Wow that was a flash from the past. I haven't hear much about flywheels and A123 in a long, long time. Then I looked up an saw it was published in 2009.Can Wind Power Be Stored?

"Wind farms typically generate most of their energy at night..."

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AwlBidnz

Old Guy to be driven around for yrs to come

To answer my own original question, I include the graphic below.

I know you understand that my beliefs have been formed by my life experience. Assuming it is different from yours seems to be a reasonable assumption. Trying to label me as a troll is not. I have been a Tesla stock holder since 2013 and a vehicle owner recently. I had expected a bit more respect on this site as we are all supposed to be "in the club". Listening to someones' opinion that is different from yours helps you get a better understanding of your position, if nothing else. You will need to read voluminous amounts of linked articles from authors with an unknown purpose in an attempt to gain the insight provided by someone you could respect that has differing opinions.

The only issue I have with pursuing any and all forms of renewable energy is that we are not investing enough in the research of same. I am doing my best to help with this ;0)

The issue I have in saying we are all going to be 100% renewable in a short time is a practical one. Our grid can't handle it, our economy can't afford it YET and, the "end user" count needs to increase substantially. All of which needs to be happening now.

On oil & gas prices, it's a Catch 22, Push to reduce petroleum prices, that reduces fuel costs which increases the cost comparison to renewables. Push to increase petroleum prices and we all suffer with higher costs, across the board, for all purchased products, while we also spend more for the renewable energy needed to replace petroleum, where it can. The best of both worlds would be cheap fuel with unthrottled renewable research and development that was not tied to energy prices.

The one issue that we all much come to realize is that, again in my opinion, the horizontal oil & gas activity that is being praised as the savior of the USA will prove to be unsustainable, in this country. Several WSJ journal articles have begun addressing this.The boom & bust that the industry has been living under since it's inception, will move to other countries, changing both the local and international economic dynamic, as long as the need for petroleum rages across the developing world.

I know you understand that my beliefs have been formed by my life experience. Assuming it is different from yours seems to be a reasonable assumption. Trying to label me as a troll is not. I have been a Tesla stock holder since 2013 and a vehicle owner recently. I had expected a bit more respect on this site as we are all supposed to be "in the club". Listening to someones' opinion that is different from yours helps you get a better understanding of your position, if nothing else. You will need to read voluminous amounts of linked articles from authors with an unknown purpose in an attempt to gain the insight provided by someone you could respect that has differing opinions.

The only issue I have with pursuing any and all forms of renewable energy is that we are not investing enough in the research of same. I am doing my best to help with this ;0)

The issue I have in saying we are all going to be 100% renewable in a short time is a practical one. Our grid can't handle it, our economy can't afford it YET and, the "end user" count needs to increase substantially. All of which needs to be happening now.

On oil & gas prices, it's a Catch 22, Push to reduce petroleum prices, that reduces fuel costs which increases the cost comparison to renewables. Push to increase petroleum prices and we all suffer with higher costs, across the board, for all purchased products, while we also spend more for the renewable energy needed to replace petroleum, where it can. The best of both worlds would be cheap fuel with unthrottled renewable research and development that was not tied to energy prices.

The one issue that we all much come to realize is that, again in my opinion, the horizontal oil & gas activity that is being praised as the savior of the USA will prove to be unsustainable, in this country. Several WSJ journal articles have begun addressing this.The boom & bust that the industry has been living under since it's inception, will move to other countries, changing both the local and international economic dynamic, as long as the need for petroleum rages across the developing world.

Attachments

TheTalkingMule

Distributed Energy Enthusiast

I would wager the pushback is rooted in two areas:I know you understand that my beliefs have been formed by my life experience. Assuming it is different from yours seems to be a reasonable assumption. Trying to label me as a troll is not. I have been a Tesla stock holder since 2013 and a vehicle owner recently. I had expected a bit more respect on this site as we are all supposed to be "in the club". Listening to someones' opinion that is different from yours helps you get a better understanding of your position, if nothing else. You will need to read voluminous amounts of linked articles from authors with an unknown purpose in an attempt to gain the insight provided by someone you could respect that has differing opinions.

1) All those arguments are basically disproven talking points from 10 years ago.

2) You don't sound like you're from Edmond, Oklahoma.

AwlBidnz

Old Guy to be driven around for yrs to come

You lose on both wagersI would wager the pushback is rooted in two areas:

1) All those arguments are basically disproven talking points from 10 years ago.

2) You don't sound like you're from Edmond, Oklahoma.

From time to time we discuss the role of electrolyzers in pursuit of deep decarbonization. This video is good for understanding scale up in the electrolyzer industry. Nel Hydrogen has produced 80 MW of electrolyzers. They have an order from Nikola Motors for 1 GW of electrolyzers for delivery over the next 5 years.This is truly a huge scale. To produce this order, they will expand manufacturing capacity from 40 MW/year to 360 MW/year. Nel believes that this scale will cut cost per MW by 40%. They later anticipating scaling annual factory capacity to 2.2GW, which would support another 40% cost reduction.

The scale of 1GW can produce 500 tonnes per day or 180k tonne per annum (tpa) at near 100% capacity factor, while current industrial use of hydrogen is about 55 million tpa sourced almost exclusively from fossil fuels. So we see that to replace this supply would require 400 GW of electrolyzers operating at about 75% capacity factor (lower CF helps grids solve daily and seasonal balancing). So Nel Hydrogen and others do need to build out gigafactories to be able to manufacture this fleet of electrolyzers in less than several decades.

Naturally Nel Hydrogen wants to drum up as much demand for their electrolyzers as possible. So it is understandable that the industry wants hydrogen vehicles of all sorts. Personally I don't see much need for hydrogen in ground transport, but shipping will need it. I would caution Tesla investors not to be too hostile about electrolyzers. Keep in mind that just to replace 55 Mtpa of industrial hydrogen demand with non-fossil sources will require a massive electrolyzer fleet potentially on order of the grid battery fleet that is needed. It will take decades to build out both fleets. The presence of one in the grid will improve the economics of the other. Both will synergistically enable the grid to utilize complete penetration of renewables. And both are highly critical to deep decarbonization. Batteries and electrolyzers are not competitors; rather they are co-conspirators in taking down fossils.

ItsNotAboutTheMoney

Well-Known Member

Wow that was a flash from the past. I haven't hear much about flywheels and A123 in a long, long time. Then I looked up an saw it was published in 2009.

Last I heard about flywheels was the use of a flywheel on Kodiak Island in Alaska. It was added to allow the island to replace a diesel crane with an electric crane, avoiding adding more battery capacity and reducing cycling of the existing batteries.

Overall the island went from 80% hydro and 20% diesel in 2009 to 100% renewable with $55.6M of investment eliminating the import of 2.8Mgal of diesel per year.

To answer my own original question, I include the graphic below.

I know you understand that my beliefs have been formed by my life experience. Assuming it is different from yours seems to be a reasonable assumption. Trying to label me as a troll is not. I have been a Tesla stock holder since 2013 and a vehicle owner recently. I had expected a bit more respect on this site as we are all supposed to be "in the club". Listening to someones' opinion that is different from yours helps you get a better understanding of your position, if nothing else. You will need to read voluminous amounts of linked articles from authors with an unknown purpose in an attempt to gain the insight provided by someone you could respect that has differing opinions.

The only issue I have with pursuing any and all forms of renewable energy is that we are not investing enough in the research of same. I am doing my best to help with this ;0)

The issue I have in saying we are all going to be 100% renewable in a short time is a practical one. Our grid can't handle it, our economy can't afford it YET and, the "end user" count needs to increase substantially. All of which needs to be happening now.

On oil & gas prices, it's a Catch 22, Push to reduce petroleum prices, that reduces fuel costs which increases the cost comparison to renewables. Push to increase petroleum prices and we all suffer with higher costs, across the board, for all purchased products, while we also spend more for the renewable energy needed to replace petroleum, where it can. The best of both worlds would be cheap fuel with unthrottled renewable research and development that was not tied to energy prices.

The one issue that we all much come to realize is that, again in my opinion, the horizontal oil & gas activity that is being praised as the savior of the USA will prove to be unsustainable, in this country. Several WSJ journal articles have begun addressing this.The boom & bust that the industry has been living under since it's inception, will move to other countries, changing both the local and international economic dynamic, as long as the need for petroleum rages across the developing world.

I don't think you've been keeping up with your state's power production. TTM's point #1 is correct. You're just spouting old talking points.

As of Dec 2018, Oklahoma was producing over 1/3 of their electricity from non-hydro renewables: Oklahoma - State Energy Profile Overview - U.S. Energy Information Administration (EIA)

As for the grid, have you not noticed that you've been incentivized to charge your EV during off-peak hours. During the times when the grid is least stressed? If the grid can handle industrial/commercial loads during peak hours, then it can handle a bunch of EV's charging during off-peak hours. That's an old talking point that's been debunked from just a little critical thinking.

adiggs

Well-Known Member

From time to time we discuss the role of electrolyzers in pursuit of deep decarbonization. This video is good for understanding scale up in the electrolyzer industry. Nel Hydrogen has produced 80 MW of electrolyzers. They have an order from Nikola Motors for 1 GW of electrolyzers for delivery over the next 5 years.This is truly a huge scale. To produce this order, they will expand manufacturing capacity from 40 MW/year to 360 MW/year. Nel believes that this scale will cut cost per MW by 40%. They later anticipating scaling annual factory capacity to 2.2GW, which would support another 40% cost reduction.

The scale of 1GW can produce 500 tonnes per day or 180k tonne per annum (tpa) at near 100% capacity factor, while current industrial use of hydrogen is about 55 million tpa sourced almost exclusively from fossil fuels. So we see that to replace this supply would require 400 GW of electrolyzers operating at about 75% capacity factor (lower CF helps grids solve daily and seasonal balancing). So Nel Hydrogen and others do need to build out gigafactories to be able to manufacture this fleet of electrolyzers in less than several decades.

Naturally Nel Hydrogen wants to drum up as much demand for their electrolyzers as possible. So it is understandable that the industry wants hydrogen vehicles of all sorts. Personally I don't see much need for hydrogen in ground transport, but shipping will need it. I would caution Tesla investors not to be too hostile about electrolyzers. Keep in mind that just to replace 55 Mtpa of industrial hydrogen demand with non-fossil sources will require a massive electrolyzer fleet potentially on order of the grid battery fleet that is needed. It will take decades to build out both fleets. The presence of one in the grid will improve the economics of the other. Both will synergistically enable the grid to utilize complete penetration of renewables. And both are highly critical to deep decarbonization. Batteries and electrolyzers are not competitors; rather they are co-conspirators in taking down fossils.

Where my brain goes sideways with hydrogen, is trying to treat it as roughly comparable to methane / propane / natural gas, as a fuel source.

I'm completely clear on the idea that there are tradeoffs - that it might be significantly easier to manufacture hydrogen gas and compress / liquefy that for storage than it is to manufacture methane and then store that for later use.

The problem I see is in the life cycle, where the life cycle is presumed to be surplus electricity to usable energy (whether that's a fuel cell vehicle moving, or electricity used in the myriad forms electricity is used).

The primary problem I don't see a way around for really big scale use of hydrogen is all central to hydrogen itself. It's hard enough to handle in large scale industrial settings where nothing else will do for the purpose, and the penalties for mishandling it are severe enough and require enough safety equipment and specialized training for everybody in the vicinity, I don't see hydrogen leaving that large scale industrial setting.

So a circumstance where we're turning very large quantities of surplus power into large quantities of hydrogen for seasonal storage, at which point the hydrogen is turned back into electricity right there onsite (at least mostly) and to the outside consumer, it's all just electricity - that makes sense to me.

This research paper is one I go back to try and wrap my brain around the destructive possibilities with hydrogen:

https://pdfs.semanticscholar.org/e5c9/2ead8b933bed601347179b17f7a8df919838.pdf

From the abstract, the found that 3.5 to 7 kg of hydrogen was "burning violently in the explosion". Sidebar - that's approximately the quantity of hydrogen you'll find in the tank of a personal hydrogen fuel cell vehicle. I'll have to come back to this later - my point is that this is tough stuff to handle, at the scale it's currently being handled, and scaling it up from here by multiple orders of magnitude sounds like beyond hard. Especially if there's an alternative.

Think of hydrogen rather as a feedstock. Over half of hydrogen is used to make ammonia. It can be a feedstock for other petrochems as well including things like plastics and polyesters. It's also needed for steel and other industrial processes.Where my brain goes sideways with hydrogen, is trying to treat it as roughly comparable to methane / propane / natural gas, as a fuel source.

I'm completely clear on the idea that there are tradeoffs - that it might be significantly easier to manufacture hydrogen gas and compress / liquefy that for storage than it is to manufacture methane and then store that for later use.

The problem I see is in the life cycle, where the life cycle is presumed to be surplus electricity to usable energy (whether that's a fuel cell vehicle moving, or electricity used in the myriad forms electricity is used).

The primary problem I don't see a way around for really big scale use of hydrogen is all central to hydrogen itself. It's hard enough to handle in large scale industrial settings where nothing else will do for the purpose, and the penalties for mishandling it are severe enough and require enough safety equipment and specialized training for everybody in the vicinity, I don't see hydrogen leaving that large scale industrial setting.

So a circumstance where we're turning very large quantities of surplus power into large quantities of hydrogen for seasonal storage, at which point the hydrogen is turned back into electricity right there onsite (at least mostly) and to the outside consumer, it's all just electricity - that makes sense to me.

This research paper is one I go back to try and wrap my brain around the destructive possibilities with hydrogen:

https://pdfs.semanticscholar.org/e5c9/2ead8b933bed601347179b17f7a8df919838.pdf

From the abstract, the found that 3.5 to 7 kg of hydrogen was "burning violently in the explosion". Sidebar - that's approximately the quantity of hydrogen you'll find in the tank of a personal hydrogen fuel cell vehicle. I'll have to come back to this later - my point is that this is tough stuff to handle, at the scale it's currently being handled, and scaling it up from here by multiple orders of magnitude sounds like beyond hard. Especially if there's an alternative.

So here's the thing, current consumption of hydrogen is about 55 Mtpa and 95% of that comes from natural gas, coal and oil. An electrolyzer at 1GW capacity can produce about 400 to 500 tonnes per day. So a fleet of 400 GW of electrolyzers would be needed to kick fossil fuels out of the current hydrogen market. Your concerns about hydrogen as a widespread fuel are mostly about expanding beyond the is current industrial market. But it would be a massive feat just to get to the 400 GW by 2030 and this fleet would solve a lot of grid balance problems too even without burning hydrogen to make power.

adiggs

Well-Known Member

Think of hydrogen rather as a feedstock. Over half of hydrogen is used to make ammonia. It can be a feedstock for other petrochems as well including things like plastics and polyesters. It's also needed for steel and other industrial processes.

So here's the thing, current consumption of hydrogen is about 55 Mtpa and 95% of that comes from natural gas, coal and oil. An electrolyzer at 1GW capacity can produce about 400 to 500 tonnes per day. So a fleet of 400 GW of electrolyzers would be needed to kick fossil fuels out of the current hydrogen market. Your concerns about hydrogen as a widespread fuel are mostly about expanding beyond the is current industrial market. But it would be a massive feat just to get to the 400 GW by 2030 and this fleet would solve a lot of grid balance problems too even without burning hydrogen to make power.

Then I'm back into the land of "good idea"

I'm having to evolve on this a bit too. I think Nikola should just focus on the battery side of their trucks, but seeing this 1GW order for electrolyzers is shifting my thinking. I still thing hydrogen is not needed for trucking; nevertheless, that one order is spurring Nel to scale up a 40MW factory to 360MW capacity. In the process they will be able to cut costs by 40% (15% learning rate). This is huge. Nel seriously need a crazy big order like this to be able to scale. Nel also sees potential to build out a 2.2 GW gigafactory and knock anothe 40% off the cost. This has got to go a long ways to taking electrolyzer to the scale needed to balance the grid and beat back fossil demand.Then I'm back into the land of "good idea". Kicking fossil fuels out of the current hydrogen market - great idea.

I've been trying to get a grip on how big 400GW of electrolyzers is. How about this? Average global power generation is about 2.9 TW. 400GW of electrolyzers would have the ability to throttle generation nearly 14%. This means renewables would be able to oversupply a typical grid by 15% or so for most of the year, while there would be enough electrolyzer capacity to completely absorb the surplus, and then shed that load when there is no surplus. That goes a substantial way toward seasonal balancing.

For another comparison, average nuclear generation is 300GW which would be swallowed up a third over by 400GW of electrolyzers.

I think we need this scale. But before we get to the 400 GW scale, the industry needed the likes of Nikola Motors to take a chance on a first 1 GW order.

AwlBidnz

Old Guy to be driven around for yrs to come

I don't think you've been keeping up with your state's power production. TTM's point #1 is correct. You're just spouting old talking points.

As of Dec 2018, Oklahoma was producing over 1/3 of their electricity from non-hydro renewables: Oklahoma - State Energy Profile Overview - U.S. Energy Information Administration (EIA)

As for the grid, have you not noticed that you've been incentivized to charge your EV during off-peak hours. During the times when the grid is least stressed? If the grid can handle industrial/commercial loads during peak hours, then it can handle a bunch of EV's charging during off-peak hours. That's an old talking point that's been debunked from just a little critical thinking.

As I elluded to previously, data is easily manipulated. From your referenced website of the EIA there is another table showing the BTU production from fossil fuels and renewables. I assume you know what BTU's are. The US total BTU production for renewables in 2016 was 12%. Oklahoma was 6%. Any ideas why those "averages" are so different? Could it be that electricity is only one component of energy use? The spreadsheet from the EIA is attached. I apologize for the "old talking points". It seems the EIA has only compiled & released their results thru 2016.

As you obviously do not live in Edmond, our electric utility does not offer off-peak rates for electricity. It is an issue we are working on as OG&E does offer reduced rates for large users and off-peak.

Instead of just trying to shame me by calling me a troll or that I am using old talking points, please tell me what points are ten years old & which of those are no longer correct?

Renewables have huge potential for many energy applications and also potential environmental benefits. The all-in costs of any energy source needs to be understood, as well as, the "all-in" environmental benefits. Rose colored glasses never work well for that "all-in" evaluation.

Are you really having trouble understanding that I live in Oklahoma AND need that as one of your "talking points"?

Attachments

TheTalkingMule

Distributed Energy Enthusiast

If you don't understand that Oklahoma can easily go 100% wind + storage, then you have more reading to do on your "local market".

Wind is so cheap and plentiful in Oklahoma, they'll be installing tons of transmission lines just to export their excess.

None of that happens until the fracking pyramid(and their absolute legislative control) collapses, obviously.

Wind is so cheap and plentiful in Oklahoma, they'll be installing tons of transmission lines just to export their excess.

None of that happens until the fracking pyramid(and their absolute legislative control) collapses, obviously.

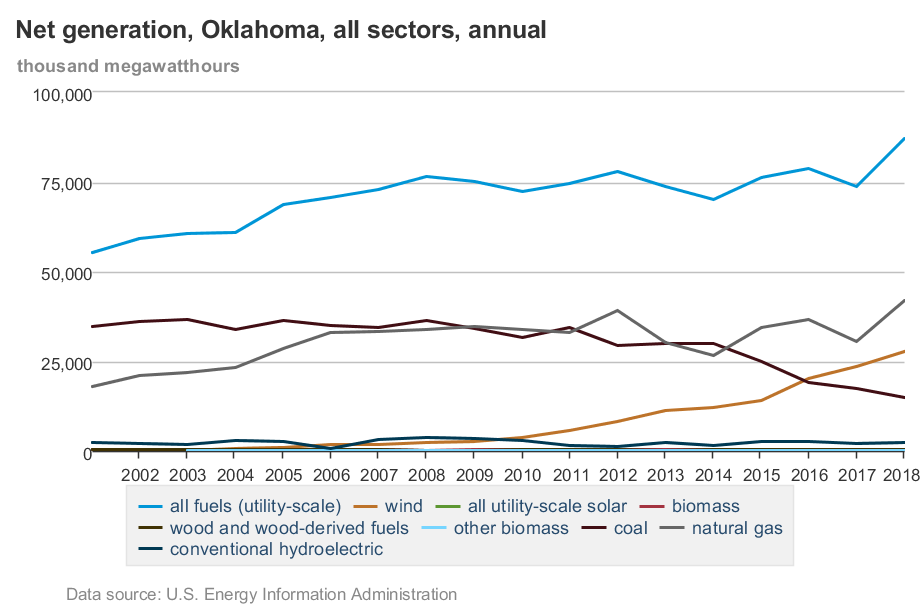

Guys, let's not get snippy. This chart may help clarify what is going on in Oklahoma. I extracted it from Electricity Data Browser I encourage people to play with this data viewer.

The chart indicates the OK coal generation began to decline in the early 2000s. At first natural gas was filling the state's growing power consumption, but gas generation looks to have plateaued since mid 2000s to present (although there was recent uptick in demand in 2018). The clear growth story has been wind which started to take off in mid 2000s. Wind crossed over coal in 2018, and looks to be able to surpass natural gas in a few years. Had there not ben such a strong uptick in consumption in 2018, natural gas and wind would have been neck and neck. Solar is not a big player in Oklahoma. Hydro and pumped hydro storage help round out the renewable supply.

The chart indicates the OK coal generation began to decline in the early 2000s. At first natural gas was filling the state's growing power consumption, but gas generation looks to have plateaued since mid 2000s to present (although there was recent uptick in demand in 2018). The clear growth story has been wind which started to take off in mid 2000s. Wind crossed over coal in 2018, and looks to be able to surpass natural gas in a few years. Had there not ben such a strong uptick in consumption in 2018, natural gas and wind would have been neck and neck. Solar is not a big player in Oklahoma. Hydro and pumped hydro storage help round out the renewable supply.

AwlBidnz

Old Guy to be driven around for yrs to come

Again, those are the electric numbers. MUCH more work is needed before we should try to convince investors the petroleum death grip has ended. As I am sure you have or will soon hear about how the economics are not real for the boom in horizontally frac’d wells...It is true! While it hasn’t ended, the horizontal. “mining” frenzy is losing luster... We do need to keep looking for replacements!

We need to diligently learn all we can about all renewables and how best to implement them, in the market place, before we are forced to... But, then again, when has the human race done anything without being pushed?

We need to diligently learn all we can about all renewables and how best to implement them, in the market place, before we are forced to... But, then again, when has the human race done anything without being pushed?

Sorry, but I'm not following what your concern about Oklahoma is. The oil market is largely global and at this this point any incremental US oil production is going right into the export column. The key driver of your local economics of drilling is simply the global price of oil, which is set by the global balance of supply and demand.Again, those are the electric numbers. MUCH more work is needed before we should try to convince investors the petroleum death grip has ended. As I am sure you have or will soon hear about how the economics are not real for the boom in horizontally frac’d wells...It is true! While it hasn’t ended, the horizontal. “mining” frenzy is losing luster... We do need to keep looking for replacements!

We need to diligently learn all we can about all renewables and how best to implement them, in the market place, before we are forced to... But, then again, when has the human race done anything without being pushed?

Please tell us what market you would like to discuss. I think many of us are simply confused about what exactly you are trying to address here.

AwlBidnz

Old Guy to be driven around for yrs to come

Sorry, but I'm not following what your concern about Oklahoma is. The oil market is largely global and at this this point any incremental US oil production is going right into the export column. The key driver of your local economics of drilling is simply the global price of oil, which is set by the global balance of supply and demand.

Please tell us what market you would like to discuss. I think many of us are simply confused about what exactly you are trying to address here.

Just to be clear, I didn’t bring up OK. My interest is the global markets effect on the US.

mblakele

FSD Beta (99)

As Tesla shareholders, we are painfully aware of how much the price of oil can move this stock. The stock is correlated with oil in the market whether we whether a fundamental connection exists or not.

Worse yet, oil has become quite volatile since it began falling in mid 2014. It has been in oversupply fir two years and has accumulated an historically high inventory of oil in stirage. The economics of storage tends to place both a lower and upper bound on the price of oil for the foreseeable future. I believe the lower bound is in range of $25 to $30 and the upper bound $40 to $45. These bounds depend on the oil futures curve and the cost and availability of storage capacity so long as the market is in oversupply. Thus, with these caveats, oil is likely range bound.

Tesla investors can use this information to hedge oil sensitivity out of their Tesla position or to make a conscious choice to be net long or net short oil. The purpose of this thread is to discuss oil trade and how to manage oil price risk as a Tesla investor.

Every once in a while it can be helpful to remember the first post in a thread. I'll emphasize the last sentence:

The purpose of this thread is to discuss oil trade and how to manage oil price risk as a Tesla investor.

As I elluded to previously, data is easily manipulated. From your referenced website of the EIA there is another table showing the BTU production from fossil fuels and renewables. I assume you know what BTU's are. The US total BTU production for renewables in 2016 was 12%. Oklahoma was 6%. Any ideas why those "averages" are so different? Could it be that electricity is only one component of energy use? The spreadsheet from the EIA is attached. I apologize for the "old talking points". It seems the EIA has only compiled & released their results thru 2016.

As you obviously do not live in Edmond, our electric utility does not offer off-peak rates for electricity. It is an issue we are working on as OG&E does offer reduced rates for large users and off-peak.

Instead of just trying to shame me by calling me a troll or that I am using old talking points, please tell me what points are ten years old & which of those are no longer correct?

Renewables have huge potential for many energy applications and also potential environmental benefits. The all-in costs of any energy source needs to be understood, as well as, the "all-in" environmental benefits. Rose colored glasses never work well for that "all-in" evaluation.

Are you really having trouble understanding that I live in Oklahoma AND need that as one of your "talking points"?

I feel that the others have addressed your points sufficiently, but just for my own curiousity, why are you hung up on "energy" consumption and not "electricity" consumption when espousing the old talking point about the grid not being able to handle the load?

mspohr

Well-Known Member

I'm always impressed by these charts. Especially the "Rejected Energy" category which is most (> 60%) of the energy and is all waste.

It just shows how inefficient fossil fuels are in meeting our energy needs. Solar and wind electricity have only a small amount of waste due to transmission losses (and this get smaller as solar and wind are distributed near the source of use).

Similar threads

- Replies

- 1

- Views

- 480

- Replies

- 0

- Views

- 753

- Replies

- 19

- Views

- 4K

- Replies

- 3

- Views

- 475