Spidey616

Member

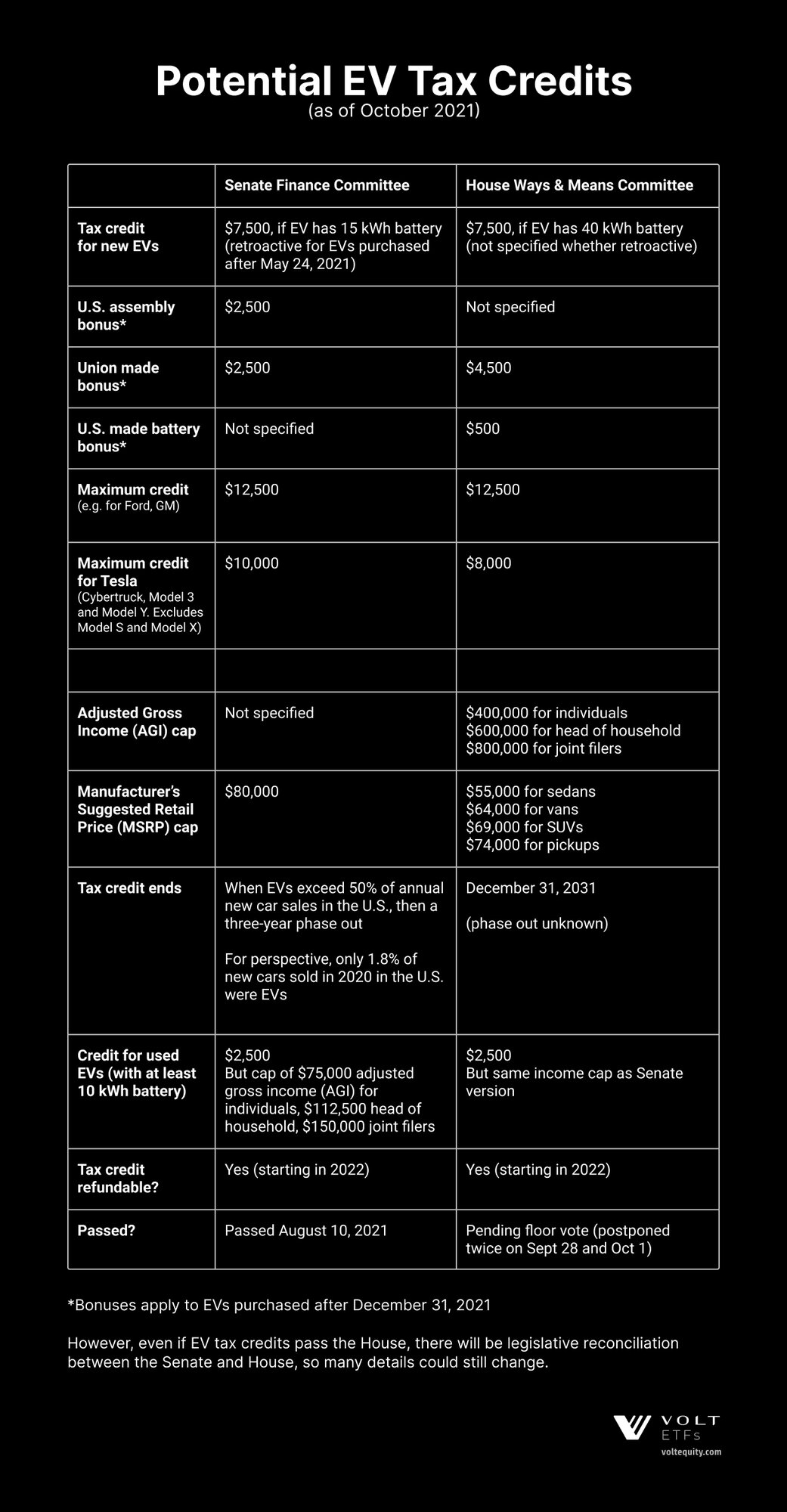

Until we hear otherwise the White House release sounds like they picked up the legislation from the House Ways and Means. Look at the right column for what that covers. Via Latest on Tesla EV Tax Credit (October 2021) - Current and Upcoming in 2022