mspohr

Well-Known Member

Why would people get mad at this?Tesla energy is riding a number of exponential curves. Battery cost, solar costs, renewable switchover plus GDP growth:

Access to energy is good. It's just fossil energy which is bad.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Why would people get mad at this?Tesla energy is riding a number of exponential curves. Battery cost, solar costs, renewable switchover plus GDP growth:

Nice - I wonder if these are Frequency Response units solely or if these will be charged by solar panels to help during the peak hours. Cool nevertheless (and hopefully Tesla will expand their grid-scale development overseas…)

Energy is now about 6% of total revenue. Now that it has similar margins you could compare that to selling around 30k extra cars per quarter. With higher yearly growth than cars this should continue to be more and more significant.

Tesla has setup the Virtual Power Plant (utilizing customer Powerwalls) in MA, CT and RI.

They keep 20% of the compensation (they receive 100% from the Utility company and pass on 80% to the homeowner).

As these programs continue to scale across the country, I suspect the margins will be huge.

View attachment 963295

20% of the profits for a service that is nearly automated sounds amazing. Tesla could well make more from energy trading over the life of the powerwall than they make from the initial sale. Or to put another way, Tesla could probably give the powerwalls away for free and still come out ahead over the life of the asset.

Energy trading desks at banks and other trading shops are extremely lucrative if done correctly (particularly when there are market dislocations) - It's a shame Tesla can only scale as fast as it's battery storage.

If the market treats this as recurring revenue it will also attract juicy valuation multiples.

Looks like getting mega pack and new switch yard at giga Texas factory can’t come sone enough. I wonder if they have had to reduce usage this summer?

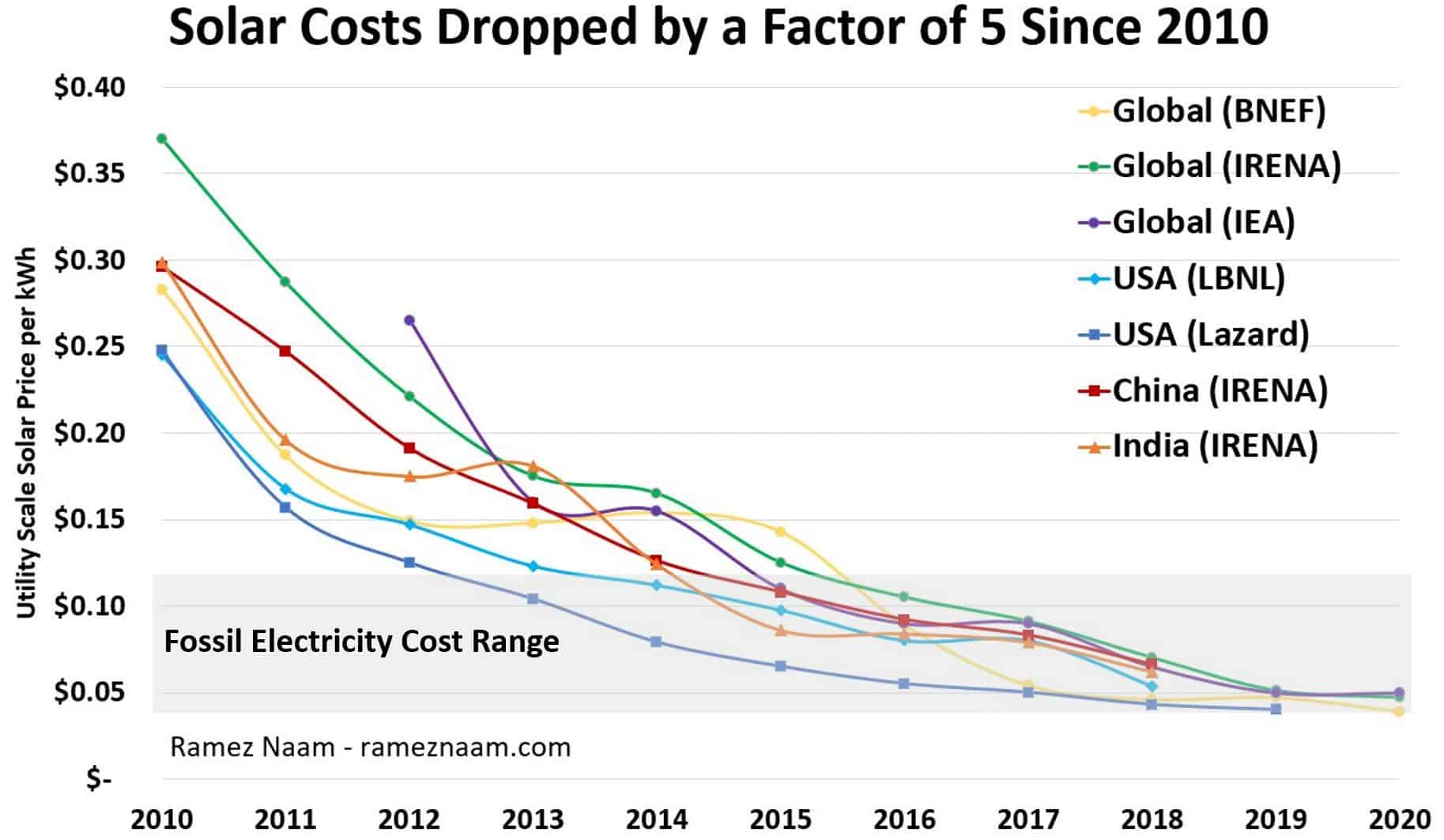

So what? The IEA forecasts have been consistently wrong on renewable energy market projections, both for cost declines and production volume growth. Badly wrong, over and over and over again. There is systematic estimation bias that they still have not fixed. Why should we believe their latest estimates?

Look at these charts. This is an embarrassment.

View attachment 967111

View attachment 967110

Solar's Future is Insanely Cheap (2020)

This is part 1 of a series where I'll look at the future costs of clean energy and mobility technologies. This is a refresh of and expansion of my 2015 series on the future oframeznaam.com

^This whole article is good and has more charts like these two.

Press release from Texas Public Utilities Commission. First VPPs (or Aggregate Distributed Energy Resources - ADERs) are online on the Texas grid (ERCOT) made up of Tesla Powerwalls.

View attachment 967617