Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Buckminster

Well-Known Member

Green has advised that autopilot assist app has been activated. Not sure what that is exactly but looks cool:

Playing_autopilot_full

Playing_autopilot_full

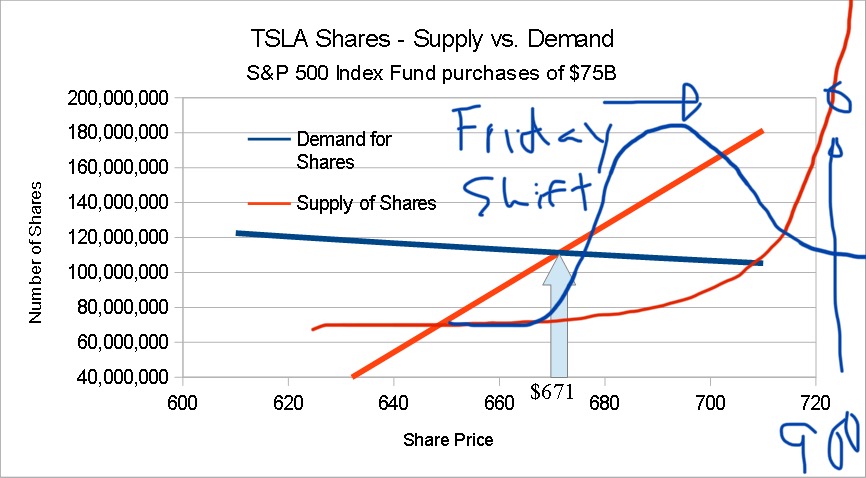

Your position results in an untentable demand curve. Plot one out for yourself.

I think we all know you meant "untenable demand curve", but why is it untenable? Secondly, the supply curve should be logarithmic not linear, since there are only 760million shares in the free float, and some of those are held by retail investors and some funds that would "never sell".

Mo City

Active Member

Good stuff. What I would like to see simultaneously along with the standard forward camera in the video are the wide-angle forward camera and both b-pillar cameras (all annotated as in the video).Green has advised that autopilot assist app has been activated. Not sure what that is exactly but looks cool:

Playing_autopilot_full

Pezpunk

Active Member

This I am afraid is nothing but overzealousness that has become more common in recent times from some in TSLA community.

I am concerned that this tendency to push expectations too far from reality will lead to disappointments, even when the team (company) does extraordinary job, giving their best.

the same exact thing happens every quarter on this very forum. Elon sets nigh-impossible goals. When everything goes right, Tesla pulls off the nigh-impossible and just barely achieves or comes within a percentage point or two of those goals. but there are also two givens:

1) the irrational bears who assume he's a fraud and a liar and it's all smoke and mirrors, and they'll deny it could ever happen even after it happened.

2) the irrational bulls who dream that Elon has been hiding cars in underground bunkers or whatever and will spring a huge surprise and announce the recently delivered Model Y's can hover and travel through time after an upcoming software update released on the last day of the quarter, and predict wild beats, which are ultimately detrimental to Tesla's fundamental goals.

the truth is easy to see if you ignore frothy rumors and look and listen to hard evidence, and most of all take Elon's public communications more or less at their word. When he says they're close to breaking even, that's the truth. when he says a quarter will be difficult, that's also the truth, almost invariably. i don't idolize or deify Elon, but i do think his public communications tend to be his real opinions on matters, and not some 4D chess match with Wall Street.

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

This chart is produced from actual data, given some assumptions.

"Some assumptions?" That's the understatement of the year isn't it? I can sort of agree on the model of these two curves existing and having an intersection which ends up being where the market, all things considered, price the shares, but how on earth did you calculate the slope of the curves. And why are they straight lines and not some more complex function???

This chart is produced from actual data, given some assumptions.

Can you share what data it is based on, and talk about what those assumptions are? You're basically just asking us to trust you that this random straight line will equal supply of TSLA shares, without explaining any of your reasoning.

If this is just your feeling of what will happen, that is totally fine, but then you need to present it as such. You make great contributions to TMC in the form of pre-market charts and action reports, so people will err on the side of trusting you. This makes it even more important to be careful about how you present your opinions, and to provide the data, assumptions, and reasoning used to come to them.

Last edited:

StealthP3D

Well-Known Member

Green has advised that autopilot assist app has been activated. Not sure what that is exactly but looks cool:

Playing_autopilot_full

That looks like it might just be a tool to assist the developers.

But it also shows just how far they have come and how close they are getting. It's unbelievably stunning how they weave all that data together into some pretty decent driving! Even though I know they are leaning most heavily on AI it's just mind-boggling how they have been able to bring it all together as they have without more glitches and totally stupid behavior (on a more regular basis).

This rapid advancement towards FSD really complicates matters for people who might be tempted to trade in and out of the stock. Because there is no way to know how much of this FSD is being priced in and how much might just be a temporary inclusion squeeze. And upcoming production and delivery numbers, battery development and production ramp, factory progress, solar ramp, possible product updates/announcements - there is more going on here than I've ever seen from one company! Which probably means some of the really good stuff could get lost in the noise temporarily.

If the overall macro market holds together methinks some large current Tesla shareholders/funds may soon (two weeks to two months) find themselves without shares while they watch the stock zoom away from them. This is not a prediction so much as a possibility.

StealthP3D

Well-Known Member

"Some assumptions?" That's the understatement of the year isn't it? I can sort of agree on the model of these two curves existing and having an intersection which ends up being where the market, all things considered, price the shares, but how on earth did you calculate the slope of the curves. And why are they straight lines and not some more complex function???

It must be some highly proprietary trading/charting formulas.

StealthP3D

Well-Known Member

I think we all know you meant "untenable demand curve", but why is it untenable? Secondly, the supply curve should be logarithmic not linear, since there are only 760million shares in the free float, and some of those are held by retail investors and some funds that would "never sell".

That occurred to me but I couldn't really get it to make sense that way either.

I like "untentable" better.

StealthP3D

Well-Known Member

2) the irrational bulls who dream that Elon has been hiding cars in underground bunkers or whatever and will spring a huge surprise and announce the recently delivered Model Y's can hover and travel through time after an upcoming software update released on the last day of the quarter, and predict wild beats, which are ultimately detrimental to Tesla's fundamental goals.

I try to read every post but it looks like I've been missing the really good stuff!

In any case, the most common mistake most TSLA bulls have made over the last year is to not be bullish enough!

I think those lines and slopes are wrong. I think the supply curve (for this week) is an exponential, staying fairly flat but approaching infinity at a very high price. The demand is going to be independent of price and increasing all week, and there are a lot of non-normal factors feeding this.Model of Supply and Demand for TSLA shares:

View attachment 617845

The point where the supply and deman curves intersect is the equilibrium SP, which in theory occurs after some hysteresis, but in practice equilibrium is never reached because of other events, ie:

This chart is produced from actual data, given some assumptions.

- Q4 P&D

- FSD Beta

- Model S refresh

- Giga Shanghai Phase 3

My personal data point. I don’t want to sell my shares, but actually CAN’T because I’ll have too much short term capitol gains. This is because I got caught trading my shares after the March CV19 scare and have no long term shares to risk losing. The price would have to go to several thousand to make it worth the risk of selling for me. I don’t think I am alone here. Any other stock, any other time I think I would take a 30%-50% gain and move on, or hope I could trade it. I learned my lesson. I’ll lose MY shares.

Last edited:

StealthP3D

Well-Known Member

I think those lines and slopes are wrong. I think the supply curve (for this week) is an exponential, staying fairly flat but approaching infinity at a very high price. The demand is going to be independent of price and increasing all week, and there are a lot of non-normal factors feeding this.

My personal data point. I don’t want to sell my shares, but actually CAN’T because I’ll have too much short term capitol gains. This is because I got caught trading my shares after the March CV19 scare and have no long term shares to risk losing. The price would have to go to several thousand to make it worth the risk of selling for me. I don’t think I am alone here. Any other stock, any other time I think I would take a 30%-50% gain and move on, or hope I could trade it. I learned my lesson. I’ll lose MY shares.

I don't see the "investor sentiment" curve for non-index funds charted there. And how can we plot this in 3D with a moving time scale? I think we are getting close to solving this problem - we just need a little more data.

If we could use Artificial Intelligence to solve it we would have a leg up on the big players...Err, wait, don't they already use AI?

Rumors on twitter that they have made several 4680 Ys.

Green Pete

Active Member

I'm at the point where I wish these types of leaks wouldn't happen or wouldn't get noticed. It's not good for anything.

I'm at the point where I wish these types of leaks wouldn't happen or wouldn't get noticed. It's not good for anything.

Some ID.x will end up waiting longer for someone to take 'em home...

ByeByeJohnny

Active Member

Once the creator stops dodging and explains to us amateurs it will all be clear for everyone.I don't see the "investor sentiment" curve for non-index funds charted there. And how can we plot this in 3D with a moving time scale? I think we are getting close to solving this problem - we just need a little more data.

If we could use Artificial Intelligence to solve it we would have a leg up on the big players...Err, wait, don't they already use AI?

j6Lpi429@3j

Closed

I wouldn't be THAT surprised to see 4680 cells in a model Y very soon. Note that at battery day their presentation was 'this is what we are planning' not 'we just thought of this yesterday but haven't any clue how to do it'. Remember how many times battery day got pushed back and back and back? They could well be much further along with this than we realized, and elon is over-focusing on the issue of making millions of them rather than thousands.

If they only have the capacity to make a few thousand Y 4680s, then they may well do it, to get some real-world customer validation that it works as expected in real world conditions.

If they only have the capacity to make a few thousand Y 4680s, then they may well do it, to get some real-world customer validation that it works as expected in real world conditions.

People seem to forget that Elon said at battery day that vehicles with 4680 are driving since May and that was back in September.

No surprise if it's now 17 of those

No news

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M