Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla Investor's General Macroeconomic / Market Discussion

- Thread starter FluxCap

- Start date

[N.B. Hope you will indulge me in a bit of an holiday aside today. If not, feel free to skip to the links for more on-topic thoughts.]

Hope everyone has an enjoyable Memorial Day holiday. I'm currently remembering my grandfather, who risked his life under heavy fire to save wounded squadmates in Okinawa, who were fighting his generation's forces of fascism and authoritarianism. He fought while his wife raised his daughter back home, who was born while he was fighting. He only lost a small chunk of skin on one ear saving those lives, and he made it home. A devout Catholic, he resolved almost out of penance for the lives he took in battle to pour as much love and kindness as he could into my mother and later her devoted husband and their children. He was not without deep scars to his psyche that would haunt him until his dying day, but he did everything he could to keep these wounds from interfering with the love he showed his family. He is a hero to me and to my family.

My grandfather wished to impart to me relentless and unyielding dedication to care and love for those in need, but also vigilance against the forces of human weakness, malice and cruelty that we humans cannot ever be fully rid of. He knew that the forces of fascism, cruelty and dictatorship can and do arise in unexpected places, usually out of fear, and their Nationality is not conveniently limited to that of past perpetrators. I am confident my grandfather would be horrified and saddened by what is happening in a portion of our country today including in its elected leadership, and I am unsure what he would try to do about it, other than keep working in a job he didn't particularly enjoy to provide for his family, and continue trying to show as much love as he could to his family and those in need of help.

Turning a bit back to our discussions here --

On Memorial Day, there are often a lot of "lists" out there, but as a fund manager I l enjoyed this 10 Memorial Day Reads from investment manager Barry Ritholtz:

10 Memorial Day Reads - The Big Picture

One of those 10 articles is on the continuing subject of the possible extent of compromise of the current administration. This is written by a former intelligence analyst, citing members of the current intelligence community:

Exclusive: NSA Chief Admits Donald Trump Colluded With Russia

If true, this amounts to a fearful, unhinged sitting President attempting to order the United States Federal counterintelligence and intelligence forces to attack the United States Federal police force on his behalf, all of which are populated by people no less dedicated to protecting American lives and freedoms than the men and women with rifles who stand watch in our armed services on the front lines. It is not unlike the President asking our Navy to attack our Coast Guard. They are not his armed forces, spies or police. They are our armed forces, spies and police, sworn to protect and defend all of us from enemies foreign and domestic. It is, simply, an(other) impeachable offense that cannot be defended by anyone who respects the US Constitution and rule of law. I have trouble seeing how these actions will have no consequences for Trump and what appears to be a deeply, deeply compromised administration. And I have trouble seeing how those consequences do not create at least some market volatility later this year, which is my job to predict.

But today amidst the cheeseburgers and revelry, I remember my grandfather and those like him, whose greatest accomplishment was not exercising strength to kill enemies, but preserving love, hope and peace in the men he saved, in his own family, and to the extent he could, in his own heart and mind, against the odds.

Hope everyone has an enjoyable Memorial Day holiday. I'm currently remembering my grandfather, who risked his life under heavy fire to save wounded squadmates in Okinawa, who were fighting his generation's forces of fascism and authoritarianism. He fought while his wife raised his daughter back home, who was born while he was fighting. He only lost a small chunk of skin on one ear saving those lives, and he made it home. A devout Catholic, he resolved almost out of penance for the lives he took in battle to pour as much love and kindness as he could into my mother and later her devoted husband and their children. He was not without deep scars to his psyche that would haunt him until his dying day, but he did everything he could to keep these wounds from interfering with the love he showed his family. He is a hero to me and to my family.

My grandfather wished to impart to me relentless and unyielding dedication to care and love for those in need, but also vigilance against the forces of human weakness, malice and cruelty that we humans cannot ever be fully rid of. He knew that the forces of fascism, cruelty and dictatorship can and do arise in unexpected places, usually out of fear, and their Nationality is not conveniently limited to that of past perpetrators. I am confident my grandfather would be horrified and saddened by what is happening in a portion of our country today including in its elected leadership, and I am unsure what he would try to do about it, other than keep working in a job he didn't particularly enjoy to provide for his family, and continue trying to show as much love as he could to his family and those in need of help.

Turning a bit back to our discussions here --

On Memorial Day, there are often a lot of "lists" out there, but as a fund manager I l enjoyed this 10 Memorial Day Reads from investment manager Barry Ritholtz:

10 Memorial Day Reads - The Big Picture

One of those 10 articles is on the continuing subject of the possible extent of compromise of the current administration. This is written by a former intelligence analyst, citing members of the current intelligence community:

Exclusive: NSA Chief Admits Donald Trump Colluded With Russia

If true, this amounts to a fearful, unhinged sitting President attempting to order the United States Federal counterintelligence and intelligence forces to attack the United States Federal police force on his behalf, all of which are populated by people no less dedicated to protecting American lives and freedoms than the men and women with rifles who stand watch in our armed services on the front lines. It is not unlike the President asking our Navy to attack our Coast Guard. They are not his armed forces, spies or police. They are our armed forces, spies and police, sworn to protect and defend all of us from enemies foreign and domestic. It is, simply, an(other) impeachable offense that cannot be defended by anyone who respects the US Constitution and rule of law. I have trouble seeing how these actions will have no consequences for Trump and what appears to be a deeply, deeply compromised administration. And I have trouble seeing how those consequences do not create at least some market volatility later this year, which is my job to predict.

But today amidst the cheeseburgers and revelry, I remember my grandfather and those like him, whose greatest accomplishment was not exercising strength to kill enemies, but preserving love, hope and peace in the men he saved, in his own family, and to the extent he could, in his own heart and mind, against the odds.

The Blue Owl

Endangerous Herbivore

Another excellent link. Thanks for posting it.[N.B. Hope you will indulge me in a bit of an holiday aside today. If not, feel free to skip to the links for more on-topic thoughts.]

Exclusive: NSA Chief Admits Donald Trump Colluded With Russia

Here are three key paragraphs:

This week’s town hall event, which was broadcast to agency facilities worldwide, was therefore met with surprise and anticipation by the NSA workforce, and Rogers did not disappoint. I have spoken with several NSA officials who witnessed the director’s talk and I’m reporting their firsthand accounts, which corroborate each other, on condition of anonymity.

In his town hall talk, Rogers reportedly admitted that President Trump asked him to discredit the FBI and James Comey, which the admiral flatly refused to do. As Rogers explained, he informed the commander in chief, “I know you won’t like it, but I have to tell what I have seen”—a probable reference to specific intelligence establishing collusion between the Kremlin and Team Trump.

Rogers then added that such SIGINT exists, and it is damning. He stated, “There is no question that we [meaning NSA] have evidence of election involvement and questionable contacts with the Russians.” Although Rogers did not cite the specific intelligence he was referring to, agency officials with direct knowledge have informed me that DIRNSA was obviously referring to a series of SIGINT reports from 2016 based on intercepts of communications between known Russian intelligence officials and key members of Trump’s campaign, in which they discussed methods of damaging Hillary Clinton.

A highly recommended read.In his town hall talk, Rogers reportedly admitted that President Trump asked him to discredit the FBI and James Comey, which the admiral flatly refused to do. As Rogers explained, he informed the commander in chief, “I know you won’t like it, but I have to tell what I have seen”—a probable reference to specific intelligence establishing collusion between the Kremlin and Team Trump.

Rogers then added that such SIGINT exists, and it is damning. He stated, “There is no question that we [meaning NSA] have evidence of election involvement and questionable contacts with the Russians.” Although Rogers did not cite the specific intelligence he was referring to, agency officials with direct knowledge have informed me that DIRNSA was obviously referring to a series of SIGINT reports from 2016 based on intercepts of communications between known Russian intelligence officials and key members of Trump’s campaign, in which they discussed methods of damaging Hillary Clinton.

Edited to add: equally important is the background of the author:

John Schindler is a security expert and former National Security Agency analyst and counterintelligence officer. A specialist in espionage and terrorism, he’s also been a Navy officer and a War College professor. He’s published four books and is on Twitter at @20committee.

This won't go down well - but I doubt the market will respond currently;

Assuming it goes through, I'm marking this down as another, pending uncorrected risk in the spring load of macro-risk

Trump expected to pull out of Paris climate agreement

Assuming it goes through, I'm marking this down as another, pending uncorrected risk in the spring load of macro-risk

Trump expected to pull out of Paris climate agreement

The market is likely to react very unfavorably at 3pm EST tomorrow. I'm wondering just how much total cap the American stock exchanges are going to shed.

Already priced in, IMO. Indexes barely flinched when the news came out yesterday.

Now, if he decides to flip to full support, that could cause a reaction, particularly from "energy" (aka legacy energy) stocks, as markets tend to not like surprises.

Dow races to new record

S&P 500: All-time High

Dow: All-time High

Nasdaq: All-time High

NYSE: All-Time High

Dow Global: All-time High

S&P 500: new all-time high today along with 7 sectors... Tech, Consumer Discretionary, Utilities, Health Care, Staples, Industrials Materials.

S&P 500: All-time High

Dow: All-time High

Nasdaq: All-time High

NYSE: All-Time High

Dow Global: All-time High

S&P 500: new all-time high today along with 7 sectors... Tech, Consumer Discretionary, Utilities, Health Care, Staples, Industrials Materials.

Last edited:

UnknownSoldier

Unknown Member

Already priced in, IMO. Indexes barely flinched when the news came out yesterday.

Now, if he decides to flip to full support, that could cause a reaction, particularly from "energy" (aka legacy energy) stocks, as markets tend to not like surprises.

Well, you were right! Now let's all join hands and sing "Kumbaya" together while admiring our stock portfolios

(TSLA was actually down slightly today, oh well)

Limited on time- so quick post I wanted to get in over the weekend-

I'm upping the macro danger level from

Yellow Caution to

Orange Hard Watch

A week ago Bond spreads flattened significantly to under 1 and have held and actually moved down a bit more. The Bond market is inapposite to Equity. It's clearly predicting more risk and possible down turn or at least roll-over (anytime from now to 6 months out or so);

It's been reacting to both data and Poli-Social as well as evaluation of Trump policy moves. It correctly predicted the anemic jobs report for example. There are other markers as well that support this conclusion, but no time to cover them all currently.

Anyway- nothing catastrophic here, as rates still low (but will rise), and US economy/earnings rolling over, but OK;

This should place a red flag for you relative to how you leverage and plan for the coming months.

Remember the Bond market is usually a better predictor of future economic performance that the more volatile Equities market; It's also twice the size (US)

gotta run---

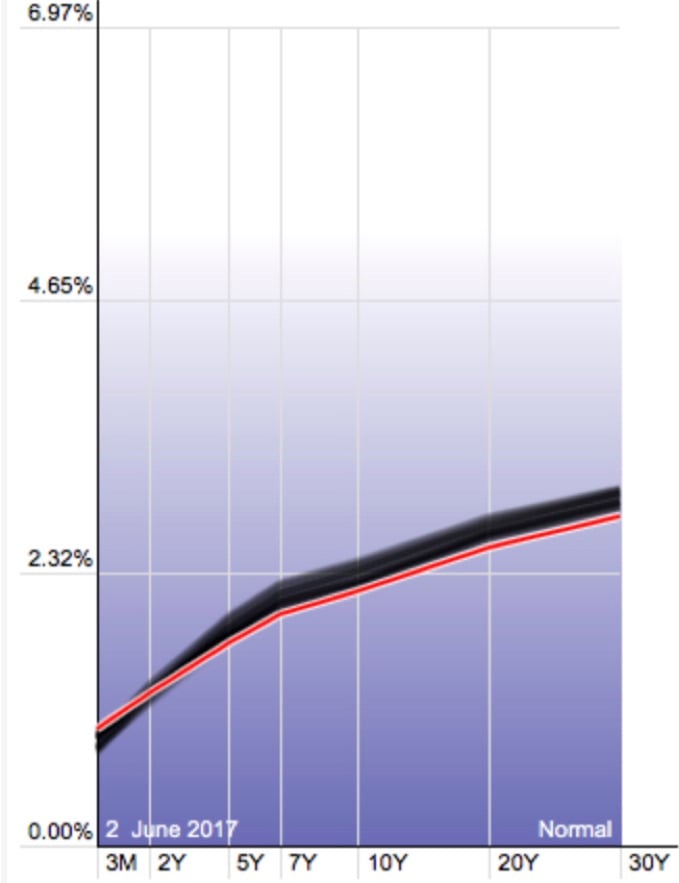

shadow trail showing how yield curve is trending to flat over past month

Yield spread approaching lowest in several years and continuing-

I'm upping the macro danger level from

Yellow Caution to

Orange Hard Watch

A week ago Bond spreads flattened significantly to under 1 and have held and actually moved down a bit more. The Bond market is inapposite to Equity. It's clearly predicting more risk and possible down turn or at least roll-over (anytime from now to 6 months out or so);

It's been reacting to both data and Poli-Social as well as evaluation of Trump policy moves. It correctly predicted the anemic jobs report for example. There are other markers as well that support this conclusion, but no time to cover them all currently.

Anyway- nothing catastrophic here, as rates still low (but will rise), and US economy/earnings rolling over, but OK;

This should place a red flag for you relative to how you leverage and plan for the coming months.

Remember the Bond market is usually a better predictor of future economic performance that the more volatile Equities market; It's also twice the size (US)

gotta run---

shadow trail showing how yield curve is trending to flat over past month

Yield spread approaching lowest in several years and continuing-

Tragedy in London today.

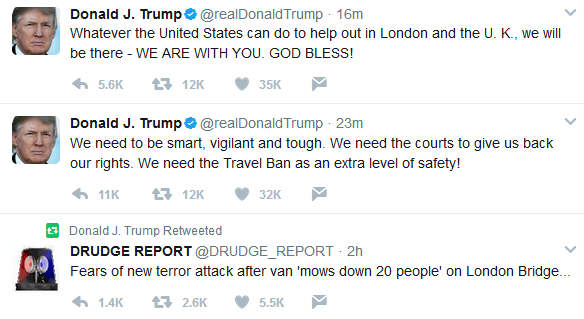

True to his paranoid/opportunistic form, the current President of the United States first retweeted a sensationalist tabloid, then used these deaths in London to plug an illegal policy, then finally offered support to victims in London two hours later:

I am currently theorizing that this behavior is consistent with a pattern suggesting that Trump and many in his administration want to create a war, which historically drums up support for unpopular Presidents and tends to overshadow other problems they face. We already know that using small attacks to spark a holy war with the "West" is the explicit goal of many ISIS-affiliated terrorists. I'm now also looking past Putin's goals of dismantling and destabilizing NATO to what country he would most like to attack outside Eastern Europe, and trying to figure out which timeline will complete first: Trump's war plans or Mueller's investigation into Trump & associates Russia compromise that will likely produce indictments that could blunt Trump's war ambitions. I'm then trying to theorize what either scenario could do to global markets. I suppose it's entirely possible it does nothing, or causes a rally, or causes a crash. But it does not feel to me like the smooth sailing, ultra-low volatility, super-low interest rate, risk-on party in the markets will last another year.

Independent of these global risks, Tesla remains one of the best companies on the planet, and assuming the Model 3 launch goes off as planned in July, I can see more upside for TSLA before any global / macro risk eventually takes hold.

True to his paranoid/opportunistic form, the current President of the United States first retweeted a sensationalist tabloid, then used these deaths in London to plug an illegal policy, then finally offered support to victims in London two hours later:

I am currently theorizing that this behavior is consistent with a pattern suggesting that Trump and many in his administration want to create a war, which historically drums up support for unpopular Presidents and tends to overshadow other problems they face. We already know that using small attacks to spark a holy war with the "West" is the explicit goal of many ISIS-affiliated terrorists. I'm now also looking past Putin's goals of dismantling and destabilizing NATO to what country he would most like to attack outside Eastern Europe, and trying to figure out which timeline will complete first: Trump's war plans or Mueller's investigation into Trump & associates Russia compromise that will likely produce indictments that could blunt Trump's war ambitions. I'm then trying to theorize what either scenario could do to global markets. I suppose it's entirely possible it does nothing, or causes a rally, or causes a crash. But it does not feel to me like the smooth sailing, ultra-low volatility, super-low interest rate, risk-on party in the markets will last another year.

Independent of these global risks, Tesla remains one of the best companies on the planet, and assuming the Model 3 launch goes off as planned in July, I can see more upside for TSLA before any global / macro risk eventually takes hold.

<snip> Trump and many in his administration want to create a war, which historically drums up support for unpopular Presidents and tends to overshadow other problems they face. <snip>

I generally try to stay out of the political discussions for various reasons (including because it's just depressing), but I think the likelihood of this happening is very high for the reasons you state. If it does happen, it may turn out to be a non-event from the perspective of investors depending on who the administration picks a fight with. Or not.

I generally try to stay out of the political discussions for various reasons (including because it's just depressing), but I think the likelihood of this happening is very high for the reasons you state. If it does happen, it may turn out to be a non-event from the perspective of investors depending on who the administration picks a fight with. Or not.

Trump's method of operation is to invest in something and then ham it up so much everyone involved in carrying it out gets hurt. On the foreign policy front as many have suggested McMaster's reputation is the latest casualty, following on the retreat from Pence's effort to sell the manufactured story for Comey's firing (I mean, resignation, for those of you enthralled by Fox News). Spicer and others are on the firing line daily but now seem to insulate themselves by suggesting reporters "ask him" who makes the decisions.

It appears the likely target for a next strike by the administration in foreign affairs would likely be North Korea and people are already aghast at Trump's ignorance of nuclear weapons and nuclear weapons strategic thinking over the years, as was Reagan, incidentally, but he had Jim Baker at his side and listened to him. A direct strike against North Korea is less likely because the South and Japan (which has experienced the effects of nuclear weapons) will always be countervailing forces. China too. Again, in this scenario the likely state losers are collateral damage like McMaster as a person of integrity and high talent.

Fluxcap was also concerned about Putin's next aggression outside Europe. I don't think he will really seek to retake the old territories of the Soviet Union in either the caucuses or the "Stans" to the East. Just as Europe is the hardest hit by refugees and terrorists, thanks to the idiocy of the Iraq War and subsequent occupation policies--dismantling the army and Bathist governmental infrastructure from the gitgo--being just a few of the biggest mistakes. (By favoring Shia over Sunni the War made some of us think Dick Cheney was actually a pawn of Iran.) Russia has a host of problems in the south related to terrorism and despite the Chechen War will depend on Satraps to run things rather than outright annexation. The recent Georgian incident was in part provoked by the Georgians when they moved against South Ossetia. Made me laugh when McCaine said "we are all Georgians now." Crimea is different and the tactical scenario in Ukraine is unlikely to change. I also bet Putin will think twice about any Baltic adventure now that NATO is doing maneuvers there. Any massive preparation would be signaled by lots of increase in conscription, training, and other preparations in Russia itself. They should remember how difficult the so-called Winter War with Finland was in 1940-41. (Few Americans know "Molotov Cocktails" were used by the Finns as a great anti-tank weapon.) I conjecture Putin will stick to guerrilla warfare.

On balance I'm not too concerned about war but the economic impact of Trumpcare is potentially massive, though in the best scenario the Senate will dither and just fail to act.

On the likely crash sometimes the wisdom of a retired economist colleague is comforting. Our economy is massive in size, geographically varied, and technically and structurally variegated as well. It is a beast in scale. And, as always, we exaggerate the role any president can have on it. Most of us here, including present company agree a massive change is happening in the field of energy, far greater than any other forces at work to the contrary. Tesla and company is a key part of that along with the democratizing of energy and knowledge. I'm not sufficiently expert in math to understand complex adaptive systems theory, but our economy and civilization are certainly adaptive systems. Elon Musk and Tesla may just be the attractors we need, not a pipsqueak of a man like Trump.

Limited on time- so quick post I wanted to get in over the weekend-

I'm upping the macro danger level from

Yellow Caution to

Orange Hard Watch

A week ago Bond spreads flattened significantly to under 1 and have held and actually moved down a bit more. The Bond market is inapposite to Equity. It's clearly predicting more risk and possible down turn or at least roll-over (anytime from now to 6 months out or so);

It's been reacting to both data and Poli-Social as well as evaluation of Trump policy moves. It correctly predicted the anemic jobs report for example. There are other markers as well that support this conclusion, but no time to cover them all currently.

Anyway- nothing catastrophic here, as rates still low (but will rise), and US economy/earnings rolling over, but OK;

This should place a red flag for you relative to how you leverage and plan for the coming months.

Remember the Bond market is usually a better predictor of future economic performance that the more volatile Equities market; It's also twice the size (US)

shadow trail showing how yield curve is trending to flat over past month

Yield spread approaching lowest in several years and continuing-

Had some requests to provide more explanation and color for this post- I'm on a big external project currently so have very limited time to post, so apologize for the more cryptic and summary posts.

Here's a bit more detail:

The US Bond market is twice the size of the US equity market and much more conducive for accurately predicting forward states of the economy - this is of course my opinion from experience, but also pretty well established as generally accepted. I use it for tracking across economic macro volatility and historically found it VERY accurate for that purpose -much less so for short term events;

Makes sense given the broad money invested for longer term expectation; close tie to Fed rates, Bank rates and expectations, and much less 'corrupted' by micro-bots and other similar trading. Nothing I've said here is new or controversial etc. It's largely accepted as truthy--

I track multiple macro markers but perhaps the one that singularly provides the best view that easily posted here- is the Bond Spread and the Bond yield curve which shows yields over the common Bond time periods available (3month thru 30year Bonds).

The Yield Curve is an excellent indicator of what the massive Bond market believes about the health of the economy and financial condition of capital markets. (Remember the lower the Yield of any Bond, the higher the demand or buying and vise versa). When short term Bonds are popular their yield goes down and shows invested money believes the value of those will increase over the months of the bond. A 'normal' Yield curve will pay higher Yield for longer terms. i.e. A 10 year bond will pay more interest (higher Yield) than a shorter term 2 year bond- signaling the Bond investor's belief that the economy and capital markets will contuse to grow and expand over the time in between. The steeper the curve, the more that market believes in solid future economic returns of capital. When the curve inverts, short term Bonds are being shunned relative to longer term bonds IOW- the Bond market predicts recession or relative fundamental slowdown risk relative to current conditions. You can see why Bond markets are better suited- since their investors must consider the length and rate of return over a give time period (much more so than equity markets generally).

This would be a healthy Bond Yield curve in today's low interest rate environment and typical for recent past years of Great Recession recovery-

This is the Yield curve (late 2000) preceding the 2001 recession

The Yield curve July 2007 ahead of the 2008 Great Recession (this was prevalent for much of all 2007)

This is today's Yield Curve and how it's changed just over the last 30 days or so (the recent past are shone as black shadow lines, showing progress flattening)

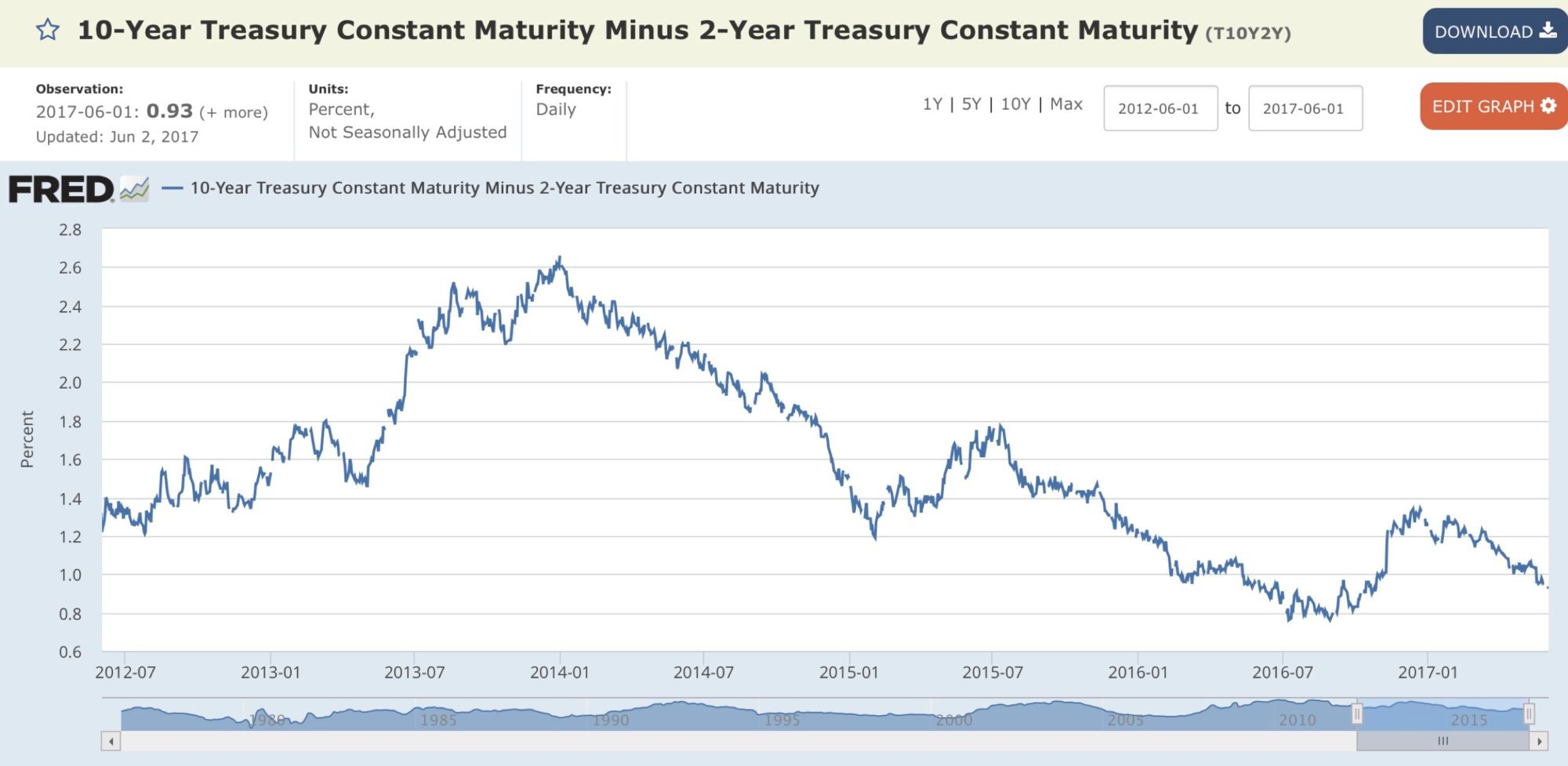

This can also be expressed as a number- by taking the difference between the 10-Year Yield rate and the 2-Year rate. Strongly positive indicates predicted growing economy (relative to inflation and other alternative investments for capital). An inverted curve is less than zero.

The inverted curve doesn't always mean a recession, but almost always positive prediction of corrections, economic drudgery, and equity market volatile or corrections. However, all 7 US recessions have predictive inverted Bond Yield curves (usually a few months ahead- up to a year or so). But remember we don't have to enter an actual recession for the equity markets to drop- The point here is that the Bond market will usually out-predict the Equity market (both sooner and more accurately)- Just a historical fact.

Here is 10 Years of starting from late 2007 Inverted prediction of 2008 and our subsequent decade of recovery.

We are currently at .93 - we dropped below 1.0 couple of weeks ago for only the second time in that period continuing the long trip down toward Inversion (<0). The Chinese Bond market just went inverted a short time ago, accurately predicting their recent negative growth numbers. Note we don't have to get to zero to be cautious- It's progressively unhealthy.

I have 3 levels of macro warning (driven not just by this marker but this is a good leading one for posting);

We were at Yellow for many months- I've moved myself to Orange now

That means my experience shows we could enter corrective equity reaction anytime starting now thru 6 months from now;

If I move thru that to Red- we are in my mind highly likely to see recessive corrections;

Right now I just see volatility and market corrections- but any macro world even could push that risk higher.

It's an unfortunate position to be in timing wise, because full investment in TSLA IS warranted given their imminent drivers. But unfortunately the macro risks are increasing. Hence my strategy to Triple common stock- but un-leveraged and out of options. This allows me to strike a very strong investment gain, but an option to lever with LEAPS if we see a Marco induced downturn.

After living thru too many macro events- I don't subscribe to the TSLA being inoculated from those- They might be from a company health perspective, but the stock market won't accommodate that and you need to be prepared to ride thru it- just like Tesla.

Anyway- this entire subject is massive- but I hope this helps somewhat with context--

ken

This could be a textbook lesson in the yield curve as an indicator. Bravo, Ken.

FWIW, I agree with Ken that bond markets are not signaling we are in danger of imminent recession *right now*, but it also doesn't look like an easy-breezy boom time on the horizon either. If your investment time horizon is longer than a month, a quarter or even a few quarters, then it's especially wise to consider tools available to you to forecast economic affects on your portfolio, and most professional investors pay very close attention to the bond markets and yield curve specifically.

FWIW, I agree with Ken that bond markets are not signaling we are in danger of imminent recession *right now*, but it also doesn't look like an easy-breezy boom time on the horizon either. If your investment time horizon is longer than a month, a quarter or even a few quarters, then it's especially wise to consider tools available to you to forecast economic affects on your portfolio, and most professional investors pay very close attention to the bond markets and yield curve specifically.

I have some further thoughts on Fluxcap's concerns about presidents seeking some foreign adventure to escape domestic criticism. The idea is as old as one of Aristotle's dictums on avoiding revolution: "bring distant dangers near."

In the case of Putin he does not have effective domestic opposition. On the contrary, his "salami slices" so far are very popular but the Russian people, in contrast to the American, know what general war is like since so much of it was fought on their actual land during World War II. In the Soviet era and probably today as well there is a lot of memorial devoted to that period.

The disaster of the Bush/Cheney Iraq War backfired as I noted above, so much so that Cheney should be considered a very effective agent of Iran. Likewise, Trump's tweets today on the travel bans show how effective he is as an enabler of ISIS. The Trump version of Aristotle's injunction is to bring the terror threat to our homeland. Many experts on terrorism strongly advise your indigenous population is the best guardian against wannabe homegrown islamic terrorist sympathizers. Trump's practice of vilifying all immigrants, all muslims (during his campaign and in part now), all refugees, and promoting stronger enforcement of existing laws, while softening civil rights enforcement and kissing up to the gun lobby, is bound to weaken that dam against domestic terrorism. Furthermore, it is well known in anti-terrorist literature that provoking excessive response by governments is a major goal of the perpetrators. They want governments to treat their own people as terrorists; with every squeeze more will be generated. On these scores Trump is uniquely qualified as an enabler of domestic terrorism. Such policies have positive feedback characteristics and each tweet adds fuel to the next explosion.

Look how Trump's unleashing of the Saudis has led to sanctions on Qatar!

Finally, the best desires of Trump along with the Republican predilection in Congress to favor or augment wealth and income inequality will eventually break the quiescent of what's left of the middle class. When Trump supporters begin to see through the lies of the campaign, armed with weapons, their actions will exceed the incidence of jihad inspired terrorism. We are destined for many more real and self-inflicted wounds.

In the case of Putin he does not have effective domestic opposition. On the contrary, his "salami slices" so far are very popular but the Russian people, in contrast to the American, know what general war is like since so much of it was fought on their actual land during World War II. In the Soviet era and probably today as well there is a lot of memorial devoted to that period.

The disaster of the Bush/Cheney Iraq War backfired as I noted above, so much so that Cheney should be considered a very effective agent of Iran. Likewise, Trump's tweets today on the travel bans show how effective he is as an enabler of ISIS. The Trump version of Aristotle's injunction is to bring the terror threat to our homeland. Many experts on terrorism strongly advise your indigenous population is the best guardian against wannabe homegrown islamic terrorist sympathizers. Trump's practice of vilifying all immigrants, all muslims (during his campaign and in part now), all refugees, and promoting stronger enforcement of existing laws, while softening civil rights enforcement and kissing up to the gun lobby, is bound to weaken that dam against domestic terrorism. Furthermore, it is well known in anti-terrorist literature that provoking excessive response by governments is a major goal of the perpetrators. They want governments to treat their own people as terrorists; with every squeeze more will be generated. On these scores Trump is uniquely qualified as an enabler of domestic terrorism. Such policies have positive feedback characteristics and each tweet adds fuel to the next explosion.

Look how Trump's unleashing of the Saudis has led to sanctions on Qatar!

Finally, the best desires of Trump along with the Republican predilection in Congress to favor or augment wealth and income inequality will eventually break the quiescent of what's left of the middle class. When Trump supporters begin to see through the lies of the campaign, armed with weapons, their actions will exceed the incidence of jihad inspired terrorism. We are destined for many more real and self-inflicted wounds.

adiggs

Well-Known Member

...

After living thru too many macro events- I don't subscribe to the TSLA being inoculated from those- They might be from a company health perspective, but the stock market won't accommodate that and you need to be prepared to ride thru it- just like Tesla.

...

An anecdote of mine to add to this idea that good companies can go on fire sales during macro events...

I was able to buy a nearly 11% dividend paying stock during the '08 downturn. A company with closer to 80% of their next 2 years revenues already contracted for, and a history of increasing their dividend quarterly (not just annually). I looked at it three ways from Sunday, sure I was missing something obvious.

My only regret after buying and owning the company for about 6 or 7 years, besides the annual tax pain, was I hadn't bought an order of magnitude (or 2) more than I did. The stock doubled, the dividend kept growing quarterly, year after year. The lesson I learned was that markets CAN be irrational (macro events can overrun the best of company's stock prices, even if they don't overrun the business), and when I have a conviction about a company (I've had 2 so far in my life), take advantage of the situation.

(I've since sold that company as I wanted out of the oil & gas industry - natural gas pipelines are probably the one segment of that business I would still consider buying a piece of).

MitchJi

Trying to learn kindness, patience & forgiveness

The Yield Curve is an excellent indicator of what the massive Bond market believes about the health of the economy and financial condition of capital markets. (Remember the lower the Yield of any Bond, the higher the demand or buying and vise versa). When short term Bonds are popular their yield goes down and shows invested money believes the value of those will increase over the months of the bond. A 'normal' Yield curve will pay higher Yield for longer terms. i.e. A 10 year bond will pay more interest (higher Yield) than a shorter term 2 year bond- signaling the Bond investor's belief that the economy and capital markets will contuse to grow and expand over the time in between. The steeper the curve, the more that market believes in solid future economic returns of capital. When the curve inverts, short term Bonds are being shunned relative to longer term bonds IOW- the Bond market predicts recession or relative fundamental slowdown risk relative to current conditions. You can see why Bond markets are better suited- since their investors must consider the length and rate of return over a give time period (much more so than equity markets generally).

This would be a healthy Bond Yield curve in today's low interest rate environment and typical for recent past years of Great Recession recovery-

Thank you very much Ken!

But isn't a major part of the reason that the longer term bonds are in less demand due to the expectation that interest rates will rise?

Who wants to be locked into long term bonds if interest rates continue to increase?

Last edited:

Reciprocity

Active Member

I posted a question in the thread here: We Are Still In (United States / Paris Climate Accord)

Followup question: Will this add momentum to Tesla/TSLA?

Yes, I would hope so. If people really do care about the climate then $TSLA is a great proxy for decarbonization of the environment. I put forth the following poll as a way to make people think about this issue, with mixed results. The idea was that the money going to the UN for the Greenfund would be better spent investing in Tesla and Elon:

Poll: $100 Billion - Elon or Green Fund?

I dont trust the UN as much as I do Musk and Tesla. Can you imagine what he could do with $100B?

Similar threads

- Replies

- 2

- Views

- 932

- Replies

- 6

- Views

- 11K

- Replies

- 0

- Views

- 1K

- Replies

- 98

- Views

- 26K

- Replies

- 84

- Views

- 18K