Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tax Bill and EV Tax Credit Discussion

- Thread starter UZJedi

- Start date

-

- Tags

- Model 3 tax credit

WileyTheMan

Peanut Gallery Member

I wouldn't go as far as to say that. To hinge your success on a tax credit which can be repealed at any time would have been a poor business decision. The whole point of Tesla is to make enticing vehicles that happened to be electric. This means price point as well as the car itself. The tax credit was just icing on the top for Tesla....while Tesla's success hinges on EV tax credit and Model 3 for 2018.

turnbowm

Member

The Model 3 is most definitely a "make or break" situation for Tesla but I don't think their success hinges on the tax credit. For someone buying a $100,000 model S or X, the $7500 tax credit is a minor consideration.I'm not sure I get your point. Other car manufacture sell millions of cars a year who can post a profit while Tesla is burning cash through expansion. This will hurt EV adoption for Tesla more than other manufactures. The big names like Toyota, Ford, Honda, Nissan etc can afford to slowly ramp up production while Tesla's success hinges on EV tax credit and Model 3 for 2018.

So sad to think our government can’t do the right thing and support innovation and green energy. This is partisan politics at its worst. There is FINALLY some progress in E.V. technology and adoption that could lead a healthier economic revolution yet these idiots in congress cant put practical pro environmental policy ahead of their pocket books.

yup, its toast guys

SA 1746. Mr. FLAKE submitted an amendment intended to be proposed to

amendment SA 1618 proposed by Mr. McConnell (for Mr. Hatch (for himself

and Ms. Murkowski)) to the bill H.R. 1, to provide for reconciliation

pursuant to titles II and V of the concurrent resolution on the budget

for fiscal year 2018; which was ordered to lie on the table; as

follows:

At the appropriate place, insert the following:

SEC. ____. TERMINATION OF CREDIT FOR NEW QUALIFIED PLUG-IN

ELECTRIC DRIVE MOTOR VEHICLES.

(a) In General.--Subpart B of part IV of subchapter A of

chapter 1 is amended by striking section 30D (and by striking

the item relating to such section in the table of sections

for such subpart).

(b) Conforming Amendments.--

(1) Section 38(b) is amended by striking paragraph (35).

(2) Section 1016(a) is amended by striking paragraph (37).

(3) Section 6501(m) is amended by striking ``30D(e)(4),''.

(c) Effective Date.--The amendments made by this section

shall apply to vehicles placed in service in taxable years

beginning after December 31, 2017.

geneclean55

Active Member

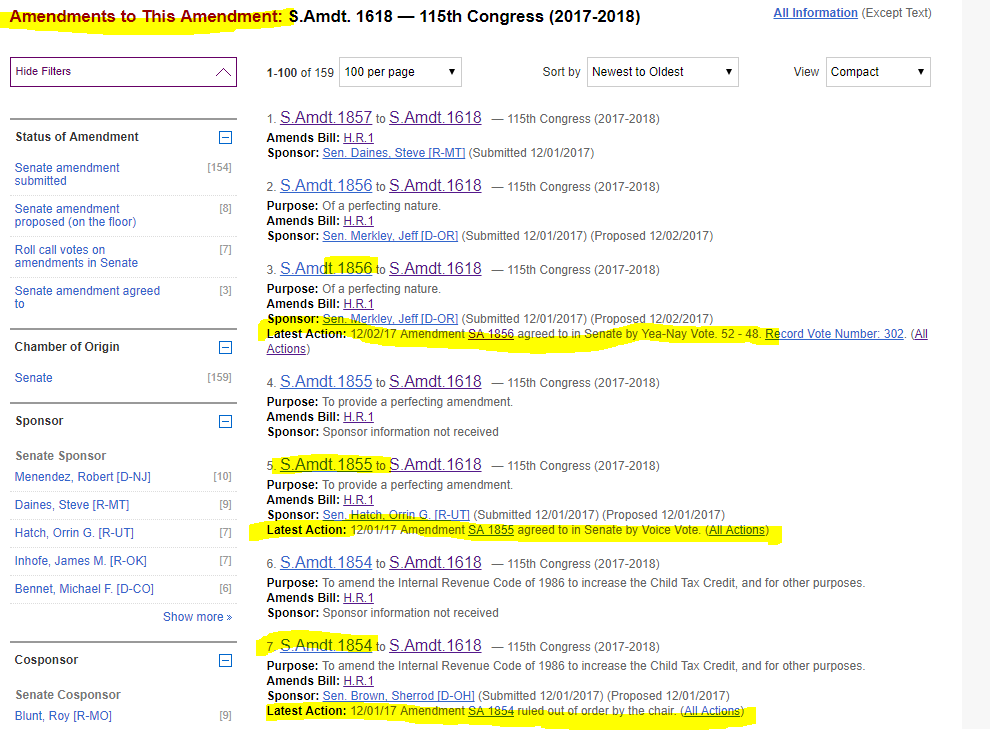

Nope. They were proposed amendments. Many of which came from democratic senators. Even some proposed by republican senators were considered "out of order" and rejected. Go through that list yourself. We are looking for the agreed to amendments.at S.Amdt.1618 to H.R.1 - 115th Congress (2017-2018) - Amendment Text

the 1618 substitute bill itself doesn't have the 30D repeal, but the list of passed additional amendments to 1618 refers to 1746 which has the 30D repeal language. . .

What we need to see is the "engrossed senate tax bill" that has the final language of the senate tax bill after the vote late last night.

This document may not even be publicly available yet.

SeaDoc

2018 P3 on FSD Beta & 2022 X Plaid FSD

After yesterday's vote by the Senate, I have become a clean air liberal, who will continue to do everything in my power to pursue clean energies as well as do everything in my power to get every right-wing loonie tune out of Congress and the White House. It has become my life's goal as I drive from SuperCharger to SuperCharger, and hope to meet other Tesla owners with similar goals... I bet Elon's glad he dumped working with Trump... Good Riddance, I say...

Esme Es Mejor

Member

I ain’t even mad.

It’s terrible policy— phasing out the end of the credit over 2-3 years, and pairing it with the elimination of fossil fuel subsidies would have been good policy— but governments rarely make good policy.

The saving grace is that this really won’t slow down Tesla or EVs or sustainable transportation. That growth will be concentrated in Europe and Asia (and in US trucking) before making its way to the US. But these politicians aren’t stopping that growth— they’re just moving it to more thoughtful locations.

It’s terrible policy— phasing out the end of the credit over 2-3 years, and pairing it with the elimination of fossil fuel subsidies would have been good policy— but governments rarely make good policy.

The saving grace is that this really won’t slow down Tesla or EVs or sustainable transportation. That growth will be concentrated in Europe and Asia (and in US trucking) before making its way to the US. But these politicians aren’t stopping that growth— they’re just moving it to more thoughtful locations.

mtndrew1

Active Member

It’s terrible policy— phasing out the end of the credit over 2-3 years, and pairing it with the elimination of fossil fuel subsidies would have been good policy

The thing as implemented by the Bush Administration already had a built-in sunset on it. 200k cars per manufacturer then it goes away. It wasn’t some open-ended tax credit.

Nope. They were proposed amendments. Many of which came from democratic senators. Even some proposed by republican senators were considered "out of order" and rejected. Go through that list yourself. We are looking for the agreed to amendments.

What we need to see is the "engrossed senate tax bill" that has the final language of the senate tax bill after the vote late last night.

This document may not even be publicly available yet.

hmm. I hope you are right. I read "Amendments to This Amendment" to be those amendments that actually did amend because they passed. but maybe not. If those are just all the amendments proposed, whether they passed or not, then we still don't know for sure.

edit to add: it looks 1806 was submitted by Kamala Harris, and without looking to see what it was, I doubt it was agreed to. So if that list isn't the list of amendments that actually passed, then were the F is it?

deonb

Active Member

I ain’t even mad.

It’s terrible policy— phasing out the end of the credit over 2-3 years, and pairing it with the elimination of fossil fuel subsidies would have been good policy— but governments rarely make good policy.

The saving grace is that this really won’t slow down Tesla or EVs or sustainable transportation. That growth will be concentrated in Europe and Asia (and in US trucking) before making its way to the US. But these politicians aren’t stopping that growth— they’re just moving it to more thoughtful locations.

Me neither. EV's are here to stay. Enough other countries have passed laws that effectively mandate EV's.

It's just that the people in those countries will be driving cars called BYD or Kandi instead of cars called FORD or GM.

And instead of being able to tax the industry on trillions of yummy foreign-earned dollars on the cars they would have exported in the future, they get to save a couple of billion now. Woo-hoo!

C'est la vie.

Esme Es Mejor

Member

I know, but that was a really dumb way to sunset it— incentivizes a slow rollout, since latecomers end up with a competitive advantage over early movers on EV. Bad policy.The thing as implemented by the Bush Administration already had a built-in sunset on it. 200k cars per manufacturer then it goes away. It wasn’t some open-ended tax credit.

Phasing it out on a time table (2-3 years), rather than sales numbers, incentivizes auto makers to get EVs on the market as soon as possible & doesn’t give advantages to slow-moving automakers. Good policy.

Of course, Congress chose the worst of all possible choices.

Esme Es Mejor

Member

It's just that the people in those countries will be driving cars called BYD or Kandi instead of cars called FORD or GM.

True. But mainly they’ll be driving Teslas instead of Ford or GM. Maybe my optimism is crazy, but I believe Tesla is more powerful than Congress.

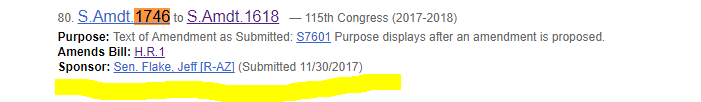

This now takes me full circle -- I don't think the Senate bill repealed the EV tax credit. Flake's 1746 amendment didn't pass. and the repeal wasn't in the substitute bill 1618 which did pass, and we don't know the repeal to be in any other amendment that did actually pass.

I think which amendments were agreed to is found at this page which shows amendments that passed, ruled out of order, or lay still born.

1746 seems to be in the still born category: no "Latest action" showing that it passed:

@ohmman I move to change the thread title

edit to add: this analysis agrees: Federal EV tax credit appears to have been left intact and unchanged in the Senate's tax bill. • r/teslamotors

were the F is it?

I think which amendments were agreed to is found at this page which shows amendments that passed, ruled out of order, or lay still born.

1746 seems to be in the still born category: no "Latest action" showing that it passed:

@ohmman I move to change the thread title

edit to add: this analysis agrees: Federal EV tax credit appears to have been left intact and unchanged in the Senate's tax bill. • r/teslamotors

Last edited:

turnbowm

Member

Tesla is certainly higher in approval rating.True. But mainly they’ll be driving Teslas instead of Ford or GM. Maybe my optimism is crazy, but I believe Tesla is more powerful than Congress.

I completely agree. Tesla is the winner here as the competition will have a much harder time competing. Telsa was about to be at a competitive disadvantage. No longer. Sorry VW.Elimination of the tax credit will have a telling effect on the PHEV/EV market. I'm sure that Tesla is celebrating, since this will eliminate a net cost advantage that competitors would have enjoyed downstream.

The Model 3 is most definitely a "make or break" situation for Tesla but I don't think their success hinges on the tax credit. For someone buying a $100,000 model S or X, the $7500 tax credit is a minor consideration.

But for those buying the Model 3 it does. 7500 is a 15% discount on the first production LR model - or if you want, the way it gets to similar price with BMW 3 series. I will consider other cars without the incentives.

dhrivnak

Active Member

Unfortunate but that is your loss.But for those buying the Model 3 it does. 7500 is a 15% discount on the first production LR model - or if you want, the way it gets to similar price with BMW 3 series. I will consider other cars without the incentives.

I completely agree. Tesla is the winner here as the competition will have a much harder time competing. Telsa was about to be at a competitive disadvantage. No longer. Sorry VW.

It is not only about competing with other electric cars. It is about competing with plug-in EVs. I can drive electric (in a grandmotherly kind of way) and hardly ever use gasoline in many offers today (BMW iPerformance series, MB C350e etc etc). Too bad pure EVs will be hit by this change. And talk about lack of vision to take world leadership in the electric revolution.......

Unfortunate but that is your loss.

Yes, it is; I imagine others will have a similar loss. Too bad that our leaders fail to take real opportunities.

SMAlset

Well-Known Member

To me if you wanted to continue to improve air quality and cut expenditures, continue the EV credit but only for Zero emmision vehicles, dump the plug-in credit on those "compliance" vehicles. For the vast majority of those miles able to be driven on those cars, they still put out more carbon emissions than not.

Similar threads

- Replies

- 1

- Views

- 282

- Replies

- 11

- Views

- 1K

- Replies

- 51

- Views

- 6K

- Sticky

- Replies

- 387

- Views

- 21K

- Replies

- 1

- Views

- 545