Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

By Tesla's definition of Autopilot it no longer makes sense to call it Autopilot once it is fully autonomous.

It is not. The video demonstrated just a state of software development.

By Tesla's definition of Autopilot it no longer makes sense to call it Autopilot once it is fully autonomous.

Good point. Even the term "Autonomous" is broken down in to levels by a couple of different "authorities" (US gov't & SAE?).

I think the average consumer who refuses to read even the most basic explanation or owner's manual will continue to be confused.

Mike

428,898 shares available for shorting at Fidelity, with estimated annual interest rate jumping from long standing 1% to 2.5%. Could be an indication of tightening supply...

There already is a drawdown of 86K of TSLA shares available for shorting:

I just got notification on IB Trader WorkStation that trading in SCTY has been halted.

EDIT: Says "Regulatory Halt". Based on this it looks to me like the exchange of shares will happen today.

EDIT: Says "Regulatory Halt". Based on this it looks to me like the exchange of shares will happen today.

Nate the Great

Member

Business Insider providing correction on Chanos Bloomberg appearance.

Here's what Jim Chanos is getting wrong about Tesla

Here's what Jim Chanos is getting wrong about Tesla

Jonathan Hewitt

Active Member

Date of article Oct. 12, 2015?Business Insider providing correction on Chanos Bloomberg appearance.

Here's what Jim Chanos is getting wrong about Tesla

dc_h

Active Member

Off track warning, but for some reason this quote cam to mind this morning from Mark Twain, "there are liars, damn liars and lobbyists". I might have got that last word wrong, but maybe not.

Gerardf

Active Member

Just in my mailbox.

FORM 25 : NOTIFICATION OF REMOVAL FROM LISTING AND/OR REGISTRATION UNDER SECTION 12(b) OF THE SECURITIES EXCHANGE ACT OF 1934.

SolarCity - Notification filed by National Security Exchange to report the removal from listing and registration of matured, redeemed or retired securities Initial Filing Amendments

FORM 25 : NOTIFICATION OF REMOVAL FROM LISTING AND/OR REGISTRATION UNDER SECTION 12(b) OF THE SECURITIES EXCHANGE ACT OF 1934.

SolarCity - Notification filed by National Security Exchange to report the removal from listing and registration of matured, redeemed or retired securities Initial Filing Amendments

3Victoria

Active Member

MartinAustin

Active Member

According to CNBC: "TESLA BUY OF SOLAR CITY HAS CLOSED - STATEMENT"

Total drawdown of 192K. Short sellers are loading before the market open...

And in this corner, wearing black, is Shortie the Short, aiming to scare the longs today then possibly cash out and run for the hills.

And in this corner, wearing the green, is the magnificent Tesla,

Let's have a fair fight, no ear nibbling or rabbit punches.

And in this corner, wearing the green, is the magnificent Tesla,

Let's have a fair fight, no ear nibbling or rabbit punches.

SunCatcher

Member

With all the rapid, and regular improvements we keep seeing from Tesla, it won't be too much longer before owning an ICE vehicle will be, well, ludicrous.

428,898 shares available for shorting at Fidelity, with estimated annual interest rate jumping from long standing 1% to 2.5%. Could be an indication of tightening supply...

The TSLA borrow rate jump from 1 to 2.5% today made it to TheFlyOnTheWall list of largest increases. From the Fidelity newsfeed:

Largest borrow rate increases among liquid names (TheFlyOnTheWall)

FLY ON THE WALL 8:45 AM ET 11/21/2016

Latest data shows the largest indicative borrow rate increases among liquid option names include: EWW (EWW) 4.57% +1.84, Zillow(ZG) 2.68% +1.50, ARIAD (ARIA) 1.56% +1.00, Tesla (TSLA) 2.47% +0.64, ProShares Ultra VIX Short Term Futures (UVXY) 10.49% +0.63, Twilio(TWLO) 9.64% +0.38, EEM (EEM) 1.40% +0.37, Swift Transport (SWFT) 0.91% +0.33, Tesoro (TSO) 0.58% +0.25, and Direxion Daily Gold Miners Bull 3X Shares (NUGT) 3.84% +0.19.

On Merrill the news is showing

SolarCity Corp. (SCTY) Halted due to additional information requested by NASDAQ

I see SCTY frozen after some brief pre-market trading. My fidelity shares of SCTY still say SCTY, so I don't see them converted yet.

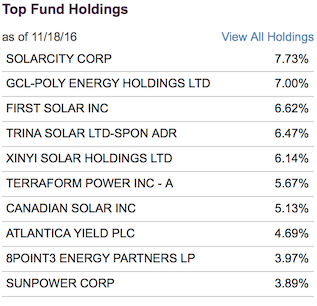

I still wonder if we could see some volatility from ETFs coming up. Below are the holdings of $TAN (Guggenheim Solar ETF):

Their stated investment objective is:

Guggenheim Solar ETF (TAN) seeks investment results that correspond generally to the performance, before the fund’s fees and expenses, of the MAC Global Solar Energy Index. TAN generally will invest in all of the securities comprising the index in proportion to their weightings in the index.

I wonder if they will own $TSLA after or have to dump all their converted shares on the open market?

Mike

Their stated investment objective is:

Guggenheim Solar ETF (TAN) seeks investment results that correspond generally to the performance, before the fund’s fees and expenses, of the MAC Global Solar Energy Index. TAN generally will invest in all of the securities comprising the index in proportion to their weightings in the index.

I wonder if they will own $TSLA after or have to dump all their converted shares on the open market?

Mike

GBleck

Member

Noticed my schwab SCTY shares are not trading. Figured they are converting today. Damit if tesla goes up today do we loose out on that?

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 2

- Views

- 933

- Replies

- 19

- Views

- 1K

- Replies

- 20

- Views

- 3K