JusRelax

Active Member

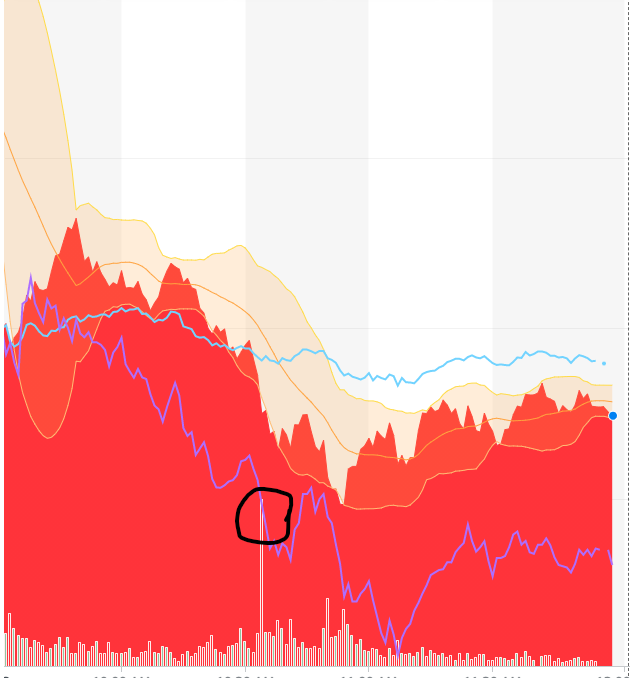

Anybody have any guesses as to what the huge volume spike at 10:34am EST was? That spike in volume is extremely noticeable IMO.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Folks, be careful out there. We know big auto is having supply chain problems due to semiconductor shortage. And Texas plants last week shut down making it even worse. These supply shortages could very well, and if fact I would argue, is likely to affect Tesla as well. THAT could be the reason for the standard range Model Y pull back. They are reserving chips for higher margin cars. If so, this isn't a good short term sign. It means Tesla production and top line sales would suffer until this chip shortage is resolved.

I'm no expert in macros etc but I do follow this guy Mohamed El-Erian on twitter and here is what he says. A lot of the macro activity seems to be related to the rise in 10-year yields. Mohamed seems to think it's a factor of how much of rise we are seeing in the yield.

Mohamed pretty much called the bottom during covid crash and also predicted a V shaped recovery. Definitely a great follow if you are looking to understand macros.

https://twitter.com/elerianm/status/1363830288594309121?s=20

A massive position being liquidated at $750? It's a big spike relatively speaking, but still only 950k shares. Someone selling(or shorting!) ~600k shares or thereabouts?Anybody have any guesses as to what the huge volume spike at 10:34am EST was? That spike in volume is extremely noticeable IMO.

Folks, be careful out there. We know big auto is having supply chain problems due to semiconductor shortage. And Texas plants last week shut down making it even worse. These supply shortages could very well, and if fact I would argue, is likely to affect Tesla as well. THAT could be the reason for the standard range Model Y pull back. They are reserving chips for higher margin cars. If so, this isn't a good short term sign. It means Tesla production and top line sales would suffer until this chip shortage is resolved.

Also our needs in absolute terms are a tiny compared to other players in the market.Tesla has been quiet on this, but I am hoping that they reaffirmed the chips they wanted and should have less of a problem than the OEMs.

I don't buy this "too many orders for SR, and that hits margins" argument. If you have too many orders for a lower margin product (compared to a higher margin product) you simply raise the price to get the right margins. For example if the margins on LR is $3k and SR is only $1.5K, then just increase the price of SR by $1.5K.

In that case, some will stick to SR with the increased price and some will upscale to LR, and some will cancel. On the other hand Tesla has cancelled SR and decreased the price of LR by $1K. A better option would have been to increase the price of SR by $1K while decreasing the price of LR by $1K.

I don't say that like you don't know or weren't invested back then, because I have no idea what you have or haven't done. What you stated was "I can nearly guarantee this will pay off in spades" to someone asking a question about a call purchase, and ostensibly as evidence highlighted that call options were ridiculously profitable in a given timeframe of a massive bull run.You say that like I don't know or wasn't invested back then. Frankly the warnings about call options are annoying as hell and played out. This comes up every single time

Yes options are risky. Be a big boy and don't pee the bed.

That was all the stop loss orders @ 750.Anybody have any guesses as to what the huge volume spike at 10:34am EST was? That spike in volume is extremely noticeable IMO.

View attachment 638875

Perhaps model2 $25 thousands car Announcing for reservations soon!Why cancel the sr+ for Ys and not sr+ for the 3 if there's a chip shortage? Tesla not a fan of making more money? Also why the price drops? It's conflicting when we speculate that there's not enough chips to go around but then pull demand levers?

Also they can always leave order page up but just extend delivery dates if there's a chip shortage.

That was all the stop loss orders @ 750.

Impossible. That's Osborne city while the Y is not even close to being ramped.Perhaps model2 $25 thousands car Announcing for reservations soon!

Me too, except I am just trying to time transfer of shares into a conversion Roth - hate to pay taxes on those shares that are now worth less...I’ve recently bought at $796, $779 & $765. I’m really bad at catching falling knives

If higher interest is likely, does that mean having $20B in cash/bitcoin is better than huge debt?

Year ago...

View attachment 638874

I agree, they may be diverting more cell production to Powerwalls. Considering that it has taken Tesla 3 years+ since I put down my Powerwall deposit (they never responded), and the local Tesla approved installer took 14 months to finally install them after I signed the contract, there must be a HUGE backlog of Powerwall orders. My installer told me that they have 155 installations waiting, but Tesla is only shipping them 2 or 3 Powerwalls at a time. For many customers it also meant holding up their solar installation, but this company finally decided to just install the solar and all the needed electrical panels, and come back later to install the Powerwalls when they come in. Florida could be a HUGE Powerwall opportunity, if they only had enough cells.

The individual I replied to was asking whether he placed his order correctly and I affirmed that he had, and patted him on the back for his fairly-safe and likely-profitable choice.I don't say that like you don't know or weren't invested back then, because I have no idea what you have or haven't done. What you stated was "I can nearly guarantee this will pay off in spades" to someone asking a question about a call purchase, and ostensibly as evidence highlighted that call options were ridiculously profitable in a given timeframe of a massive bull run.

Frankly I think bragging about huge call gains during that time frame is also annoying as hell and played out. Yes, all of us who invested that way have had massive, often life-changing returns, and we are all very pleased. The thing is that not everyone coming in here and trying to glean information is an expert or knows about option risks. Warnings are meant for them, not you.

Actually, it seems you are quite good at catching falling knives. The saying is: "DON'T try to catch a falling knife". I.e., wait for the bottom. Oh well, maybe a lesson learned.I’ve recently bought at $796, $779 & $765. I’m really bad at catching falling knives

You're in the groove today and in tight connection with the universe. Reality is being blurred like mad since the new year, please continue to add clarity!Impossible. That's Osborne city while the Y is not even close to being ramped.

All this 25k car and tax credit coming soon are all going into the FUD category as they do nothing but Osborne sales.