Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

john tanglewoo

2012 Roadster Owner

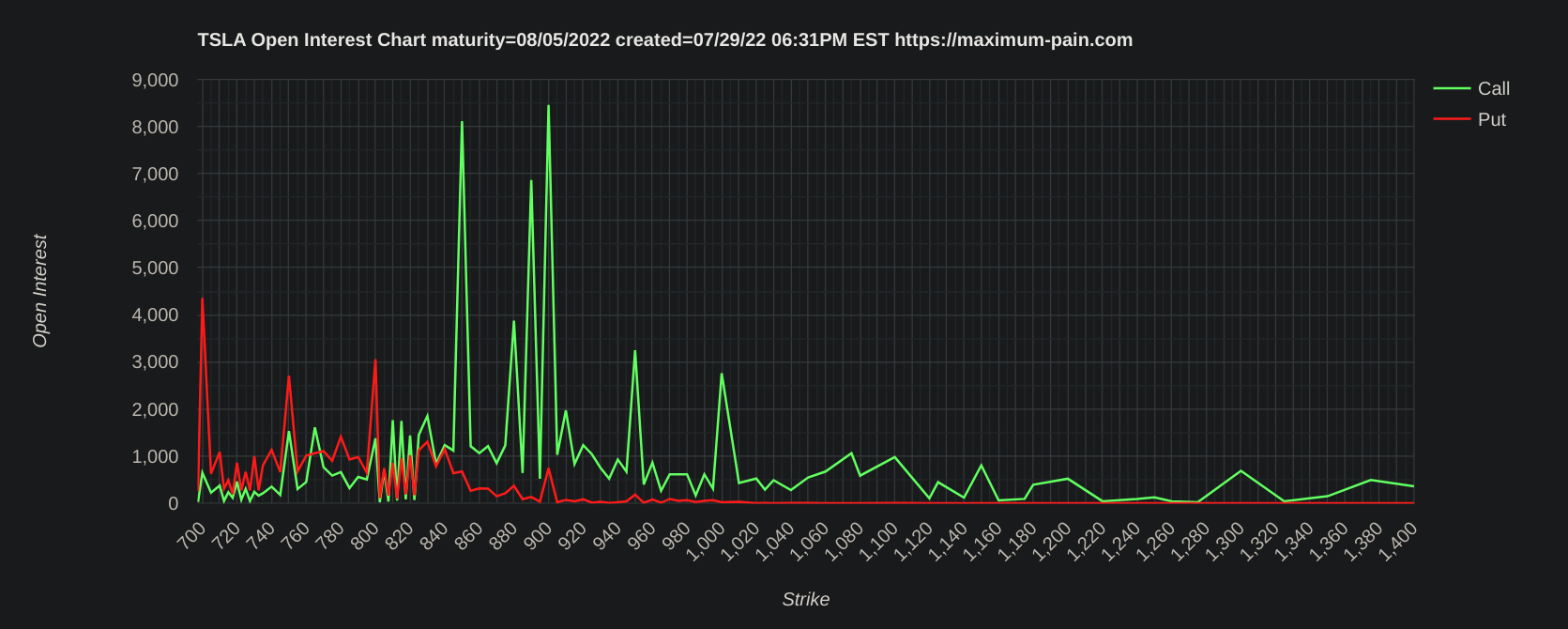

Nailed it!Nasdaq futures up over 1% right now. I don't see us closing at 850 tomorrow. Max-pain is out the window. 880-910 is my guess. For the sake of my calls, I hope I still have my old contra-indicator powers.

We need more stories like this...No more trading from my phone.

I was drinking a beer on a boat on Lake Tahoe. I decided to sell $870 calls.

Except I accidentally bought $870 calls (OTM when bought). Closed those out for a 5x return.

I’m an idiot, but at least I just paid for this vacation.

No more trading from my phone.

I was drinking a beer on a boat on Lake Tahoe. I decided to sell $870 calls.

Except I accidentally bought $870 calls (OTM when bought). Closed those out for a 5x return.

I’m an idiot, but at least I just paid for this vacation.

Well my 950CCs I sold for next week are already -500%. You are officially 10 times better than me

maybe lots of window-dressing today due to monthendWell my 950CCs I sold for next week are already -500%. You are officially 10 times better than me

i need to understand better this hedging strategy that takes 3 weeks to play outI had a dilemma. My portfolio is up 13k today. I want to buy insurance in case we go down - but don't want to give up upside.

So i played around. Straight puts are out as they most likely just burn the money. I expect that we either retract to 850 or go above 900. so i played with straddles. They all go into green waaay to far out (breakeven like 700 & 900).. And do not "scale" fast enough.

Played with butterflys and much much more.

Finally settled on this:

View attachment 834282

8/5 900p for fast gains on retraction, 8/19 800/900 BPS to lessen the impact of delta and get upside exposure, 9/16 -800p for even more upside, theta and financing.

In the screeshot the dotted line is the value on Monday. Break below 850? No problem, this thing starts printing! Rise more? Also print. Stay the same.. well.. that cost as much as the direct put and we still have 4 more days to move. But i plan on closing - or at least handling - it on monday when the stock market opens.

So in case we get a black swan on the weekend (china housing bubble finally bursts after the massive protests there currently; more covid-lockdowns; another ship blocking the suez-canal; meteorite hitting Giga Austin; ...) it should severly lessen the impact.

Also this has the possibility to "just close" the +900p if it is not needed anymore (because it is monday & i can react) and end up with a usual BPS + CSP that can be handled with the strategies we all here know.

Maybe this helps one or the other of you to protect the gains of today

Low call walls beyond $900 next week, let's see how far it will run!

Sold 950CC for next week for almost $6 just before close, in my mom's account, on shares that were assigned a couple months ago from -1000CSP. If we breach 950 (I think we will), they will be easy to roll to 1,000 to convert her shares back to cash.

Well my 950CCs I sold for next week are already -500%. You are officially 10 times better than me

How often do you do a CC like this and realize later if only you’d bought instead of sold?

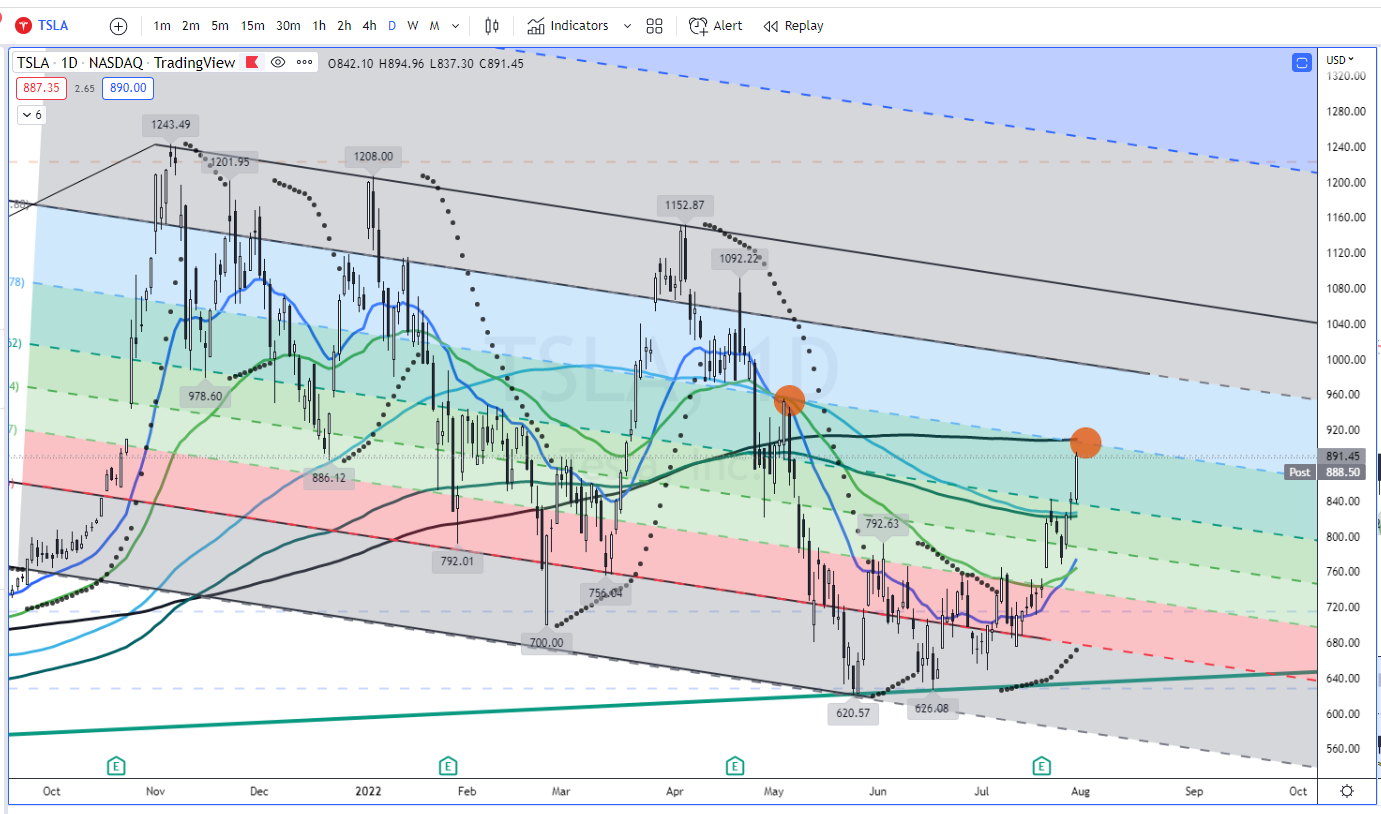

The stock is due for a breather here shortly. It is staring up a confluence of formidable barricades: 200 SMA, psychological resistance of 900 and the next fib channel. Notice how the same fib channel stopped TSLA in its track back in May @ 950 after FOMC. SPY was 430 then. SPY is 410 now. Can we see 900? Yes. Can we see 925 if SPY gets to 420? Yes. But this is where the big bad bears are lurking. I think there is a slim chance we get to test the upper trendline @ 1060 in 2 weeks if the best case scenario plays out:

1. SPY gets to 430

2. July China sales spectacular

3. A split is announced and conducted shortly after.

Other than that, at 900 I think we have a pretty good spot for profit taking.

1. SPY gets to 430

2. July China sales spectacular

3. A split is announced and conducted shortly after.

Other than that, at 900 I think we have a pretty good spot for profit taking.

I look at this as a dangerous time for both BPS and BCS. I will be opening ICs Monday, 20% OTM. Not chasing premiums.The stock is due for a breather here shortly. It is staring up a confluence of formidable barricades: 200 SMA, psychological resistance of 900 and the next fib channel. Notice how the same fib channel stopped TSLA in its track back in May @ 950 after FOMC. SPY was 430 then. SPY is 410 now. Can we see 900? Yes. Can we see 925 if SPY gets to 420? Yes. But this is where the big bad bears are lurking. I think there is a slim chance we get to test the upper trendline @ 1060 in 2 weeks if the best case scenario plays out:

1. SPY gets to 430

2. July China sales spectacular

3. A split is announced and conducted shortly after.

Other than that, at 900 I think we have a pretty good spot for profit taking.

View attachment 834388

Last edited:

TheTalkingMule

Distributed Energy Enthusiast

I look at this is a dangerous time for both BPS and BCS.

That's the sentiment MM's are looking to establish obviously. Uncertainty. Preferably in both directions!

I think this legislation puts a near term floor much higher than if it hadn't popped up. We didn't have much to carry us thru to 3Q bananas earnings, now we do.

I think $900 turns into the floor mighty quickly and a further pop is needed to create true uncertainty to the downside. At -20% for next week, are we really worried about $710/$610 BPS?

Folks will sell stuff like that for $1 on a dip Monday with reckless abandon and be safe as could be.

Yeah, the shareholder meeting on Thursday should limit the downside potential for next week, but I'm probably not going higher than 750 for the BPS short leg. Thinking it can't go down because of amazing catalyst "X" is what blew up my account starting with Q4 earnings back in January....That's the sentiment MM's are looking to establish obviously. Uncertainty. Preferably in both directions!

I think this legislation puts a near term floor much higher than if it hadn't popped up. We didn't have much to carry us thru to 3Q bananas earnings, now we do.

I think $900 turns into the floor mighty quickly and a further pop is needed to create true uncertainty to the downside. At -20% for next week, are we really worried about $710/$610 BPS?

Folks will sell stuff like that for $1 on a dip Monday with reckless abandon and be safe as could be.

Edit: We were in the 770s 3 days ago and I can make an equally strong argument for why we get there again next week, or why we get to 1,000.

How often do you do a CC like this and realize later if only you’d bought instead of sold?

I would of loved to buy it instead of selling it however I was not on a boat at Lake Tahoe, I was at work. I need to take more vacation lol

Some weekend musings...

I've no idea where we go next week - logic would say up, given, well, everything, but could be the markets reverse when the main resistance on the indexes hits, and the bears all jump in together, no idea...

With this in mind, I sold 10x -p900/-c900 straddles, in order to do this, needed to buy 500 $TSLA at market as I only had the 5 LEAPS available - those LEAPS are almost back to break-even, which is nice... TBH I would like to buy some more shares anyway, even if the SP dumps again, it's fine without the clock ticking, just hold forever and milk cc's against them

Thanks to the rally I was able to exit my AAPL calls with a modest profit - and I offloaded my GOOGL shares and cc's - I still have 100x GOOGL J24 -c150's 70% under water still , whether they come back into play at some point, we'll see - can't do anything with them for the moment, even writing calls against them isn't interesting this far OTM and the GOOGL premiums are dreadful, roughly half those of TSLA for the same capital at risk

So I'm back to focusing on TSLA, which is how I should have kept it all along - in the current environment, everything pretty much goes up and down with the macro, so spreading it around doesn't add much IMO, just means you need to keep your eye on more stuff, for which I don't have the time, so that they puts it more down to guesswork than just following Tesla in depth (plus I found I often took a bearish position say, on GOOGL and a bullish one on TSLA, then they just tended to move together - wishing one to drop and the other to pop becomes quite frustrating and a waste of energy)

With regards to @Drezil's down-side protection post... perhaps somewhat inadvertently, I discovered (with AAPL) that selling DITM calls when the SP is high is a pretty good insurance mechanism - you don't have the risk of the calls going to zero, like buying puts, you'll harvest some Theta and of course you can roll them forever, unless early exercised. It's one strategy

I've no idea where we go next week - logic would say up, given, well, everything, but could be the markets reverse when the main resistance on the indexes hits, and the bears all jump in together, no idea...

With this in mind, I sold 10x -p900/-c900 straddles, in order to do this, needed to buy 500 $TSLA at market as I only had the 5 LEAPS available - those LEAPS are almost back to break-even, which is nice... TBH I would like to buy some more shares anyway, even if the SP dumps again, it's fine without the clock ticking, just hold forever and milk cc's against them

Thanks to the rally I was able to exit my AAPL calls with a modest profit - and I offloaded my GOOGL shares and cc's - I still have 100x GOOGL J24 -c150's 70% under water still , whether they come back into play at some point, we'll see - can't do anything with them for the moment, even writing calls against them isn't interesting this far OTM and the GOOGL premiums are dreadful, roughly half those of TSLA for the same capital at risk

So I'm back to focusing on TSLA, which is how I should have kept it all along - in the current environment, everything pretty much goes up and down with the macro, so spreading it around doesn't add much IMO, just means you need to keep your eye on more stuff, for which I don't have the time, so that they puts it more down to guesswork than just following Tesla in depth (plus I found I often took a bearish position say, on GOOGL and a bullish one on TSLA, then they just tended to move together - wishing one to drop and the other to pop becomes quite frustrating and a waste of energy)

With regards to @Drezil's down-side protection post... perhaps somewhat inadvertently, I discovered (with AAPL) that selling DITM calls when the SP is high is a pretty good insurance mechanism - you don't have the risk of the calls going to zero, like buying puts, you'll harvest some Theta and of course you can roll them forever, unless early exercised. It's one strategy

The Accountant

Active Member

I don't know this person's track record but he thinks gamma comes Monday and short squeeze comes later above 900.

Does his comment that gamma usually occurs on Monday and not Friday sound reasonable to any of you?

Does his comment that gamma usually occurs on Monday and not Friday sound reasonable to any of you?

It is only a hedge for the weekend until monday. If we stay around 900 it gets expensive FAST. This thing is not meant to be held to expiry - but depending on sentiment one only needs to close some parts of it and keep the rest as a trade one would have entered anyway.i need to understand better this hedging strategy that takes 3 weeks to play out

Quite the opposite..Does his comment that gamma usually occurs on Monday and not Friday sound reasonable to any of you?

"Gamma-Squeeze" is "just", that gamma is at maximum, when the SP hovers at the strike. Why? Because Delta is at 0.5 at that moment.

On mondays gamma is smaller, because delta won't rise/fall as fast, as proportionally more money wanders into theta and is burned slowly. Think of delta as "money burned by SP-moves" and theta as "money burned until expiration". So on monday you have a bigger theta-pile so moves won't swing hard. You have to go 1 standard-deviation from the SP (roughly 20$ on tesla on mondays) to get from 0.5 delta to 0.75 or 0.25.. But on friday afternoon a standard-deviation is only 5$ ..

So to "squeeze" from 0.25 to 0.75 delta you have to go 40$ on monday fast. Or 10$ late on friday.

ALL with the caveat that most participants won't cover and just hedge - basically not looking at it and letting the algos trade.

Why is this delta-number so important? Delta equates to the probability of the option ending in the money implied by the options market (i.e. open options). One option "risks" 100 shares. If you want to "insure" yourself according to probability then the mathematically minimal risk would be to have 25 stock for every 0.25-delta option sold.

BUT if the Stock rises then your equations move. You get "more risk" to be really on the hook for 100 shares and you only got 25. Therefore for every dollar up/down you buy/sell the gamma of stock.

In the 10$ friday-afternoon example above: you hegded your 0.25 delta bet with 25 stock. The next time you look the stock is up and the option has 0.75 delta. Now you are on the hook for stochastically 75 shares. Two solutions: Hope the stock reverses or adopt your position. First one is a recipe for bankruptcy. So you have to but 50 shares on the market to bring your risk-metrics in line.

This is what you can extend to the whole market. Rough calculation: On friday we had roughly 4k open interest at 880. meaning 400k shares. At 15:00 we were at 870, 30 minutes later at 888. Meaning that the hedge alone was responsible for 200k net shares bought (100k shares hedged at 87, 300k needed at 890) in 30 minutes - ONLY on the 880 strike. don't forget about double the interest at 890 and again at 900!

If you switch on the minute-chart and zoom out to see 11-16h you can see, that it escalated quadratically (aka: "the stock went parabolic").

What alleviated the pressure is that not everyone held the open calls from thursday afternoon (the basis for the OI i took), that many took profit on the way, etc.

What worsened the pressure was that many peeps watching the stock intensely piled in and bought 850, 880, 900 calls leading to even more delta-hedging neccessary.

Normally we see a hard hard crush on the SP as soon as the stock goes parabolic - breaking the trend. But yesterday against linear rising Nasdaq (look at it .. basically a straight line from 12:00 to end) it seems like the usual suspects were outgunned.

It is rare to see this. I even had powder on the sidelines because i was sure we would see a punch below 850.. but after the dip short before open it looks like all the powder for the punchdown was gone.

--

To come back to the question: Gamma-Squeezes are more likely to happen on fridays.

BUT i do not know how often other people update their hedges. Because every time you do it is potentially false (as on an oscillating SP it would be buy high & sell low). Maybe some who only trade monthly options rebalance and hedge only once per day, maybe they did not hedge yet because they still think that the bear-market is not over.. i don't know. But there can a reasonable argument be made that if they hedge only once a day or week that monday might see more of that.

Just look at the open-interest for the next few weeks and especially the monthly expiration in august. There are nearly no puts above 800. All calls. All needing to be hedged...

---

Note: all math is very crude approximate so you can do it in your head. I always do those things in my head & got quite good at it. It's more about the gist & intuition than accuracy.

i bookmarked thisQuite the opposite..

"Gamma-Squeeze" is "just", that gamma is at maximum, when the SP hovers at the strike. Why? Because Delta is at 0.5 at that moment.

On mondays gamma is smaller, because delta won't rise/fall as fast, as proportionally more money wanders into theta and is burned slowly. Think of delta as "money burned by SP-moves" and theta as "money burned until expiration". So on monday you have a bigger theta-pile so moves won't swing hard. You have to go 1 standard-deviation from the SP (roughly 20$ on tesla on mondays) to get from 0.5 delta to 0.75 or 0.25.. But on friday afternoon a standard-deviation is only 5$ ..

So to "squeeze" from 0.25 to 0.75 delta you have to go 40$ on monday fast. Or 10$ late on friday.

ALL with the caveat that most participants won't cover and just hedge - basically not looking at it and letting the algos trade.

Why is this delta-number so important? Delta equates to the probability of the option ending in the money implied by the options market (i.e. open options). One option "risks" 100 shares. If you want to "insure" yourself according to probability then the mathematically minimal risk would be to have 25 stock for every 0.25-delta option sold.

BUT if the Stock rises then your equations move. You get "more risk" to be really on the hook for 100 shares and you only got 25. Therefore for every dollar up/down you buy/sell the gamma of stock.

In the 10$ friday-afternoon example above: you hegded your 0.25 delta bet with 25 stock. The next time you look the stock is up and the option has 0.75 delta. Now you are on the hook for stochastically 75 shares. Two solutions: Hope the stock reverses or adopt your position. First one is a recipe for bankruptcy. So you have to but 50 shares on the market to bring your risk-metrics in line.

This is what you can extend to the whole market. Rough calculation: On friday we had roughly 4k open interest at 880. meaning 400k shares. At 15:00 we were at 870, 30 minutes later at 888. Meaning that the hedge alone was responsible for 200k net shares bought (100k shares hedged at 87, 300k needed at 890) in 30 minutes - ONLY on the 880 strike. don't forget about double the interest at 890 and again at 900!

If you switch on the minute-chart and zoom out to see 11-16h you can see, that it escalated quadratically (aka: "the stock went parabolic").

What alleviated the pressure is that not everyone held the open calls from thursday afternoon (the basis for the OI i took), that many took profit on the way, etc.

What worsened the pressure was that many peeps watching the stock intensely piled in and bought 850, 880, 900 calls leading to even more delta-hedging neccessary.

Normally we see a hard hard crush on the SP as soon as the stock goes parabolic - breaking the trend. But yesterday against linear rising Nasdaq (look at it .. basically a straight line from 12:00 to end) it seems like the usual suspects were outgunned.

It is rare to see this. I even had powder on the sidelines because i was sure we would see a punch below 850.. but after the dip short before open it looks like all the powder for the punchdown was gone.

--

To come back to the question: Gamma-Squeezes are more likely to happen on fridays.

BUT i do not know how often other people update their hedges. Because every time you do it is potentially false (as on an oscillating SP it would be buy high & sell low). Maybe some who only trade monthly options rebalance and hedge only once per day, maybe they did not hedge yet because they still think that the bear-market is not over.. i don't know. But there can a reasonable argument be made that if they hedge only once a day or week that monday might see more of that.

Just look at the open-interest for the next few weeks and especially the monthly expiration in august. There are nearly no puts above 800. All calls. All needing to be hedged...

---

Note: all math is very crude approximate so you can do it in your head. I always do those things in my head & got quite good at it. It's more about the gist & intuition than accuracy.

you're not allowed to leave this thread

Outstanding; thanks @Drezil!Quite the opposite..

"Gamma-Squeeze" is "just", that gamma is at maximum, when the SP hovers at the strike. Why? Because Delta is at 0.5 at that moment.

On mondays gamma is smaller, because delta won't rise/fall as fast, as proportionally more money wanders into theta and is burned slowly. Think of delta as "money burned by SP-moves" and theta as "money burned until expiration". So on monday you have a bigger theta-pile so moves won't swing hard. You have to go 1 standard-deviation from the SP (roughly 20$ on tesla on mondays) to get from 0.5 delta to 0.75 or 0.25.. But on friday afternoon a standard-deviation is only 5$ ..

So to "squeeze" from 0.25 to 0.75 delta you have to go 40$ on monday fast. Or 10$ late on friday.

ALL with the caveat that most participants won't cover and just hedge - basically not looking at it and letting the algos trade.

Why is this delta-number so important? Delta equates to the probability of the option ending in the money implied by the options market (i.e. open options). One option "risks" 100 shares. If you want to "insure" yourself according to probability then the mathematically minimal risk would be to have 25 stock for every 0.25-delta option sold.

BUT if the Stock rises then your equations move. You get "more risk" to be really on the hook for 100 shares and you only got 25. Therefore for every dollar up/down you buy/sell the gamma of stock.

In the 10$ friday-afternoon example above: you hegded your 0.25 delta bet with 25 stock. The next time you look the stock is up and the option has 0.75 delta. Now you are on the hook for stochastically 75 shares. Two solutions: Hope the stock reverses or adopt your position. First one is a recipe for bankruptcy. So you have to but 50 shares on the market to bring your risk-metrics in line.

This is what you can extend to the whole market. Rough calculation: On friday we had roughly 4k open interest at 880. meaning 400k shares. At 15:00 we were at 870, 30 minutes later at 888. Meaning that the hedge alone was responsible for 200k net shares bought (100k shares hedged at 87, 300k needed at 890) in 30 minutes - ONLY on the 880 strike. don't forget about double the interest at 890 and again at 900!

If you switch on the minute-chart and zoom out to see 11-16h you can see, that it escalated quadratically (aka: "the stock went parabolic").

What alleviated the pressure is that not everyone held the open calls from thursday afternoon (the basis for the OI i took), that many took profit on the way, etc.

What worsened the pressure was that many peeps watching the stock intensely piled in and bought 850, 880, 900 calls leading to even more delta-hedging neccessary.

Normally we see a hard hard crush on the SP as soon as the stock goes parabolic - breaking the trend. But yesterday against linear rising Nasdaq (look at it .. basically a straight line from 12:00 to end) it seems like the usual suspects were outgunned.

It is rare to see this. I even had powder on the sidelines because i was sure we would see a punch below 850.. but after the dip short before open it looks like all the powder for the punchdown was gone.

--

To come back to the question: Gamma-Squeezes are more likely to happen on fridays.

BUT i do not know how often other people update their hedges. Because every time you do it is potentially false (as on an oscillating SP it would be buy high & sell low). Maybe some who only trade monthly options rebalance and hedge only once per day, maybe they did not hedge yet because they still think that the bear-market is not over.. i don't know. But there can a reasonable argument be made that if they hedge only once a day or week that monday might see more of that.

Just look at the open-interest for the next few weeks and especially the monthly expiration in august. There are nearly no puts above 800. All calls. All needing to be hedged...

---

Note: all math is very crude approximate so you can do it in your head. I always do those things in my head & got quite good at it. It's more about the gist & intuition than accuracy.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K