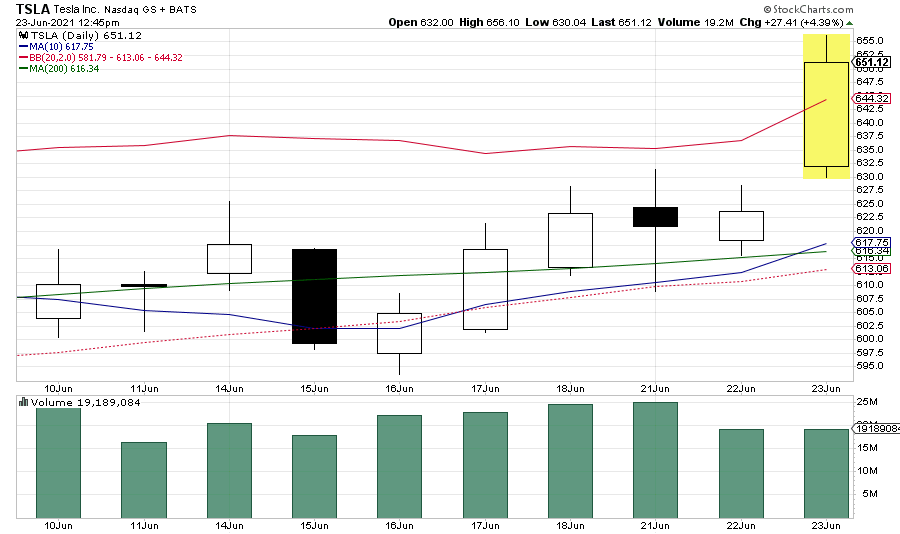

I do. The market is realizing how much capacity Tesla has now, and how much they will have in the near future. Small things like dropping radar and these price increases that have happened in the past two months will keep margins higher then what analysts had expected. While Q2 is going to be nice, this price jump is about re-evaluating Q3. The insane margins on the S, plus the very likely tax credit will sell every 3 they can make at $39k plus and not require bringing out a Y SR yet in Q3. Y SR will come after Austin is not only open, but starting to ramp.Ideal scenario for me to Fade some TSLA @ $652 and simultaneously sold 650 PUT

Do not see any news or catalyst to correlate todays +30 gain.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

MissAutobahn

Elon, please ramp up Semi production!

I hate days like these. So much to do for work but me just staring at my gains. A gain and a gain and a gain...

2daMoon

Mostly Harmless

Sometimes, I have dreams. Weird dreams where the perfect storm brews around a great quarterly report, coincidental with an annual meeting, where they vote to add shares enough to call a 10:1 split as soon as allowed.Perhaps a TSLA stock split is imminent.

Weird dreams I said. The next one has the Dow all tickled about the $65 stock price being in their realm of "affordable" and brings TSLA into the fold, which then opens the door for all those tied to the Dow to buy.

Like I said, weird dreams about perfect storms.

The MMs can't take MY dreams away.

jhm

Well-Known Member

Not to worry, your work will still be there when Tesla retreats back below $600.I hate days like these. So much to do for work but me just staring at my gains. A gain and a gain and a gain...

Brilliant timing by Barrons,

Tesla Stock Has Become a Snoozer. Here’s Why

June 23, 2021 10:44 am E

Electric-vehicle pioneer Tesla has become positively boring. The stock’s volatility is way down. Shares haven’t moved much lately. That might give Tesla bulls a breather. Still, for traders expecting more wild stock swings, it takes some getting used to. What Tesla stock needs are catalysts, which should arrive around year-end

By

Al Root

June 23, 2021 10:44 am ET

Last edited:

Or just drive it across the border lookin' like Cheech and Chong.SM should have the car X-Rayed, determine the Battery form factor and Body structure and keep the car and go PLAID

Don't want to be disappointed.

StealthP3D

Well-Known Member

Any bets as to whether or not the media picks up on either the story that Model 3 and Y top the US made list or that Elon, hated as a greedy billionaire lives in a tiny manufactured home?

I expect the media will maximize BOTH those stories, we all know how they like anything with "Tesla" in the headline to get lots of clicks!

Er, wait...Those stories might not be quite significant enough to be newsworthy...Yup, missed it by a hair.

myt-e-s-l-a

Member

Perhaps a reverse split ? Have too much TSLA chairs atm.Perhaps a TSLA stock split is imminent.

Artful Dodger

"Neko no me"

At half-time, we've already exceeded yesterday's volume:

Cheers!

Cheers!

I made my case earlier for NorgesBank to make their move this quarter- they already own some* - and, although window dressing is not, to the best of my knowledge and remembrance, of any utility to them whatsoever, it also could be the case that their avowed portfolio shifting also only now has enabled them to start making their move.As @Curt Renz often reminds us, I wonder if there is some buying for window dressing. The funds that disclose Q2 holdings may want to show more Tesla as part of their portfolio at June 30. But if that were the case, why all of a sudden today?

I fully - okay: formally - expect them to be a shareholder of at least the same magnitude as Bailie Gifford and Fidelity had been/are.

*more even than I have!

Does this set us up for an inevitable and incomprehensible [to me] dip to "fill the gap" later in the week?At half-time, we've already exceeded yesterday's volume:

Cheers!

jhm

Well-Known Member

Momentum, eh?Joe Terranova just bought Tesla shares. Jon Najarian owns Tesla call options.

CNBC Video - half hour ago:

Artful Dodger

"Neko no me"

Does this set us up for an inevitable and incomprehensible [to me] dip to "fill the gap" later in the week?

Lol, not much of a gap there; Monday's high was above today's low. Right now, every little $2 dip is being bought up agressively (look at the volume).

I'd be more watching the Upper-BB as a tgt for shortzes, but so far buyers are showing up.

Cheers!

Thanks for sharing the info, however, I have no idea what that means. Is it a vote for or against TSLA? Is it riskier than usual positioning? Is it contrary? Throw me a, would ya?

Someone making an unusually large bullish bet (relative to existing interest in the position).

One never has too many TSLA chairs. You just need to grow more toes to count them with.Perhaps a reverse split ? Have too much TSLA chairs atm.

jhm

Well-Known Member

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M