Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Short-Term TSLA Price Movements - 2013

- Thread starter Robert.Boston

- Start date

- Status

- Not open for further replies.

aznt1217

Active Member

sorry but i'm not following you, please explain

He's essentially saying separate your heart from your mind. Everybody wants to see Tesla lower so they will get in, but the funny thing about us humans is we have a tendency to exaggerate. Once Tesla dips, you are going to set an even lower target. It's just standard behavior. When the price goes up we have a bias to prop up our targets (if we have the stock/interest). All of these sentiments mean nothing till you press the button. It's standard behavioral finance.

Set up your stops based on facts and trade on that.

He's essentially saying separate your heart from your mind. Everybody wants to see Tesla lower so they will get in, but the funny thing about us humans is we have a tendency to exaggerate. Once Tesla dips, you are going to set an even lower target. It's just standard behavior. When the price goes up we have a bias to prop up our targets (if we have the stock/interest). All of these sentiments mean nothing till you press the button. It's standard behavioral finance.

TSLA is not an issue for me chosing trading or investing but the all market itself.

i don't want to see TSLA lower and as far as i concern they can hit 1000$ but don't expect me to invest in something that the market value more then i do. again i repeat it's not about TSLA but the market as a total, it's overvalued as far as i concern and i'll wait for it in a lower levels.

Set up your stops based on facts and trade on that.

but i do

FredTMC

Model S VIN #4925

Citizen-T

Active Member

Over $170 now on spiked vol... News?

Goldman Sachs just added it to some buy list.

DJ Frustration

Former Model X Sig, Model S, Model 3, Model Y

It's the realization that the rumor about a cap raise is false. Look at the timing of my last post.

Citizen-T

Active Member

Goldman Sachs just sent out an email to all their clients saying that TSLA has been aded to their "buy-in" list.

kevin99

Member

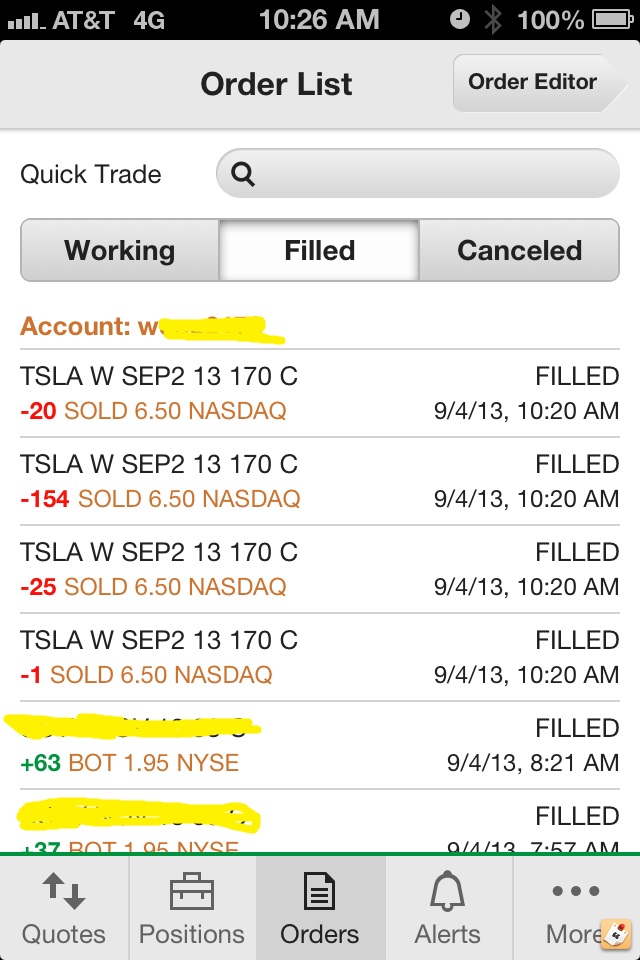

I can't believe it. My limit order to sell to open sep2(weekly) call @170 for $6.5 get executed! And it was the absolute high of the moment. It is at $5.3 now. You can calculate my gain of the 200 calls, just on paper:

This is the first time I ever execute an option trade at the best price, so I am a bit excited. For option, you always suffer the ask/bid split a lot more severe than the shares. Typically as soon as the trade executed, you would already incur a loss immediately.

For option, you always suffer the ask/bid split a lot more severe than the shares. Typically as soon as the trade executed, you would already incur a loss immediately.

This is the first time I ever execute an option trade at the best price, so I am a bit excited.

Last edited:

Citizen-T

Active Member

hello SEC is someone there hello?!

yesterday offering, today price raise, well somebody have fun here

Information is just trickling in. Looks like there was some confusion. People thought that GS was recommending that clients buy TSLA. This is not the case, the buy-in list is somehow related to lending of shares. False alarm. Looks like the market quickly corrected after it realized the mistake.

I can't believe it. My limit order to sell to open sep2(weekly) call @170 for $6.5 get executed! And it was the absolute high of the moment. It is at $5.3 now. You can calculate my gain of the 200 calls, just on paper:

you are a lucky devil...

24,000$ in 5 min that's not a bad day to say the least

- - - Updated - - -

Information is just trickling in. Looks like there was some confusion. People thought that GS was recommending that clients buy TSLA. This is not the case, the buy-in list is somehow related to lending of shares. False alarm. Looks like the market quickly corrected after it realized the mistake.

confusion my (beep)

even if GS banker will spend the rest of their life in alcatraz prison it still won't be enough punishment for their crimes

DJ Frustration

Former Model X Sig, Model S, Model 3, Model Y

Me thinks we're in for another delivery surprise after Q3. On the Delivery Update thread, they are reporting VINs in 21,400 range for end of September delivery.

Causalien

Prime 8 ball Oracle

So what made you start shorting TSLA?I can't believe it. My limit order to sell to open sep2(weekly) call @170 for $6.5 get executed! And it was the absolute high of the moment. It is at $5.3 now. You can calculate my gain of the 200 calls, just on paper: This is the first time I ever execute an option trade at the best price, so I am a bit excited.For option, you always suffer the ask/bid split a lot more severe than the shares. Typically as soon as the trade executed, you would already incur a loss immediately.

I can't believe it. My limit order to sell to open sep2(weekly) call @170 for $6.5 get executed! And it was the absolute high of the moment. It is at $5.3 now. You can calculate my gain of the 200 calls, just on paper

Hi Kevin, just curious can you share your exit plan if the trade goes against you (ie., what's your stop loss)?

Convert2013

Member

it's only a surprise if you're not on TMC

So when are you changing your username? Gaswalla means someone who deals with Gas and gas cars in this case.. ;-)

kevin99

Member

Short-Term TSLA Price Movements

Sure Dave. It is all about hedging, ie now that TSLA has come back to $170 level, this particular trade does not have the same gain when TSLA drops, my overall balance actually increased quite a lot due to my other long position. If TSLA continue to rise, my gain will be less but still the gain overall will be handsome.

As I stated earlier, my overall position is moderately long. So it is not a simple short.

It happens I like to catch these inexplicable daily Significant turn. Sometime it works in my favor sometime it doesn't. But doing short options gives me extra cushion because of the time vale decay.

Hi Kevin, just curious can you share your exit plan if the trade goes against you (ie., what's your stop loss)?

Sure Dave. It is all about hedging, ie now that TSLA has come back to $170 level, this particular trade does not have the same gain when TSLA drops, my overall balance actually increased quite a lot due to my other long position. If TSLA continue to rise, my gain will be less but still the gain overall will be handsome.

As I stated earlier, my overall position is moderately long. So it is not a simple short.

It happens I like to catch these inexplicable daily Significant turn. Sometime it works in my favor sometime it doesn't. But doing short options gives me extra cushion because of the time vale decay.

Last edited by a moderator:

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 137

- Replies

- 0

- Views

- 239

- Locked

- Replies

- 0

- Views

- 4K

- Poll

- Replies

- 16

- Views

- 2K

- Replies

- 21

- Views

- 6K