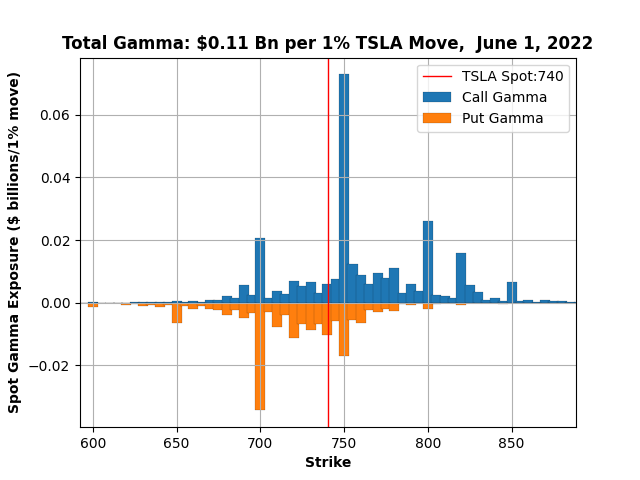

P&D may have a larger effect than normal this Q, potentially in either direction.My best guess is we hit 1000 early July. Next stop from here is 710, though. Then, EMA 200 @ 850.View attachment 811049

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Agreed. If not P&D, then June China sales a week later showing pre-lockdown level should do the job. The most likely direction IMHO is up. All the bad news have been priced in.P&D may have a larger effect than normal this Q, potentially in either direction.

boys, i need your help bigly

my former boss asked me to go back to work, so i need to unretire

it's 9-5 onsite and personal electronic devices are not allowed except during the lunch break

that means i can't trade on the dips and peaks anymore... the best would be to open contracts during the breaktime (but prems won't be the best)

and they would have to be DOTM and directionless since i can't babysit

"set it and forget it" would be too dangerous nowadays

for you all who are still in the workforce with the same dilemma, how do you fix this problem? (do a market order sunday night? that would be too risky)

help meeeeeeeeeee

TIA!

Well, that was easy for me.

The ortho chief of an hospital I used to take calls when I statrted my practice offered me some OR time and to take calls last Friday-Saturday-Sunday. Said yes because I was going to work with old friends and have more fun working with them than I would with day trading. However I make more income with my job that day trading and less potentiel loss

If you have more fun and have more value doing something, do it. If you don’t like it and it makes your life worse, drop it. I am going to drop doing medicolegal expertises as soon as I build a descent bankroll back. Just punishing myself to have letting myself getting buried by too many rolled contracts on the way down. This way I remember. You have to at least do something you don’t like to realize how much you appreciate the rest. Just not too much of it, 2 or 3 days a month is enough :X

Now, I have a question of what people here think of a weird deal I found out 2 days ago: A guy I trained with has met a retired Lawyer day trading the 5M he cashed out selling his shares from a popcorn company, he took a private loan from my friend of 200k and has been giving him 3% interest monthly on this 200k loan. He keeps the extra profit he makes with his day trading activity. He told him the total amount can be cashed anytime. Is that even legal to accept private loans, day trade it, keep the extra and pay a fixed interest rate to the private lender?

Last edited:

bkp_duke

Well-Known Member

Now, I have a question of what people here think of a weird deal I found out 2 days ago: A guy I trained with has met a retired Lawyer day trading the 5M he cashed out selling his shares from a popcorn company, he took a private loan from my friend of 200k and has been giving him 3% interest monthly on this 200k loan. He keeps the extra profit he makes with his day trading activity. He told him the total amount can be cashed anytime. Is that even legal to accept private loans, day trade it, keep the extra and pay a fixed interest rate to the private lender?

In the states, yes, 100% legal (probably Canada too, but someone should check). The loan money, he can do anything with. His only obligation is to pay the loan back per the agreed-upon terms (3%, monthly payments, can call for full payment at any time).

Sounds pyramidy...Now, I have a question of what people here think of a weird deal I found out 2 days ago: A guy I trained with has met a retired Lawyer day trading the 5M he cashed out selling his shares from a popcorn company, he took a private loan from my friend of 200k and has been giving him 3% interest monthly on this 200k loan. He keeps the extra profit he makes with his day trading activity. He told him the total amount can be cashed anytime. Is that even legal to accept private loans, day trade it, keep the extra and pay a fixed interest rate to the private lender?

If you're already making 42.5% annualized on 5M, why bother with an extra 200k? That's like one month's return. (Ok, maybe wrong thread for that question ;-) )

3%*200k= 6k a month to look like the principle is growing. Spend 120k on life expenses and skip out after a year if the long shots fail.

Knightshade

Well-Known Member

Yeah legally pretty much any private loan terms are fine (outside of any state-specific consumer protections that don't sound relevant here- like a max cap on interest rates or a prohibition on prepayment penalities)

But I agree with Mongo the "I have 5 mil to trade but want 200k more" story sounds weird.

Esp. when he presumably would have WAY more than that available to him via a margin loan, and with someone like iBKR he'd be paying less than 3% interest too.

But I agree with Mongo the "I have 5 mil to trade but want 200k more" story sounds weird.

Esp. when he presumably would have WAY more than that available to him via a margin loan, and with someone like iBKR he'd be paying less than 3% interest too.

thank you everyone for your wonderful commentsboys, i need your help bigly

my former boss asked me to go back to work, so i need to unretire

it's 9-5 onsite and personal electronic devices are not allowed except during the lunch break

that means i can't trade on the dips and peaks anymore... the best would be to open contracts during the breaktime (but prems won't be the best)

and they would have to be DOTM and directionless since i can't babysit

"set it and forget it" would be too dangerous nowadays

for you all who are still in the workforce with the same dilemma, how do you fix this problem? (do a market order sunday night? that would be too risky)

help meeeeeeeeeee

TIA!

this is a "come back and name whatever your price" thing that is too tempting to resist (and it's a temporary 1-yr gig anyways)

weekly, my trading (in 1 hour) does earn 20x more than this job (37 hours), but i miss scheduled work life and friends and a structured day

so here i am on my lunch break and the first thing i read is this thread - you guys better make sure there is something for me to read OR ELSE

as for options, i decided to:

- Mondays - observe only; check for clues on sp direction and market sentiment, do not trade today

- Tuesdays - open CSP/CC based on best guess strikes/prems; limit order

- focus on B/W strategy for now... 700 dropping to 600 is no big deal compared to starting at 1000

- stock split is coming, i still think this is the biggest driver of sp move

- NO bcs, NO bps, NO ic - these are not "set it and forget it" trades

yes. this is exactly how we got that capital into our company.Now, I have a question of what people here think of a weird deal I found out 2 days ago: A guy I trained with has met a retired Lawyer day trading the 5M he cashed out selling his shares from a popcorn company, he took a private loan from my friend of 200k and has been giving him 3% interest monthly on this 200k loan. He keeps the extra profit he makes with his day trading activity. He told him the total amount can be cashed anytime. Is that even legal to accept private loans, day trade it, keep the extra and pay a fixed interest rate to the private lender?

There is a reason in every loan-agreement the "purpose" of the loan is stated. In this case it would be "freely available"

In Europe (esp. Germany) this is illegal IF YOU DON'T TAKE REASONABLE INTEREST. Because then it counts as "gift" and is taxed by "gifting tax". You have to pay tax on the interest - but not on the back-payment of capital. So your "income" can be laughably low (because only the interest-payment), but the capital you get can be arbitrarily high (until the loan is payed back fully).

In our contract we have clauses that any loan-given can request arbitrary amounts of the loan back at any time (foregoing future interest-payments) and has to get the money immediately (or the next month) depending on the amount.

The recieving party can cancel the contract at any time as well (about any amount) - but has to pay the interest-difference that would have been accured if the contract was fulfilled orderly. This is a method of getting capital out of the company without things like "dividends on shares" etc... and the "costs" are tax-deductible in the company as well

If you are confident to gamble with "other peoples money" then this is a nice way.

I DON'T know if you have to be accredited investor or some other BS to be able to give such loans - but i doubt you have to be. At least in my jurisdiction (i know german, austrian & liechtenstein law in that regard) a LOAN is fine. But an INVESTMENT with variable returns depending on performance is harshly regulated.

To friends i can make the offer: invest in the company. You gain a fixed amount of interest, but have all of the risk if i **** up. No, you cannot get interest based on the performance (because then we would have to be regulated as financial entity similar to banks). You can get shares in the company.. but those dividend payments would be after all costs of the company (including loan-payments, salaries, etc. pp.) and maybe way lower then the "real" performance your money earns..

We tried to look into it.. and it is ... complicated with tons of pitfalls regarding to accounting, regulations, liability-laws, etc.. basically "hire 1 person fulltime to manage that $foo".. which most likely would eat up all benefits.

-----

Big edit:

One thing others noted is: Why take 200k if you have 5M? .. well.. if you retired with 5M 2 years ago noone says that you still have 5M

Maybe he is in a pickle & needed a capital injection to get things rolling again (ask me how i know ..

I know of other "traders" that took such loans successfully to get their stuff back in order & pay back things like 30% interest per year.. because they only needed the money for some months to get the "swing back up" with leverage.

Can fire backwards hard

Last edited:

What do you want to read?so here i am on my lunch break and the first thing i read is this thread - you guys better make sure there is something for me to read OR ELSE

I can ramble for hours in your private messages if you like ..

samppa

Active Member

Rolled my 06/03 -c690 to 06/10 -c705 for a little credit + strike improvement. Still ITM but these are covered by shares I wouldn't mind selling.

And I decided to play a little AMZN lottery, opened jun03/jun24 2500 call calendar. Debit $72.

And I decided to play a little AMZN lottery, opened jun03/jun24 2500 call calendar. Debit $72.

As expected, TSLA is underperforming the broader market. However, I'm not in the camp who think this is manipulation by market makers.

A lot of OTM calls were loaded last week which helped propel the $150 point zipper in 4 days. Those calls have to be unwound now that momentum has stalled. However, they are not being dumped but instead slowly bled out throughout the day even as SPY recovers somewhat. This keeps a lid on the stock price as MMs also have to sell share to un-hedge these calls.

Updated 4H chart with a new short term support trendline. The stock stopped at 730.95 today. I'm still expecting 710 by next Friday.

NOT AN ADVICE: Even though I'm pretty confident in this 5 wave impulse move, frequently when call IVs get crushed, it's a signal for upcoming softness in the stock. This is most likely a small pullback but nobody can guarantee it's not a devastating next leg lower. I'd avoid opening close to the money short puts / BPS right at this moment. I'd even consider taking some profit. The wind is not at our back anymore atm.

A lot of OTM calls were loaded last week which helped propel the $150 point zipper in 4 days. Those calls have to be unwound now that momentum has stalled. However, they are not being dumped but instead slowly bled out throughout the day even as SPY recovers somewhat. This keeps a lid on the stock price as MMs also have to sell share to un-hedge these calls.

Updated 4H chart with a new short term support trendline. The stock stopped at 730.95 today. I'm still expecting 710 by next Friday.

NOT AN ADVICE: Even though I'm pretty confident in this 5 wave impulse move, frequently when call IVs get crushed, it's a signal for upcoming softness in the stock. This is most likely a small pullback but nobody can guarantee it's not a devastating next leg lower. I'd avoid opening close to the money short puts / BPS right at this moment. I'd even consider taking some profit. The wind is not at our back anymore atm.

Last edited:

On the other hand: Max pain creeps up significantly.As expected, TSLA is underperforming the broader market. However, I'm not in the camp who think this is manipulation by market makers.

A lot of OTM calls were loaded last week which helped propel the $150 point zipper in 4 days. Those calls have to be unwound now that momentum has stalled. However, they are not being dumped but instead slowly bled out throughout the day even as SPY recovers somewhat. This keeps a lid on the stock price as MMs also have to sell share to un-hedge these calls.

Updated 4H chart with a new short term support trendline. The stock stopped at 730.95 today. I'm still expecting 710 by next Friday.

NOT AN ADVICE: Even though I'm pretty confident in this 5 wave impulse move, frequently when call IVs get crushed, it's a signal for upcoming softness in the stock. This is most likely a small pullback but nobody can guarantee it's not a devastating next leg lower. I'd avoid opening close to the money short puts / BPS right at this moment. I'd even consider taking some profit. The wind is not at our back anymore atm.

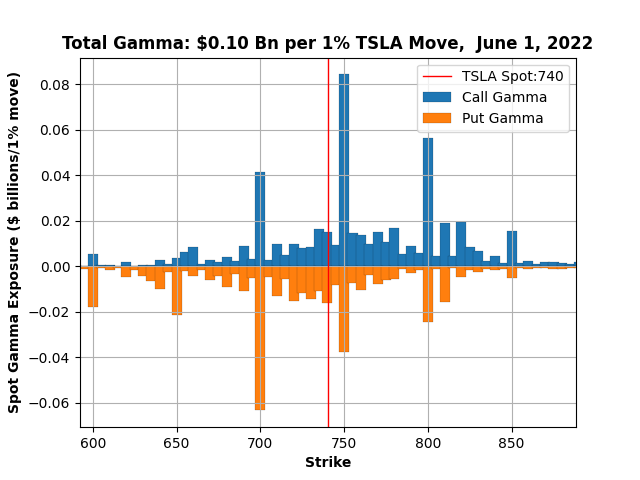

View attachment 811505

IIRC we were on 680 on friday/monday, 700 yesterday, 725 today...

Yesterday a whole lot of 700 puts were opened, so that puts overtook calls in that area.

I do also think that we could see 700 in the short-term - but the market imo has to have a really bad day for us to go significant (read: 600 and below) down.

edit: Also put:call ratio of 3:4 is signing bullish for this week and the following ones.

I have to say that for options trading I'm much happier with $TSLA being low than high - puts for the win at these levels!

And I still hold onto my dream of loading up shares at $500 - then I'd sell covered calls $100 above the SP, one month ahead, zero stress, win/win

Right now shares seem far more attractive than LEAPS from a put risk-management perspective, i.e. they don't expire and have a great Delta

And I still hold onto my dream of loading up shares at $500 - then I'd sell covered calls $100 above the SP, one month ahead, zero stress, win/win

Right now shares seem far more attractive than LEAPS from a put risk-management perspective, i.e. they don't expire and have a great Delta

intelligator

Active Member

First chart is for this week only. Gamma positive yesterday and today, calls slightly outweigh puts, 710-780 is busy, edge interest at 700 and 800.

The chart below is for month of June. 600 and 650 are more pronounced as are 800 and 850, where we sit and 50+- gets busier. Gamma has been positive past Thursday through today, yesterday .21, Friday .23 and Thursday .03 , somewhat backing the price pattern we are seeing? I didn't feel we'd close below 700 this week, so I rolled a 680CC as part of a buy write to next week 690CC for credit. I may open several -p675 to snag credit and buy back shares, roll down if price drops quick, or do nothing and get a look next week given the interest at 650 and 600.

The chart below is for month of June. 600 and 650 are more pronounced as are 800 and 850, where we sit and 50+- gets busier. Gamma has been positive past Thursday through today, yesterday .21, Friday .23 and Thursday .03 , somewhat backing the price pattern we are seeing? I didn't feel we'd close below 700 this week, so I rolled a 680CC as part of a buy write to next week 690CC for credit. I may open several -p675 to snag credit and buy back shares, roll down if price drops quick, or do nothing and get a look next week given the interest at 650 and 600.

I think today will be a make or break day. MSFT adjusted their guidance due to FX pressure, nothing too significant. Market/TSLA holding up well so far but that MSFT guidance thing will get lots of media coverage and impact all the stocks. Just keep that in mind.

bkp_duke

Well-Known Member

Technical Analysts are saying we are looking at the right shoulder of a reverse head and shoulders pattern. They are expecting us to dip down in the coming days before a rebound. Arguments about "how far" the dip is.

jeewee3000

Active Member

Sold some 6/3 $800cc's @1.02 at open.

Might close today if >50% profit. Quite convinced these won't end up ITM.

EDIT: you can all thank me for the SP rise. I doubled down and sold some more 800 cc's at $1.7 and have laddered cc-sell orders @$3 $6 and $8.

Might close today if >50% profit. Quite convinced these won't end up ITM.

EDIT: you can all thank me for the SP rise. I doubled down and sold some more 800 cc's at $1.7 and have laddered cc-sell orders @$3 $6 and $8.

Last edited:

TheTalkingMule

Distributed Energy Enthusiast

Lol....yeah, I have a much simpler map of what's going on yesterday and today. To me it simply looks like a summer week with little to no real buying or selling.Sold some 6/3 $800cc's @1.02 at open.

Might close today if >50% profit. Quite convinced these won't end up ITM.

EDIT: you can all thank me for the SP rise. I doubled down and sold some more 800 cc's at $1.7 and have laddered cc-sell orders @$3 $6 and $8.

Max pain is whatever, but the big call spike was at 750 yesterday and another smaller at 800. Today that's shifted to 800/750/825/850 in order of spike magnitude.

Action this morning looks to me like we're in for a rollercoaster 2 days that end up at 799 rather than 749. You are in my thoughts and prayers.

Last edited:

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K