Those 4 months could have been spent watching TSLA. Just saying...Stumbled across an interesting bit of information. The average person (at least in the US) will spend about 4 months of their life waiting at red lights. Imagine if that time could instead be spent working, watching TV, etc.

You’ll Spend This Much of Your Life Waiting at Red Lights (yahoo.com)

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

2daMoon

Mostly Harmless

Those 4 months could have been spent watching TSLA. Just saying...

What are you talking about?

That 4 months WAS spent watching TSLA.

At least now I know how much time at red lights I avoided ...

MartinAustin

Active Member

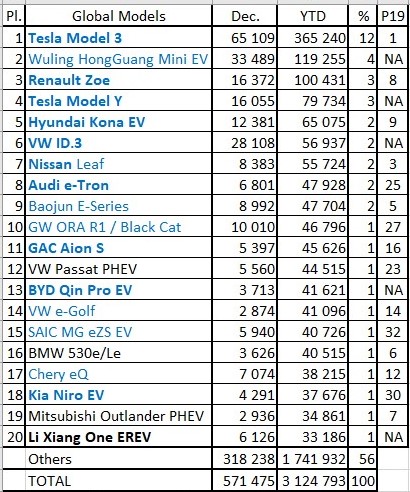

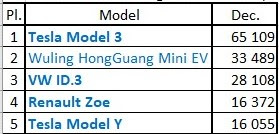

I notice GM is not in the top 20 and neither they nor Ford are anywhere to be seen.

UnknownSoldier

Unknown Member

Bezos retiring as CEO from Amazon. End of an era.

We still got at least another decade of Elon, so don't worry guys.

We still got at least another decade of Elon, so don't worry guys.

This dip in TSLA clearly correlated with the boom.

As TSLA had its second highest close ever, the drop towards the close notably happened on a day's volume that was only 54% of the average.

Todd Burch

14-Year Member

AMZN only down 0.3% after Bezos announces he's stepping down as CEO. Wonder if TSLA would react the same way?

RobStark

Well-Known Member

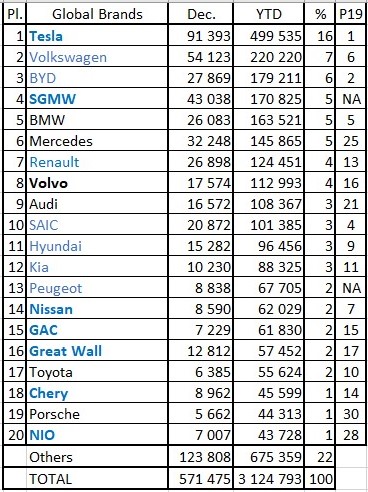

Actual numbers are now in for 2020. Tesla had 16% share of global EV market.

By 2030, the EV market is expected to grow from 3% to 50% of all autos.

By 2035, EVs will make up 95% of all autos.

This is inevitable, as sure as the sun will come up tomorrow morning.

And because the sun will come up tomorrow morning.

Jose is reporting all the numbers there are to report. Not a guess.

Some companies don't report BEV sales separately from PHEV numbers.

Anybody telling you they have exact global 2020 BEV sales is lying.

Any attempt to decipher exact BEV sales is a guestimate by separating reported PEV sales into PHEV sales and BEV sales.

Bezos stepping down is positive news for Tesla. One of the few potential threats to Tesla's domination will now be busy for a while.

2daMoon

Mostly Harmless

I'm surprised no one questioned that idiot hiding at the launch site.

What were they up to? Causing trouble on launch day?

What kind of Truck was it?

I don't know what that one was, but if it had been a Cybertruck with the armored glass and body they probably could have let them stay for the show.

G

goinfraftw

Guest

Bezos stepping down is positive news for Tesla. One of the few potential threats to Tesla's domination will now be busy for a while.

The articles are saying he's going to be focusing on the Bezos Earth Fund among others, but that was listed first.

How Jeff Bezos Is Spending His $10 Billion Earth Fund

Tesla cancels Model Y Long Range RWD variant, honors FSD price from pre-order date

"Teslarati readers indicate that Tesla is reaching out to them to make them aware of the cancelation. Instead of canceling their orders altogether, Sales Advisors are encouraging owners to choose either the Standard Range RWD Model Y or the Long Range AWD configurations of the all-electric crossover. These two builds are the closest to the LR RWD variant of the Model Y."

RWD LR is my preferred vehicle. Sad to see it go

"Teslarati readers indicate that Tesla is reaching out to them to make them aware of the cancelation. Instead of canceling their orders altogether, Sales Advisors are encouraging owners to choose either the Standard Range RWD Model Y or the Long Range AWD configurations of the all-electric crossover. These two builds are the closest to the LR RWD variant of the Model Y."

RWD LR is my preferred vehicle. Sad to see it go

CNN quoted someone who works for this "non-profit" organization. A little bit of history in it's opinion of Tesla.CNN believes Tesla will sell less cars in the U.S. in 2024 than they did in 2020.

This is job one for President Biden in the climate debate and the push for electric cars - CNNPolitics

From wikipedia,

Center for Automotive Research

In 2003, the Center for Automotive Research (CAR) was established as an independent non-profit research organization. CAR creates economic and systems modeling research, develops new manufacturing methodologies, forecasts industry futures, advises on public policy, and conducts industry conferences and forums. As an example of its economic research, CAR chairman emeritus David Cole has in relation to the Tesla Michigan dealership dispute said: "The value of Tesla is all based on hype and not substance"

larmor

Active Member

At some point, the production of cars and batteries and their related machinery that builds them will be on a pathway which will benefit from commoditization and economies of scale. At that point would be useful to have Elon more involved in FSD and other projects-- wireless energy transmission with starlink and tinfoil hat production. I would welcome others in the room who can accelerate the rollout of multiple GFs instead of just relying on Elon.AMZN only down 0.3% after Bezos announces he's stepping down as CEO. Wonder if TSLA would react the same way?

TSLA would be hard down if Elon said he was retiring anything before the next two factories are fully ramped. After that, the damage would be less. Someday Elon will step down from Tesla. And really Tesla would survive even today. But the direction and ideas (like diecast and 4680) probably had a lot to do with Elon. And the Cybertruck is certainly his baby. Would someone else have the drive to complete these things? But within ten years, Elon will find the Gwynne Shotwell for Tesla.AMZN only down 0.3% after Bezos announces he's stepping down as CEO. Wonder if TSLA would react the same way?

ByeByeJohnny

Active Member

That was Bezos. It's gotten to be a full time job to sabotage Space X. He doesn't have time to be CEO anymore.I don't know what that one was, but if it had been a Cybertruck with the armored glass and body they probably could have let them stay for the show.

ByeByeJohnny

Active Member

It's actually up almost 2% now . He's just like most of us. Gets richer after he stops working.AMZN only down 0.3% after Bezos announces he's stepping down as CEO. Wonder if TSLA would react the same way?

I'm trying to determine if I'm part of that "most", and if so, then if I should be happy, scared, proud...or just confused.... He's just like most of us...

This video highlights a few sections of a podcast Ron Baron recently had with Bloomberg. Baron made the enlightening comment that if, say, you bought a McDonald's franchise for $1 million dollars, worked your tail off for a year, and in that first year you made $250,000, you would've been very happy as an investor with your 25% return. But in comparison, Tesla's China factory, which cost $1 billion, already made $2.5 billion for the company (I don't know if this is pre-tax, post-tax, etc, I'm simply repeating what Baron said), an astounding 250% return in year one!

Funny how the bears are always poo-pooing Tesla's regulatory credits as one-time events. But what they fail to mention is that the approximately $1.1 billion of credits Tesla has received/is going to receive from FCA will pay for one whole factory. And that factory is not a "one-time event" that goes away. No, the factory keeps generating billions in profits for years to come. And that's just for one factory, purchased for Tesla, and by their competition no less.

‘My guess would be that Ron estimated $10k gross profit / car and 250k/ year output for phase 1. But there’s a difference between gross profit and net profit, which is probably what the McDonalds franchisees made.

The questions would be:

1) How much overhead(Operating Expenses) at Shanghai will there be in total and per production phase. My guess would be fairly small, but non trivial. There will be Shanghai R&D, executive costs, HR... So hopefully great Operating leverage means Shanghai will make a great contribution to Net profits.

2) @The Accountant Did Phase 1 really only cost $1B? Does that include the Loans/Leases?

Artful Dodger

"Neko no me"

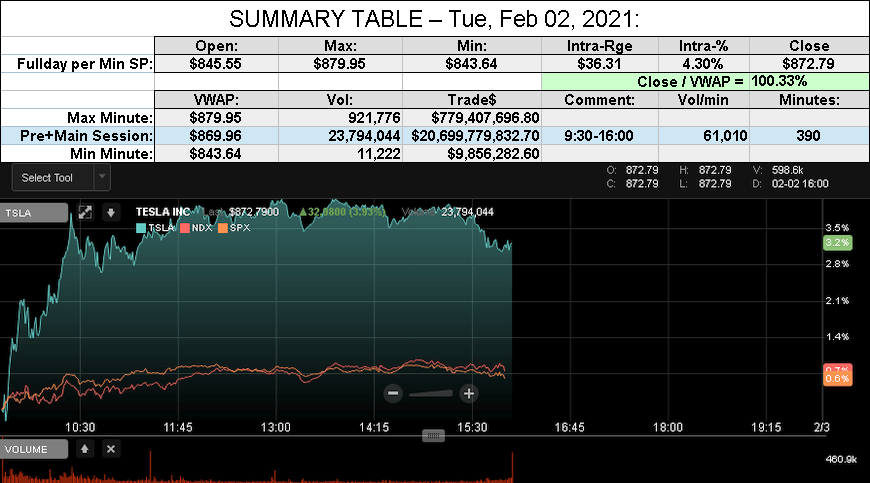

After-action Report: Tue, Feb 02, 2021: (Pre+Main Session Trading)

Headline: "TSLA Roars; SN9 Bores"

Pre-Market:

Main Session:

TSLA S&P 500 Weight: 1.999428% (Feb 01)

Mkt Cap: TSLA / FB $827.318B / $760.556B = 108.78%

NB: Yahoo hasn't updated Mkt Cap re 7.91M shares issued Dec 11th

CEO Comp. Status: (est'd Mkt Cap including Dec 11th shares ~$6.90B)

QOTD: @GrandEnigma "SN10 it is"

Comment: "Greed is not enough"

View all Lodger's After-Action Reports

Cheers!

Headline: "TSLA Roars; SN9 Bores"

Pre-Market:

Volume: 649,103

SP High $855.11

SP Low $832.00

SP High $855.11

SP Low $832.00

Main Session:

Traded: $20,699,779,832.70 ($20.70B)

Volume: 23,794,044

VWAP: $869.96

Close: $872.79 / VWAP: 100.33%

TSLA closed ABOVE today's Avg SP

TSLA MaxPain (7:00 A.M.): $820 (-$5 from Mon)

Volume: 23,794,044

VWAP: $869.96

Close: $872.79 / VWAP: 100.33%

TSLA closed ABOVE today's Avg SP

TSLA MaxPain (7:00 A.M.): $820 (-$5 from Mon)

TSLA S&P 500 Weight: 1.999428% (Feb 01)

Mkt Cap: TSLA / FB $827.318B / $760.556B = 108.78%

NB: Yahoo hasn't updated Mkt Cap re 7.91M shares issued Dec 11th

CEO Comp. Status: (est'd Mkt Cap including Dec 11th shares ~$6.90B)

TSLA 30-day Closing Avg Market Cap: $794.66B

TSLA 6-mth Closing Avg Market Cap: $496.59B

Mkt Cap req'd for 8th tranche ($450B) likely achieved Tue, Jan 19, 2021

Mkt Cap req'd for 9th tranche ($500B) POSSIBLE Wed, Feb 03, 2021

Nota Bene: Operational milestones req'd (chart at link).

'Short' Report:TSLA 6-mth Closing Avg Market Cap: $496.59B

Mkt Cap req'd for 8th tranche ($450B) likely achieved Tue, Jan 19, 2021

Mkt Cap req'd for 9th tranche ($500B) POSSIBLE Wed, Feb 03, 2021

Nota Bene: Operational milestones req'd (chart at link).

FINRA Volume / Total NASDAQ Vol = 43.7% (42nd Percentile rank FINRA Reporting)

FINRA Short / Total Volume = 38.9% (45th Percentile rank Shorting)

FINRA Short Exempt ratio was 1.15% of Short Volume (51th Percentile Rank Exempt)

FINRA Short / Total Volume = 38.9% (45th Percentile rank Shorting)

FINRA Short Exempt ratio was 1.15% of Short Volume (51th Percentile Rank Exempt)

QOTD: @GrandEnigma "SN10 it is"

Comment: "Greed is not enough"

View all Lodger's After-Action Reports

Cheers!

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K