I've got to believe Redwood is Tesla's ace up their sleeve for the mid 20s when supply material constraints hit the industry.Redwood materials to introduce recycled copper into new batteries at GF1 by EoY ‘22

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

ZeApelido

Active Member

thesmokingman

Active Member

That is such a Musk replay, I was lol'ing all over.Biden: You led GM. You led with your20112021 Q4 sales of 26 EVs and it matters.

TheTalkingMule

Distributed Energy Enthusiast

Would definitely buy.

TheTalkingMule

Distributed Energy Enthusiast

Seeing a lot of concern that "hedgies and MM's are in control". There's no chance in hell these people are dumb enough to stand in front of the 4Q earnings steamroller.

This is an effort to protect 1200 this week. I bet it'll just repeat next week as well. They can maybe swing it through 1/14, but the tops gonna blow eventually.

I don't see this pushdown effort being maintained to the point we close under 1150 this week.

This is an effort to protect 1200 this week. I bet it'll just repeat next week as well. They can maybe swing it through 1/14, but the tops gonna blow eventually.

I don't see this pushdown effort being maintained to the point we close under 1150 this week.

Do not underestimate the power of the dark side. Plus, most of them are stupid. They will drop their last penny for their cause regardless of the costs.Seeing a lot of concern that "hedgies and MM's are in control". There's no chance in hell these people are dumb enough to stand in front of the 4Q earnings steamroller.

This is an effort to protect 1200 this week. I bet it'll just repeat next week as well. They can maybe swing it through 1/14, but the tops gonna blow eventually.

I don't see this pushdown effort being maintained to the point we close under 1150 this week.

If anyone here could be please tell this dumb ass, when to sell and when to buy, it would be greatly appreciated. My track record ( pre- HODL days) was pretty.

Here’s a suggestion

Buy between 10 and 11 AM, Monday morning

Sell 10 years later

StealthP3D

Well-Known Member

I've got to believe Redwood is Tesla's ace up their sleeve for the mid 20s when supply material constraints hit the industry.

Maybe. There would have to be a whole lot of recycled cell phone and laptop batteries for it to be very significant. When EV's are growing exponentially, recycling batteries from 10+ year old EV's will simply not provide a meaningful amount of material, relative to production volumes that have been growing exponentially for a decade or more. On the bright side, many of those older batteries will be particularly rich in certain elements (like cobalt) that have been drastically reduced in more modern formulations.

Of course, every little bit helps.

Well well, looks Sony is already being out competed by the company that makes swimwear as they just acquired a company that will ship evs in 2022.

pitabun

Member

Would definitely buy.

You know they'll have a proprietary power cable with a wonky UI!

-edit-

Imagining PS3 orchestra ensemble intro when opening your car. - nice.

Gigapress

Trying to be less wrong

A couple months ago there was a lot of talk about TSLA at $1,000 being an indication the stock had been far outpacing the fundamentals on a frenzy of hype and gamma squeeze buying.

We just had a quarter that will yield profit (EBIT) of $2.5-3.5 billion in EBIT this quarter, which is $10-14 billion annualized. Split the middle and call it expected annualized earnings of $12 billion.

BEFORE the Shanghai expansion, Giga Berlin and Giga Austin all enter the show.

They are growing production and margins at such an outrageous pace that a price to EBIT ratio of at least 100 is reasonable.

$12 B * 100 / 1.1 B shares = $1,090

The current fundamentals already have largely caught up with the stock price.

We just had a quarter that will yield profit (EBIT) of $2.5-3.5 billion in EBIT this quarter, which is $10-14 billion annualized. Split the middle and call it expected annualized earnings of $12 billion.

BEFORE the Shanghai expansion, Giga Berlin and Giga Austin all enter the show.

They are growing production and margins at such an outrageous pace that a price to EBIT ratio of at least 100 is reasonable.

$12 B * 100 / 1.1 B shares = $1,090

The current fundamentals already have largely caught up with the stock price.

Last edited:

B

betstarship

Guest

Don't know if this has been posted, but if you take James Stephenson's revenue number for Q4/2021 earnings...

2020 Revenue: $31.536B

2021 Revenue: $54.225B

71.95% increase in y-o-y revenue

2020 Revenue: $31.536B

2021 Revenue: $54.225B

71.95% increase in y-o-y revenue

Ironically he was actually pretty smart but somehow turned into a moron.

Hmm, this video about our TMC clown turned out to be much more interesting than I thought beforehand.

At the end some sound investing advice in my opinion (but not from GoJo).

Gigapress

Trying to be less wrong

And to add to this, they have accomplished this while constructing the world's top two most technologically advanced and largest production capacity automotive factories with world record construction speed, and they spent only a few billion dollars in CapEx doing so.A couple months ago there was a lot of talk about TSLA at $1,000 being an indication the stock had been far outpacing the fundamentals on a frenzy of hype and gamma squeeze buying.

We just had a quarter that will yield profit (EBIT) of $2.5-3.5 billion in EBIT this quarter, which is $10-14 billion annualized. Split the middle and call it expected annualized earnings of $12 billion.

BEFORE the Shanghai expansion, Giga Berlin and Giga Austin all enter the show.

They are growing production and margins at such an outrageous pace that a price to EBIT ratio of at least 100 is reasonable.

$12 B * 100 / 1.1 B shares = $1,090

The current fundamentals already have largely caught up with the stock price.

And operating expenses have flatlined for a year now. This has been pure unadulterated leverage thus far in 2021.

Earnings and deliveries in 2022 will astonish the whole world. 2022 will have a quarter where Tesla sells more total cars than the leader of the EV revolution, GM, who delivered 440k vehicles this quarter. Tesla *is* the "Big Dog" now.

Operating margins will be pushing 25+% by the end of the year. Profits will be $20-40 billion annualized depending on how fast the Berlin and Austin ramps go. I would not be surprised to see a $3,000 share price this time in 2023.

Please buckle your seatbelt and ensure that your shares and call options are securely stored in the overhead bins before launch.

Last edited:

I think they've earned enough in reg credits to at least pay for one; no?And to add to this, they have accomplished this while constructing the world's top two most technologically advanced and largest production capacity automotive factories with world record construction speed, and they spent only a few billion dollars in CapEx doing so.

This is how real the competition is: ”Sony is planning to launch a company to examine if they should enter the EV market. Stock +4% on this concrete news.

I find that when everyone gets snippy on here, then it's usually a good time to buy.Understand your limitations more than anything, if you suck at trading Tesla... don't. Just HODL. If you're great at trading Tesla, there is a good amount of money on the table. Will take a lot of work though. I feel like I'm a fairly good trader, and Tesla can still give me fits in short term movements.

mars_or_bust

Member

I find that when everyone gets snippy on here, then it's usually a good time to buy.

So, basically, you are just saying "buy all the time".

One less thing to deal with…

driveteslacanada.ca

driveteslacanada.ca

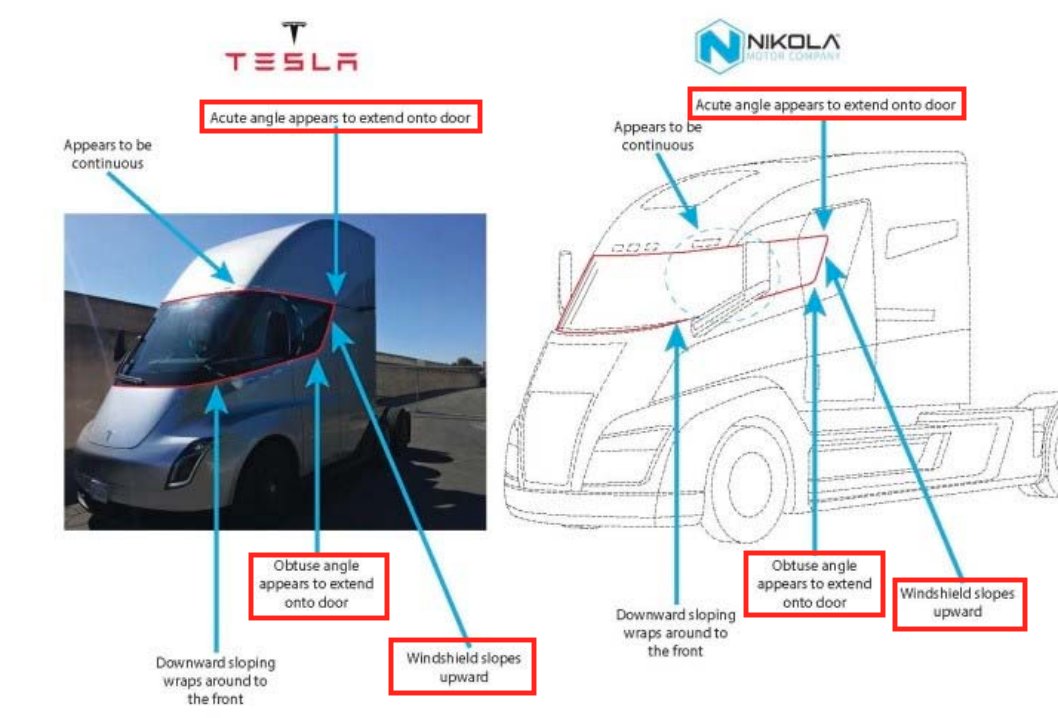

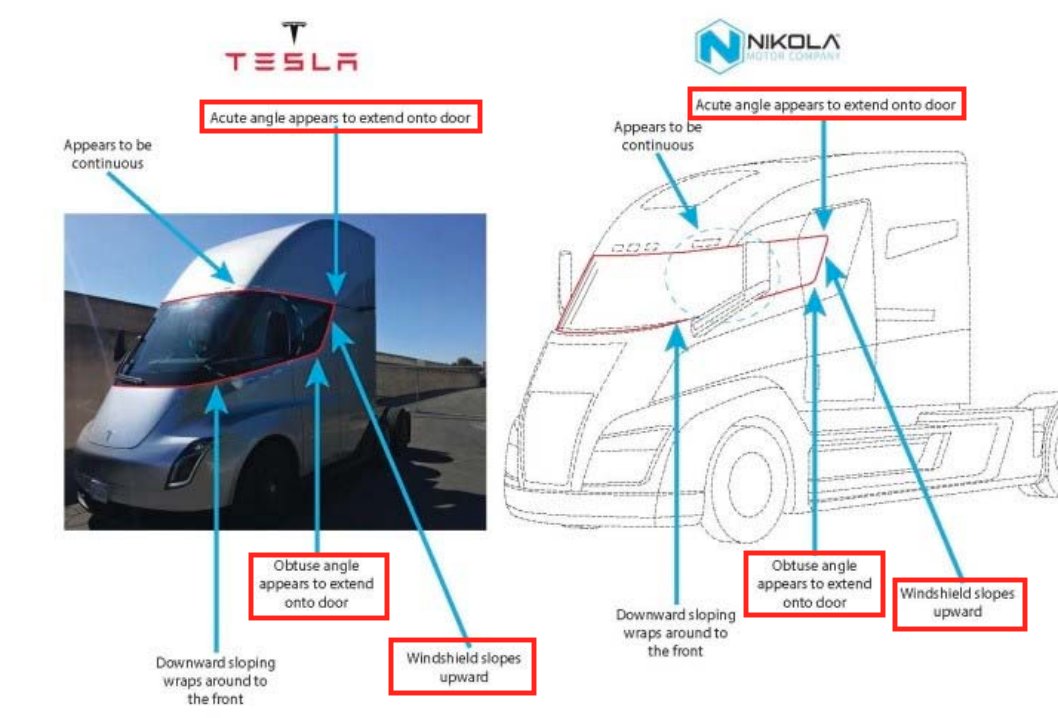

Nikola drops $2 billion patent infringement lawsuit against Tesla

After recently settling with the US Securities and Exchange Commission (SEC) and agreeing to pay $125 million over federal security law violations, Nikola Corp. has dropped its $2 billion patent infringement lawsuit against Tesla. According […]

driveteslacanada.ca

driveteslacanada.ca

Are you timing for sub $1100 or $1000 according to a previous post of yours?I didn’t really think this would take a day, but I’m out again 4/5ths fo the position in the pre. Didn’t really think $1210 would be an EXACT number, but it was my target for this phase. Targeting later Jan’22 for possible re-entry

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K