves for whatever they think is the best position to be in as each of those things happen.

So depending on what details Tesla provides at what stage, we might see significant share price impact at steps 1 or 3 and certainly at 4-6. But we don't know any of the dates involved.

The "possible window" though is Tesla could issue the proxy statement with full details tomorrow. Or they could provide no details at all beyond # of new shares to authorize (and that will probably be a big number regardless of split details) and not give any split details until a board vote long after the shareholder meeting.

tl;dr- Anytime between tomorrow and "many months from now" is the potential window for the split moving the stock, and possibly multiple times in the range

Just think about how this would work for you if the SP dumped down to 700 and stayed there for the foreseeable futurePlease someone talk me out of STO -p1300 19/8 Puts for $318 credit to edge against my 19/8 1500 CC. I could close my -p1050 for a profit if the stock goes down in the 900s for margin management. I have 75% of margin available now. I just don’t see how the stock could not continue to increase once split announcement is officially announced in the next couple of months.

I don’t know if I should bet on a SP increase against like I did for the January earnings and get screwed again.

Just think about how this would work for you if the SP dumped down to 700 and stayed there for the foreseeable future

Yes, that is exactly what I have done and reduced my number of contracts accordingly to sustain a drop in the 600s without any problem. However, what is the possibility of the stock going back to 700 and staying there for a prolonged period with all the catalysts to come. That is what I have problems evaluating because the stock market is behaving irrationally and I have to analyse the SP action emotionally like it is behaving.

I guess it is safer to keep the number of contracts the same and open a new position only when I can close the first position for 85% profit and be ready for a black swan event at all time.

samppa

Active Member

"Market can stay irrational longer than you can stay solvent. "Yes, that is exactly what I have done and reduced my number of contracts accordingly to sustain a drop in the 600s without any problem. However, what is the possibility of the stock going back to 700 and staying there for a prolonged period with all the catalysts to come. That is what I have problems evaluating because the stock market is behaving irrationally and I have to analyse the SP action emotionally like it is behaving.

I guess it is safer to keep the number of contracts the same and open a new position only when I can close the first position for 85% profit and be ready for a black swan event at all time.

Now, I really need to learn that sentence too..

Yes, that is exactly what I have done and reduced my number of contracts accordingly to sustain a drop in the 600s without any problem. However, what is the possibility of the stock going back to 700 and staying there for a prolonged period with all the catalysts to come. That is what I have problems evaluating because the stock market is behaving irrationally and I have to analyse the SP action emotionally like it is behaving.

I guess it is safer to keep the number of contracts the same and open a new position only when I can close the first position for 85% profit and be ready for a black swan event at all time.

This is, for me at least, an articulation of the ultimate challenge behind anything options related - that being right on timing is just as important as being right about direction.

If you're long term buy and hold, no margin, and you never trade with an open ended holding period, then none of those questions matter (at least for most of us). The notion that Tesla will fall below 700 and stay there - maybe forever - is pretty ridiculous. To do so would require some major deviations from how the company has performed in the past, and probably a melt down in the economy. The latter case still won't matter - just hold 2 or 3 years through something like 2008 and you're good to go.

Anything more than that, and timing becomes a thing.

Outsides of these really outstanding events, its a lot harder today for Tesla to experience such a large drop in share price and sustain it. The financial results are getting better fast enough, and have been positive long enough, that the financial metrics types have something to measure and use to make investment decisions. There really is a price that is too cheap for Tesla now, in any macro environment. The number of people that would buy Tesla at a 20 PE for example (something like a $300-400 share price depending on who you use as your PE projection). Go back 5 years and there was no PE as there was no earnings to calculate a price from.

A 20 PE on a company that has been growing >50% per year and is guiding >50% growth for multiple years into the future is ridiculously low. I personally think that's worth at least 100PE, but the point here is that absent complete failure of Tesla to perform, or a seismic change in consumer desire for EVs, Tesla does have a bottom price now. It can still be lower and longer that we think rational

You've got my previous attempt to present the "don't do it" side; none of it is advice of course, including "don't do it".

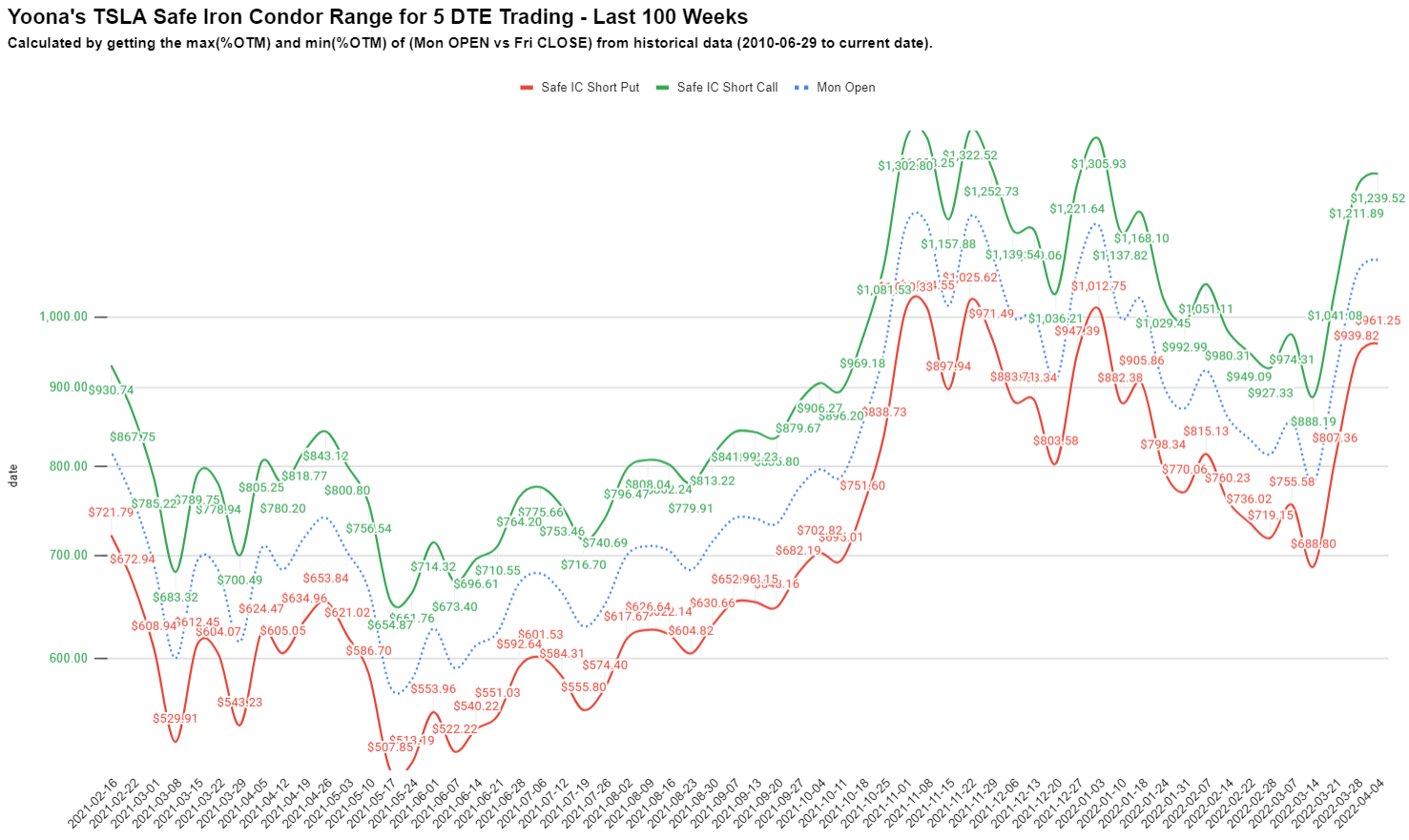

1027 seems to be the floor the last 2 days this week. I am still at 961 just to be safe, and will not creep up. I backtested TSLA historical data (June 2010 to today, 613 weeks) and concluded that 961-1239 is my Iron Condor safe range this week.

Last edited:

Weeklies I presume? Do you do this for monthlies as well?1027 seems to be the floorthe last 2 daysthis week. I am still at 961 just to be safe, and will not creep up. I backtested TSLA historical data (June 2010 to today, 613 weeks) and concluded that 961-1239 is my Iron Condor safe range this week.

View attachment 791009

5 DTE only. I didn't backtest nor open longer periods - too terrified of black swan...Weeklies I presume? Do you do this for monthlies as well?

juanmedina

Active Member

5 DTE only. I didn't backtest nor open longer periods - too terrified of black swan...

what was the payout?

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K