Based on alexa analytics, tesla.cn finally passed pre-shanghai brake fud rankings of around 7800.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I think they're going to Katmandu, that's really really where they're going to...Ummm....Timbuktu?

vwman111

Member

Has anyone done research into Tesla's suppliers? We know who the large ones are, however some of the smaller ones are likely ramping up nicely with the upcoming increase in Tesla production. I'm trying to think of components that may be enough of a specialty that they aren't already mass produced. for example the vision cameras vs chips.

CLK350

Member

I recall reading about one of the camera suppliers in a teaser newsletter, can't locate it now - but in tech news recently: Omnivision is the company providing at least the rear view camera chip for Tesla - owned by Chinese company WiII semi, traded on Shanghai exchange and corresponding US based exchanges.Has anyone done research into Tesla's suppliers? We know who the large ones are, however some of the smaller ones are likely ramping up nicely with the upcoming increase in Tesla production. I'm trying to think of components that may be enough of a specialty that they aren't already mass produced. for example the vision cameras vs chips.

Considering the market for all camera equipped gadgets, might be a good candidate for the What other stocks to consider thread

Components of both the S&P 500 and the Dow Jones Industrial Average are selected by S&P Dow Jones Indices LLC. S&P Global is the majority shareholder: Wikipedia - S&P Dow Jones IndicesConsidering that the DJIA components are decided by the WSJ - with their standard established businesses anti Tesla FUD, I don't see this happening till they are forced to do so, much like the S&P 500 dragged their feet for as long as they could.

A more likely source for a split would be from Tesla's internal decision makers - but why and when would they want to do it?

Why: could be to compensate for the overall USD de facto devaluation (or real inflation, which is about 10%) - meaning, hedge funds and financial giants / entities (FINHF) make tons of profit from their usual manipulations and the free Fed distribution** of paper/ digital $, so to not see its own USD reserves lose their value (relative to FINHF) Tesla could do another scalping of the Hedge Funds fake shorts like it did earlier, collecting $5B to "save" them, issuing them real TSLA shares to cover.

The other alternative, buying BTC has been put on hold re pollution impact as Elon /Tesla decided.

When: clueless here - best argument I recall someone here mentioning earlier would be better for Tesla' employee stock participation/ distribution - also wondering how the Hedge Funds fake shorts have prepared for another potential split, have they planned a new escape route, or just accept its happening again as a cost of doing business ? (comments/ feedback welcome)

FYI - from Dow Jones Industrial Average (DJIA) Definition the most recent changes and its current 30 components, clearly some of these should be swapped with Tesla *if* they were rational - but we know few things are rational/ reasoned anymore these days.

On June 26, 2018, Walgreens Boots Alliance, Inc. replaced General Electric Company. In addition, United Technologies merged with Raytheon Company and the new corporation entered the index as Raytheon Technologies, while DowDuPont spun off DuPont and was replaced by Dow Chemical Company in 2020 and 2019, respectively.

On Aug. 24, 2020, Salesforce, Amgen, and Honeywell were added to the Dow, replacing ExxonMobil, Pfizer, and Raytheon Technologies.

(**) Fed loans at near zero interest rates or probably never to be repaid among other anomalies of our financial apparatus.

Thekiwi

Active Member

Who cares about the Dow30 these days though? there are hardly any funds tracking It, and most of he fast growing large cap companies aren’t on it. It’s a relic of the past, and it’s price based system is hilariously outdated/meaningless.

Knightshade

Well-Known Member

I'm pretty sure it says 1.5TWh of energy storage.

Well, yes- as is made obvious when I actually quote it directly below with the correct figure.

Thanks for the disagree for the obvious (and even corrected with the correct info in bold in the same post) typo though.

I recall reading about one of the camera suppliers in a teaser newsletter, can't locate it now - but in tech news recently: Omnivision is the company providing at least the rear view camera chip for Tesla - owned by Chinese company WiII semi, traded on Shanghai exchange and corresponding US based exchanges.

Considering the market for all camera equipped gadgets, might be a good candidate for the What other stocks to consider thread

The other cameras are all the Aptina AR0132- Aptina is owned by ON Semiconductor

CLK350

Member

Indeed, my mistake - was being really sloppy, the inbreeding /cross breeding in the Wall Street crowd being .. what it is - Douglas Peterson, CEO of S&P Global who controls 73% of the joint venture running the DJI index - is also COO of Citibank .. umm so in short the WSJ is directed by Wall Street. - my upside down conflating sort of mistake .. the WSJ journal just publishes what Wall Street folks decide .. they don't determine the DJI index.Components of both the S&P 500 and the Dow Jones Industrial Average are selected by S&P Dow Jones Indices LLC. S&P Global is the majority shareholder: Wikipedia - S&P Dow Jones Indices

I need another drink - uh or maybe I shouldn't have had one ; D

I had a well paying job and put my entire life savings into TSLA since 2013.... But, my brother has a lot fewer shares than me, and he has also learned to make more than he does as a surgeon by selling options. (However, do it wrong, and you can lose A LOT).

juanmedina

Active Member

Wow. You must hold a lot of shares.

If you sold Leaps when the SP was in the $900-850 range when IV was 100+ compared to todays 40 IV and SP you would have made a killing.

Jun 2023 $1700 strikes were selling for $300 in February. I still remember clearly staring at the screen thinking "should I sell some? But I think TSLA is worth more than $1700 a share...". I wish I sold some now lol.If you sold Leaps when the SP was in the $900-850 range when IV was 100+ compared to todays 40 IV and SP you would have made a killing.Why did I BTC the Leaps that I sold at a lost.

juanmedina

Active Member

Jun 2023 $1700 strikes were selling for $300 in February. I still remember clearly staring at the screen thinking "should I sell some? But I think TSLA is worth more than $1700 a share...". I wish I sold some now lol.

Next time we will get them

jkirkwood001

Active Member

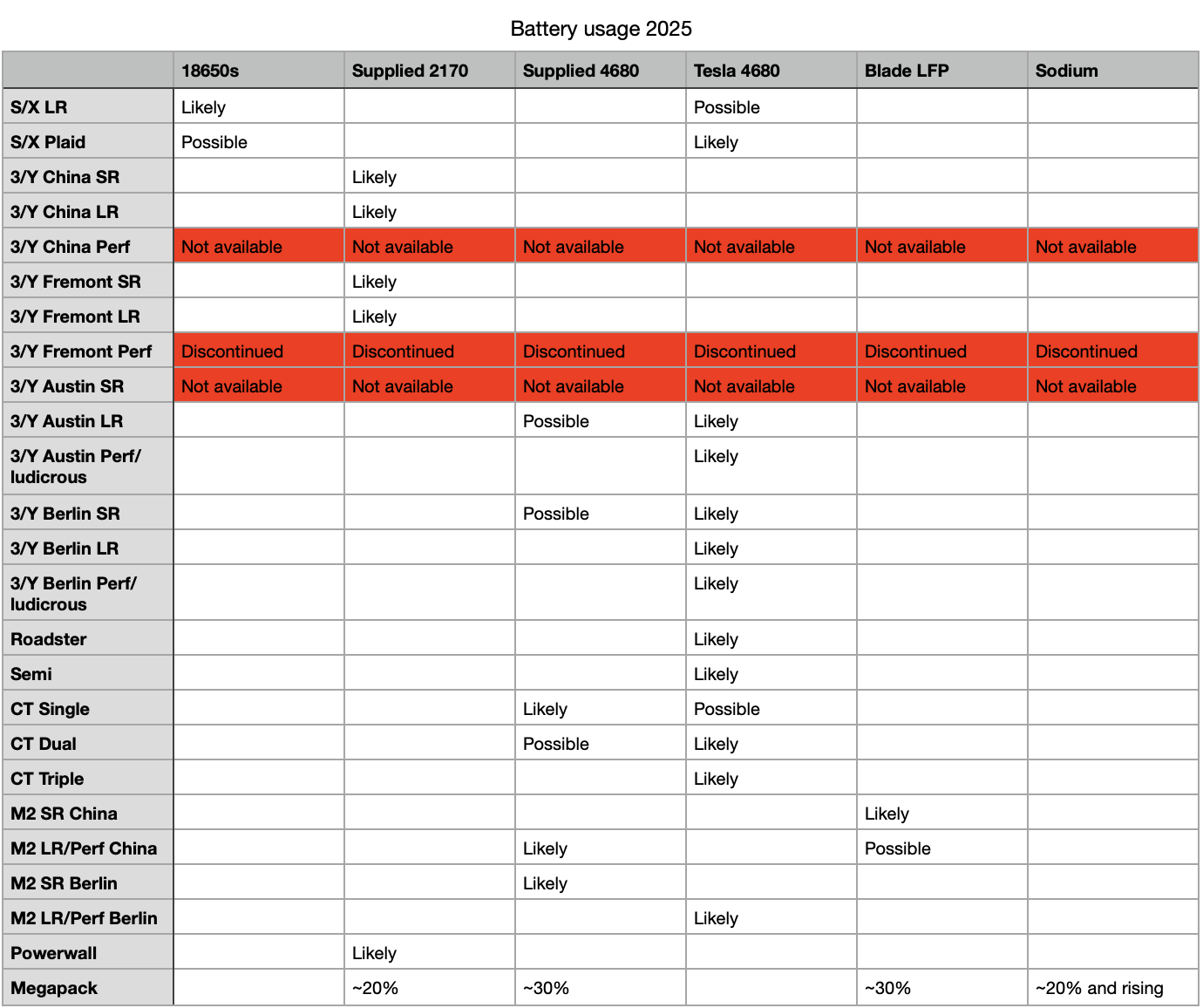

Haven't shown this in a while.

Observations

Observations

- No significant changes since 6 months ago - it's still a long way to catch AAPL and AMZN

- Our sample Big Oil stock - Royal Dutch Shell - continues to slide. Further to the latest IPCC report, may they all just "flame out".

- In 2021, why would anybody still buy a BMW?? Oh, right, because Tesla is back-ordered.

Stretch2727

Engineer and Car Nut

Good chart, but can we remove Nikola and put a company that that doesn't have their ex CEO indicted for fraud.Haven't shown this in a while.

Observations

- No significant changes since 6 months ago - it's still a long way to catch AAPL and AMZN

- Our sample Big Oil stock - Royal Dutch Shell - continues to slide. Further to the latest IPCC report, may they all just "flame out".

- In 2021, why would anybody still buy a BMW?? Oh, right, because Tesla is back-ordered.

Knightshade

Well-Known Member

Good chart, but can we remove Nikola and put a company that that doesn't have their ex CEO indicted for fraud.

That'd knock VW out too... and can't use Nissan as a replacement either

Tesla Model Y Test Vehicle Moving Forward At Tesla Gigafactory Texas — Leaked Pics - CleanTechnica

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News! Article courtesy of Tesla Oracle. Preparation of Tesla Model Y production at the automaker’s Gigafactory Texas has gained momentum lately. A few images from inside Giga Texas have leaked via a local...

cleantechnica.com

cleantechnica.com

Tesla Model Y Test Vehicle Moving Forward At Tesla Gigafactory Texas — Leaked Pics - CleanTechnica

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News! Article courtesy of Tesla Oracle. Preparation of Tesla Model Y production at the automaker’s Gigafactory Texas has gained momentum lately. A few images from inside Giga Texas have leaked via a local...cleantechnica.com

I really wonder if we'll see any new colors out of Austin? I sure do hope so.

Tesla Stock: Billions in Net Inflows for Q3

After two quarters of selling, Tesla stock is experiencing a net inflow into institutional ownership.

www.thestreet.com

www.thestreet.com

Dan Detweiler

Active Member

Only color I care about coming out of Austin is Stainless Steele.I really wonder if we'll see any new colors out of Austin? I sure do hope so.

Dan

Buckminster

Well-Known Member

I posted this a couple of days ago in the gigafactory thread:

Improvements in this thread pls:

Gigafactory locations and products

Improvements in this thread pls:

Gigafactory locations and products

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K