Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla Investor's General Macroeconomic / Market Discussion

- Thread starter FluxCap

- Start date

Here's a more detailed look at my recent time extension call (and my associated stock>LEAPS trade)

-Time extension before we see macro roll over-

-Based on LEI just out and the components;

-and correlating trends of recovery, relative to roll-over and next recession;

Even with the much worsening Yield Curve, the other elements improved. Also, (outside of Trump-macro effects), we should see some more growth before rolling over. Staying on Orange alert, but some time reprieve here get's us through M3 ramp

(IOW higher reward/risk ration of that happening).

Continue to watch for increasing volatility through this approaching period- but looks like to me we may get through the next months without major pullbacks. Note, I place a higher weight to Yield Spread accuracy (historically and more outward looking); as the other elements can change much faster -

That and the Trump unknown causing me to stay at Orange- otherwise, I would pull back to just Yellow caution.

(ironic my Orange alert includes Trump watch - I swear it's a coinkedink );

);

Consider this when thinking about if/when to pull back on your medium term elevated position through the M3 as the SP rises-

I would reduce your allocation of our elevated macro risk and not pull off those positions too early, is my point here-

again according to the factual data-

per usual - Not An Advice

and as Ol Blue Eyes would say - Luck Be a Lady

-Time extension before we see macro roll over-

-Based on LEI just out and the components;

-and correlating trends of recovery, relative to roll-over and next recession;

Even with the much worsening Yield Curve, the other elements improved. Also, (outside of Trump-macro effects), we should see some more growth before rolling over. Staying on Orange alert, but some time reprieve here get's us through M3 ramp

(IOW higher reward/risk ration of that happening).

Continue to watch for increasing volatility through this approaching period- but looks like to me we may get through the next months without major pullbacks. Note, I place a higher weight to Yield Spread accuracy (historically and more outward looking); as the other elements can change much faster -

That and the Trump unknown causing me to stay at Orange- otherwise, I would pull back to just Yellow caution.

(ironic my Orange alert includes Trump watch - I swear it's a coinkedink

Consider this when thinking about if/when to pull back on your medium term elevated position through the M3 as the SP rises-

I would reduce your allocation of our elevated macro risk and not pull off those positions too early, is my point here-

again according to the factual data-

per usual - Not An Advice

and as Ol Blue Eyes would say - Luck Be a Lady

OK some important new positive data on macro front-

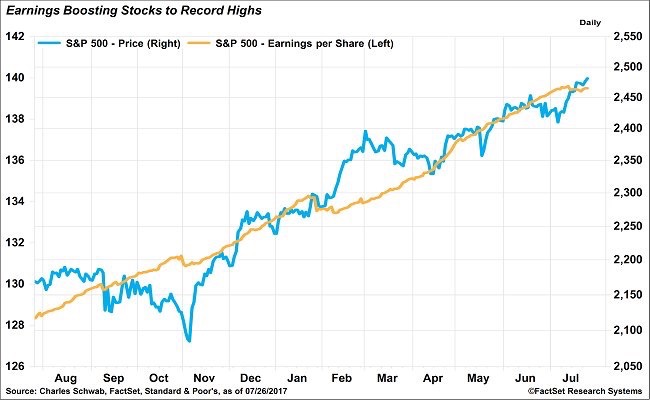

S&P Earnings coming in strong- further reducing medium term macro risk

(this allows some relief in the high P/E market valuations we're in)

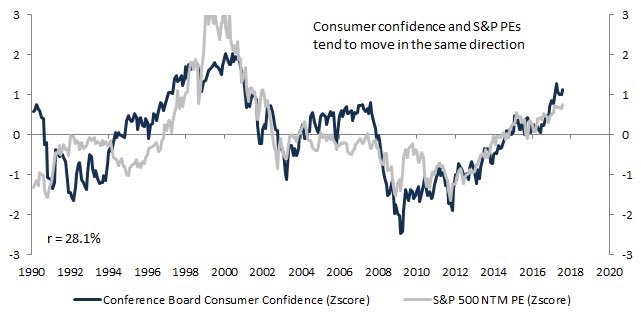

Consumer confidence lifting said P/Es (generally a leading pull of S&P)

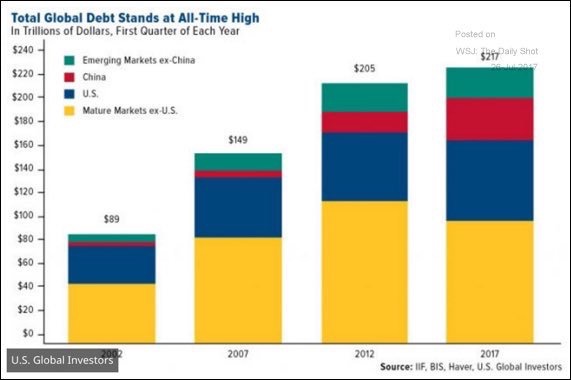

finally- although world (and US) debt at record highs (due to low interest rates)

We're seeing some leveling (finally) - except China

(China Yield curve is inverted- they are a mess over there currently, so still in cautionary mode there)

So I'm going to lower our Macro Alert

from Orange- Hard Watch

to Yellow- Cautionary

Yield curve and other data still give us some real cause for caution here- so not all clear - just a further medium term easing

But I will say we are on the edge there beyond the next few months and I may go back again depending on the data-

Further, I'm making this call with one important exception-

The Trump effect is a complete unknown;

Economic/Financial leadership there is the most incompetent I've ever seen- and nearly devoid of fact;

And the Admin is in real trouble vis-a-vi Russia etc. -

This is not a political statement- it's just fact, and a constant cloud that could rainstorm at any time. I'm following it- but predicting it's effects is near impossible- so laying down an asterisked exception on my rating call...

(yes it's a cop-out, I have no f...' idea what's going on there)

S&P Earnings coming in strong- further reducing medium term macro risk

(this allows some relief in the high P/E market valuations we're in)

Consumer confidence lifting said P/Es (generally a leading pull of S&P)

finally- although world (and US) debt at record highs (due to low interest rates)

We're seeing some leveling (finally) - except China

(China Yield curve is inverted- they are a mess over there currently, so still in cautionary mode there)

So I'm going to lower our Macro Alert

from Orange- Hard Watch

to Yellow- Cautionary

Yield curve and other data still give us some real cause for caution here- so not all clear - just a further medium term easing

But I will say we are on the edge there beyond the next few months and I may go back again depending on the data-

Further, I'm making this call with one important exception-

The Trump effect is a complete unknown;

Economic/Financial leadership there is the most incompetent I've ever seen- and nearly devoid of fact;

And the Admin is in real trouble vis-a-vi Russia etc. -

This is not a political statement- it's just fact, and a constant cloud that could rainstorm at any time. I'm following it- but predicting it's effects is near impossible- so laying down an asterisked exception on my rating call...

(yes it's a cop-out, I have no f...' idea what's going on there)

Last edited:

I used to have some instincts for the Soviet Union but all I can contribute regarding Putin is well known, principally his secret police background (KGB and variations). The country has become a kleptocracy because none of even the specialist Western students of that command economy were able to predict how a transition could occur. (If I remember correctly Anders Aüsland was probably the most concerned at the time.) Politically it has now reverted to authoritarian type characteristic of traditional Russia. And boy does Putin use that symbolism well, as does Steve Bannon here. Some commentator on Charley Rose recently made a remark that rang true. Something to the effect: Putin has already achieved his goal: the disruption of our democracy. Whatever Trump does or is forced to do there is chaos now and we are going to experience even more. (I removed quotes because not direct language. Meaning is ok.)

What I fear most is not concern about climate change (the economics are clear and operative already) or maybe even disastrous health care reform, is the decline of the Republican Party. That is a structural tragedy; we need a "loyal" opposition, not just an opposition party. The "loyal opposition" leaders in the Repulican Party are scarce; some leaders are really pernicious.

Another scary thought In the long term is the tampering of elections by the so-called Electoral Reform Commission and collusion by red state election supervisors in suppressing the vote. We may turn into a defacto dictatorship instead of a mere plutocracy which probably is why Trump admires and attempts to emulate Putin. (The best short survey of American politics I taught in Government 1 called our system a "populist system of elite reconciliation." I called it a plutocracy even then because of the role of money in elections and now, of course, we really have only one effective elite: the super-wealthy.)

That super-elite includes a few who might pressure the Reeps to work with Democrats. We will know if the denouement of the health care fiasco is succeeded by a new search for improvement under regular order which could fix the competitive climate for access and price on health care in a positive way, or gradual evolution into a single-payer system which would be ideal for Democrats. This is a scenario like Churchill or a doppelgänger once said: "the Americans will do the right thing after they try everything else." I'm an optimistic person, generally, but this is the scenario named Rosie.

There are some possibilities present in the viscera of today's news, namely, the public relations struggle between Trump and Sessions. Sessions is in a game of chicken with Trump over whether he resigns voluntarily or is fired. My sense of Trump the paranoid is that he will eventually, if not soon because of the Senate recess, fire him regardless. I don't think Mitch McConnell has the guts to fake the Senate being in session, to save Sessions, as they have done in the past to forestall recess appointments by Obama. For the party's survival he should, especially as Sessions marshals his troops, Senators, Breitbart, et allii.

This last scenario is widely agreed to by pundits. I think it likely, but then INAA (I'm not an Americanist.)

Of course this can be construed as obstruction of justice in any impeachment proceedings and might be if there is a Democratic House in 2019. However, as many in the media have already pointed out, impeachment becomes a real possibility only if the majority of Americans then are finally fed up. Withal, democracy infects candidates for office with cowardice. That's why so many Red State legislatures are so intent on restricting the vote while following Orwell's advice doing it in the name of protecting the integrity of the election. Again, my greatest fear is the lack of a "loyal opposition."

What I fear most is not concern about climate change (the economics are clear and operative already) or maybe even disastrous health care reform, is the decline of the Republican Party. That is a structural tragedy; we need a "loyal" opposition, not just an opposition party. The "loyal opposition" leaders in the Repulican Party are scarce; some leaders are really pernicious.

Another scary thought In the long term is the tampering of elections by the so-called Electoral Reform Commission and collusion by red state election supervisors in suppressing the vote. We may turn into a defacto dictatorship instead of a mere plutocracy which probably is why Trump admires and attempts to emulate Putin. (The best short survey of American politics I taught in Government 1 called our system a "populist system of elite reconciliation." I called it a plutocracy even then because of the role of money in elections and now, of course, we really have only one effective elite: the super-wealthy.)

That super-elite includes a few who might pressure the Reeps to work with Democrats. We will know if the denouement of the health care fiasco is succeeded by a new search for improvement under regular order which could fix the competitive climate for access and price on health care in a positive way, or gradual evolution into a single-payer system which would be ideal for Democrats. This is a scenario like Churchill or a doppelgänger once said: "the Americans will do the right thing after they try everything else." I'm an optimistic person, generally, but this is the scenario named Rosie.

There are some possibilities present in the viscera of today's news, namely, the public relations struggle between Trump and Sessions. Sessions is in a game of chicken with Trump over whether he resigns voluntarily or is fired. My sense of Trump the paranoid is that he will eventually, if not soon because of the Senate recess, fire him regardless. I don't think Mitch McConnell has the guts to fake the Senate being in session, to save Sessions, as they have done in the past to forestall recess appointments by Obama. For the party's survival he should, especially as Sessions marshals his troops, Senators, Breitbart, et allii.

This last scenario is widely agreed to by pundits. I think it likely, but then INAA (I'm not an Americanist.)

Of course this can be construed as obstruction of justice in any impeachment proceedings and might be if there is a Democratic House in 2019. However, as many in the media have already pointed out, impeachment becomes a real possibility only if the majority of Americans then are finally fed up. Withal, democracy infects candidates for office with cowardice. That's why so many Red State legislatures are so intent on restricting the vote while following Orwell's advice doing it in the name of protecting the integrity of the election. Again, my greatest fear is the lack of a "loyal opposition."

Last edited:

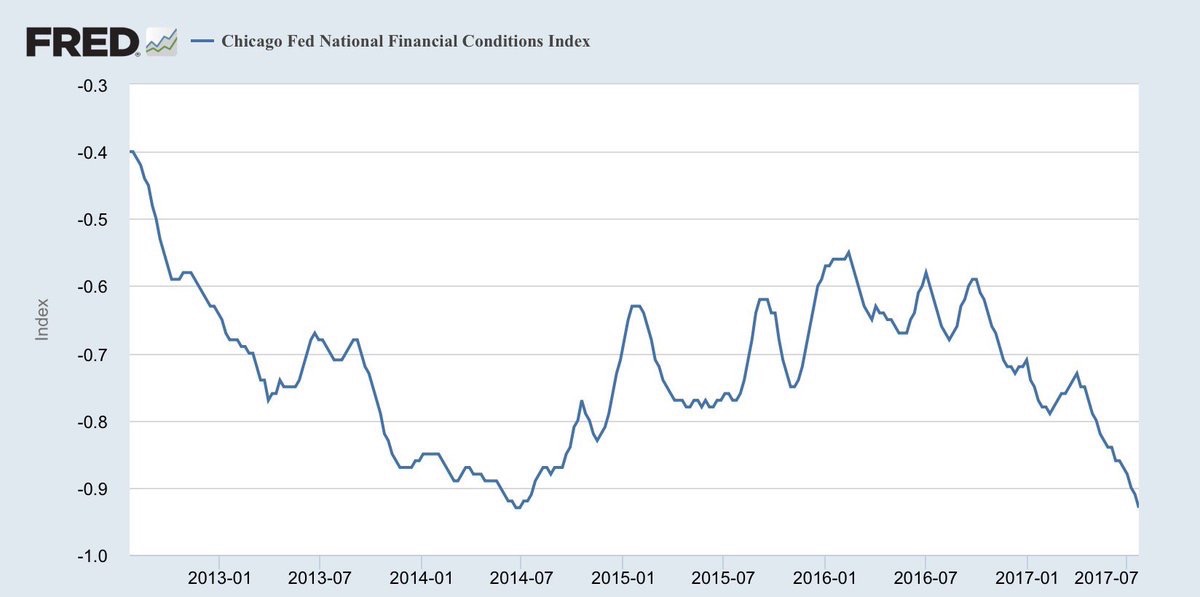

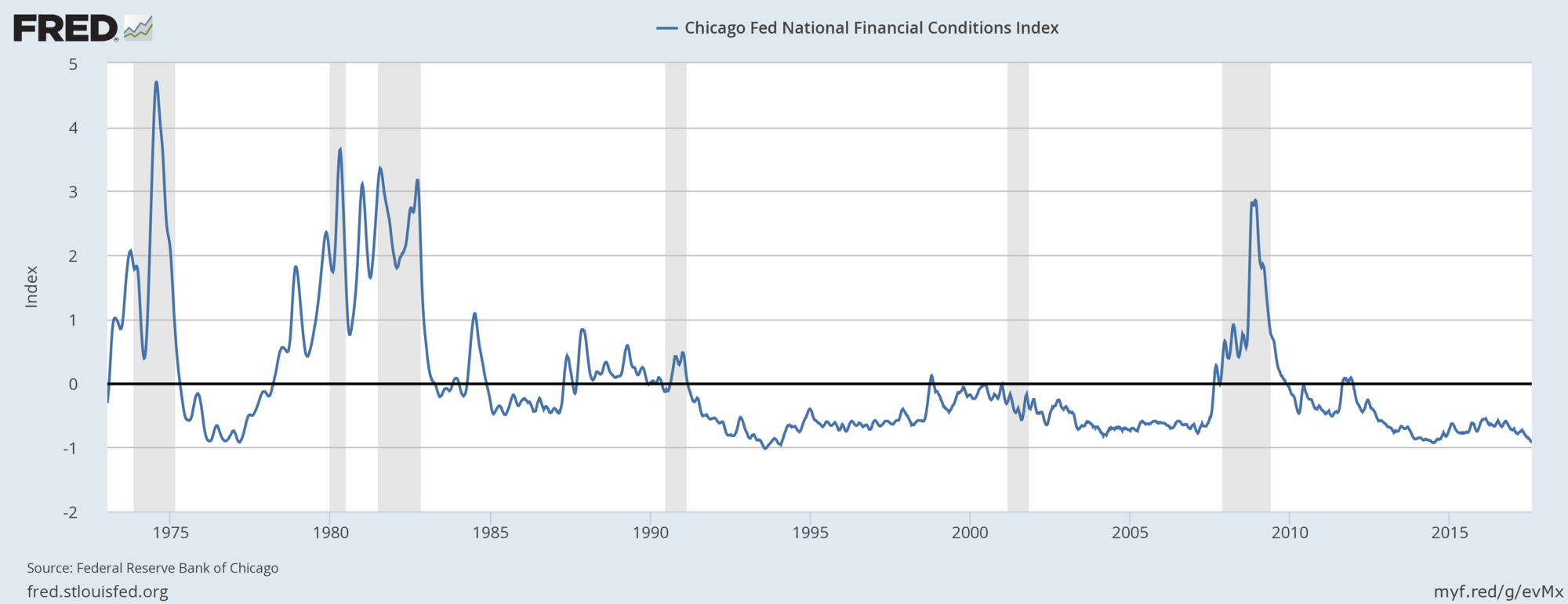

some recent confirmation of trend reversal in macro lower risk per call--

this marker based on Financial Systematic risks- leverage and availability of capital

note: we reversed trend and returned to near all time low

For those unfamiliar - this a national index out of the Chicago Fed- It measures risk and liquidity leverage across money markets, debt markets, equity markets and both traditional and 'shadow' banking system. In general positive values are tight money / higher risk- negative are loose money / lower risk;

Here's historical for reference:

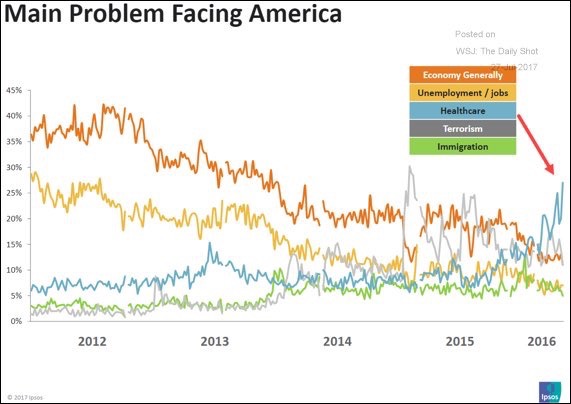

Finally- WSJ historical polling and measurement update just out-

Economic and unemployment worries bottomed but continued low-

Healthcare rocketing to top (must be that disastrous O-Care )

)

maintain Yellow alert (from other measures)

Case in point- I've already posted these markers above as our reason for caution- but confirmation here and review from Howard Marks

1. "The S&P 500 is selling at 25 times trailing-twelve-month earnings, compared to a long-term median of 15."

2. "The Shiller Cyclically Adjusted PE Ratio stands at almost 30 versus a historic median of 16. This multiple was exceeded only in 1929 and 2000 – both clearly bubbles."

3. "The 'Buffett Yardstick' – total US stock market capitalization as a percentage of GDP … hit a new all-time high last month of around 145, as opposed to a 1970-95 norm of about 60 and a 1995-2017 median of about 100."

Billionaire Marks, who called financial crisis, says ‘this is a time for caution’ on the markets

rock on

this marker based on Financial Systematic risks- leverage and availability of capital

note: we reversed trend and returned to near all time low

For those unfamiliar - this a national index out of the Chicago Fed- It measures risk and liquidity leverage across money markets, debt markets, equity markets and both traditional and 'shadow' banking system. In general positive values are tight money / higher risk- negative are loose money / lower risk;

Here's historical for reference:

Finally- WSJ historical polling and measurement update just out-

Economic and unemployment worries bottomed but continued low-

Healthcare rocketing to top (must be that disastrous O-Care

maintain Yellow alert (from other measures)

Case in point- I've already posted these markers above as our reason for caution- but confirmation here and review from Howard Marks

1. "The S&P 500 is selling at 25 times trailing-twelve-month earnings, compared to a long-term median of 15."

2. "The Shiller Cyclically Adjusted PE Ratio stands at almost 30 versus a historic median of 16. This multiple was exceeded only in 1929 and 2000 – both clearly bubbles."

3. "The 'Buffett Yardstick' – total US stock market capitalization as a percentage of GDP … hit a new all-time high last month of around 145, as opposed to a 1970-95 norm of about 60 and a 1995-2017 median of about 100."

Billionaire Marks, who called financial crisis, says ‘this is a time for caution’ on the markets

rock on

Last edited:

I was just about to link Howard Marks' note and you beat me to it. Great minds, Ken.

I'm not sure he's entirely correct, but there are interesting points nonetheless.

Here's the PDF:

https://www.oaktreecapital.com/docs/default-source/memos/there-they-go-again-again.pdf

I'm not sure he's entirely correct, but there are interesting points nonetheless.

Here's the PDF:

https://www.oaktreecapital.com/docs/default-source/memos/there-they-go-again-again.pdf

MitchJi

Trying to learn kindness, patience & forgiveness

JP Morgan's top market guru just identified a chilling pattern in the stock market

JP Morgan's top market guru just identified a chilling pattern in the stock market

The decline in the market appears to have coincided with the publishing and circulation of a research note from JP Morgan strategist Marko Kolanovic, who among other things noted that the recent decline in stock correlations we’ve seen mirrors action investors saw before big sell-offs in 1994 and 2001.

“Over the past year, correlation of stocks and sectors declined at an unprecedented speed and magnitude,” Kolanovic wrote in a note to clients.

“A similar decorrelation occurred on only 2 other occasions over the last 30 years: in 1993 and 2000. Both of those episodes led to subsequent market weakness and an increase in volatility (in 1994, and 2001). The current decline in market correlations started following the US elections and was largely driven by macro (rather than stock specific) forces.”

A de-correlation in stocks basically means that individual stocks began moving in different directions at different times, rather than in the same direction at the same time.

Kolanovic notes that in 1994, a rise in interest rates and a re-correlation in the stock market saw a 10% correction. In 2000, with markets bouncing off lows made during the brief 1998 crisis triggered by Russia’s default and Long-Term Capital Management’s bankruptcy, correlations plummeted.

“It ended with the tech bubble in March 2001,” Kolanovic writes, “which marked the low point of equity correlation and start of recession. Subsequently, the market declined ~30%, bottoming in late 2002.”

I was wondering why the sudden shift in the market for our portfolio, heavy on Baidu and with 42% invested in TSLA. They both looked good early on today and then suddenly turned with a lot of other stocks. Note: our portfolio, not the market in general that I know of--though a quick check reveals no particular crash evident although Nasdaq is fainting.

I haven't time nor expertise to digest Kolanovic's post yet--thanks guys for some digestion. If a macro event sets this off it may be politics. Trump's new guy is really raising waves—publicly going after Reince Priebus—while mouthpieces for Trump are uneasy about going after Sessions. The normally more circumspect Lindsey Graham had another direct statement ending with "all hell will break loose if Sessions goes and firing Moeller will be the beginning of the end of the Trump Administration." Grassley has also tweeted! there will not be time for JudCom to hear new nominations for AG. In addition, it appears the Senate will probably fail to reach a satisfactory conclusion to its current debate showing that "the ruling party" cannot rule and the President should be impeached. Frankly, from a progressive standpoint Pence may be worse on policy, we just don't know—making this constitutional crisis all the more dangerous.

I plan a fuller note later. It begins with this link and follows with links to two scholarly articles she relies on.

Big Pharma Spends on Share Buybacks, but R&D? Not So Much

The gist is we may have a broader problem with corporations "financializing" stock gains in lieu of productive investments in growth. Compare to Tesla, for example. All of this is redolent of the classic Harvard Business Review article titled "Managing Our Way to Decline." An oldie, but still goodie.

Comments welcome.

I haven't time nor expertise to digest Kolanovic's post yet--thanks guys for some digestion. If a macro event sets this off it may be politics. Trump's new guy is really raising waves—publicly going after Reince Priebus—while mouthpieces for Trump are uneasy about going after Sessions. The normally more circumspect Lindsey Graham had another direct statement ending with "all hell will break loose if Sessions goes and firing Moeller will be the beginning of the end of the Trump Administration." Grassley has also tweeted! there will not be time for JudCom to hear new nominations for AG. In addition, it appears the Senate will probably fail to reach a satisfactory conclusion to its current debate showing that "the ruling party" cannot rule and the President should be impeached. Frankly, from a progressive standpoint Pence may be worse on policy, we just don't know—making this constitutional crisis all the more dangerous.

I plan a fuller note later. It begins with this link and follows with links to two scholarly articles she relies on.

Big Pharma Spends on Share Buybacks, but R&D? Not So Much

The gist is we may have a broader problem with corporations "financializing" stock gains in lieu of productive investments in growth. Compare to Tesla, for example. All of this is redolent of the classic Harvard Business Review article titled "Managing Our Way to Decline." An oldie, but still goodie.

Comments welcome.

adiggs

Well-Known Member

...

The gist is we may have a broader problem with corporations "financializing" stock gains in lieu of productive investments in growth. Compare to Tesla, for example. All of this is redolent of the classic Harvard Business Review article titled "Managing Our Way to Decline." An oldie, but still goodie.

Comments welcome.

I haven't read the article, but the title puts me in mind of a not-so-oldie (2011) that's been influential in my life:

Why Amazon Can't Make A Kindle In the USA

General idea being about how cost accounting and a focus on quarterly results has led to a series of good choices with destructive long term consequences.

I haven't read the article, but the title puts me in mind of a not-so-oldie (2011) that's been influential in my life:

Why Amazon Can't Make A Kindle In the USA

General idea being about how cost accounting and a focus on quarterly results has led to a series of good choices with destructive long term consequences.

I've only read parts 1, 7, and 8. I think 1 is the most useful and as a teacher I'm biased toward 8 as well. Retaining control over knowledge is probably the best investment and why in politics the South did not promote literacy among slaves or other education even now. Of course that is also why government secrecy is important to the point of control over the press and outright censorship.

When I was working on my M.A. at Colgate I had a part-time job as Graduate Preceptor, basically a counselor to freshmen. We were required to teach a book called The Humanity of Man by Ralf Barton Perry. As I recall he defined freedom as the capacity for enlightened choice, in contrast to liberty as the capacity for effective choice. Higher education he concluded should also inculcate civility and a sense of style.

The Mooch's tweets today dissing Priebus and other of his enemies in the White House certainly exhibits a style at odds with those I was paid to teach in the late 50s. Representative King of Long Island was interviewed by Wolfe Blitzer just an hour or so ago about this style which he dismissed as just the way people talk on Long Island, but he doesn't pronounce it the way I heard as a kid: "longg I land."

I think we are getting a glimmer of why the New York elite of Manhattan shunned a boor from Queens. Probably explains Trump's appeal to the masses, King explained, and I would say he is now "acting out" his anger at cultural exclusion. Cultural exclusion can lead to a lot of anger, even violence and assaultive language. Also explains much violence in ethnic communities. Imagine the anger of people of color excluded because of their skin, which they have no control over and responsibility for. Or, those culturally excluded because of their religion, or their sex, or their change in sex. What must that anger be like? Anger is a contagion.

When I think of it, I pray for Trump and the country, of course. Jefferson once said something to the effect, "when I remember that God is just, I pray for our country."

Last edited:

neroden

Model S Owner and Frustrated Tesla Fan

Another scary thought In the long term is the tampering of elections by the so-called Electoral Reform Commission and collusion by red state election supervisors in suppressing the vote. We may turn into a defacto dictatorship instead of a mere plutocracy which probably is why Trump admires and attempts to emulate Putin. (The best short survey of American politics I taught in Government 1 called our system a "populist system of elite reconciliation." I called it a plutocracy even then because of the role of money in elections and now, of course, we really have only one effective elite: the super-wealthy.)

One of the primary reasons I am optimistic -- a pretty cynical one -- is that the Republican Party, with all of its dangerous anti-democratic and pro-dictatorship tendencies, now represents only the *declining segment* of the super-wealthy. The ones who will *lose all their money* due to the renewable energy revolution.

The well-positioned super-wealthy, like Musk -- or Brin and Page and Schmidt -- or Bezos -- and you can think of others, I'm sure -- are with very few exceptions on the other side, either Democrats or Independents, supporters of the right to vote and the right to have votes counted honestly.

This is good. We would be in a much worse position if the "clash of the titans of industry" featured *rising* industrial magnates who were anti-democratic, and that was a real possibility (remember, Henry Ford was a fascist sympathizer!) So this ties back to both the Internet boom and the renewable energy transition -- if either of these hadn't happened when they did, we would be in much deeper trouble. And we are lucky that the anti-democratic forces tied themselves to oil and actively alienated the renewble energy magnates. (I think the Internet is sort of inherently pro-democracy, and so the anti-democratic forces were always going to try to censor it and infuriate the Internet magnates in that way.)

MitchJi

Trying to learn kindness, patience & forgiveness

@neroden you recently posted that Tesla is relatively immune from a recession.

Does that mean that over 12-36 months:

The company would do okay, but the SP would be in the toilet.

The company would do okay and within a year or so the SP would recover.

The company would do okay and within a year or so the SP would increase substantially (how many good investor choices will there be?).

I'm asking for your opinions about the safety of 2019 and soon 2020 LEAPS.

Does that mean that over 12-36 months:

The company would do okay, but the SP would be in the toilet.

The company would do okay and within a year or so the SP would recover.

The company would do okay and within a year or so the SP would increase substantially (how many good investor choices will there be?).

I'm asking for your opinions about the safety of 2019 and soon 2020 LEAPS.

neroden

Model S Owner and Frustrated Tesla Fan

@neroden you recently posted that Tesla is relatively immune from a recession.

Does that mean that over 12-36 months:

The company would do okay, but the SP would be in the toilet.

The company would do okay and within a year or so the SP would recover.

The company would do okay and within a year or so the SP would increase substantially (how many good investor choices will there be?).

I'm asking for your opinions about the safety of 2019 and soon 2020 LEAPS.

First of all, disclaimer: NOT INVESTMENT ADVICE!

My scenario here works as follows:

-- everything in the market goes down, including TSLA, in the near term (1 year)

-- but when the market notices that Tesla is (despite the recession) selling 500,000 cars per year, still has a waiting list, and is making profits (which I expect to happen sometime in 2018), TSLA recovers even though the market doesn't.

I hesitate to say whether TSLA would go up substantially from here. If the general market P/E ratios drop substantially (say, from the current 20 to 10), as they might during a recession, then the low $300s might be perceived as an appropriate price in early 2019. I bought then-out-of-the-money 2019 LEAP calls early in the year, considering them safe, but they had strike prices *under $280*, so they are already in the green.

Breaking it down a little more.

I think the business is pretty recession-resistant:

-- I think for several years to come, Tesla's Model 3 sales numbers and prices are recession-proof (production limited)

-- I think Model X sales numbers and prices are recession-proof for at least a year

-- I think a recession might require small cuts to Model S sales price but that that would bring sales numbers back up

-- I think the energy storage sales numbers are completely recession-proof

-- I think the solar roof business is likely to be recession-resistant

-- I think the cash/loan solar panels business is *not* recession-proof but I think that's not significant, as I think in future these panels will basically only be sold in association with batteries

-- Tesla is already getting out of the solar panel leasing business

-- income from past leases is relatively recession resistant although bad debt losses will increase some

I think the stock price would take a hit to the valuation multiples, but since revenues would still be good, this would be much better than companies who take hits to revenues during the recession.

-- I think the main effect of a recession on the stock price would be a drop in the general P/E and P/S multiples. So if you're running a multiples-based valuation model, assume a "bear market" multiple instead of the multiples you're assuming now.

-- If you're running a DCF model, increase the discount rate to reflect likely higher interest rates on borrowing and on debt investments. I've found this methodology impractical recently due to excessive difficulty predicting potential rates and high rate sensitivity, so I've been using a multiples-based method.

I guess at the moment I think -- and again this is NOT INVESTMENT ADVICE -- that Tesla is more or less fairly valued now for a scenario where Tesla executes everything competently and the macroeconomy crashes.

Last edited:

MitchJi

Trying to learn kindness, patience & forgiveness

A menacing pattern has revealed itself in the stock market

The research and testing at The Arora Report show that the traditional technical analysis no longer reliably works as described in the classical literature and as practiced by most technicians. The reason appears to be that the traditional technical patterns, support/resistance, indicators and sentiment analysis are now well-known, giving advance indications to the smarter players as to what the market participants following traditional technical analysis would do.

The smarter players take advantage of this information, sometimes acting ahead of the traditional technical signals in the direction of the predicted signals and then exiting in the order flow generated by the technical signal.

The foregoing is the reason that as the years go by, more and more technical breakouts fail, and the success rate of traditional technical analysis diminishes.

The research and testing at The Arora Report show that the traditional technical analysis no longer reliably works as described in the classical literature and as practiced by most technicians. The reason appears to be that the traditional technical patterns, support/resistance, indicators and sentiment analysis are now well-known, giving advance indications to the smarter players as to what the market participants following traditional technical analysis would do.

The smarter players take advantage of this information, sometimes acting ahead of the traditional technical signals in the direction of the predicted signals and then exiting in the order flow generated by the technical signal.

The foregoing is the reason that as the years go by, more and more technical breakouts fail, and the success rate of traditional technical analysis diminishes.

bdy0627

Active Member

Makes sense in some ways but in other ways, I would expect amplification of breakouts rather than failure. If traders are acting ahead of technical signals, wouldn't it go up rapidly in an amplified fashion?A menacing pattern has revealed itself in the stock market

The research and testing at The Arora Report show that the traditional technical analysis no longer reliably works as described in the classical literature and as practiced by most technicians. The reason appears to be that the traditional technical patterns, support/resistance, indicators and sentiment analysis are now well-known, giving advance indications to the smarter players as to what the market participants following traditional technical analysis would do.

The smarter players take advantage of this information, sometimes acting ahead of the traditional technical signals in the direction of the predicted signals and then exiting in the order flow generated by the technical signal.

The foregoing is the reason that as the years go by, more and more technical breakouts fail, and the success rate of traditional technical analysis diminishes.

geneclean55

Active Member

I think the 'smarter players' are able to manipulate chart patterns that form over shorter tight frames, at least with TSLA.

For example, ascending triangles that form over a few weeks are much more reliable indicators for a break-out, than ascending triangles that form over a day. Less money was used in forming the latter triangle, so easier to head fake traders looking for a breakout.

For example, ascending triangles that form over a few weeks are much more reliable indicators for a break-out, than ascending triangles that form over a day. Less money was used in forming the latter triangle, so easier to head fake traders looking for a breakout.

MitchJi

Trying to learn kindness, patience & forgiveness

If it's bots it could happen too quickly for traders to react?Makes sense in some ways but in other ways, I would expect amplification of breakouts rather than failure. If traders are acting ahead of technical signals, wouldn't it go up rapidly in an amplified fashion?

If it's bots it could happen too quickly for traders to react?

I am increasingly of the opinion that 'bot' trading controls the SP movements as much as anything.

The article first sentence:A menacing pattern has revealed itself in the stock market

The research and testing at The Arora Report show that the traditional technical analysis no longer reliably works as described in the classical literature and as practiced by most technicians. The reason appears to be that the traditional technical patterns, support/resistance, indicators and sentiment analysis are now well-known, giving advance indications to the smarter players as to what the market participants following traditional technical analysis would do.

The smarter players take advantage of this information, sometimes acting ahead of the traditional technical signals in the direction of the predicted signals and then exiting in the order flow generated by the technical signal.

The foregoing is the reason that as the years go by, more and more technical breakouts fail, and the success rate of traditional technical analysis diminishes.

"Prudent investors ought to pay attention to a menacing pattern developing in the stock market."

Just my opinion of course... but technical patterns stopped being reliable a long time ago. Wall Street pretty much built that into the system--

For many, many years now, the 'most prudent' INVESTORS trade on fundamentals (both company and macro) and pay very little attention to technical patterns of any kind- much less 'a developing pattern' of no pattern--

Not only should 'prudent investors' NOT pay attention to this new 'menacing pattern developing' -

it's not menacing, precisely because they stopped years ago, when it actually developed. For actual prudent investors, Wall Street already killed that under their own weight. That's who's finally succumbing - what they're admitting is they were never investors in the first place- prudent or otherwise. That's why most went to private equity or very targeted, well managed public companies.

JMHO

Last edited:

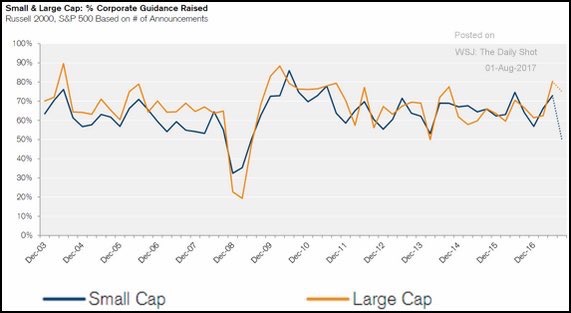

Not a particularly correlative issue with Tesla

but if some of you are in 401K or other Index funds allocated between large-mid-small Capp --

Note, we finally changed over to projected Corporate guidance of large cap cross-over;

I suspect this will be the case for a while as we enter this next phase of the economy

You might take the moment to have a look at your allocation spread in those funds and make any adjustments you deem appropriate

but if some of you are in 401K or other Index funds allocated between large-mid-small Capp --

Note, we finally changed over to projected Corporate guidance of large cap cross-over;

I suspect this will be the case for a while as we enter this next phase of the economy

You might take the moment to have a look at your allocation spread in those funds and make any adjustments you deem appropriate

Similar threads

- Replies

- 2

- Views

- 925

- Replies

- 6

- Views

- 11K

- Replies

- 0

- Views

- 1K

- Replies

- 98

- Views

- 26K

- Replies

- 84

- Views

- 18K