The Accountant

Active Member

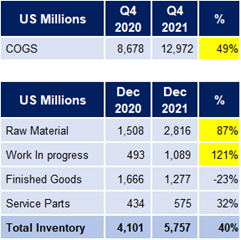

Two Insights from Tesla's Inventory Details:

I just started looking at the 10K. I went straight to the Inventory details because I had seen a pattern developing in Q2 & Q3.

Raw Materials

While Cost of Goods Sold (COGS) grew 49%, Raw Materials grew by 87% and now sits at a whopping $2.8B. Raw Materials should increase as your production grows but the $2.8B in raw materials is high even taking into account the 49% growth and the Austin/Berlin launch inventory. I suspect, Tesla increased its safety stock on key components by at least $600m.

Key Take Away: Tesla enters 2022 with a better stock position to deal with shortages than 2021 (edited to correct years mentioned).

Work In Progress (WIP)

WIP grew 121% vs PY and this cannot be the automotive division as Tesla did not double it's manufacturing lines and we don't see thousand of unfinished cars anywhere. My guess is that this increase is related to Energy and its Megapacks. We have seen many megapacks sitting around at the Sparks GF. I suspect, these Megapacks are waiting for a part. This is the reason why Energy sales and margins were so disappointing in Q4.

Key Take Away: Once the missing parts arrive and megapacks delivered, we could see a nice bump in sales possibly adding $0.25 to EPS for the Qtr.

I just started looking at the 10K. I went straight to the Inventory details because I had seen a pattern developing in Q2 & Q3.

Raw Materials

While Cost of Goods Sold (COGS) grew 49%, Raw Materials grew by 87% and now sits at a whopping $2.8B. Raw Materials should increase as your production grows but the $2.8B in raw materials is high even taking into account the 49% growth and the Austin/Berlin launch inventory. I suspect, Tesla increased its safety stock on key components by at least $600m.

Key Take Away: Tesla enters 2022 with a better stock position to deal with shortages than 2021 (edited to correct years mentioned).

Work In Progress (WIP)

WIP grew 121% vs PY and this cannot be the automotive division as Tesla did not double it's manufacturing lines and we don't see thousand of unfinished cars anywhere. My guess is that this increase is related to Energy and its Megapacks. We have seen many megapacks sitting around at the Sparks GF. I suspect, these Megapacks are waiting for a part. This is the reason why Energy sales and margins were so disappointing in Q4.

Key Take Away: Once the missing parts arrive and megapacks delivered, we could see a nice bump in sales possibly adding $0.25 to EPS for the Qtr.

Last edited: