Ah, which broker?Bought shares at ~220 with a reserve requirement of 40% - I thought I would only take a 60% hit ($13,200) because the other 40% would come back to margin from collateral from the new shares. Is that not right?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Ah hah - I read that as Jan 24 2023. As opposed to Jan '24.All this margin consideration is scary doubly-so the your brokers decide to change the rules, which you're then in contravention of, so they liquidate your portfolio instantly...

I don't have margin, but can sort of use it via the cash-reserved against sold puts - don't need 100% covered, can write approximately 3x my ability to buy the shares, but I don't go anywhere near that. If I did and they got exercised without the ability to pay, I have 5 days to fix the shortfall

Still no Elon selling by the looks of it, encouraging to see some green...

STO 15x Jan 24 -c300's @$34 - to be rebought in event of a dump

If we drop back to 200, you would expect these cc to be back around $25 (a roughly .50 delta)?

With the move today I've opened Nov 4 230 and 235 strike cc. The shares were purchased at this level, so assignment will leave cc credits as profit. I won't sell cc this aggressive using higher priced shares, but I see an opportunity and I've become pretty bearish on the stock price. Really bullish on the company, but I don't see significant company news that would alter the share price for another 2 months. I do see plenty of economic news that on balance I expect will push us down.

If I'm wrong then while the cc aren't doing great, the 275ish puts I have -will- be doing great, so there will be good news one way or the other

I think the confusion is that your equity includes (takes into account) the margin loan. So buying shares on margin does not increase your equity and thus does not boost your buying power.Schwab

Margin Equity The dollar value of marginable securities in your margin account, less the amount you owe Schwab, plus any cash in your margin account. This is the liquidation value of your margin account, but does not include option positions, segregated money market funds, or cash not held in the margin account. Margin Equity represents the total amount you invested in securities plus any excess cash, minus funds borrowed on margin.

You don't see the TWTR overhang being lifted as 'company news?' I can easily see a short squeeze happening if the deal closes on Friday with no additional selling by Elon.Ah hah - I read that as Jan 24 2023. As opposed to Jan '24.

If we drop back to 200, you would expect these cc to be back around $25 (a roughly .50 delta)?

With the move today I've opened Nov 4 230 and 235 strike cc. The shares were purchased at this level, so assignment will leave cc credits as profit. I won't sell cc this aggressive using higher priced shares, but I see an opportunity and I've become pretty bearish on the stock price. Really bullish on the company, but I don't see significant company news that would alter the share price for another 2 months. I do see plenty of economic news that on balance I expect will push us down.

If I'm wrong then while the cc aren't doing great, the 275ish puts I have -will- be doing great, so there will be good news one way or the other

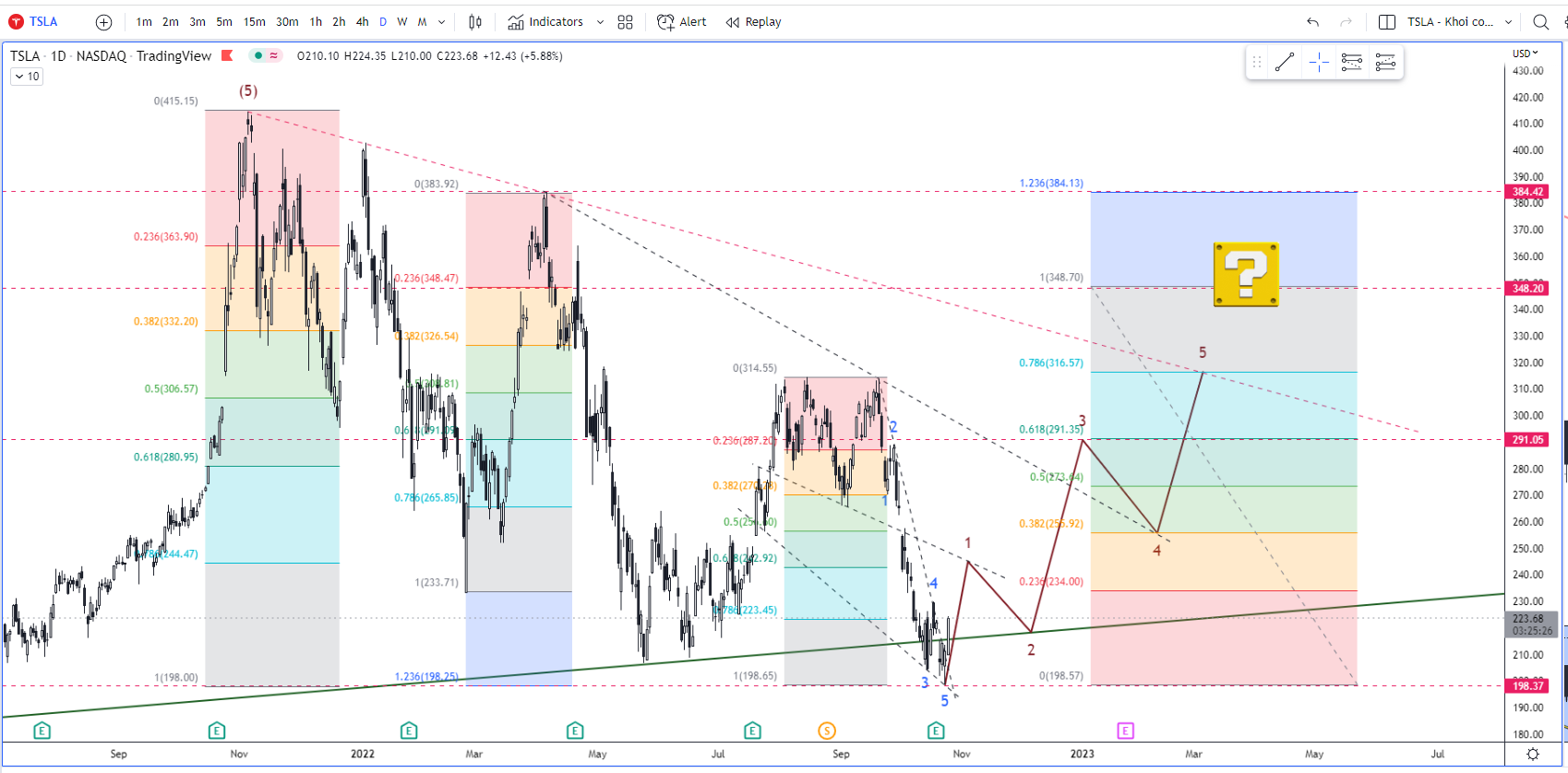

A great spot for reducing leverage / hedging will be @ 240. No matter how strong this bounce is or how good the news is going to be, it will pull back and people will be like "oh shuck here we go again." Better to anticipate the drop and act in advance. TSLA hit 198 and bounced, just $3 shy of my $195 target.

I overestimated the overall bearishness within the market. However I still don't think this bear market is remotely close to an end. Still seeing TSLA rise to 300+ early next year due to Q4 record everything. Left a gold brick in there for good luck.

I overestimated the overall bearishness within the market. However I still don't think this bear market is remotely close to an end. Still seeing TSLA rise to 300+ early next year due to Q4 record everything. Left a gold brick in there for good luck.

I guess that I don't. Which isn't to say that I think that it isn't - I guess I'm just not giving it nearly as much weight as most.You don't see the TWTR overhang being lifted as 'company news?' I can easily see a short squeeze happening if the deal closes on Friday with no additional selling by Elon.

I do agree with the premise that having TWTR resolved will eliminate some of the uncertainty and doubt about the share price (Elon selling more, in bulk) and that will probably manifest as a higher share price.

Thank you for bringing this out. I think more broadly that I've got a blind spot where it comes to Elon. I've been segmenting my view on TSLA share price into "company news" and "macro news", with a corresponding view into how that will change the share price. The blind spot is that I've been following Elon for so long that this is all more "Elon being Elon" to me and bears little impact to my own primary investing view of things (long term).

The problem is that the investing public doesn't share my view on Elon, and the short(er) term share price absolutely moves on Elon news separately from company news and macro news.

For my short term / option sales investments, I need to widen the stuff I consider to Elon news, company news, and macro. Some day I might also add meaningful technical analysis - I just need to find the motivation and I haven't been looking very hard

This is a great reason for why I regularly spell out my thinking - not to change other's view on what's going on, but so I can improve my own view based on the feedback. Thanks!

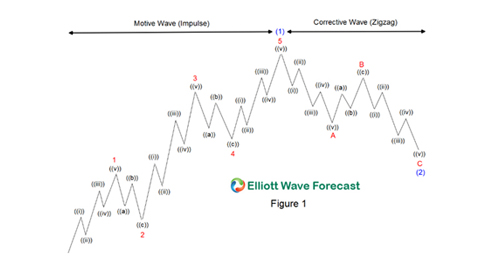

I'm looking for an educational source for Elliot Wave theory. Something more than a 5 minute web site read, but less than a master's degreeA great spot for reducing leverage / hedging will be @ 240. No matter how strong this bounce is or how good the news is going to be, it will pull back and people will be like "oh shuck here we go again." Better to anticipate the drop and act in advance. TSLA hit 198 and bounced, just $3 shy of my $195 target.

I overestimated the overall bearishness within the market. However I still don't think this bear market is remotely close to an end. Still seeing TSLA rise to 300+ early next year due to Q4 record everything. Left a gold brick in there for good luck.

View attachment 867391

I found this:

Elliott Wave Principle, Free Online Book, Instant Access

We have taught thousands of people how to use the Elliott wave method to analyze the markets they follow. We've included everything you need to learn it inside this free version of Elliott Wave Principle.

www.elliottwave.com

www.elliottwave.com

And have just begun reading. At a quick glance this looks like something closer to a few hours of reading. Do you have other sources that you've used and would recommend?

I do most of my reading on EWT here.I'm looking for an educational source for Elliot Wave theory. Something more than a 5 minute web site read, but less than a master's degree

I found this:

Elliott Wave Principle, Free Online Book, Instant Access

We have taught thousands of people how to use the Elliott wave method to analyze the markets they follow. We've included everything you need to learn it inside this free version of Elliott Wave Principle.www.elliottwave.com

And have just begun reading. At a quick glance this looks like something closer to a few hours of reading. Do you have other sources that you've used and would recommend?

Elliott Wave Theory: Rules, Guidelines and Basic Structures

Complete guide on Elliott Wave Theory. Learn what is Elliott Wave Theory, its history, basic structures, and Fibonacci relationship between waves.

EWT to me is just the finishing touch. Fib levels act as "the worst that can happen" and help me manage risks. TA is more important but EWT I think is god send for option sellers.

Closed my 28/10 230CCs this morning for a 70% profit profit in one day and sold 28/10 220 CCs at the end of the market today because I am betting on Elon selling tomorrow or Wednesday. I will close these calls tomorrow and then sit out.

I don’t know if that is a good bet or a bad one. Let’s see.

Also added shares at $200.

Maybe Elon sold yesterday after all.

Rolled my CCs to 235 2 weeks out

Wasn’t the idea of the century to sell CC yesterday at close :X

A great spot for reducing leverage / hedging will be @ 240. No matter how strong this bounce is or how good the news is going to be, it will pull back and people will be like "oh shuck here we go again." Better to anticipate the drop and act in advance. TSLA hit 198 and bounced, just $3 shy of my $195 target.

I overestimated the overall bearishness within the market. However I still don't think this bear market is remotely close to an end. Still seeing TSLA rise to 300+ early next year due to Q4 record everything. Left a gold brick in there for good luck.

View attachment 867391

Curious, were any of the technical indicators respected when SP flushed down from 300+ on ~ Sept 20?

I think every thing still depends on Feds and what they do? FOMC meeting 11/2 and market will decide ... cheers!!

(+ & TWTR overhang) ...

Last edited:

dc_h

Active Member

I've been patient, but finally sold some 240 CC's. I had 250CC's from last week. Premiums are light, wishing I had sold puts yesterday at 200, but was worried we would break resistance and find a new local low. I'm ok if we blow past 240, but don't think we'll rise straight to 300 in the next couple of weeks. I have more to win losing a few covered calls at this point.

I think Apple, Amazon, and Meta results will drive the macros for the remainder of the week, which I’m guessing will be a big influence on TSLA. Problem is, I have no idea what those results will be. Could be sour and we dump again (Netflix will be permanently infamous in my mind for that), could be solid with decent forecasts and give the market a big boost.  That and the Twitter deal… I closed my put spreads on todays rise and I’m not eager to get back in just yet. Not risking CCs either, though. I can argue decently for going way up or going way down right now…

That and the Twitter deal… I closed my put spreads on todays rise and I’m not eager to get back in just yet. Not risking CCs either, though. I can argue decently for going way up or going way down right now…

Sure. First we had a rising wedgeCurious, were any of the technical indicators respected when SP flushed down from 300+ on ~ Sept 20?

I think every thing still depends on Feds and what they do? FOMC meeting 11/2 and market will decide ... cheers!!

(+ & TWTR overhang) ...

Double bearish diversion on a daily time frame

Notice how the rising wedge was formed before we even breached the previous highs. Coupled with SPY dropping $25-30 in a matter of days, it was safe to reduce leverage. Did I know from the onset we would get to 200 in 3 weeks? Not specifically. I had 2 primary targets: 260 and 215.

I think Apple, Amazon, and Meta results will drive the macros for the remainder of the week, which I’m guessing will be a big influence on TSLA. Problem is, I have no idea what those results will be. Could be sour and we dump again (Netflix will be permanently infamous in my mind for that), could be solid with decent forecasts and give the market a big boost.That and the Twitter deal… I closed my put spreads on todays rise and I’m not eager to get back in just yet. Not risking CCs either, though. I can argue decently for going way up or going way down right now…

Adding to that GOOGL, MSFT, and TXN are putting downward pressure on the after hours market. Apparently online advertising and cloud are taking it on the chin. We'll see Thurs if AWS is holding up better than Azure. And Zuck is gonna be Zuck so Meta will probably be a downer too unless he has a plan to reduce spending.

bkp_duke

Well-Known Member

Adding to that GOOGL, MSFT, and TXN are putting downward pressure on the after hours market. Apparently online advertising and cloud are taking it on the chin. We'll see Thurs if AWS is holding up better than Azure. And Zuck is gonna be Zuck so Meta will probably be a downer too unless he has a plan to reduce spending.

Don't bet on AWS. They have had a hiring freeze, sure sign of some financial pressure.

So TSLA is the best performing MegaCap with the highest growth potential...? You would think smart people would know to transfer their money over, but for some reason TSLA is down AH as well....Adding to that GOOGL, MSFT, and TXN are putting downward pressure on the after hours market. Apparently online advertising and cloud are taking it on the chin. We'll see Thurs if AWS is holding up better than Azure. And Zuck is gonna be Zuck so Meta will probably be a downer too unless he has a plan to reduce spending.

Anyone buying weekly PUTS as insurance? If so, can you share approaches?

My approach is now selling too close CCs when I think Elon might dump shares on the open market, of course the opposite happens.

I do not recommend doing this.

intelligator

Active Member

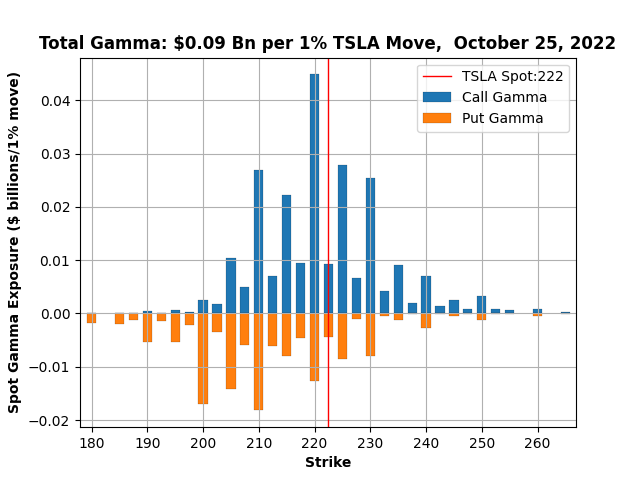

As anticipated, we are gamma positive, price went up ... some. Do we hold our breath for a 220 close this week? Seems unlikely with the poor tech sector earning reports that came out this evening; pre-market isn't looking good, we may be back where we started the week. If we do, don't forget to lock in your CC profits!

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K