I was genuinely surprised how many people we got 50+ here. This particular set of Tesla investors skews very old compared to similar groups on Reddit for example where the average age is 20's and 30's.

Considering the platforms I'm not surprised at all. Old-fashioned websites like TMC do appeal to older people.

There is quite copious use, dwell time and activity metrics (posting, response, purchasing etc) for all significant web type categories and specific platforms. All 'the good stuff' is behind paywall. Thus I will post general data for four of them. The various platform use and dominance varies dramatically by country so I list only US dat and order.

Traditional special interest (fan) website (e.g. TMC): Comparing three of those for which I had data on both the fan site and subject data. Both tend to have quite similar demographics but are overrepresented by the oldest user cohorts. [considering the dreaded 'mother-in-law' research as irrelevant. I do note there are many people active on the TMC site who are my age and older. Factually we skew OLD! Separately, the multiTesla owners and sequential ones almost by definition skew older. Obviously, quite a few of these people bought TSLA in the early years and never sold. Thus we tend to have much more financial assets than do most people our age. In any event this traditional website format skews older also.

Facebook: Slightly anomalous because so much Facebook content is advertising and promotion, with restaurant menus such in with like-minded advocates for some specific thing. Because it is strongly visual it tends towards a younger audience than do most other groups. Facebook demographics vary so dramatically that they are truly site specific.

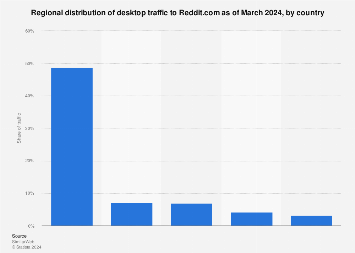

Reddit: From Statista

Reddit traffic varies by country. Currently, the United States account for almost half of global Reddit user traffic.

www.statista.com

Everything in the link seems more or less correct with two huge exception. AMA on Reddit reflects pretty much the demographics of the sponsors fans.

For Reddit fan sites that are on topics also covered with traditional websites Reddit skews very young, overwhelmingly male. These cases also tend to make the traditional sites on the same subject older and more diverse. The Statista information does give clues.

I show nothing at all for giants like Google and Baidu, each of which has almost ubuitous use among internet users in their respective markets of dominance.

I exclude specialists such as WhatsApp because they tend to be single market dominant. For example WhatApp is used universally in Brazil and Mexico, to the exclusion of traditional voicemail and other messaging applications.

Conclusions:

Running the same investor survey on Tesla Reddit, TMC and Discord Tesla groups will end out with oldest and most stable on TMC, Reddit will be youngest and probably most prone to options, margin etc. Discord will be in between, but tend slightly less aggressive than will Reddit.

I have data on a number of other platforms all does within the last year, all for product classes roughly analogous to Tesla.

It would be great to have exact data specific to Tesla. That is very, very hard to accomplish.

www.bloomberg.com