alterac000

Member

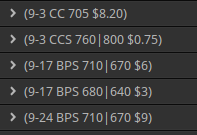

Thought I'd follow-up on a comment I recently left. My poor man's tracker using group labels in ToS:

It's a little more work though truthfully fairly trivial if you keep up with it, to manually add/subtract credits each time you roll. Beauty is you can simply update the labels as you go along to reflect the new credits/debits and positions. Can get more fancy by adding position size in the label and whatever else may be important.

Yes I still need to roll those 705cc's today, fortunate they haven't been called away. Considering sending them to a 10/15 expiry at $750 strike unless anyone has a better idea

It's a little more work though truthfully fairly trivial if you keep up with it, to manually add/subtract credits each time you roll. Beauty is you can simply update the labels as you go along to reflect the new credits/debits and positions. Can get more fancy by adding position size in the label and whatever else may be important.

Yes I still need to roll those 705cc's today, fortunate they haven't been called away. Considering sending them to a 10/15 expiry at $750 strike unless anyone has a better idea