bkp_duke

Well-Known Member

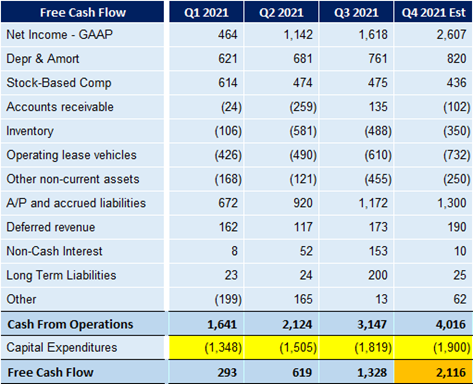

It's a Fool's Game to try to forecast Free Cash Flow (FCF). Well I'm your fool.

"Tesla Delivers $2 Billion in FCF in Q4".There I said it !

View attachment 751959

Details of my Free Cash Flow are here:

Near-future quarterly financial projections

While it won’t be $0 fixed cost it won’t be linear to rest of factory as major costs relating to structure, heating, electrical were all already in place. Plus it’s also likely that several parts of the production process are already capable of handling more volume without increasing capital...teslamotorsclub.com

We've seen it in the past, so I was wondering what your thoughts are on Tesla using that FCF to continue to aggressively pay down debt. With Elon's traches slowing, seems there would be more that can be pushed over to a purpose like that.

Obviously a better use would be to start another Giga Factory, but we haven't heard much along those lines (yet).