Yeah, I can't see Musk giving up the CEO position until after G3 launch. On the bright side, that will give JB plenty of time to eradicate 'you know' from his vocabulary. Yegads was that distracting on the call last night.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Citizen-T

Active Member

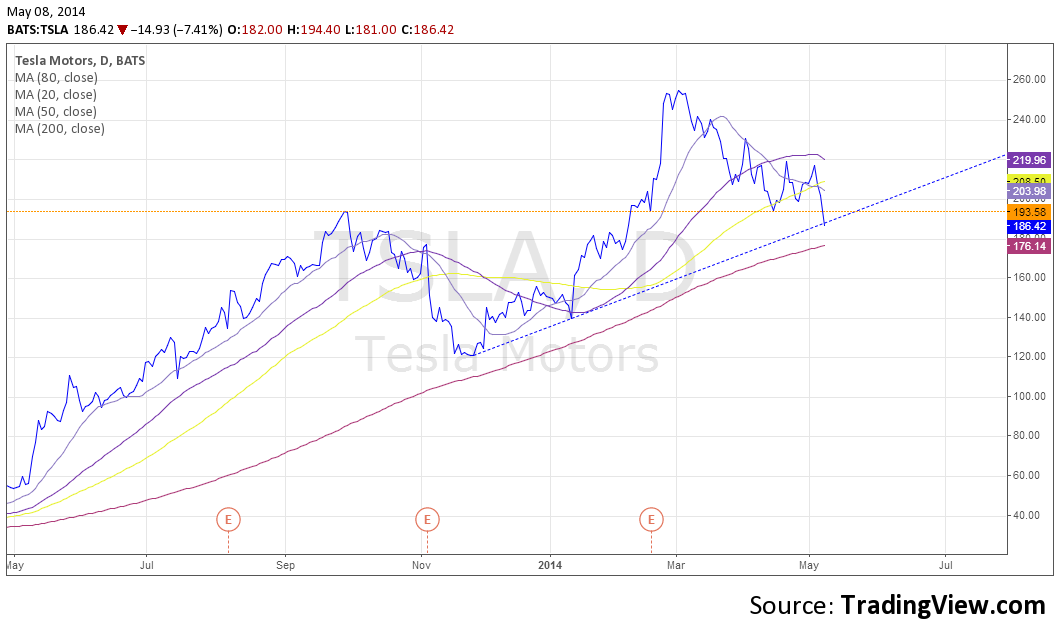

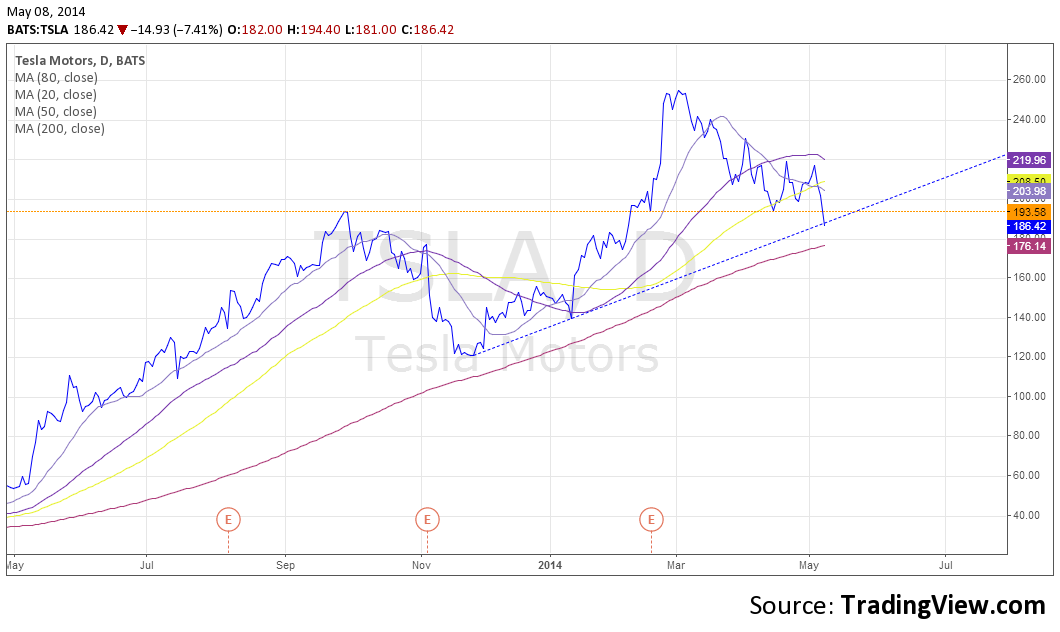

Guys, keep in mind that the 200-day is at 176ish. That's the support I'm watching. I'll buy like a mad man at that level.

BTW, I thought the report was good. Wall Street is just in a bad mood.

BTW, I thought the report was good. Wall Street is just in a bad mood.

Cwin

Member

Guys, keep in mind that the 200-day is at 176ish. That's the support I'm watching. I'll buy like a mad man at that level.

BTW, I thought the report was good. Wall Street is just in a bad mood.

The report was alright. It wasn't great.

justthateasy

Member

As of this morning, I have lost over 85% of my profit since TSLA reached the all time high of 265 because I held off and didn't want to be a "weak long". I hate to sound grim but it's days like this that make me want to eat lead.

I feel that, Elon is going to make JB CEO of Tesla in near term.

I have been seeing lot of JB in the public appearance with Elon and Today, JB was on the earnings call. It seems Elon is training JB.

Personally, I am OK with JB being CEO. But, I am wondering, how market will take it, if this happens. What do you think?

tslas, while I do think Elon will ultimately step down in favor of SpaceX, he has VERY clearly stated multiple times that he will only consider this once Gen III has been successfully delivered to the public. I think 2018 is the earliest Elon might leave. Something to be aware of being long TSLA, but not an issue in the near term.

As of this morning, I have lost over 85% of my profit since TSLA reached the all time high of 265 because I held off and didn't want to be a "weak long". I hate to sound grim but it's days like this that make me want to eat lead.

Take heart, JTE, we need your wisdom around here! The story of TSLA is a long one and this is a moment in time.

My portfolio is decimated as well, but my core share holdings are the same they have been since my $41 buy in -- a 5-year hold. Today means I am out of ammo for playing the OTM call options game for quite a while though.

Congrats to those who held their ammo for buy-in today. Huge volume of buy orders at the opening bell today means that a lot of people in the market see this as a great entry point, which I think it is. I'd be adding to my long-term position today if I had cash to deploy, but I don't.

Citizen-T

Active Member

Norbert

TSLA will win

Citizen-T

Active Member

If this morning trend continues we may have to cancel the pity party.

We can have a Model X sealant appreciation party instead!

We can have a Model X sealant appreciation party instead!

Molecules will be moved!

hockeythug

Active Member

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

What about the quality of the lithium?

That one made me cringe even more than the question about variable cost/margins vs BMW and MB.

Subhuman

Member

What about the quality of the lithium?

Right!? What a waste of a question for the conference call! I wish I could have seen Elon's and JB's faces when they heard the question.

RobotGrease

Member

Besides the market's reaction, I think it was a great ER. Everything they reported/said gives me further confidence in the company's long term performance and execution.

As for the short term, I still think we're fine. It would be nice to stay above the orange line, but for now, I'll take closing above the blue.

As for the short term, I still think we're fine. It would be nice to stay above the orange line, but for now, I'll take closing above the blue.

Besides the market's reaction, I think it was a great ER. Everything they reported/said gives me further confidence in the company's long term performance and execution.

As for the short term, I still think we're fine. It would be nice to stay above the orange line, but for now, I'll take closing above the blue.

Thanks for posting your chart.

I' m not so sure about short term, but only gut's feeling (and I should have followed the same kind of feeling yesterday, by the way...)

My feeling is that as from yesterday's AH drop, up until the recovery to 194 it was ER play, with TSLA living its own life, but thereafter we got glued to Nasdaq again, and as such, I'm not optimistic at all.

Today, between 11:00 and 11:30, after it went down from 194, it tried a few times to go above 190 again, but failed. Had it gone through and maintained, I'd have been happier and more optimistic for the shoirt term.

Support and small rebound at 180, now, hopefully?

Otherwise, what would be the next support?

I dare not buy Puts, but am tempted.

person

New Member

I still don't understand why the price drop.

The explanation that news media post negative stuff to drum up views is reasonable but can only go so far.

Why are analysts so negative?

It seems to me that as sophisticated as they are (and as I said I know nothing about business) they seem blind to what's going on here.

I don't want to assume, though, that I have some great genius about this matter that others lack. So if people could please try to explain this drop better I'd really appreciate it.

http://www.lhup.edu/~dsimanek/neverwrk.htm

The explanation that news media post negative stuff to drum up views is reasonable but can only go so far.

Why are analysts so negative?

It seems to me that as sophisticated as they are (and as I said I know nothing about business) they seem blind to what's going on here.

I don't want to assume, though, that I have some great genius about this matter that others lack. So if people could please try to explain this drop better I'd really appreciate it.

[W]hen the Paris Exhibition closes electric light will close with it and no more be heard of.

- Erasmus Wilson (1878) Professor at Oxford University

The horse is here to stay, but the automobile is only a novelty—a fad.

- Advice from a president of the Michigan Savings Bank to Henry Ford's lawyer Horace Rackham. Rackham ignored the advice and invested $5000 in Ford stock, selling it later for $12.5 million.

http://www.lhup.edu/~dsimanek/neverwrk.htm

justthateasy

Member

Here's my chart with notes I've written on it. All I did was extend the lines out going into July.

View attachment 48864

Above is the chart I posted last night and filled in where I thought today's price action would be today. Below, is a daily chart of today's price action.

I'm starting to doubt TSLA finishing above 180 today. I think the 200-day MA will be broken tomorrow and it will be a runaway train to 160 and lower.

- - - Updated - - -

TSLA just broke 180 and hit a new intraday low of 179.75. Pathetic.

- Status

- Not open for further replies.

Similar threads

- Replies

- 23

- Views

- 781

- Replies

- 21

- Views

- 6K

- Replies

- 0

- Views

- 217

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 6

- Views

- 610